Breaking Down the Barriers to Homeownership

Financing bad credit doesn’t have to be an impossible dream. While traditional lenders might turn you away, specialized lenders and manufactured home dealers offer real solutions for credit scores as low as 300. Here’s what you need to know:

Quick Solutions for Bad Credit Home Financing:

- Alternative lenders approve borrowers with credit scores below 580

- Manufactured home loans often have more flexible requirements than traditional mortgages

- Co-signers can dramatically improve your approval odds and interest rates

- Larger down payments reduce lender risk and increase approval chances

- In-house financing through dealers bypasses traditional bank requirements

Life happens. As one customer shared, “A missed bill, a failed business venture, moving address without forwarding mail, or a messy separation” can all damage your credit history. But these setbacks don’t have to destroy your homeownership dreams.

The manufactured housing industry has developed specialized financing programs specifically for people in your situation. Over 60% of customers improve their credit score through these programs, and 1 in 3 customers graduate to prime rates over time.

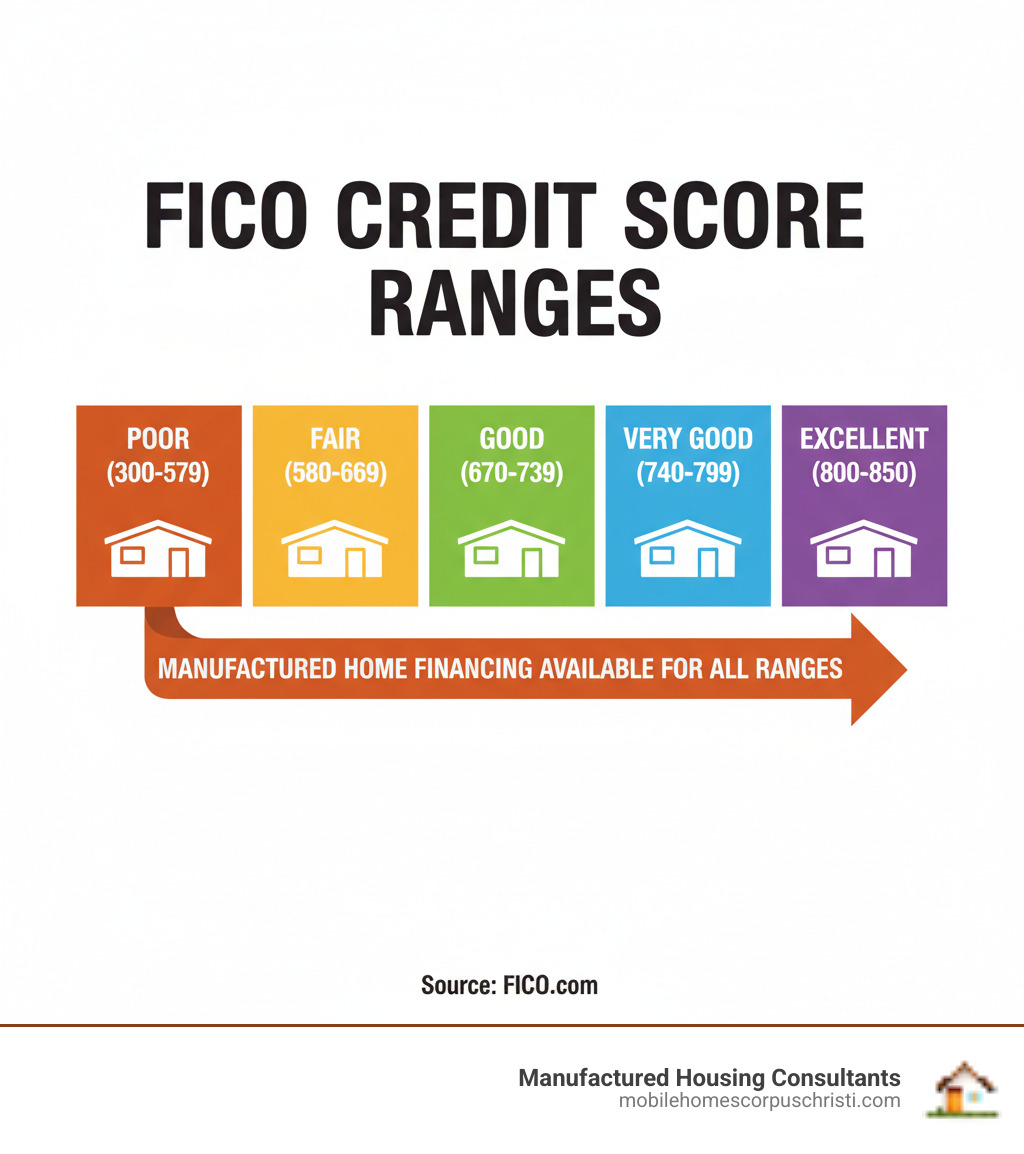

Credit scores below 660 are considered risky by most lenders. Scores between 300-559 fall into the “poor” category. But here’s the thing – your credit score is just one piece of the puzzle. Lenders also look at your income, employment history, debt-to-income ratio, and ability to make a down payment.

This guide will walk you through exactly how to overcome credit challenges and secure financing for your manufactured home. You’ll learn what documents to gather, how to present your application in the best light, and which loan options work best for your situation.

Understanding Your Credit and Why It Matters for Home Loans

Think of your credit score as your financial report card. That three-digit number tells lenders how you’ve handled money in the past – and whether they can trust you with their money in the future.

Your FICO score ranges from 300 to 850, and it’s based on several key factors. Payment history makes up the biggest chunk – about 35% of your score. This means paying bills on time is the single most important thing you can do for your credit. Credit utilization – how much of your available credit you’re actually using – accounts for another 30%.

Here’s the reality: most traditional lenders prefer to see a credit score of 670 or higher. When you’re dealing with financing bad credit situations, you’re typically looking at scores well below that magic number. And yes, this usually means higher interest rates and stricter loan terms.

But here’s what many people don’t realize – the manufactured housing industry works differently. We understand that life happens, and a low credit score doesn’t tell your whole story.

What is Considered Bad Credit?

If your credit score falls between 300 and 559, you’re in what lenders call the “poor credit” range. Scores below 660 generally signal to traditional lenders that you might have trouble getting approved.

But what puts you there? Usually it’s things like missed payments, high credit card balances, or more serious events like bankruptcy or foreclosure. Maybe you went through a divorce, lost a job, or had medical bills pile up. These life events show up on your credit report and can drag down your score.

The good news? Your credit report isn’t carved in stone. It gets updated regularly, and consistent on-time payments can start improving your score within just a few months.

Before you do anything else, you need to know exactly where you stand. Get your free credit report from Equifax or TransUnion. Look for errors – they happen more often than you’d think – and understand what’s actually hurting your score.

Soft vs. Hard Credit Inquiries

When you start shopping for loans, you’ll hear about soft inquiries and hard inquiries. The difference matters for your credit score.

A soft inquiry happens when you check your own credit report or when a lender does a quick pre-screen. These don’t hurt your credit score at all. Only you can see them on your report. This is great news because it means you can shop around and get pre-qualified without any damage to your score.

A hard inquiry is different. This happens when you formally apply for a loan and the lender pulls your full credit report. Other lenders can see these inquiries, and they can temporarily lower your credit score by a few points.

One hard inquiry won’t kill your score, but multiple applications in a short time can make you look desperate to lenders. That’s why we always recommend getting pre-qualified first with a soft inquiry. You’ll know what you qualify for without any risk to your credit score.

The smart approach? Use pre-qualification tools to compare your options, then submit formal applications only to the lenders that make the most sense for your situation.

Your Roadmap to Financing Bad Credit for a Manufactured Home

Here’s the truth: getting approved for a home loan with bad credit isn’t impossible – it just requires a different approach. Think of it like taking a scenic route instead of the highway. You’ll still reach your destination, but you need the right map and preparation.

The manufactured housing industry understands that life happens. Job losses, medical bills, divorces – these events can damage your credit through no fault of your own. That’s why we’ve developed specialized financing bad credit programs that look beyond just your credit score to see the whole person.

The secret is knowing exactly what lenders need to see and giving them a complete picture of your financial situation. When traditional banks focus only on that three-digit number, specialized lenders evaluate your entire story. More info about our financing services shows how we help people just like you achieve homeownership every day.

Preparing Your Application: Documents and Down Payments

Walking into a lender’s office unprepared is like showing up to a job interview in your pajamas. You want to make the best possible impression, and that starts with having your paperwork organized and ready.

Your valid driver’s license or government photo ID proves who you are – simple enough. But the real story comes from your proof of employment and income. Recent pay stubs (typically the last two) show you have steady work coming in. If you’re self-employed or work as a contractor, tax returns and bank statements become even more important to demonstrate your income patterns.

Bank statements from the last 90 days give lenders a window into your financial habits. They’re looking for consistency, not perfection. A recent utility bill confirms where you live and shows you’re managing basic household responsibilities.

Now, let’s talk about the game-changer: your down payment. This isn’t just money you’re putting toward the house – it’s your way of telling the lender, “I’m serious about this, and I’m willing to invest my own money to make it happen.”

A larger down payment works magic for your application. It reduces the loan amount the lender needs to risk, lowers their overall exposure, and increases your approval odds significantly. Sometimes, a solid down payment can even help you secure better interest rates because you’re sharing more of the risk.

Even if you can only manage a modest down payment, it demonstrates commitment and financial planning. Every dollar you put down is a dollar less the lender has to worry about.

The Lender’s Perspective: The 5 Cs of Credit

Want to know a secret? Lenders don’t just look at credit scores all day hoping to reject people. They’re actually in the business of approving loans – that’s how they make money. Understanding how they evaluate applications gives you a huge advantage in presenting your case.

Smart lenders use what’s called the 5 Cs of Credit to evaluate every application. Think of these as five different ways to prove you’re worth the risk.

Character goes way beyond your credit score. Yes, that number matters, but lenders also want to know why it’s low and what you’ve done since then. If your credit took a hit because of a medical emergency or job loss, explaining those circumstances honestly can actually strengthen your application. They’re looking for signs that you’re responsible and committed to repaying the loan.

Capital is simply the money you’re putting into the purchase – your down payment and any other assets. The more skin you have in the game, the less likely you are to walk away from the investment.

Capacity answers the crucial question: can you actually afford this loan? Lenders calculate your debt-to-income ratio and look at your monthly expenses. They want to see that you have enough breathing room in your budget to handle the new payment comfortably.

Collateral is the manufactured home itself. Since the home secures the loan, the lender has something valuable to fall back on if things go wrong. This actually works in your favor because it reduces their risk.

Conditions include factors like the current economy, your employment industry, and even local market conditions. While you can’t control these, understanding them helps you time your application strategically.

The beautiful thing about the 5 Cs is that strength in one area can compensate for weakness in another. A low credit score (Character) can be offset by a large down payment (Capital) and stable income (Capacity). Learn what you need to know about financing to see how we evaluate the complete picture.

Boosting Your Approval Odds for financing bad credit

Let’s be honest – financing bad credit requires some strategy. But here’s the good news: there are proven ways to dramatically improve your chances of approval.

The most powerful tool in your arsenal is a co-signer with good credit. This person essentially tells the lender, “If they can’t pay, I will.” It’s like having a financially responsible friend vouch for you. This single step can transform a risky application into an attractive one, often leading to better interest rates too.

Stable income and job history carry enormous weight with lenders. You don’t need to be wealthy – you just need to be consistent. Two years at the same job, even with modest pay, often impresses lenders more than higher income from a brand-new position.

Keep your debt-to-income ratio as low as possible. If you’re carrying high credit card balances, paying them down before applying can make a significant difference in how lenders view your application.

Don’t be afraid to explain your circumstances. Lenders are human beings who understand that life throws curveballs. A brief, honest explanation of what caused your credit problems – and what you’ve learned from the experience – can turn a rejection into an approval.

This isn’t the end of your credit journey – it’s actually a new beginning. Over 60% of our customers improve their credit scores through responsible loan management, and 1 in 3 eventually graduate to prime rates. We even offer specialized programs to help you along the way. Check out the benefits of improving your credit score before buying your mobile home, and learn about our FICO Score Improvement Program that helps turn today’s approval into tomorrow’s excellent credit.

Exploring Your Loan Options and Avoiding Pitfalls

Standing at the crossroads of homeownership with damaged credit can feel overwhelming. The traditional banking path might seem blocked, but here’s the good news: financing bad credit has opened up entirely new routes to your dream home. Alternative lenders and specialized loan products have transformed the landscape, creating real opportunities where none existed before.

Understanding these options isn’t just about finding any loan – it’s about finding the right loan that protects your financial future. Some paths lead to genuine homeownership and credit recovery, while others can trap you in cycles of debt. Let’s explore both the opportunities and the dangers ahead.

What is a Bad Credit Home Loan?

Think of a bad credit home loan as a bridge built specifically for people who traditional banks won’t help. These specialized loans look beyond your three-digit credit score to see the whole person behind the application. Unlike big bank loans that demand pristine credit, these installment loans focus on your current ability to pay rather than past financial stumbles.

The magic happens in how these lenders evaluate your application. Instead of automatically rejecting scores below 670, they consider your stable income, your employment history, and your debt-to-income ratio. They understand that life throws curveballs – medical emergencies, job losses, divorces – and that past financial hiccups don’t necessarily predict future payment behavior.

Here’s the trade-off you need to understand: because you represent higher risk to the lender, interest rates typically run higher than prime loans. We’re talking about rates that can range from around 7.8% to 35.99%, depending on your specific situation and the lender. Loan terms usually span 24 to 60 months for smaller amounts, though manufactured home loans often extend longer to keep payments affordable.

The beauty of manufactured home financing is that it’s inherently more flexible than conventional mortgages. The home itself serves as collateral, which reduces the lender’s risk and increases your approval odds. Some specialized lenders will work with credit scores as low as 300 – something virtually impossible with traditional mortgages. You can find out more about low FICO home loans to see exactly how these programs work.

The Dangers of Predatory Lending: A Warning on Payday Loans

Now let’s talk about a path you absolutely must avoid: payday loans. These financial quicksand pits masquerade as quick solutions but are actually designed to trap you in endless debt cycles. If someone suggests using payday loans for financing bad credit home purchases, run the other direction.

Payday loans charge triple-digit interest rates that would make a loan shark blush. We’re talking about APRs that can hit 365% or higher. Picture this: borrow $300 for 14 days in British Columbia, and you’ll pay $14 per $100 borrowed – that’s a crushing 365% APR. In Manitoba, that same $300 loan for 12 days carries a devastating 425.83% APR.

The trap works like this: you borrow money expecting to repay it on your next payday, but the fees are so astronomical that you can’t afford both the repayment and your regular expenses. So you take out another payday loan to pay off the first one. Before you know it, you’re caught in a vicious debt cycle that can destroy your finances for years.

Even worse, payday loans don’t help rebuild your credit. They’re typically not reported to credit bureaus, so even perfect repayment won’t improve your score. They’re financial dead ends that lead nowhere good. You can see examples of high-cost loan disclosures to understand just how expensive these loans really are.

How a specialized loan for financing bad credit can rebuild your score

Here’s where the story gets exciting: a well-chosen bad credit home loan doesn’t just get you into a home – it becomes your credit repair tool. Every monthly payment you make on time gets reported to credit bureaus, slowly but surely rebuilding your financial reputation.

Think of each payment as depositing credibility into your credit account. Payment history makes up the largest chunk of your credit score calculation, so consistent, on-time payments create a powerful positive trend. Month by month, your score begins climbing as lenders see proof of your reliability.

This isn’t just theory – it’s happening for real people every day. Over 60% of customers improve their credit score through these programs, and here’s the really exciting part: 1 in 3 customers graduate to prime rates. That means they eventually qualify for the same low interest rates that people with excellent credit enjoy.

The change can be remarkable. You start with a manufactured home loan at a higher interest rate, but as your credit improves, you gain access to better credit cards, lower insurance rates, and prime lending rates on future purchases. It’s like climbing a financial ladder where each rung represents better opportunities.

We’re so committed to this process that we’ve created specialized programs to accelerate your progress. Our FICO Score Improvement Program provides targeted strategies to maximize your score gains while you’re paying for your home. It’s not just about getting you housed – it’s about getting you financially healthy for life.

Frequently Asked Questions about Home Financing with Bad Credit

When it comes to financing bad credit for your manufactured home, we hear the same concerns over and over again. These are real questions from real people who thought homeownership was out of reach. Let’s address the most common ones – and hopefully put your mind at ease.

Can I get a home loan with a credit score under 580?

Absolutely! We’ve helped countless families with credit scores under 580 achieve their homeownership dreams. While traditional banks might see that number and immediately say “no,” we see the person behind the score.

Here’s the reality – your credit score tells only part of your story. Maybe you went through a divorce, faced unexpected medical bills, or had a business that didn’t work out. These life events don’t define your ability to be a responsible homeowner.

At Manufactured Housing Consultants, we look at your whole financial picture. Do you have steady income? Have you been at your job for a while? Can you put something down as a down payment? These factors matter just as much – if not more – than a three-digit number from your past.

We’ve approved borrowers with scores in the 300s when they could demonstrate stability in other areas. Your employment history, current income, and commitment to making payments all carry significant weight in our evaluation process.

What is the easiest type of loan to get with bad credit?

This is where we need to have an honest conversation. Yes, payday loans are easy to get – but they’re financial quicksand. With interest rates that can hit 400% or more, they’ll trap you in a cycle of debt faster than you can say “home sweet home.”

For manufactured home purchases, chattel loans are often your best bet when dealing with bad credit. These loans use the home itself as collateral rather than requiring perfect credit scores. Since the lender has the security of the manufactured home, they’re more willing to work with borrowers who have credit challenges.

Your smartest move? Work with a dealer like us who has in-house financing options and established relationships with lenders who understand manufactured housing. We know which lenders look beyond credit scores and focus on your ability to make payments. This direct approach cuts through the red tape and gets you answers faster.

How can a co-signer help my application?

A co-signer can completely transform your loan application – we’ve seen it happen countless times. When someone with good credit agrees to co-sign your loan, they’re essentially telling the lender, “I believe in this person, and I’m willing to back them up.”

This changes everything for lenders. Your co-signer’s good credit reduces their risk dramatically, which means they’re much more likely to approve your application. In many cases, it can also help you secure a lower interest rate than you’d qualify for on your own.

But let’s be crystal clear about what co-signing means. Your co-signer becomes legally responsible for the debt if you can’t make payments. Any missed payments will show up on both of your credit reports. This is a serious commitment that requires trust and clear communication between you and your co-signer.

We’ve seen family members, close friends, and even parents help make homeownership possible through co-signing. It’s a powerful tool that can turn a “maybe” into a “yes” when you’re working on financing bad credit.

The bottom line? Bad credit doesn’t have to mean no home. We’re here to help you explore every option and find a path that works for your situation.

Conclusion: Your Path to Homeownership Starts Now

You’ve made it through the complete roadmap to financing bad credit for your manufactured home, and we hope you’re feeling more confident about your path forward. The most important thing to remember is that preparation is crucial – gathering your documents, understanding your credit situation, and knowing what lenders are looking for will set you up for success.

Here’s something we want you to hold onto: bad credit is not a permanent barrier to homeownership. We’ve seen countless families transform their financial situations while achieving their dream of owning their own home. Your credit score today doesn’t define your future, and with the right approach and support, homeownership is absolutely achievable.

The manufactured housing industry has evolved specifically to serve people in your situation. We understand that life throws curveballs – medical emergencies, job losses, divorces, or simply missed bills due to life’s chaos. These experiences don’t make you a bad person or an unworthy borrower. They make you human.

At Manufactured Housing Consultants, we’ve built our entire business around making homeownership accessible to everyone. We offer the largest selection of new mobile and manufactured homes from 11 top manufacturers, all with guaranteed lowest prices. More importantly, we provide specialized financing for all credit situations, including our FICO improvement programs that help you build a stronger financial future.

We deliver homes anywhere in Texas, from our home base in Corpus Christi to every corner of the Lone Star State. Whether you’re in Houston, Dallas, Austin, or a small rural town, we’re here to help you find your perfect home and the financing to make it yours.

Your journey doesn’t have to wait. Take that first step today and start your pre-approval process. You might be surprised at what options are available to you right now.

Once your financing is secured, you’ll want to make sure your new home has the perfect place to call home. That’s where our comprehensive services really shine. Learn more about our expert site preparation and land location services to complete your homeownership journey.

The dream of having your own front door, your own space, and the stability that comes with homeownership is within reach. Don’t let past financial challenges steal your future happiness. Your path to homeownership starts now.