Why Understanding Your Double Wide’s Trade-In Value Matters

When you’re ready to upgrade your living situation, knowing your double wide trade in value can be the key to making your next home purchase more affordable. A double-wide manufactured home typically holds 20-50% higher resale value than single-wide homes, but several factors determine exactly what your home is worth.

Quick Answer: Double Wide Trade-In Value Factors

- Age and condition – Newer homes in good shape get higher values

- Location – Homes on owned land worth more than park models

- Size and features – Larger homes with upgrades command better prices

- Market demand – Local housing market affects trade-in offers

- NADA book value – Industry standard starting point for valuation

The trade-in process works much like trading in a car. Your current home’s value gets applied toward the purchase price of your new manufactured home, reducing your down payment and making homeownership more accessible. This can save you thousands of dollars compared to selling your home separately and then buying new.

Many families find trading in their double-wide home offers significant advantages over selling it themselves. You avoid the hassle of marketing, showing, and negotiating with individual buyers. Plus, you can often complete both transactions – selling your old home and buying your new one – through a single dealer.

The manufactured housing market has evolved dramatically. Between 2018 and 2023, mobile home values increased by 58% nationwide, outpacing traditional home appreciation of 37%. This means your double-wide may be worth more than you think, especially if it’s well-maintained and located on owned land rather than in a rental community.

How is a Double Wide’s Value Determined?

Determining your manufactured home’s worth is straightforward. Unlike site-built homes, the double wide trade in value follows different rules based on its construction and classification.

Manufactured homes can appreciate. While homes on rented land often depreciate 3-3.5% annually, homes on owned land can increase in value.

The data plate on your home is key. Homes built after 1976 follow the federal HUD Code, ensuring quality construction similar to site-built homes. This gives them a major advantage over pre-1976 “mobile homes,” which depreciate faster and are harder to finance.

Key Factors Influencing Your Double Wide Trade In Value

When evaluating your home, we look at several key factors.

Age and manufacturer are critical. Newer homes built to HUD standards hold their value better, and some brands are known for superior construction. A 30-year-old home may have outdated materials like ABS piping or aluminum wiring, which affects its value.

Size and floor plan give double-wides an advantage. At 20 to 36 feet wide, they offer more space than single-wides and command 20-50% higher values. Popular features like open floor plans and master suites also boost value.

Overall condition is paramount. We inspect everything from the roof and siding to flooring and fixtures. A well-maintained home gets a better offer, and simple fixes like fresh paint can significantly increase your double wide trade in value.

Upgrades and features pay off. Energy-efficient windows, modern appliances, and updated kitchens or bathrooms boost your home’s appeal and value. Modern homes can be 25% more energy-efficient, a major selling point.

Location is a huge factor. Homes on private land are classified as “real property” and can appreciate, commanding higher prices than homes in parks, which are considered depreciating “personal property.”

Community quality matters for homes in parks. Well-managed communities with good amenities help preserve value. However, a home on a permanent foundation on owned land will almost always have a higher trade-in value.

Understanding NADA Guides and Professional Appraisals

Accurate valuation uses industry-standard tools, similar to car valuations.

The NADA Book Value is the industry’s Kelley Blue Book. For homes built after 1976, it provides a value based on manufacturer, model, year, size, and condition. This report, available online, offers a solid starting point, but it’s an average—your home may appraise for more or less.

Professional appraisals provide a more detailed valuation, often required for financing. Appraisers use Form 1004C for manufactured homes on real property, conducting a physical inspection and analyzing local market conditions.

A Comparative Market Analysis (CMA) compares your home to recent sales of similar homes in the area, providing a highly accurate, market-based valuation.

‘In-Place’ Value vs. ‘Pull-Out’ Value

This distinction is critical to your double wide trade in value because moving these homes is a major undertaking.

‘In-Place’ value is your home’s worth in its current location. This value is higher, especially on owned land, as it assumes the home will not be moved.

‘Pull-out’ value is the home’s value minus the significant cost of moving it, which can range from $1,000 to $20,000 plus setup fees. For older homes, this value can even be negative, reflecting disposal costs.

Our trade-in offers account for these potential moving costs, highlighting why location is so crucial to your home’s final value.

Maximizing Your Double Wide Trade In Value

Now let’s focus on how to boost your double wide trade in value. Small investments in maintenance and upgrades can yield a significant return.

Just as you’d wash a car before trading it in, a little TLC on your home can make a big difference in your offer. The good news is you don’t need to break the bank. Affordable maintenance and smart upgrades often pay for themselves with a higher trade-in value.

Essential Maintenance and Repairs

Regular maintenance protects your investment. During our evaluation, these are the key areas we focus on:

Roofing and siding create the first impression. Missing shingles or cracked siding suggest costly water damage. Ensure your roof is watertight and your siding is in good condition.

Skirting protects your home’s underside from moisture, pests, and cold air. Damaged skirting looks neglected and can lead to bigger problems.

Leveling is crucial. An unlevel home can cause sticking doors, bouncy floors, and structural stress leading to cracks. A level home feels solid and prevents damage.

Plumbing and electrical problems can be deal-breakers. A dripping faucet or flickering light suggests bigger issues. Fix these minor problems before they become costly.

Flooring heavily influences first impressions. Worn carpets or cracked linoleum make a home feel dated. New flooring can make the entire home feel fresh and clean.

Smart Upgrades That Boost Value

Strategic upgrades can increase your double wide trade in value. Here’s where to focus your renovation budget:

Kitchen renovations offer a high return. Simple updates like new countertops, hardware, or a backsplash can transform the space. Upgrading old appliances to energy-efficient models is also a major plus.

Bathroom updates are also high-impact. A new vanity, modern fixtures, or updated lighting can make a small space feel completely new.

Energy-efficient windows lower utility bills and modernize your home’s look. They are a valuable upgrade that appeals to new buyers.

Fresh paint is the most cost-effective upgrade for a major visual impact. Neutral colors make rooms feel larger and cleaner, while fresh exterior paint boosts curb appeal.

Landscaping creates curb appeal. A neat lawn, trimmed bushes, and a few flowers show pride of ownership and create a welcoming entrance.

Keep all receipts, photos, and warranties for your upgrades. This documentation helps us justify a higher valuation by proving the improvements you’ve made.

The Trade-In Process with Manufactured Housing Consultants

At Manufactured Housing Consultants, we know that juggling the sale of your current home while shopping for a new one can feel overwhelming. That’s exactly why we’ve designed our trade-in process to take the stress out of upgrading your living situation. Think of it like trading in your car at a dealership – simple, straightforward, and all handled in one place.

| Benefit | Description |

|---|---|

| Convenience | Avoid the complexities of private selling, including marketing, showing, and negotiating. We handle the assessment and paperwork. |

| Streamlined Process | Complete both transactions – trading in your old home and purchasing your new one – through a single, coordinated process. |

| Professional Guidance | Our experienced team provides expert advice, helping you understand your double wide trade in value and steer financing options. |

| Trade-In Value Applied to New Home | The value of your current home is directly applied to the purchase price of your new manufactured home, reducing your out-of-pocket costs or down payment. |

| Simplified Paperwork | We assist with all necessary documentation, making the transition from your old home to your new one smooth and easy. |

The beauty of our approach is that you’re not dealing with multiple parties, endless showings, or the uncertainty of whether your home will sell. Instead, you get professional guidance from start to finish, with your double wide trade in value applied directly toward your new home purchase. This means less money out of your pocket and a much smoother transition.

We’ve helped hundreds of Texas families upgrade their homes this way, and many tell us they wish they’d known about the trade-in option sooner. No more worrying about timing two separate transactions or dealing with the headaches of private buyers who change their minds at the last minute.

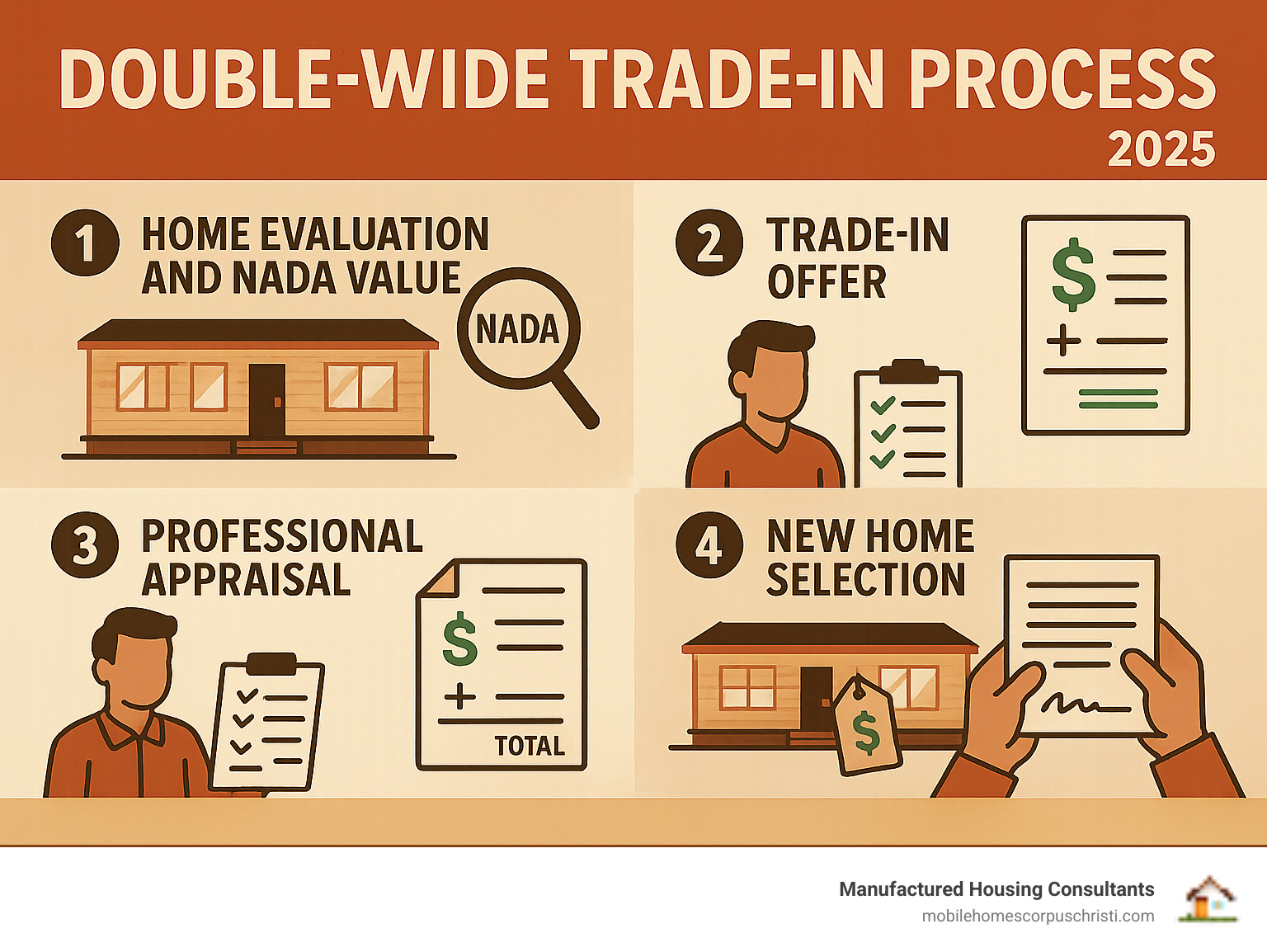

Steps in a Typical Trade-In

Our trade-in process is designed to be as straightforward as possible. Here’s exactly what happens when you work with us:

Initial consultation is where everything begins. One of our friendly consultants will sit down with you to understand what you’re looking for in your new home and learn about your current double-wide. This isn’t a high-pressure sales meeting – it’s more like having coffee with a knowledgeable friend who happens to know everything about manufactured homes. Feel free to ask any questions you have about the process.

Home evaluation comes next, and it won’t cost you a penny. We’ll visit your property to assess your home’s condition, features, and location. Our team looks at everything from the roof and siding to the interior upgrades and overall maintenance. This thorough evaluation helps us determine the most accurate double wide trade in value possible.

Receiving an offer is when things get exciting. Based on our comprehensive evaluation, we’ll present you with a fair, no-obligation trade-in offer. This offer takes into account current market conditions, your home’s unique features, and any costs we might incur to prepare your home for its next owner. We believe in transparency, so we’ll explain exactly how we arrived at the number.

Choosing your new home is definitely the fun part. With your trade-in value established, you can browse our incredible selection of new double-wide manufactured homes from 11 top manufacturers. We’re talking about homes ranging from 704 to 2,300 square feet, with 3-5 bedrooms and 2-5 bathrooms. Whether you want something budget-friendly or you’re dreaming of custom designs with all the bells and whistles, we’ve got options that’ll make you excited to come home every day.

Finalizing the deal is where our expertise really shines. We’ll walk you through all the financing options and paperwork, making sure everything is crystal clear. Our specialized financing works with all credit situations – we even offer FICO improvement programs. Your trade-in value gets applied directly to your new home purchase, which often means a smaller down payment and lower monthly payments.

When a Trade-In Makes the Most Sense

Trading in your double-wide isn’t right for everyone, but it’s absolutely perfect in certain situations. If you’re upgrading to a new home because your family is growing or you want modern energy-efficient features, a trade-in eliminates the juggling act of selling and buying simultaneously. Many of our customers tell us they wanted more space for grandchildren or were tired of high utility bills in their older homes.

Seeking a hassle-free process is another great reason to consider a trade-in. Selling a home privately means dealing with real estate agents, staging your home, accommodating showings at all hours, and negotiating with strangers. Frankly, it’s exhausting. Our trade-in process cuts through all that noise.

Wanting to apply trade-in value directly to your next purchase makes financial sense for most families. Instead of waiting months for your home to sell and then scrambling to find financing for your new home, you can move forward with confidence knowing exactly what you’re working with. This direct application often reduces your down payment and can lower your monthly payments too.

Looking for expert support throughout the process is where we really add value. The manufactured home market has its own unique considerations – from understanding HUD codes to navigating specialized financing options. Our team has years of experience helping Texas families make smart decisions about their housing investments.

Navigating the Financials of a Trade-In

Understanding the financial aspects of your double wide trade in value is crucial for making an informed decision. It’s not just about the number; it’s about how that value impacts your new home purchase and your overall financial picture.

Financial Implications of Your Double Wide Trade In Value

Think of your trade-in value as a powerful financial tool that can transform your home buying experience. When you trade in your double-wide, that value becomes real money working for you in several important ways.

Applying value to your new purchase is the most straightforward benefit. Let’s say your dream home costs $120,000 and your current double-wide has a trade-in value of $50,000. Instead of financing the full $120,000, you only need to secure financing for $70,000. That’s a significant difference that impacts everything from your loan approval to your monthly budget.

Reducing your down payment is where many families see immediate relief. Your trade-in value can serve as all or part of your down payment, which means you don’t need to scramble to save up a large chunk of cash. This is especially helpful when the national average price for a new manufactured home reached $124,300 in 2023.

Lowering your monthly payments naturally follows. When you finance less money, your monthly payments shrink too. This frees up room in your budget for other priorities – maybe that family vacation you’ve been planning or building up your emergency fund.

Even if you’re trading in an older home that doesn’t have the value you hoped for, the trade-in process can still work in your favor. We often offer incentives or absorb some costs associated with older homes to help make your upgrade possible. Your current home might be worth more to us as part of a complete transaction than it would be to a private buyer.

Does Your Home Need to Be Paid Off?

Here’s some good news that surprises many homeowners: you don’t necessarily need to own your home free and clear to trade it in.

Trading with an existing loan is often completely doable. We work with families in this situation regularly. The key is understanding exactly how much you still owe – what lenders call the payoff amount.

Lender communication becomes part of our process. We coordinate directly with your current lender to handle the payoff as part of your new home purchase. You won’t need to juggle multiple transactions or worry about timing issues between selling your old home and buying your new one.

Rolling debt into a new loan might be an option if you find yourself in a situation where you owe more than your home’s current trade-in value. This happens sometimes, especially with older homes or if you purchased during a market peak. We offer specialized financing for all credit situations, including FICO improvement programs, so we can explore creative solutions that work for your specific circumstances.

The important thing is being upfront about your current loan situation. We’ve helped families steer all kinds of financial scenarios, and there’s usually a path forward that makes sense.

Tax Implications to Consider

Nobody likes surprises at tax time, so let’s talk about how a trade-in can actually save you money.

Sales tax savings represent one of the biggest immediate benefits of trading in versus selling privately. When you trade in your double-wide, you typically only pay sales tax on the difference between your new home’s price and your trade-in value. Using our earlier example, you’d pay sales tax on $70,000 instead of $120,000 – that’s substantial savings that stays in your pocket.

Property tax considerations depend on how your manufactured home is classified. If your new home will be placed on owned land and becomes real property, it will be subject to property taxes similar to a site-built home. This isn’t necessarily bad news – it often means your home can appreciate in value over time.

Consulting a tax professional is always smart when making a major financial decision. While we can share general information about how trade-ins typically work, a qualified tax professional can give you personalized advice based on your complete financial picture. Every family’s situation is unique, and getting expert guidance ensures you’re making the most informed decision possible.

Frequently Asked Questions about Mobile Home Trade-Ins

We hear these questions all the time from families just like yours who are considering a trade-in. Let’s walk through the answers together so you can feel confident about your decision.

Can I trade in a mobile home that is not in perfect condition?

Absolutely! We understand that life happens, and homes show their age over time. You don’t need a picture-perfect home to get started with a trade-in.

Your home’s condition will definitely affect your double wide trade in value – that’s just being honest with you. But we’ve seen homes in all kinds of conditions, from those needing minor touch-ups to others requiring more significant work. Our evaluation process takes everything into account, and we’ll give you a fair offer based on what we see.

Here’s the reality: we need to make the numbers work when we resell your home, so our offer reflects any costs we’ll have for repairs, cleaning, or transportation. For homes that need extensive work, the value might be lower than you’d hope. In rare cases with very old or severely damaged homes, the trade-in value might be minimal, but we’ll always explore every option to help you move forward.

The good news? Even if your home isn’t in great shape, trading it in can still be your best path to upgrading. We’ve helped countless families transition from older homes to beautiful new ones, and we’re here to make it work for you too.

Do I need a broker or agent for a mobile home trade-in?

Not when you work directly with us! That’s one of the biggest advantages of choosing Manufactured Housing Consultants for your trade-in.

When you sell a home privately, you might need a broker or agent to help with marketing, showings, and negotiations. These professionals typically charge around 6% commission on your sale price. But with our trade-in process, we handle everything ourselves.

We take care of the valuation, all the paperwork, and even the logistics of moving your old home. It’s a direct, straightforward process between you and us – no middleman needed. This saves you money on commissions and eliminates the hassle of coordinating with multiple parties.

Think of it like trading in your car at a dealership versus selling it privately. We make it simple and convenient, so you can focus on choosing your perfect new home instead of worrying about the selling process.

How long does the trade-in process typically take?

This is probably our most common question, and the honest answer is: it depends on your specific situation.

The initial steps move pretty quickly. We can usually schedule your home evaluation within a few days, and you’ll have your trade-in offer shortly after that. Once you accept our offer and choose your new home, the timeline depends on several factors.

If you’re buying a home we already have built and ready, you could be moving in within a few weeks. But most families need a bit more time because of financing approval, site preparation, or customizations to their new home.

The typical timeline runs several months when you factor in getting your loan approved, preparing your land (if you’re placing the home on private property), and handling local permits and inspections. If you’re ordering a custom home with specific features, add extra time for manufacturing.

Site preparation often takes the longest – things like pouring a foundation, running utilities, and getting permits can vary significantly depending on your location and local regulations.

We know waiting isn’t fun when you’re excited about your new home! That’s why our team stays in close contact throughout the process, keeping you updated on every step. We’ll give you realistic timelines upfront and work hard to keep things moving as smoothly as possible.

Conclusion

Making the move to upgrade your manufactured home doesn’t have to be overwhelming when you understand your double wide trade in value. Throughout this guide, we’ve walked through the key factors that influence what your home is worth – from its age and condition to location and any upgrades you’ve made. We’ve also broken down how valuation works, whether through NADA Guides or professional appraisals, and why the difference between ‘in-place’ and ‘pull-out’ values matters so much.

The best part? You have real control over maximizing your home’s value. Simple maintenance like keeping your roof in good shape and ensuring proper leveling can protect your investment. Smart upgrades to your kitchen or bathroom can actually boost your double wide trade in value significantly. Even fresh paint and good curb appeal make a meaningful difference.

When you’re ready to make that move, trading in with us eliminates the headaches of selling privately. No more dealing with showings, negotiations, or uncertain buyers. Instead, you get a straightforward process where your home’s value goes directly toward your new purchase, often reducing your down payment and monthly payments.

At Manufactured Housing Consultants, we’ve made it our mission to help Texas families find their perfect home without the stress. With our selection from 11 top manufacturers, guaranteed lowest prices, and financing options for every credit situation, we’re here to make your upgrade as smooth as possible.

Your current double-wide has served you well, but that doesn’t mean you can’t do even better. Whether you’re looking for more space, modern energy efficiency, or just a fresh start, trading in your home with us means you’re one step closer to the lifestyle you want.

Ready to see what your home is worth and explore your options? Let’s talk about how we can help you trade up to something amazing.