Understanding Mobile Home Trade-In Options

When you trade in your mobile, you’re exchanging your current manufactured home for credit toward purchasing a newer model, similar to how car dealerships work. This process can save you thousands and eliminate the hassle of selling your old home privately.

Quick Mobile Home Trade-In Overview:

- What it is: Exchange your current mobile home for credit toward a new one

- Who qualifies: Owners of single-wide, double-wide, and manufactured homes

- Benefits: Instant credit, no private sale hassles, one-stop transaction

- Timeline: Typically 2-4 weeks from appraisal to completion

- Requirements: Clear title, accessible location, structural integrity

Mobile home trade-ins function like car trade-ins. You get your current home appraised and receive credit that goes directly toward your new home purchase. The difference is that professionals handle the entire process at your current location.

This approach is ideal for families wanting to upgrade without the stress of coordinating two separate transactions. You avoid the time-consuming process of listing your home, showing it to potential buyers, and handling financing complications. Our customers often tell us how the trade-in process made upgrading their family home much easier than they expected.

Simple guide to Trade in your mobile terms:

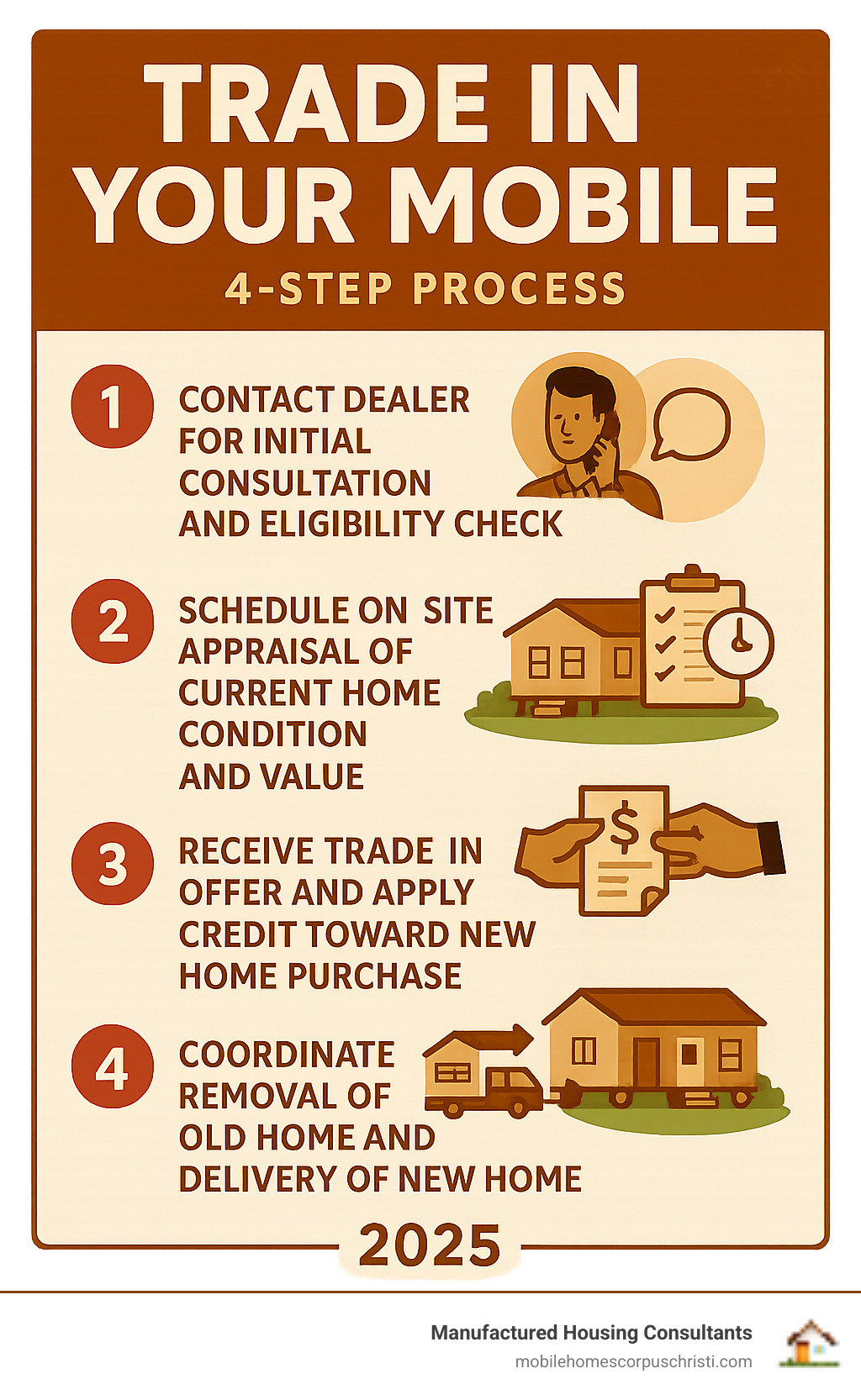

How the Mobile Home Trade-In Process Works

When you’re ready to trade in your mobile home, the process is straightforward. Our system is designed to take the stress out of upgrading so you can focus on choosing your new home.

At Manufactured Housing Consultants, we handle everything. Our team comes to you, eliminating the need for public showings and dealing with non-serious buyers.

The process begins with an initial consultation to discuss your needs and what you’re looking for in an upgrade. With homes from 11 top manufacturers and specialized financing for every credit situation, we can find a solution that fits your budget.

The next step is our on-site appraisal. An experienced professional will visit your property to evaluate your mobile home’s foundation, roof, structural integrity, systems, and overall condition to determine its fair market value.

After the appraisal, we’ll present a clear trade-in offer. This credit goes directly toward your new home, reducing your upfront costs. We believe in transparency, so you’ll understand exactly how we arrived at our offer.

The beauty of this process is its simplicity. Instead of juggling two separate transactions, everything happens in one smooth transaction.

More info about our trade-in process.

Determining Your Home’s Eligibility

Most well-maintained manufactured homes qualify for a trade-in. We accept both single-wide and double-wide homes. While age is a factor, it’s not a deal-breaker if your home has been well cared for.

The most important factor is structural integrity. Your home’s frame, roof, and foundation must be solid. Major structural damage can be a complication, but minor issues usually just factor into the valuation.

Ownership verification is essential. You’ll need to prove ownership with a clear title. If there are any liens or legal complications, they must be sorted out first. We can also work with you if your home still has a mortgage.

Finally, we consider location and accessibility. Our team needs to be able to safely remove your home. This is rarely an issue, but it’s something our appraiser will confirm during their visit.

Understanding the Appraisal and Offer

Our professional assessment is a comprehensive evaluation of your mobile home’s condition and value.

During the condition evaluation, our appraiser examines major systems like plumbing, electrical, and HVAC. They’ll check the roof, flooring, walls, windows, and any included appliances. We’re assessing honest condition and functionality, not perfection.

We also perform a market comparison, researching recent sales of similar homes in your area. Current demand for your specific home type plays a big role in determining value, and this research ensures our offer reflects today’s marketplace.

If the condition doesn’t match our initial estimate, we’ll provide a revised assessment and explain our reasoning. You are never locked into accepting an offer.

Negotiating the offer is part of the process, and we encourage open communication. Our guaranteed lowest prices on new homes often make up for any differences you might find elsewhere. We want you to feel confident about the entire transaction.

Once we reach an agreement, finalizing the paperwork includes setting up financing for your new home and coordinating your old home’s removal with your new home’s delivery.

How to Prepare to Trade in Your Mobile Home

Preparing to trade in your mobile home helps you get the best possible value and ensures a smooth transition. The good news is that most of the steps are straightforward, and we’ll guide you through the process.

Start with your documentation checklist; we’ll help you gather your title, proof of paid property taxes, and any mortgage information. Then, focus on cleaning and decluttering. A well-maintained home shows our appraisers you’ve taken good care of your investment, which can positively impact your offer.

If you can handle any minor repairs, like a squeaky door or a loose cabinet handle, now is the time. These small touches show pride of ownership.

Crucially, you must remove all personal property. We cannot stress this enough: everything you want to keep needs to be removed. We are not responsible for items left behind.

Finally, you’ll want to secure the home for transport by ensuring windows and doors latch properly and any loose fixtures are tightened.

More info about how to trade in a mobile home.

Gathering Necessary Paperwork

Being organized with your paperwork pays off. The title or ownership documents are essential to prove you are the legal owner.

Your proof of paid property taxes shows there are no outstanding debts that could complicate the transfer. Your local tax office can provide a copy if needed.

If you have a mortgage or lien holder, we just need the details about your lender to coordinate the payoff as part of your trade-in.

Keep your personal identification handy for legal paperwork. If you have service and repair records, bring them along. While not required, they can sometimes boost your home’s value by showing a history of good maintenance.

Having everything ready before our appraisal visit will make the process much smoother.

Staging Your Home for Maximum Value

A little effort in staging can go a long way toward maximizing your trade-in value. A well-presented home suggests it’s been cared for.

Start with deep cleaning. Scrub bathrooms, make kitchen surfaces gleam, and clean appliances to suggest good maintenance habits.

Minor cosmetic fixes can have a big impact. Touch up chipped paint, replace broken outlet covers, and tighten wobbly door handles. These simple fixes show attention to detail.

Don’t forget curb appeal. Your home’s exterior is the first thing our appraiser sees. Sweep porches, trim bushes, and ensure the skirting looks tidy.

Depersonalizing the space helps our appraisers focus on the home itself. Pack away family photos and clear countertops of personal belongings.

We’re not expecting perfection, but a home that has been cared for. These steps help your home put its best foot forward.

More info about the mobile home trade-in complete guide.

Calculating Your Mobile Home’s Trade-In Value

Understanding how we determine your home’s value helps you feel confident when you trade in your mobile. Similar to a car appraisal, we assess specific factors to determine its current market worth.

The biggest factor is your home’s age and condition. A well-maintained 10-year-old home is worth more than a 20-year-old home needing repairs. We also look at the manufacturer and model, as some brands hold their value better. Since we work with 11 top manufacturers, we know which brands command higher resale values.

Your home’s size and floor plan also make a difference. Double-wide homes typically have higher trade-in values than single-wide models. We also factor in current market demand for pre-owned homes in your area. Our team stays current on market trends, so our offer reflects what buyers are paying.

The location of your home matters as well, as does the ease of access for removal, which affects the overall cost of the trade-in.

More info about mobile home trade-in value.

Factors That Increase or Decrease Value

Let’s be honest about what affects your trade-in value. Recent upgrades and renovations like new flooring or energy-efficient windows can boost your home’s worth. A well-maintained exterior and interior show you’ve cared for your investment.

On the other hand, structural issues like roof leaks or foundation problems will decrease your trade-in value. Significant problems require honest pricing adjustments.

Your home’s included appliances and features add value if they’re in good working order. However, non-working major systems like HVAC or plumbing will impact our offer. A clear title with no outstanding liens is also necessary.

The location affects both the value and the logistics of removal. Homes that are easily accessible help keep costs down, which can translate to better trade-in offers.

| Factors That Increase Value | Factors That Decrease Value |

|---|---|

| Recent upgrades and renovations (e.g., new appliances, flooring, energy-efficient windows) | Structural issues (e.g., roof leaks, foundation problems, water damage) |

| Well-maintained exterior and interior | Significant cosmetic damage (e.g., large holes in walls, heavily stained carpets) |

| Functional and included major appliances and features | Non-working major systems (e.g., HVAC, plumbing, electrical) |

| Clear title with no outstanding liens | Outstanding liens or unpaid property taxes |

| Easily accessible location for removal | Difficult access for removal |

More info about double wide trade-in value.

How to Get the Best Deal When You Trade In Your Mobile Home

Getting the best deal is about getting the most value from your entire home upgrade. Here’s how we help you achieve that.

Start by researching your options. Look at similar homes for sale in your area to get a general idea of market values. You can also learn more about general manufactured housing standards from official resources like the U.S. Department of Housing and Urban Development (HUD) via its Manufactured Housing Program. This helps you have realistic expectations.

We’ll provide multiple quotes from Manufactured Housing Consultants showing how your trade-in credit applies to different new home models. This helps you see all your options.

Remember to consider the value of your new home purchase. We offer guaranteed lowest prices on new homes from 11 top manufacturers, which means significant savings that often outweigh small differences in trade-in values.

Timing the market can sometimes work in your favor. Our experts understand current market conditions and can advise you if it’s a good time to trade in your specific type of home.

Don’t forget to leverage your home’s best features during the appraisal. Point out recent upgrades or unique features that make your home special.

The secret to the best deal is focusing on the complete package: your trade-in credit combined with our guaranteed lowest prices on new homes creates exceptional value.

Important Considerations When You Trade In Your Mobile Home

When you trade in your mobile, it’s important to understand the process to make the best decision for your family. The trade-in offers significant advantages, and it’s wise to know what to expect.

The benefits of trading in go beyond convenience. You get a fast-track to your dream home upgrade without the headaches of selling privately. No more surprise visits from potential buyers or dealing with financing complications from multiple parties.

There are also environmental benefits of reuse. Your current mobile home gets a second chance. Many traded-in homes are refurbished and find new families who need quality, affordable housing. You’re giving your home the opportunity to create new memories for someone else.

Understanding the common terms and conditions is important. Once you sign the trade-in agreement and we apply the credit to your new home purchase, the deal is final. Your old home becomes ours to handle.

As for what happens to your old home, that becomes our responsibility. Our team handles all aspects of removal and transportation, saving you thousands of dollars and countless headaches. Moving a mobile home requires special permits and professional crews.

More info about trading in manufactured homes.

Can You Trade In a Mobile Home That Is Still Under a Financing Plan?

Yes! This is a common situation, and we’ve helped hundreds of families steer it successfully. The process overview is straightforward.

First, contact your lender to get your current payoff amount. This number changes daily due to interest, so you’ll want a recent quote.

The equity calculation is next. If your home is worth more than you owe, that positive equity becomes credit toward your new home. If you owe more than the trade-in value, we can often help you roll that remaining debt into a new loan. Our specialized financing team has creative solutions for almost every situation.

The required documentation includes your loan statements, the payoff quote, and proof of payment history. Having these ready speeds up the process. We’ve worked with lenders across Texas and know how to make the transition as smooth as possible.

More info about how to trade in a mobile home with a mortgage.

The Benefits of Trading In vs. Selling Privately

While selling your mobile home privately might seem appealing, the reality is often complicated. For most families, the convenience and speed of a trade-in far outweighs any potential extra cash from a private sale.

A private sale involves pricing, listing, photography, fielding calls, scheduling showings, and keeping your home in perfect condition for weeks or months. Then comes negotiating with buyers and handling their financing issues.

With our one-stop transaction approach, you handle the sale and purchase in a single visit. We appraise your home, apply the credit to your new purchase, and coordinate everything from financing to delivery.

The financial simplicity saves significant stress. Your trade-in value is immediately applied to your new home purchase. Plus, you’re avoiding the expense and headache of moving your old home yourself, which can cost thousands and requires professional transport.

When you trade in your mobile home with us, you’re choosing peace of mind and efficiency over the uncertainty of a private sale.

More info about mobile home exchange.

Frequently Asked Questions about Mobile Home Trade-Ins

Here are the answers to the questions we hear most often from Texas families looking to upgrade their homes.

What happens to my old mobile home after I trade it in?

After you trade in your mobile, your old home gets a second chance. Most traded-in homes go through a refurbishment process where we clean them, make repairs, and sometimes add upgrades. Once refurbished, these homes find their way to new owners who get a quality home at an affordable price.

For homes that have seen better days, we focus on repurposing materials whenever possible. When materials can’t be reused, we handle responsible disposal following all environmental regulations.

Your contribution to affordable housing stock is something to feel good about. By trading in your home, you’re helping make homeownership possible for another family.

How long does the mobile home trade-in process typically take?

Most trade-ins are completed within two to four weeks. The timeline overview depends on a few key factors, and we work to keep the process moving smoothly.

The journey from initial quote to final agreement can happen in just a few days once we have your paperwork and complete our on-site appraisal. The main factors affecting speed are the availability of your title and whether we need to coordinate with a lender for a payoff.

Coordinating the move of both your old and new homes is like a carefully planned dance. Our experienced team knows all the steps to make it happen seamlessly.

Can I trade in a mobile home that needs significant repairs?

Yes. We’ve seen homes in all conditions, and we believe every home has some value. However, repairs do affect the process.

During our assessment of repair costs, we’ll identify everything from minor cosmetic issues to major structural concerns. The impact on trade-in value is straightforward: the cost of repairs is factored into the offer.

We handle “as-is” trade-ins, and you might be surprised at what your home is still worth. Even homes with significant issues often have value. Our company policies on damaged homes are flexible, and we evaluate each situation individually.

In rare cases where repair costs would exceed the home’s potential value, selling for scrap might be better. We’ll be honest if we believe that’s the most practical path for your situation.

Our best advice? Give us a call. You might be pleasantly surprised at what we can offer.

Conclusion

When you trade in your mobile home, you’re making a smart decision for your family’s next chapter. This guide has walked you through the process, from the initial call to getting the keys to your new home.

The beauty of trading in lies in its simplicity, value, and convenience. Instead of the months-long hassle of a private sale, you can focus on what really matters: choosing your perfect new home.

Upgrading to a modern, energy-efficient home means lower utility bills, better comfort, and the pride of a brand-new space. Plus, when you trade in your old home, you’re helping another family find affordable housing while keeping your old home out of a landfill.

At Manufactured Housing Consultants, we care about helping Texas families find their dream home. With our selection from 11 top manufacturers, guaranteed lowest prices, and financing for every credit situation, we’re here to make your upgrade enjoyable.

Your current home has served you well, but it doesn’t have to limit your future. Let us show you how rewarding it can be to move into the home you’ve been dreaming about.