Why Trading In Your Mobile Home with a Mortgage Makes Sense

Wondering how to trade in a mobile home with a mortgage? It’s a straightforward process many families use to upgrade their homes. You don’t need to pay off your current loan first; dealers work with lenders to roll your existing mortgage into the new financing, making the process seamless.

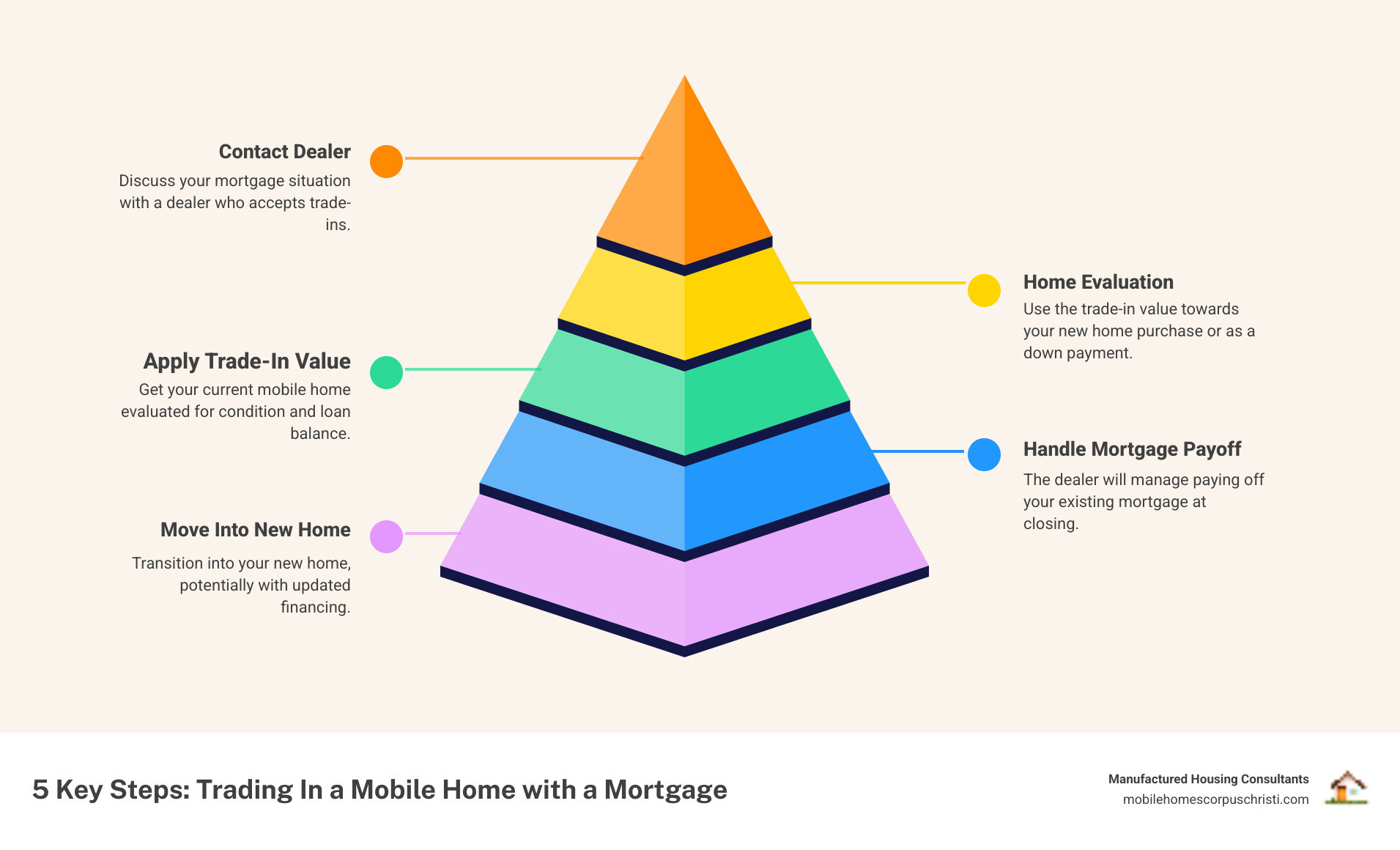

The 5-Step Process is Simple:

- Contact a dealer who accepts trade-ins and discuss your mortgage.

- Get your home evaluated to assess its condition and loan balance.

- Apply the trade-in value toward your new home purchase.

- Let the dealer handle paying off your existing mortgage at closing.

- Move into your new home, often with updated financing.

If you owe money on your manufactured home, you don’t have to worry about finding a private buyer or navigating complex financial hoops. Trading in is a popular solution that avoids these hassles.

Why consider a trade-in? Beyond convenience, you can save on sales tax (you only pay tax on the balance after your trade-in credit), avoid the stress of a private sale, and get professional help with financing. The mobile home industry is equipped to handle complex situations, including positive or negative equity, to find a solution that works for you.

Can You Really Trade In a Mobile Home with a Mortgage?

Yes, absolutely! It is entirely possible to trade in a mobile home with a mortgage. You don’t need to wait until your home is paid off to upgrade. Lenders and dealers work together regularly to handle these transactions smoothly, whether you have positive equity (your home is worth more than you owe) or negative equity (you owe more than it’s worth).

The loan payoff process is straightforward when you work with an experienced dealer. They coordinate with your current lender to handle the mortgage payoff at closing, so you don’t have to juggle multiple transactions. Your dealer handles most of the communication, requesting your loan balance and arranging the payoff as part of your new financing, which can simplify your finances. For more details, see our guide on Financing: What You Need to Know.

Understanding the Process: How to trade in a mobile home with a mortgage

Trading in a mortgaged mobile home is similar to trading in a car. Your home’s value becomes a credit toward your new purchase, with a few extra steps for the mortgage.

First, your dealer gets a lender payoff calculation from your mortgage company to determine the exact amount needed to clear your debt. The dealer then coordinates the title transfer between your old lender, your new lender, and the title company. Your home’s appraised trade-in value is applied to your remaining mortgage balance.

If your trade-in value exceeds what you owe, you can use that equity as a down payment on your new home, potentially lowering your monthly payments. If you owe more than the trade-in value, the difference can often be rolled into your new loan. The entire process concludes at a single closing.

Pros and Cons of a Trade-In

Trading in offers significant benefits, but it’s wise to consider the trade-offs.

| Feature | Mobile Home Trade-In | Selling Privately |

|---|---|---|

| Convenience | High: Dealer handles everything including mortgage payoff | Low: You manage all aspects of the sale |

| Speed | Fast: Usually complete within weeks | Slow: Can take months to find the right buyer |

| Value | Guaranteed offer, though potentially lower | Potentially higher, but no guarantees |

| Hassle | Minimal: One-stop solution | High: Marketing, showings, negotiations |

| Sales Tax | Pay tax only on remaining balance after trade credit | Pay full sales tax on new home purchase |

| Financing | Dealer coordinates mortgage payoff and new loan | You handle old payoff before new purchase |

The biggest advantages are convenience and speed. The process is hassle-free, and you benefit from sales tax savings. The main downside is a potentially lower value compared to a private sale, as dealers must account for reconditioning and resale costs. Your choices are also limited to the dealer’s inventory.

Alternatives to Trading In

While a trade-in is often the smoothest path, consider these other options:

- Refinancing: If you like your home but want better loan terms, refinancing can lower your monthly payment.

- Selling Privately: This could net you more money but requires you to manage the mortgage payoff, which is more complex.

- Cash Buyers: This offers speed and simplicity, similar to a trade-in, but often at a below-market price.

Before deciding, consider the Benefits of Improving Your Credit Score Before Buying Mobile Home. A better score can open up better financing terms, no matter which path you choose. For most families, trading in is the most practical way to upgrade without the stress of managing multiple transactions.

Determining Your Mobile Home’s Trade-In Value

When figuring out how to trade in a mobile home with a mortgage, understanding its value is essential. The trade-in value directly affects how your existing mortgage is handled. While manufactured homes typically depreciate over time, the actual value depends heavily on maintenance, location, and market conditions.

Dealers evaluate your home using industry guides (like the NADA book) and a hands-on inspection. The appraisal process is straightforward: a dealer representative will walk through your home to assess its condition, features, and any upgrades you’ve made.

Key Factors That Influence Value

Several key factors determine your mobile home’s trade-in worth:

- Age and Condition: Newer homes in great shape command higher values. Regular maintenance is crucial.

- Manufacturer and Model: Some brands are known for quality and hold their value better.

- Size: Double-wides and triple-wides typically have higher values than single-wides.

- Location: A home in a desirable community or on private land is worth more.

- Pre-1976 Homes: Homes built before the HUD Code have limited trade-in value due to difficulties in moving and financing them.

- Upgrades and Repairs: New appliances, updated flooring, a good roof, or additions like decks add value.

Understanding ‘In-Place’ vs. ‘Pull-Out’ Value

Your home’s location dramatically affects its value in two ways:

- ‘In-place’ value is the value if the home stays where it is. This is the highest possible value because it avoids moving costs and allows the dealer to resell it on-site.

- ‘Pull-out’ value is the value if the home must be moved. This is significantly lower because the dealer must factor in expensive costs for transport and setup.

An older home might have very little pull-out value but decent in-place value if it’s in a desirable location.

How to Get an Official Valuation

To get a clear picture of your home’s worth, use a combination of these methods:

- NADA Book Value: This industry guide for homes built after 1976—similar to the Kelley Blue Book for cars—provides a baseline estimate.

- Professional Appraisal: An independent appraiser can provide a detailed report, though this comes at a cost.

- Dealer Assessment: This is the most practical step. A dealer provides a free, formal trade-in offer based on market conditions and a physical inspection.

Understanding your home’s value is key to navigating the trade-in process and your financing options. To learn more about financing, see our guide on Mobile Home Loans or Financing. This knowledge helps you set realistic expectations for your trade-in journey.

The Step-by-Step Guide on How to Trade In a Mobile Home with a Mortgage

This guide walks you through exactly how to trade in a mobile home with a mortgage. The process is more straightforward than you might imagine, and we’re here to guide you through each step.

Step 1: Initial Consultation and Pre-Approval

Your journey begins with a call or visit to a dealer. We’ll discuss your current home’s details, your existing mortgage, and your goals for a new home. We will also discuss your budget and begin the pre-approval process for new financing.

Getting pre-approved early helps you focus on homes within your budget. Our team will guide you through the necessary documents. For more details, visit our Financing: Pre-Approval Process page.

Key Task: Contact your current lender and request a written “30-day payoff” statement. This document is crucial for calculating your trade-in numbers accurately.

Step 2: Home Evaluation and Trade-In Offer

Next, we determine the value of your current home. You’ll start by sharing basic details and photos. Then, we’ll schedule an in-person inspection to assess the home’s condition, note any upgrades, and determine its “in-place” or “pull-out” value.

Within a few days, you’ll receive a formal trade-in offer. This is a firm number based on market conditions, NADA guidelines, and our physical assessment. Feel free to ask how we arrived at the value, especially if you’ve made recent improvements.

Step 3: Navigating the Finances: How to trade in a mobile home with a mortgage and a new loan

Our expertise simplifies the financial aspects of your trade-in. Your trade-in value acts as a down payment, reducing the amount you need to finance for your new home.

You don’t need to pay off your current mortgage beforehand. We coordinate with your new lender to handle the payoff of your existing mortgage at closing, building it into the transaction.

If you have negative equity (owing more than the home is worth), we can often roll the remaining balance into your new loan. This avoids a large out-of-pocket payment. Your new loan will reflect the new home’s price, minus your trade-in credit, plus any rolled-over balance.

Bonus: You only pay sales tax on the remaining balance after your trade-in credit is applied, which can lead to significant savings. For more tips, see our Top 7 Mobile Home Financing Tips.

Step 4: Finalizing the Deal

In the final stage, we’ll review the sales agreement together. This document outlines the new home’s price, your trade-in credit, financing terms, and delivery timeline. The signing process includes the purchase agreement, trade-in paperwork, and financing documents.

As part of the service, we handle the removal of your old home, managing the complex logistics so you don’t have to. Finally, we schedule the delivery and setup of your new manufactured home, coordinating everything from permits to utility connections.

The entire process typically takes a few weeks to a couple of months. Our team will keep you informed every step of the way, allowing you to focus on the excitement of your new home.

Frequently Asked Questions about Mobile Home Trade-Ins

Trading in a mobile home with a mortgage brings up many questions. Here are answers to the most common ones we hear.

What happens if I owe more on my mortgage than the trade-in value?

This situation is called negative equity or being “upside-down,” and it doesn’t have to stop you from upgrading. Many dealers can roll the difference between what you owe and your trade-in value into your new loan.

For example, if you owe $45,000 and your trade-in value is $40,000, the $5,000 difference can often be added to your new financing. While this increases your new loan amount, it allows you to move forward without a large out-of-pocket expense.

It’s crucial to discuss this with your financing specialist to explore all options. We can often structure the new loan to find a payment that fits your budget.

How long does the trade-in process typically take?

The timeline typically ranges from a few weeks to a couple of months. The speed depends on several factors:

- Your document submission: Providing your loan information and income verification quickly is key.

- New home availability: Choosing a home already on the lot is faster than a custom order.

- Financing approval: Working with specialists in manufactured home lending streamlines this step.

We coordinate all the logistics between lenders and movers to make the process as efficient as possible.

Do I need to make repairs to my old mobile home before trading it in?

Generally, it’s best to get an “as-is” offer first. This provides a baseline value without you spending money on repairs.

- Minor improvements: Cost-effective fixes like deep cleaning, patching small holes, or touching up paint can improve your offer by showing the home has been well-cared for.

- Major issues: It’s usually not worth investing in significant repairs (like a new roof or structural work) for a trade-in. We will factor these issues into our offer, and the convenience of an as-is trade often outweighs the cost of major repairs.

We are professionals who can see past cosmetic issues to the home’s underlying value and are accustomed to handling homes in all conditions.

Your Path to a New Home Starts Here

Understanding how to trade in a mobile home with a mortgage makes upgrading your lifestyle an exciting and achievable opportunity. Your existing home and its mortgage can be a stepping stone, not an obstacle, to a home that better fits your family’s needs.

With the financial flexibility of a trade-in and the expert guidance of an experienced dealer, the process is seamless. We handle the mortgage payoffs, valuations, and financing, turning a complex transaction into a simple one.

At Manufactured Housing Consultants, our mission is making homeownership possible for families across Texas. From our Corpus Christi location, we offer the largest selection from 11 top manufacturers at guaranteed lowest prices. This ensures you get the best value for both your trade-in and your new home.

Our specialized financing for all credit situations, including FICO improvement programs, sets us apart. We work with lenders who understand that every family’s financial story is unique. With Texas-wide delivery, your perfect home is never out of reach.

Ready to take the next step? The process is simpler and more rewarding than you might imagine. Trade-in or Sell Us Your Old Mobile Home and find how quickly you could be in a home that truly fits your life. With the right Financing partner, your new home is closer than you think.