Why Understanding Financing Options Opens the Door to Affordable Homeownership

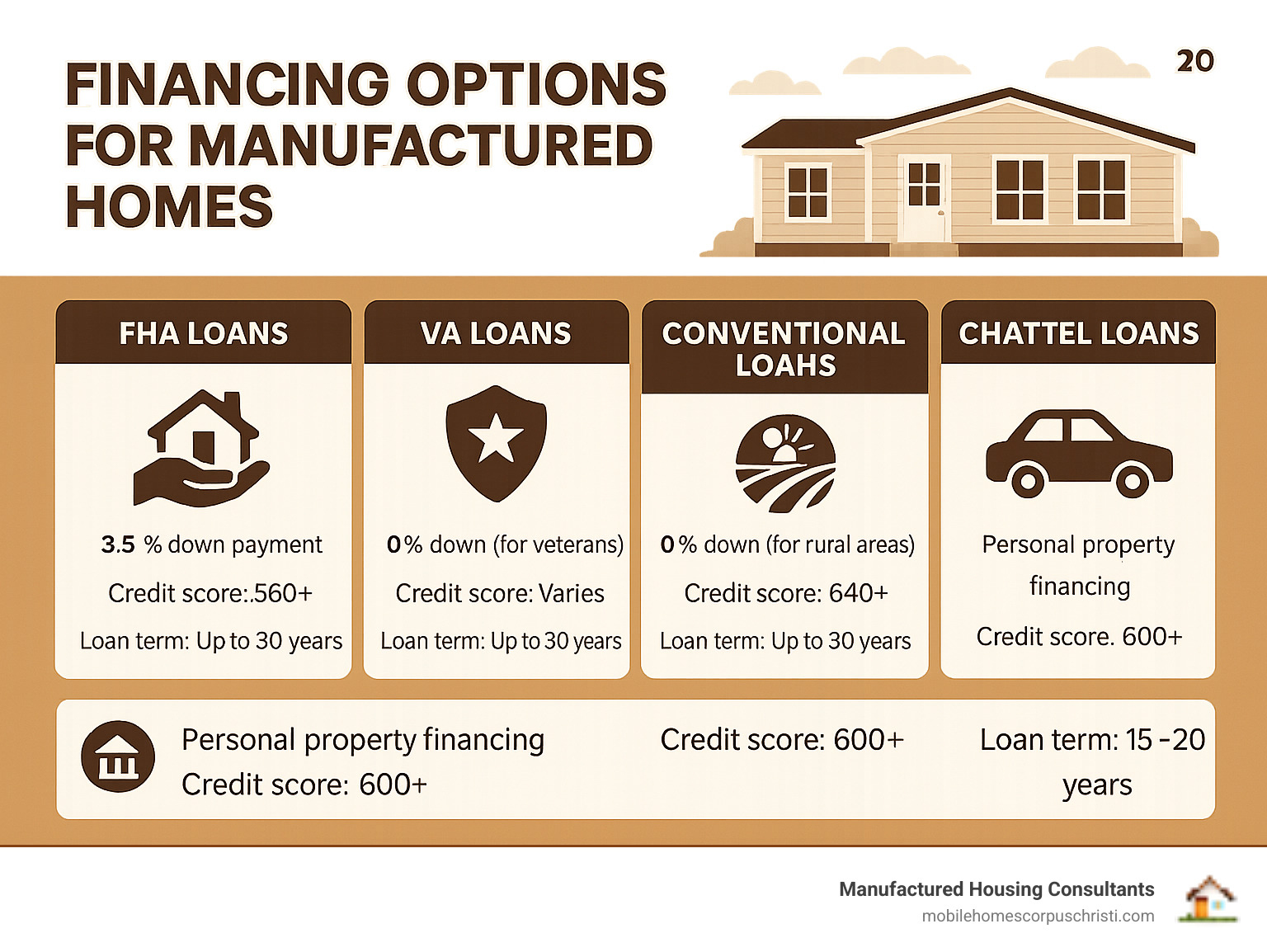

Financing options for manufactured homes range from government-backed loans (FHA, VA, USDA) and conventional mortgages to chattel and personal loans. Each has unique down payment, interest rate, and property requirements.

Quick Overview of Main Financing Types:

- FHA Loans: 3.5% down, credit scores as low as 580, includes Title I (home only) and Title II (home + land)

- VA Loans: 0% down for eligible veterans, up to 100% financing available

- USDA Loans: 0% down for rural properties, income limits apply

- Conventional Loans: 3% down with MH Advantage® or CHOICEHome® programs, 620+ credit score

- Chattel Loans: Personal property financing, higher rates but more flexible property requirements

With the median price of traditional homes over $416,900, manufactured homes offer a path to homeownership at roughly one-third the cost. The average manufactured double-wide home costs approximately $145,200. Research from The Urban Institute also shows these homes appreciate at nearly the same rate as site-built homes.

The key difference in financing lies in whether the home is classified as real estate (allowing traditional mortgages) or personal property (requiring chattel loans). This classification affects everything from interest rates to loan terms.

Understanding these options can be the difference between renting and building equity. Many families find they can own a quality manufactured home for less than their monthly rent.

Introduction: Understanding Your Home and Its Value

Before exploring financing options for manufactured homes, it’s crucial to know your home type. The terms “mobile home,” “manufactured home,” and “modular home” are often used interchangeably, but their differences significantly impact financing.

-

Mobile homes were built before June 15, 1976, to older construction standards. Their age can make financing more challenging.

-

Manufactured homes, built after June 15, 1976, adhere to the federal HUD Code for safety, quality, and energy efficiency. Designed to be permanent once installed, they come in various sizes, from single- to quadruple-wides.

-

Modular homes are also factory-built but must meet local and state building codes, just like site-built houses. Once assembled on a permanent foundation, they are often indistinguishable from traditional homes.

Why does this matter for your financing? The more a factory-built home resembles a traditional house, the better your loan options become. When a manufactured home is placed on a permanent foundation and titled as real property, it can appreciate in value just like a site-built home. The Urban Institute found that manufactured homes appreciated at the same rate as site-built homes, debunking old myths about these homes losing value.

This research is a game-changer, confirming that you’re not just buying a place to live—you’re making a smart investment. The key is understanding how the right financing can make quality, affordable homeownership a reality.

Exploring the Primary Financing Options for Manufactured Homes

Navigating the financing options for manufactured homes begins with understanding two loan categories: those for real property and those for personal property. This distinction dictates the loan types, interest rates, and terms available to you.

- Real Property Loans (Traditional Mortgages): When a manufactured home is permanently affixed to land you own and titled as real estate, it can be financed with a traditional mortgage, offering the most favorable terms.

- Personal Property Loans (Chattel Loans): If the home is on leased land or not permanently affixed, it’s considered personal property and financed with a chattel loan, which has different terms than a mortgage.

For more details, check out our Mobile Home FAQS: What Homeowners Need to Know page.

Government-Backed Loans: FHA, VA, and USDA

These programs are designed to make homeownership more accessible with flexible terms and low down payments.

- FHA Loans: Insured by the Federal Housing Administration, these loans are popular for their lenient credit criteria.

- Title I Loans: Finance a home, a lot, or both, and are often used for personal property (home not permanently affixed). Loan limits are around $105,532 for a home only and $237,096 for a home and lot. Terms are typically shorter and rates higher than Title II loans.

- Title II Loans: These are for manufactured homes permanently affixed to owned land and treated as real estate. They offer traditional 30-year mortgage terms with a low 3.5% down payment for credit scores of 580+, or 10% down for scores of 500-579.

- VA Loans: Guaranteed by the U.S. Department of Veterans Affairs, VA loans are a powerful tool for eligible veterans and service members. They offer up to 100% financing (no down payment) for manufactured homes that are permanently affixed to owned land and titled as real property.

- USDA Loans: The USDA’s Single Family Housing Guaranteed Loan Program helps buyers in designated rural areas. It includes options for manufactured homes, such as the Combination Construction-to-Permanent Loan, which can offer 100% financing with no money down.

Conventional Mortgages: Fannie Mae & Freddie Mac

Conventional mortgages from Fannie Mae and Freddie Mac are another great option, especially for high-quality manufactured homes that meet specific installation standards.

- Fannie Mae MH Advantage® & Freddie Mac CHOICEHome®: These similar programs treat high-quality manufactured homes like site-built properties. To qualify, homes must have features like permanent foundations, garages, and pitched roofs. Both programs offer financing with down payments as low as 3% and typically require a minimum credit score of 620. The home must be titled as real property with the land you own. You can find more details in resources like Review FAQs on Freddie Mac Mortgages or on our Manufactured Home Financing Options page.

Chattel Loans vs. Traditional Mortgages

Understanding the difference between chattel loans and traditional mortgages is crucial when exploring financing options for manufactured homes.

| Feature | Chattel Loan (Personal Property) | Traditional Mortgage (Real Property) |

|---|---|---|

| Property Type | Manufactured home not permanently affixed to land, or on leased land. | Manufactured home permanently affixed to land you own. |

| Lien Type | Secured by the home itself (like a car or RV loan). | Secured by both the home and the land (real estate). |

| Loan Term | Typically shorter (10-20 years). | Generally longer (15-30 years), offering lower monthly payments. |

| Interest Rates | Generally higher, reflecting the perceived higher risk of personal property. | Generally lower, similar to site-built home mortgages. |

| Down Payment | Varies, can be higher than traditional mortgages. | Can be as low as 0-5% for government-backed or special programs. |

| Closing Costs | Typically lower, as there’s no land appraisal or title insurance. | Higher, includes land appraisal, title insurance, and other fees. |

| Flexibility | Can be easier to obtain if you don’t own land or if the home isn’t permanently affixed. | Requires land ownership and permanent attachment. |

| Appreciation | Historically, homes financed with chattel loans may depreciate faster. | Homes titled as real property can appreciate at similar rates to site-built homes. |

In short, chattel loans finance the home as personal property, offering flexibility for homes on leased land but with higher rates and shorter terms. Traditional mortgages finance the home and land together as real property, providing lower rates and longer terms similar to a site-built house. Qualifying for a traditional mortgage is often the most financially advantageous route.

The Application Process: What Lenders Look For

Getting approved for financing options for manufactured homes is straightforward once you know what lenders need. By preparing your information, you can move forward with confidence.

The process usually begins with pre-approval. A lender reviews your finances to determine your borrowing capacity, which strengthens your position as a serious buyer when you make an offer. You’ll need standard financial documents like pay stubs, tax returns, and bank statements. We guide our clients through this gathering process to ensure everything is in order.

For a complete breakdown, check out our Financing: What You Need to Know page.

Key Borrower Requirements for Manufactured Home Financing Options

Lenders assess a few key areas to ensure you can comfortably make your monthly payments.

-

Credit Score: While your credit score is important, a perfect score isn’t required. FHA loans are flexible, allowing scores as low as 580 with 3.5% down (or 500 with 10% down). Conventional loans typically require a 620 minimum, while chattel loan standards vary by lender. Our Benefits of Improving Your Credit Score Before Buying Mobile Home guide offers practical tips.

-

Income and Debt-to-Income (DTI) Ratio: Lenders assess your income and DTI ratio to confirm you can afford payments. They look for steady income and a DTI ratio (monthly debt payments divided by gross monthly income) ideally below 43%, though some programs are more flexible.

-

Down Payment: Requirements vary significantly. VA and USDA loans offer 0% down for eligible buyers. FHA loans require just 3.5% down, and conventional programs like MH Advantage® can be as low as 3%. Our guide on How to Budget for Your New Manufactured Home can help you plan.

Property Requirements: Titling Your Home as Real Property

The home itself must also meet standards to qualify for the best financing options for manufactured homes. Classifying it as real property is key to securing lower interest rates.

To be titled as real property, the home must be on a permanent foundation that meets FHA and local codes, with wheels and axles removed. Lenders will require the HUD Data Plate and Certification Label to verify it was built to federal standards. Finally, you’ll file an Affidavit of Affixture and surrender the vehicle title to legally convert the home from personal to real property. This process open ups access to traditional mortgages.

Financing can differ for new vs. used manufactured homes. New homes easily meet current codes, simplifying the process. Used homes may require extra verification to ensure they meet lender standards, including age restrictions, but financing is still widely available.

Understanding these requirements makes the pre-approval process much easier. Our Financing: Pre-Approval Process guide walks you through the details.

Overcoming Common Financing Challenges

While financing options for manufactured homes are plentiful, challenges can arise. Think of them not as roadblocks, but as detours toward the right solution for your situation.

A common hurdle is finding lenders who specialize in manufactured homes. Many traditional banks lack the specific programs and expertise required. This is where specialized lenders like us excel. We understand the unique requirements of manufactured home financing, from HUD codes to titling, making a complex process simple for you.

Other common challenges include financing older homes or those in leased land communities. For older homes, FHA Title I loans can be a flexible option. For homes on leased land where mortgages aren’t possible, chattel loans provide a clear path to ownership. Worried about a low credit score? FHA loans accept scores as low as 580 with 3.5% down, and we specialize in financing for all credit situations, including FICO improvement assistance.

For more strategies, see our Top 7 Mobile Home Financing Tips.

Comparing Alternative Financing Options for Manufactured Homes

If a traditional loan isn’t the right fit, alternative financing options for manufactured homes can help.

-

Personal loans are a flexible alternative for less expensive homes. As unsecured loans, they are quicker to obtain with fewer property requirements. However, this comes with higher interest rates, shorter terms, and loan caps (often around $100,000). They can be a useful bridge to homeownership in specific situations.

-

Seller financing is a creative option where the seller acts as your bank. This can allow for flexible terms, but a solid legal agreement is essential.

-

Paying cash eliminates financing challenges entirely, giving you immediate equity and a simpler buying process. Our guide on how to Buy a Mobile Home with Cash explores this path.

The key is to remember there’s almost always a path to homeownership. If one option doesn’t work, we’ll help you find another that does.

Frequently Asked Questions about Manufactured Home Loans

Here are answers to some of the most common questions we hear about manufactured home financing.

How much of a down payment do I need for a manufactured home?

The required down payment for financing options for manufactured homes varies, and you might need less than you think.

- 0% Down: Available for eligible borrowers through VA loans (for veterans) and USDA loans (for rural properties).

- 3-5% Down: FHA loans require as little as 3.5% down (for credit scores 580+), while conventional programs like MH Advantage® and CHOICEHome® start at 3% down.

- Varies: Chattel loan down payments are set by the lender and depend on your credit and the home.

You’ll also have closing costs, which are typically 2-5% of the loan amount but can sometimes be rolled into the loan.

Can I get a loan for a manufactured home on leased land?

Yes, you can absolutely get a loan for a home on leased land. This is a common scenario, and specific loan products are designed for it.

- Chattel Loans: These personal property loans are secured by the home itself, not the land. They are the most common financing method for homes in manufactured home communities.

- FHA Title I Loans: These government-insured loans are also designed for homes not classified as real property. HUD requires your land lease to have an initial term of at least three years for this option.

Working with a lender who understands these products is key to a smooth process.

Is it harder to finance a manufactured home than a traditional house?

It’s different, but not necessarily harder. The process involves a few unique steps but is very manageable with the right guidance.

- Finding the Right Lender: Not all banks handle manufactured home loans, so working with a specialist like us is crucial. We can often get you pre-approved the same day.

- Specific Property Requirements: For a traditional mortgage, the home must be on a permanent foundation and titled as real property. If not, a chattel loan is the solution.

- Proven Appreciation: Thanks to research from The Urban Institute, it’s now confirmed that manufactured homes titled as real property appreciate at similar rates to site-built homes, debunking old myths.

We’ve helped thousands of Texas families secure financing. If you’re worried about the process, don’t be. We’ll walk you through every step.

Conclusion: Taking the Next Step Towards Homeownership

The journey through financing options for manufactured homes is full of possibilities. From zero-down VA and USDA loans to accessible FHA and conventional programs, there is a path to homeownership for nearly every family.

Manufactured homes offer incredible affordability, costing a fraction of site-built homes with lower monthly payments. Better yet, research from The Urban Institute confirms they appreciate in value just like traditional homes when financed as real property. This means you’re not just buying a home—you’re building wealth.

At Manufactured Housing Consultants, our mission is to make homeownership a reality for Texas families. We offer the largest selection of new homes from 11 top manufacturers at guaranteed lowest prices. What truly sets us apart is our specialized financing. We work with all credit situations, provide FICO improvement assistance, and deliver your new home anywhere in Texas. We are your partners in this journey.

The complexity of manufactured home financing doesn’t have to overwhelm you. We’re here to walk alongside you, answer every question, and find the financing solution that fits your unique situation. Homeownership is for everyone, and we’re committed to proving that.

Ready to stop paying rent and start building equity? We’d love to help you steer this exciting journey with confidence. Start your financing journey with us today—your future self will thank you.