Why Finding Affordable Housing in Texas Has Become So Critical

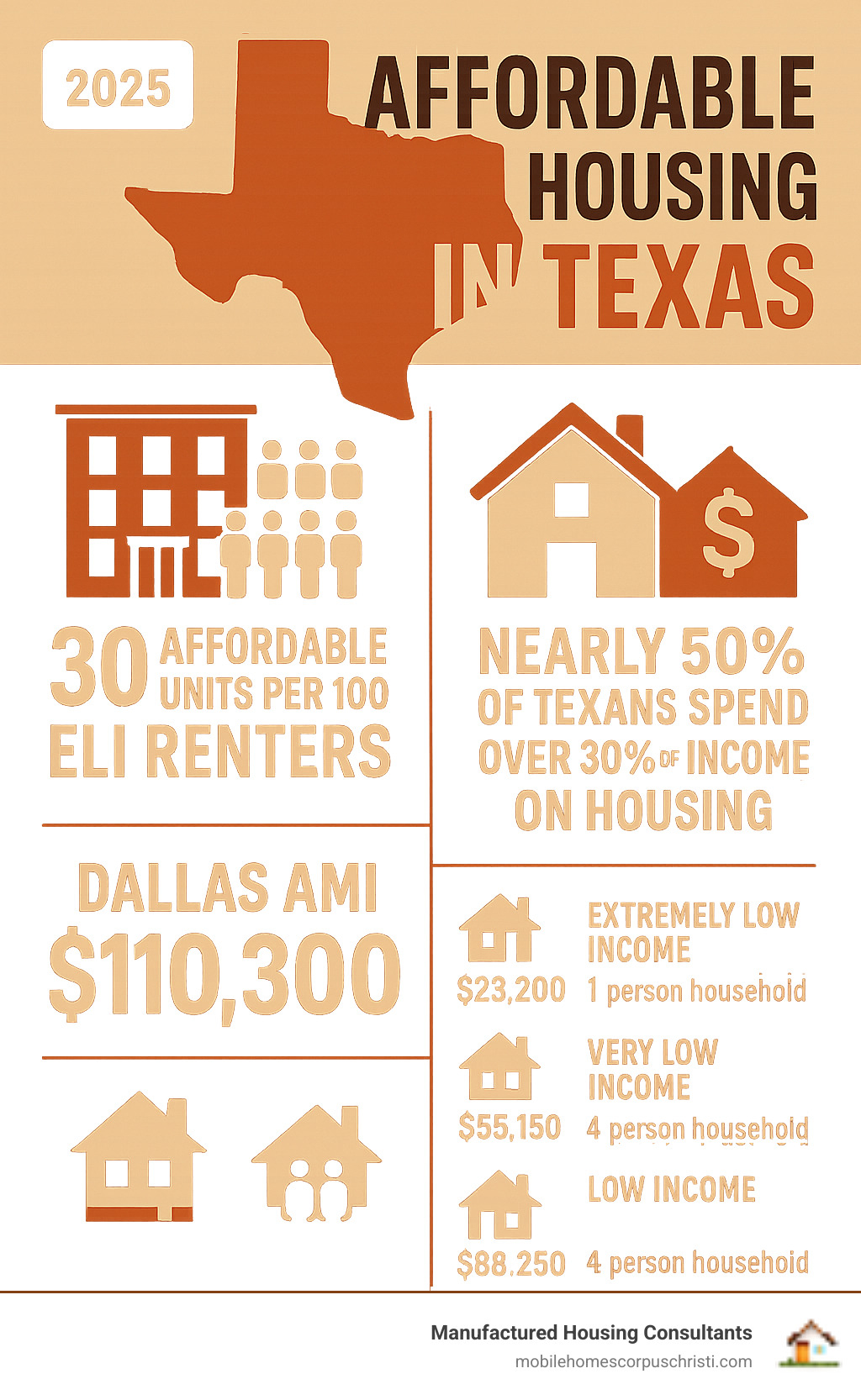

Searches for affordable housing Texas have skyrocketed as working families face an impossible choice: spend half their paycheck on rent or endure long commutes. The numbers tell a stark story: nearly half of all Texans now spend more than 30% of their income on housing, pushing many to the financial brink.

Quick Guide to Finding Affordable Housing in Texas:

- Government Programs: Section 8 Housing Choice Vouchers, Public Housing, USDA Rural Development

- State Resources: Texas Department of Housing and Community Affairs (TDHCA) programs and vacancy clearinghouse

- Income Limits: Extremely Low (30% AMI), Very Low (50% AMI), Low Income (80% AMI)

- Alternative Options: Manufactured homes, repossessed properties, tax credit developments

- Key Stat: Only 30 affordable units available per 100 Extremely Low Income renters in Texas

The reality is brutal. Housing costs keep climbing while paychecks stay flat. In Dallas alone, a family of four earning $55,150 (considered “Very Low Income”) faces a housing market where median rent often exceeds what financial experts recommend spending.

But here’s what most people don’t know: Texas has dozens of programs and pathways to affordable homeownership. From federal vouchers to manufactured housing, real options exist for families who look beyond traditional rentals.

This guide cuts through the confusion. We’ll show you how to steer government programs, understand income requirements, and explore alternative paths like quality manufactured homes that can help you achieve homeownership faster than you think.

Affordable housing Texas terms at a glance:

The Texas Housing Challenge

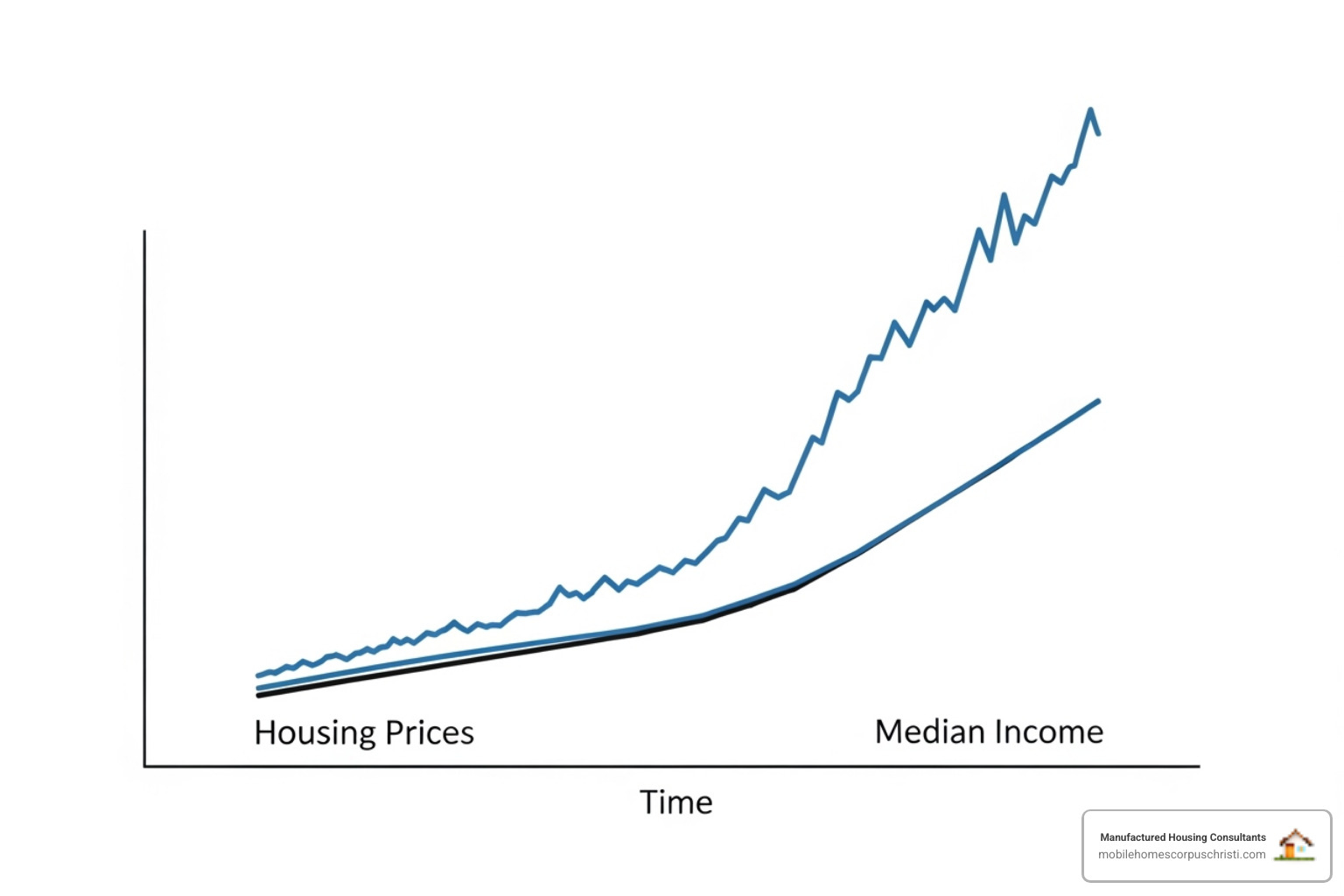

The challenge with affordable housing Texas is a perfect storm hitting working families. Rents rise annually while paychecks stagnate. Sound familiar? You’re not alone.

The math is brutal. Housing costs are soaring while wages crawl, creating a significant “housing cost burden” for many Texans. The reality: nearly half of all Texans spend more than 30% of their household income on housing, pushing families to the financial edge.

For Extremely Low Income (ELI) renters, the situation is dire. In Texas, there are only 30 affordable units available for every 100 families who desperately need them. Imagine 100 people trying to squeeze into 30 chairs—that’s our housing crisis in a nutshell. The National Low Income Housing Coalition’s data on low-rent units in large Texas markets paints this picture clearly.

This shortage hits some groups harder than others. Seniors on fixed incomes watch their rent consume more of their Social Security. Persons with disabilities need accessible housing but face fewer options. Low-income families are caught between wanting stability for their kids and being able to pay the bills.

The ripple effects are heartbreaking. Older adults are especially vulnerable to housing insecurity and even homelessness, struggling with both housing and medical costs.

Understanding the Landscape of affordable housing Texas

Let’s simplify the affordable housing Texas landscape. It starts with Area Median Income (AMI), the midpoint of what everyone in your area earns. Half the people make more, half make less.

Take Dallas, for example. The AMI there is $110,300 as of April 2024. That might sound like a lot, but it’s the middle point.

Now here’s the golden rule of housing: the 30% income rule. Experts say you shouldn’t spend more than 30% of your gross income on housing. Go over that, and you’re officially “cost-burdened”—a polite way of saying you’re probably eating ramen more nights than you’d like.

The government uses these income categories to determine who gets help:

Extremely Low Income (ELI) means you’re making 30% of AMI or less. In Dallas, that’s $23,200 for a single person or $33,100 for a family of four. Very Low Income (VLI) is 50% of AMI—$55,150 for a Dallas family of four. Low Income (LI) goes up to 80% of AMI, which is $88,250 for that same family.

These aren’t just numbers; they determine your eligibility for assistance programs.

Economic Benefits of Investing in Housing

Investing in affordable housing Texas isn’t just about helping people—it’s smart business for entire communities.

When families have stable, affordable homes, amazing things happen. Kids do better in school. Parents can focus on work. Neighborhoods become safer and stronger because people stick around and invest in their community.

The economic benefits are huge. Affordable housing development creates construction jobs, supports local businesses, and frees up family income. When people aren’t house-poor, they contribute more to the local economy.

There’s also the health factor. Stable housing means less stress, better access to healthcare, and healthier living conditions for children. It’s a domino effect of good outcomes.

The bottom line? Investing in affordable housing creates a stronger, more prosperous Texas for everyone. It’s not charity—it’s smart economics that pays dividends for generations.

Navigating Government-Assisted Affordable Housing in Texas

When searching for affordable housing Texas, you’re not alone. State and federal governments offer numerous programs to help families find safe, affordable homes. These programs are different pathways to the same goal: stable housing.

The system is a partnership: federal programs provide funding and rules, while state and local agencies handle operations. You apply locally, but the funding is often federal. This combines local expertise with national resources to ensure consistent standards.

These programs fall into two main categories: rental assistance (helping you afford rent in existing housing) and homeownership aid (helping you buy a place of your own). Both can be life-changing opportunities for Texas families.

State and Local Initiatives

The Texas Department of Housing and Community Affairs (TDHCA) is your state’s housing headquarters. If you’re feeling overwhelmed, their TDHCA website should be your first stop. They coordinate everything from rental assistance to homebuyer programs across Texas.

A key TDHCA tool is the Low-Income Housing Tax Credit (LIHTC) program. This program incentivizes developers with tax credits to build affordable apartments for working families. It’s a win-win that has created more affordable rental housing than any other program in U.S. history.

But Texas cities aren’t just waiting for state help. Major cities across Texas have rolled up their sleeves to tackle housing challenges. Dallas created their comprehensive housing policy through their Dallas Comprehensive Housing Policy. Austin developed their Strategic Housing Blueprint. San Antonio’s Mayor’s Housing Policy Task Force took a market-driven approach to creating more affordable options.

Houston turned the Hurricane Harvey crisis into an opportunity to build back more affordably. Fort Worth integrated housing into its city planning. Each city’s approach differs, but the goal is the same: ensuring working families can afford to live where they work.

Non-profit organizations add another layer of support. The Texas Low Income Housing Information Service advocates for low-income Texans and provides valuable resources. These organizations often work with government agencies, bringing community insight to housing projects.

Key Federal Programs in Texas

Federal programs form the backbone of affordable housing Texas assistance. The most famous is Section 8 Housing Choice Vouchers. Think of these as housing coupons—you find a place that meets program standards, and the voucher helps cover the rent you can’t afford. The beauty of this program is choice.

Public Housing Authorities (PHAs) run the Section 8 program locally, and TDHCA serves as the PHA for 34 counties. You can learn more about rental assistance options through HUD rental assistance info. The program also includes special purpose vouchers for specific situations, like helping people with disabilities or families experiencing homelessness.

For rural Texas families, the USDA Rural Development program is a game-changer. USDA is a major player in rural housing, and their USDA Texas programs help develop affordable apartments and provide financing for rural families.

What makes USDA programs special is their focus on smaller communities where other assistance might be scarce. They understand that affordable housing challenges aren’t just big-city problems.

Exploring Alternative Paths to Homeownership

Beyond traditional rentals and government programs, alternative paths to homeownership can help you build equity and achieve long-term financial stability. These innovative solutions might be the perfect fit for your budget and lifestyle.

Many families think homeownership requires a huge down payment and perfect credit for a traditional house. That’s no longer the only way. Smart families are finding creative paths to own a home faster and for less money.

Manufactured Homes: A Key Solution for affordable housing Texas

For affordable housing Texas, manufactured homes should be a top consideration. Many families overlook this option due to outdated stereotypes, but today’s manufactured homes are vastly different and higher quality.

The cost-effectiveness is unbeatable. Because these homes are built in controlled factory environments, manufacturers eliminate weather delays, reduce waste, and streamline construction. The result is high-quality homes at prices often thousands less than traditional construction. We’re proud to offer the largest selection from 11 top manufacturers with guaranteed lowest prices, making homeownership accessible.

Modern manufactured homes also feature impressive quality construction. Every home is built to strict federal standards called the HUD Code, ensuring safety, durability, and energy efficiency. Your new home will be well-insulated, structurally sound, and designed to keep utility bills low.

The customization options are incredible. You’re not stuck with a cookie-cutter design. These homes offer a wide range of floor plans, features, and finishes, from sleek island kitchens to luxurious master bedrooms with walk-in closets, providing both elegance and functionality.

We specialize in making homeownership dreams come true through specialized financing for all credit situations, including FICO improvement programs. Even with imperfect credit, you have a clear path to homeownership. And we deliver homes anywhere in Texas!

Want to learn more? Check out our resources on Affordable Mobile Homes in Corpus Christi, Repo Mobile Homes for Affordable Housing in Corpus Christi, and Investing in a Repo Mobile Home.

The Role of Repossessed Homes

For affordable housing Texas seekers, repossessed mobile homes, or “repo” homes, can be goldmines. They are resold quickly, often at prices considerably lower than new models.

The main draw is the opportunity for value. You can often get more home for your money or enter the housing market with a smaller initial investment. It’s like finding a diamond in the rough.

But let’s be honest about inspection importance. A thorough inspection helps you understand the home’s condition and identify any needed repairs. We always recommend a detailed assessment so you know exactly what you’re getting into.

Financing options for repo homes can be different, but don’t let that scare you. While some lenders might be hesitant, specialized financing solutions are often available. We work with all credit situations to help you secure the financing you need.

| Feature | New Manufactured Home | Repossessed Mobile Home |

|---|---|---|

| Price | Higher initial cost, but new condition | Potentially significantly lower price |

| Condition | Brand new, full warranty, no prior wear | Used, may have wear & tear, varying condition |

| Customization | Full range of options, finishes, floor plans | Limited to existing features, cosmetic updates possible |

| Warranty | Full manufacturer’s warranty (often lifetime) | Limited or no warranty, “as-is” sale common |

| Financing | Broader range of traditional and specialized options | May require specialized or in-house financing |

| Availability | Built to order, or from existing inventory | Dependent on market availability of foreclosures |

Ready to explore this option? Our Repo Mobile Homes: A Complete Guide and information on Bank Repos will give you everything you need to make an informed decision.

The bottom line? Whether you choose a new manufactured home or a repo, you’re taking control of your housing future, building equity, and proving that homeownership in Texas is within reach.

How to Find and Apply for Housing Assistance

When you’re ready to find affordable housing Texas assistance, knowing where to look and what to expect is key. The process requires patience but is manageable when broken into steps.

Finding Available Properties

Your housing search starts with tapping into the right resources, and Texas has excellent tools to help you.

The TDHCA Vacancy Clearinghouse is your best friend. This online directory from the Texas Department of Housing and Community Affairs lets you search for rent-reduced apartments. Their Find Affordable Rental Housing tool is user-friendly and provides real-time availability.

Each major Texas city has its own Public Housing Authority (PHA) that manages local programs. These are your gateway to Section 8 vouchers and public housing. The Dallas Housing Agency, for example, has an interactive map of its communities. Search online for “[your city] housing authority” to find your local PHA.

Online search portals like AffordableHousing.com have become game-changers. You can filter results by income level, household size, and accessibility needs, saving you time.

If you’re looking in rural areas, don’t overlook USDA Rural Development properties. Their website has a tool to locate apartments they’ve financed, which often have shorter waiting lists than urban options.

Here’s the reality: most programs have waiting lists, so apply to multiple options to improve your chances.

The Application Process

Once you’ve found options, the application process is predictable, which makes it less stressful.

Document gathering is your first task. You’ll need to prove your income, household size, and identity with documents like pay stubs, tax returns, bank statements, birth certificates, and social security cards. Start collecting these early.

Income verification is thorough. They need to confirm you fall within the program’s income limits based on your area’s median income. Be honest and complete with your financial information to avoid delays.

Background checks and landlord references are standard. Most programs run criminal background checks, and some include credit checks. It’s better to address any concerns upfront.

The waitlist reality is something to prepare for. Demand for affordable housing Texas assistance is high, so waits can be long. The key is to be responsive; when contacted, reply immediately to keep your spot.

Modern online portals make tracking your application easier. The TDHCA PHA Portal lets Section 8 applicants check their waitlist status online. Setting up access to these portals keeps you in the loop.

Throughout this process, fair housing laws protect you from discrimination. If you feel you’ve been discriminated against based on race, religion, family status, or disability, you can get help and report it through the Fair Housing information from the Texas Workforce Commission.

Applying for housing assistance requires patience and detail, but thousands of Texas families succeed every year. The stability of a good home is worth the effort.

Frequently Asked Questions about Affordable Housing in Texas

We hear these questions every day from folks trying to figure out their path to affordable housing Texas. Let’s explore the answers that matter most.

What income level qualifies for affordable housing in Texas?

Qualifying for affordable housing isn’t based on one number. It’s based on the Area Median Income (AMI), which varies by your location and household size in Texas.

Most programs help households earning 80% of AMI or less, but the most help goes to those who need it most. The income categories break down like this:

Extremely Low Income (ELI) families earn 30% of AMI or less. Very Low Income (VLI) households make 50% of AMI or less. And Low Income (LI) families earn up to 80% of AMI.

Let’s make this real with Dallas numbers. A single person making $23,200 or less would qualify as Extremely Low Income. A family of four earning $55,150 would be considered Very Low Income. These numbers are updated annually by HUD and differ for every metro area.

The key takeaway? Even if you think you might make “too much,” it’s always worth checking. You might be surprised which programs you qualify for.

How long is the waiting list for Section 8 in Texas?

The waiting lists can be very long—often years—due to high demand for affordable housing Texas. It’s a frustrating reality.

The wait time depends on your location and the local Public Housing Authority. Some places have such long lists that they periodically stop accepting new applications. When they do open, spots fill fast.

Our advice: apply to every open waitlist you can find as soon as possible. Your spot is usually based on when you applied. While you’re waiting, don’t put your life on hold. That’s why we’re here—to help you explore other options like quality manufactured homes that can get you into your own place much faster.

Are manufactured homes a safe and durable housing option?

This is a common question, and the answer might surprise you. Yes, modern manufactured homes are absolutely safe and durable!

Today’s manufactured homes are built to strict federal standards called the HUD Code. These aren’t your grandfather’s mobile homes; they are homes that meet rigorous requirements for safety, durability, and energy efficiency. Every home is inspected multiple times during construction in climate-controlled factories.

This means you get consistent quality, energy-efficient features that lower your utility bills, and a home designed to handle Texas weather like any traditional house. Many customers are amazed at how solid and well-built their new homes feel.

The best part? These homes provide the safety and durability of site-built construction at a fraction of the cost. To dig deeper into what makes these homes a smart choice, check out our information about mobile homes for sale in Texas.

We’ve helped thousands of Texas families find that manufactured homes are a smart, long-term housing solution that can get you out of the rental cycle and into homeownership.

Your Path to an Affordable Texas Home Starts Now

Finding affordable housing Texas doesn’t have to be overwhelming. This guide has covered the challenges, from high housing costs to long waiting lists, but more importantly, it has uncovered workable solutions.

The numbers are tough, but not impossible. Texas has dozens of programs, from Section 8 Housing Choice Vouchers to USDA Rural Development initiatives. State agencies like TDHCA and local housing authorities in Dallas, Austin, Houston, and San Antonio are actively working to create more affordable options.

Government programs are just one piece of the puzzle. While navigating waitlists, there’s another path many Texas families are finding: manufactured homes. Today’s manufactured homes are built to strict federal standards, offering the safety and durability of traditional homes at a fraction of the cost.

Here’s what makes manufactured homes a smart choice for affordable housing Texas: you build equity instead of paying rent. You can customize your space with modern, energy-efficient features. And with our specialized financing, even if your credit isn’t perfect, you can still achieve homeownership.

At Manufactured Housing Consultants, we’ve helped hundreds of Texas families. We work with 11 top manufacturers to guarantee the lowest prices. Our financing specialists handle everything from FICO improvement to statewide delivery, offering solutions for all credit situations because we know every family is unique.

The Texas dream of homeownership is still alive. Whether you’re exploring government assistance, considering a quality manufactured home, or looking at repossessed properties for extra savings, there’s a path forward for your budget.

Your affordable home in Texas is waiting. For expert guidance on finding a high-quality, budget-friendly home that you can actually afford, we’re here to help you every step of the way.