Your Path to Homeownership in a Tough Market

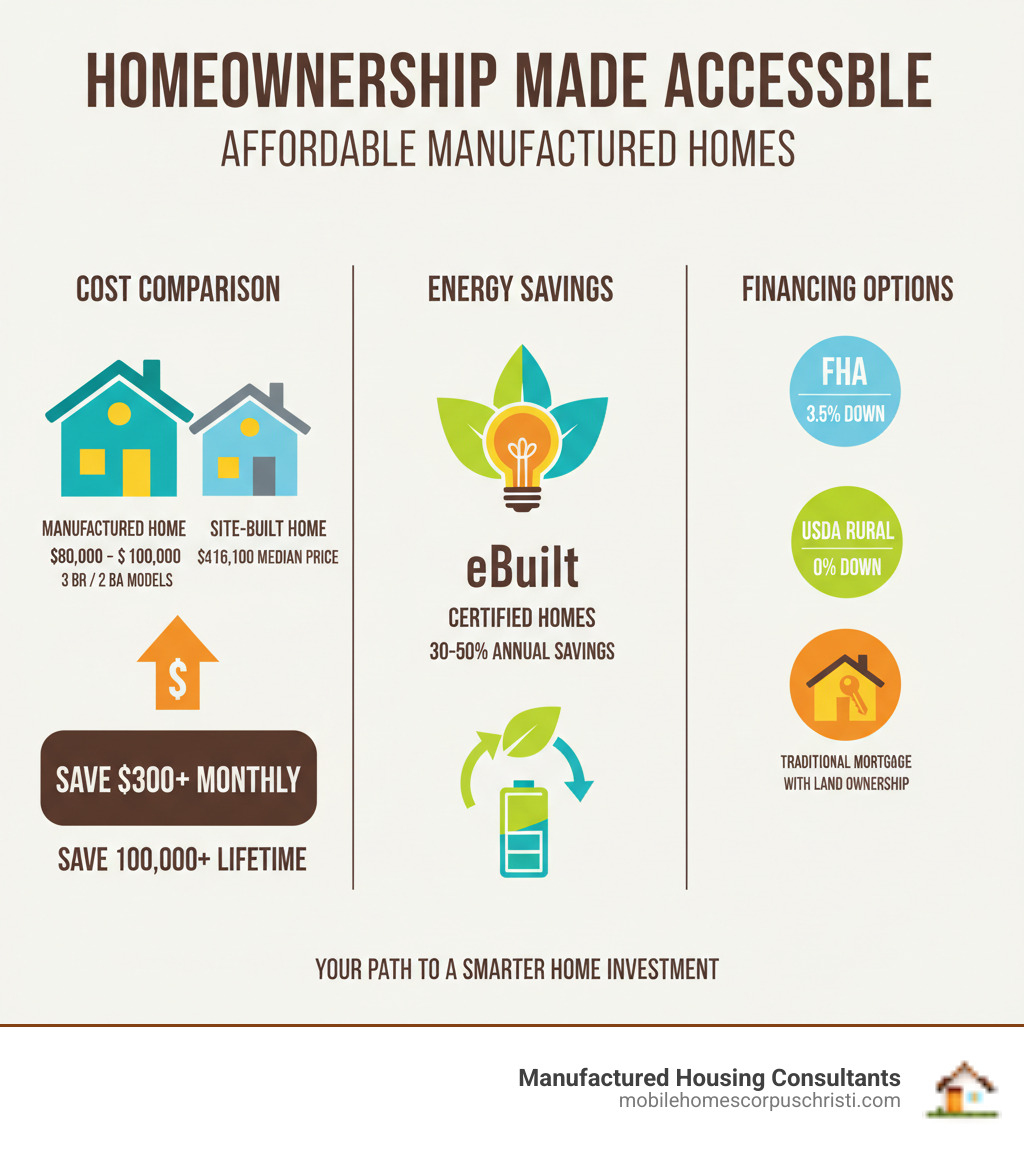

Affordable manufactured homes are factory-built houses constructed to federal HUD standards, offering a cost-effective alternative to traditional site-built homes. They typically cost 30-50% less than comparable site-built homes, with options starting under $100,000 and savings of over $100,000 over a 30-year mortgage.

Quick Facts About Affordable Manufactured Homes:

- Cost Range: Starting under $80,000, with many quality options between $100,000-$200,000

- Monthly Savings: Over $300 per month compared to similar site-built homes

- Types Available: Single-wide, double-wide, modular, and CrossMod® homes

- Energy Savings: Up to 30-50% reduction in annual energy bills with eBuilt® certified homes

- Financing Options: Traditional mortgages (if you own land), FHA loans (3.5% down), VA loans, and USDA Rural Housing loans (no down payment)

- Speed: Faster construction in controlled factory environments

The housing market has become increasingly challenging for first-time buyers and families on a budget. With the median sale price of a home reaching $416,100 in early 2023—a 26% increase since 2020—traditional homeownership feels out of reach for many Americans.

Manufactured homes offer a proven solution. Research from Harvard University’s Joint Center for Housing Studies confirms that manufactured homes cost far less than similar site-built homes, even when comparing higher-end models with premium finishes. These aren’t the “mobile homes” of decades past. Today’s manufactured homes feature modern designs, energy-efficient construction, and quality materials—all built in climate-controlled factories to strict federal standards.

This guide will walk you through everything you need to know about affordable manufactured homes: the types available, how to finance them (even with credit challenges), where to find the best deals, and how to choose a reputable dealer. Whether you’re a first-time buyer, downsizing, or simply seeking better value, manufactured housing could be your path to homeownership.

Why Choose a Manufactured Home? The Affordability Advantage

Affordable manufactured homes are a game-changer for those who thought homeownership was out of reach. They offer a combination of quality, speed, and value that traditional construction struggles to match in today’s challenging market.

Key Benefits of Affordable Manufactured Homes

The cost savings are significant. As site-built home prices climb, affordable manufactured homes provide a quality alternative for far less. Even larger models with high-end finishes cost significantly less than comparable site-built homes.

This is possible because manufactured homes are built in a controlled factory environment. This streamlined process avoids weather delays, reduces material waste, and lowers labor costs, preventing the unpredictability and surprise delays of on-site construction.

Every manufactured home is built to a single federal specification overseen by the U.S. Department of Housing and Urban Development (HUD). This federal standard ensures consistent quality and safety, providing certified quality.

The factory setting also means faster build times. We’re not talking weeks faster—we’re talking months faster in many cases. You could be settling into your new home while your neighbor is still waiting for their site-built foundation to cure.

And don’t worry about getting a cookie-cutter box. Modern manufactured homes offer extensive customization options. You can choose your floor plan, pick your finishes, select your fixtures, and make the space truly yours. The difference? You’re doing it at a fraction of what those same choices would cost in traditional construction.

Yes, there are pros and cons to manufactured home living—just like any housing option. But for thousands of families across Texas, the benefits of affordability, modern design, and reliable quality construction have made homeownership possible when it otherwise wouldn’t be.

Long-Term Savings with Energy Efficiency

The savings continue long after the purchase. Modern affordable manufactured homes are designed for long-term energy efficiency, keeping more money in your pocket month after month.

Today’s energy efficient manufactured homes are built with serious attention to keeping your utility bills low. Many qualify as ENERGY STAR certified homes, which means they’ve met strict energy performance guidelines set by the Environmental Protection Agency. These aren’t just marketing claims—these are real standards that translate to real savings on your heating and cooling bills.

Some manufacturers offer specialized energy packages like eBuilt® homes that take efficiency even further. These homes are designed to help you save up to 50% on your annual energy bills, which can mean hundreds of dollars in savings each year.

What creates these savings? High-efficiency HVAC systems that use less energy to keep you comfortable. Superior insulation in the walls, floors, and ceilings that keeps the heat out in summer and in during winter. Energy-efficient windows that don’t leak your conditioned air. And increasingly, features like smart thermostats that learn your schedule and automatically adjust to save energy when you’re away.

The beauty of this is simple: lower utility bills mean your home costs less to live in, not just less to buy. Over the life of your home, those energy savings add up to thousands of dollars. That’s money you can use for your kids’ education, your retirement, or that vacation you’ve been dreaming about. Now that’s what we call smart homeownership.

Exploring the Types of Affordable Manufactured Homes

When shopping for affordable manufactured homes, you’ll find several styles and sizes designed for different needs and budgets. Let’s walk through the options to find your perfect fit.

Single-Wide and Double-Wide Homes

The most popular manufactured home styles are single-wides and double-wides, and for good reason—they offer incredible value.

Single-wide homes are built and transported as one complete section. These single-section homes deliver the greatest cost savings and are perfect for individuals, couples, or small families who want to keep housing costs low without sacrificing comfort. Browse our single wide mobile homes to see what’s available.

Double-wide homes are built in two sections and joined on-site, offering much more space and layout possibilities. You’ll find double-wides with multiple bedrooms, spacious living areas, and floor plans similar to traditional homes, making them ideal for growing families. Even with the extra space, they cost significantly less than comparable site-built homes. Check out our selection of double wide mobile homes to explore your options.

Modular, CrossMod®, and Park Model Homes

Beyond the traditional manufactured home options, there are some exciting alternatives worth considering. Each brings something unique to the table.

Modular homes might look similar to manufactured homes during construction, but there’s a key difference: they’re built to local building codes rather than federal HUD standards. These homes are constructed in sections at a factory, then assembled on a permanent foundation at your property. Because they meet the same codes as traditional homes, modular homes often appraise like site-built homes in the local real estate market. They offer extensive customization options, letting you create a home that perfectly matches your vision. Learn more about modular home options.

CrossMod® homes represent something truly innovative—a hybrid that combines the efficiency of factory construction with the features buyers love about traditional homes. These homes are built off-site but assembled on your property atop a permanent foundation. They include design elements you’d typically only find in site-built homes: higher roof pitches, covered porches, and even attached garages or carports. The real advantage? CrossMod® homes are designed to appraise using site-built comparisons, which means better financing options and long-term value. Buyers can save over $300 per month and more than $100,000 over a 30-year mortgage compared to traditional construction.

Park Model homes offer something completely different for those drawn to the tiny home movement. These compact recreational vehicles come in under 400 square feet, proving that good things really do come in small packages. Don’t let the size fool you—each features beautifully designed interiors that blend luxury with smart, efficient living. They’re perfect for minimalists, retirees, or anyone seeking a simpler lifestyle.

Here’s how these different home types stack up:

| Home Type | Cost (Relative) | Size Range | Foundation | Financing Options | Key Feature |

|---|---|---|---|---|---|

| Single-Wide | Lowest | 500-1,200 sq ft | Pier & Beam, Slab | Chattel, Mortgage (with land) | Greatest initial cost savings |

| Double-Wide | Low-Moderate | 1,200-3,000+ sq ft | Pier & Beam, Slab | Chattel, Mortgage (with land) | More space, diverse floor plans |

| Modular | Moderate | 1,000-4,000+ sq ft | Permanent | Traditional Mortgage | Built to local codes, appraises like site-built |

| CrossMod® | Moderate-High | 1,000-2,500+ sq ft | Permanent | Traditional Mortgage | Hybrid, site-built aesthetics, better appraisal |

Finding Truly Affordable Manufactured Homes Under $100k

A common question is: “Can I really find a quality home for under $100,000?” The answer is yes, and you won’t have to sacrifice style or essential features.

We’re proud to offer numerous affordable manufactured homes that prove you don’t need a massive budget to own a beautiful home. Take Clayton’s The Shower House 2.0 and The Anniversary 76, which start around $80,000. Or consider The Breeze, available from $70,000. These aren’t bare-bones starter homes—they come loaded with features that would surprise you.

In a home under $100,000, you can expect features like three bedrooms and two full bathrooms, open-concept floor plans, and modern touches like island kitchens with stainless steel appliances. Many models also include thoughtful details like walk-in closets, barn doors, and built-in entertainment centers.

These homes are designed to maximize every square foot, creating spaces that are both functional and comfortable. They prove that a tight budget doesn’t mean compromising on your vision of home. Whether you’re buying your first home, downsizing to simplify your life, or simply seeking the best value for your money, there are fantastic options waiting for you. Explore our 3 bedroom prefab homes under 100K to see what’s possible within your budget.

How to Finance Your Manufactured Home

Understanding how to finance your affordable manufactured home is one of the most important steps in your journey to homeownership. The good news? You have more options than you might think, and we’re here to walk you through each one.

Mortgages vs. Personal Property (Chattel) Loans

Here’s where things get interesting: the way you finance your manufactured home depends largely on whether you own the land it sits on. This single factor can make a big difference in your monthly payments and overall costs.

When you own the land, your manufactured home is classified as real property—just like a traditional house. This means you can qualify for conventional mortgages with lower interest rates, longer repayment terms (often 15 to 30 years), and better consumer protections. These traditional mortgages typically offer the best overall value and can cover both your home and the land in one convenient loan. The lower interest rates can save you thousands of dollars over the life of your loan.

If you’re renting the land—perhaps in a manufactured home community—your home is considered personal property. In this case, you’ll use what’s called a chattel loan. These personal property loans work a bit differently. They typically have shorter repayment periods (usually up to 20 years), somewhat higher interest rates, and cover only the home itself, not the land. While the monthly payments might be higher than a traditional mortgage, chattel loans offer flexibility for buyers who prefer the community lifestyle without the responsibility of land ownership.

Neither option is inherently better—it all depends on your situation and preferences. We specialize in helping you steer both paths and find the financing that fits your life. For a deeper dive into your options, check out our comprehensive guide to financing for mobile homes.

Government-Backed Loan Options

One of the best-kept secrets about affordable manufactured homes is the number of government programs designed to help make homeownership possible. These aren’t just for site-built homes—manufactured home buyers can take advantage of them too!

FHA-insured loans are incredibly popular for good reason. Backed by the Federal Housing Administration, these loans require a down payment of just 3.5% if your credit score is 580 or higher. Even if your score is between 500 and 579, you can still qualify with a 10% down payment. FHA loans work for both traditional mortgages (when you own the land) and personal property loans (when you don’t). They’re designed to help people who might not qualify for conventional financing achieve their homeownership dreams.

VA loans offer an outstanding benefit for those who’ve served our country. Service members and veterans can access VA loans for manufactured homes titled as real property, typically with a 5% down payment and loan terms ranging from 20 to 25 years. What’s really exciting is the VA’s energy-efficient mortgage option, which can finance up to $6,000 in energy-efficient improvements. This means you can make your home even more comfortable while saving on utility bills from day one.

USDA Rural Housing loans might be the most attractive option if you’re looking at properties in rural areas. These loans often require no down payment at all for eligible low- and moderate-income buyers. You’ll generally need a credit score of at least 650 and must meet income-eligibility requirements based on your area. If you’ve been dreaming of a quieter life outside the city, this program could be your ticket to homeownership.

At Manufactured Housing Consultants, we specialize in helping buyers with all credit situations find the right financing path. Whether you have excellent credit or you’re working to rebuild, we offer specialized financing options and even FICO improvement services. Don’t let credit concerns hold you back—we’ve helped countless families overcome these challenges. Learn more about our low FICO home loans and let us show you what’s possible.

Government Incentives and Rebates

Here’s something many buyers don’t realize: beyond the loan itself, there are often additional programs that can put money back in your pocket when you purchase an affordable manufactured home. These incentives can reduce your upfront costs or help you save money for years to come.

Many states and local utility companies offer rebates for purchasing energy-efficient manufactured homes or making energy-efficient upgrades. For example, programs like Efficiency Vermont’s manufactured home replacement program, Maine State Housing Authority’s low-interest loan and grant offerings, Energy Trust of Oregon’s cash incentives, and South Carolina Energy Office’s ENERGY STAR manufactured home rebates can provide significant savings. The amount varies by location and program, but these incentives are worth investigating.

The ENERGY STAR rebate finder is your starting point for finding what’s available in your area. This free online tool helps you search for federal, state, and local incentives based on your location and the energy-efficient features of your home.

For even more comprehensive information, the Database of State Incentives for Renewables & Efficiency (DSIRE) catalogs thousands of programs across the country. It’s an invaluable resource that can help you find incentives you never knew existed.

Down payment assistance programs work just like they do for site-built homes. Various organizations offer help with down payments or closing costs specifically for manufactured home purchases. Next Step’s Down Payment Seeker™ tool is particularly helpful—find down payment assistance that can reduce your upfront or monthly costs and make homeownership even more affordable.

We encourage you to explore these programs thoroughly. The combination of affordable manufactured home prices, favorable financing, and available incentives creates an incredibly compelling path to homeownership. And we’re here to help you steer every step of that journey.

Frequently Asked Questions about Affordable Manufactured Homes

We hear certain questions over and over from people exploring their options, and we’re always happy to answer them. Your concerns are valid, and we want to make sure you feel confident as you move toward homeownership.

How do I choose a reputable manufacturer or dealer?

Finding the right partner for your affordable manufactured homes journey is one of the most important decisions you’ll make. After all, this is likely one of the biggest purchases of your life, and you deserve to work with people who have your best interests at heart.

Start by looking for transparent pricing. If a dealer won’t show you clear, upfront costs—or if they’re vague about fees and add-ons—that’s a red flag. We believe in showing you all prices upfront, including online price estimates for homes and delivery. No surprises, no games.

Next, dig into their customer reviews and reputation. What are real customers saying about their experience? Check their BBB rating—it’s a quick way to see if they’ve been handling complaints fairly. We’re proud of our A+ BBB rating and the reviews from families who’ve found their dream homes with us.

Make sure the dealer has proper credentials and licenses. In Texas, certification by the TDHCA (Texas Department of Housing and Community Affairs) shows that a dealer meets state standards and follows the rules. It’s a mark of professionalism and reliability.

A truly reputable dealer will offer comprehensive support throughout the entire process. This means helping you select and customize your home, navigating permits, arranging financing, and even coordinating site preparation. We make the buying process easy and smooth, helping with everything from beginning to end. You shouldn’t feel like you’re on your own once you sign a contract.

Finally, trust your gut about the sales approach. If you feel pressured or rushed, walk away. A good dealer respects your timeline and your need to make an informed decision. We believe in friendly staff and low-pressure sales, allowing you to tour homes at your own pace and ask all the questions you need.

Understanding what to expect can ease a lot of anxiety. Learn more about the manufactured home buying process with our comprehensive guide.

How does owning the land impact affordability?

This is one of the most important questions when considering affordable manufactured homes, and the answer can significantly affect your financial future.

When you own the land where your manufactured home sits, everything changes. Your home can be titled as real property, just like a traditional site-built house. This isn’t just a technicality—it’s a game-changer for your financing options.

With real property titling, you gain access to traditional mortgages from Fannie Mae, Freddie Mac, FHA, VA, and USDA. These loans typically come with lower interest rates, longer loan terms (often 30 years), and stronger consumer protections than personal property loans. Over the life of your loan, this can save you tens of thousands of dollars.

There’s another huge benefit: no monthly lot rent. When you rent a space in a manufactured home community, that monthly payment goes on forever—it’s money you’ll never see again. But when you own your land, that expense disappears. Your housing costs become more predictable and often lower.

Perhaps most importantly, owning land allows you to build equity in both your home and the property. As your home appreciates and you pay down your mortgage, you’re building real wealth. This equity can be tapped later for emergencies, home improvements, or even as a stepping stone to another property down the road.

We understand that buying land might feel like a big step, but it’s often more achievable than people think. We offer a variety of land home packages designed to simplify the process and make this path to homeownership smoother.

What are Resident-Owned Communities (ROCs)?

If you’re considering affordable manufactured homes in a community setting but worry about landlord control or rising lot rents, Resident-Owned Communities might be the perfect solution you haven’t heard about yet.

In a ROC, the homeowners themselves band together to form a non-profit cooperative that owns the land. Instead of paying rent to a corporate landlord, you’re essentially paying into a cooperative that you and your neighbors control. It’s a democratic approach to manufactured home living that’s gaining popularity across the country.

The benefits are pretty compelling. As a member of the cooperative, you have a real voice in how your community is run. You get to vote on important decisions like lot rent amounts, community rules, and how maintenance is handled. If you’re passionate about improving things, you can even run for a position on the board of directors and help shape your community’s future.

This structure also provides genuine housing security. You don’t have to worry about a new owner coming in and jacking up the rent or deciding to close the community. That stability is priceless, especially if you’re planning to stay in your home for many years.

Because there’s no profit motive driving decisions, lot rents in ROCs tend to be more stable and affordable. Any money left over after expenses typically gets reinvested back into the community or used to keep costs down for residents. It’s a model that prioritizes people over profits.

There’s something else we’ve noticed, too: ROCs tend to foster a stronger sense of community. When everyone has a stake in maintaining and improving the neighborhood, people naturally take more pride in their homes and look out for each other. Organizations like ROC USA help communities make this transition, providing financing and support to turn traditional manufactured home parks into resident-owned cooperatives.

It’s an innovative approach that combines the affordability of manufactured home living with the security and control of homeownership—giving you the best of both worlds.

Conclusion: A Smart Solution to the Housing Crisis

Affordable manufactured homes offer a clear path to homeownership without sacrificing quality. Built in controlled factories to HUD standards, they deliver real savings, faster timelines, and modern design.

The value is compelling: many buyers save over $100,000 versus comparable site-built homes, and energy-efficient models can cut utility bills by 30-50% year after year. You can choose what fits your life and budget—from cost-friendly single-wides to spacious double-wides and CrossMod ae homes with site-built aesthetics. Yes, quality three-bedroom homes with modern amenities are available for under $100,000.

Financing is flexible too. If you own land, traditional mortgages open up lower rates and longer terms. Government-backed options like FHA (as low as 3.5% down), VA, and USDA (often 0% down in eligible rural areas) can make monthly costs more manageable. Add rebates, energy incentives, and down payment assistance, and the numbers get even better.

In Texas, Manufactured Housing Consultants makes the process simple with the largest selection from 11 top manufacturers, guaranteed lowest prices, and specialized financing for all credit situations. Ready to start? Explore our affordable mobile homes in Corpus Christi and let us help you find the right home, at the right price.