Why Bank Foreclosed Homes Could Be Your Path to Affordable Homeownership

Cheap bank foreclosed homes offer an accessible path to homeownership, especially for buyers on a budget. Also known as REO (Real Estate Owned) properties, these are homes that banks own after they failed to sell at a foreclosure auction.

Quick Guide to Finding Cheap Bank Foreclosed Homes:

- Bank of America REO listings – Search their dedicated foreclosure portal

- Auction.com – Nation’s largest online marketplace with 533K properties closed

- HUD homes – Government-backed foreclosed properties

- Local bank websites – Many banks list their REO inventory directly

- Real estate agents specializing in REOs – Get access to exclusive listings

The numbers are compelling. In some markets, like Tampa Bay, foreclosed homes have a median list price of $300,000, often well below market value. Banks typically price these properties based on the remaining loan balance, creating real opportunities for buyers.

However, experts caution that “sometimes foreclosures and bank owned property are good deals but certainly not always.” The key is understanding the process, knowing where to look, and doing thorough due diligence. While these homes can be affordable, success requires research and realistic expectations about potential repair costs.

What Exactly is a Bank-Owned (REO) Property?

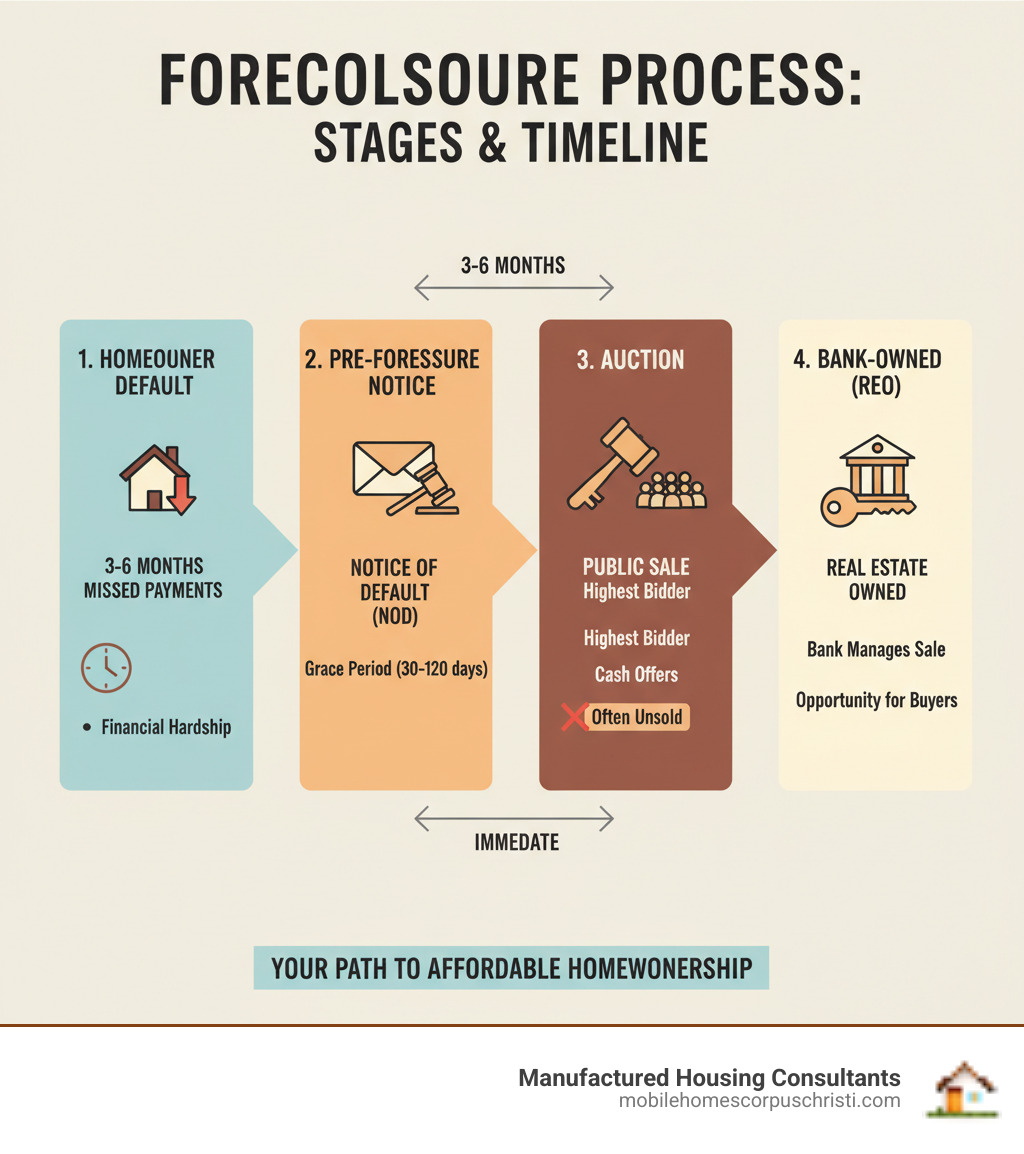

When discussing cheap bank foreclosed homes, we’re often referring to REO (Real Estate Owned) properties. An REO is a home a bank or lender owns because it failed to sell at a foreclosure auction. After a homeowner defaults on their loan, the bank initiates foreclosure. If no one buys the property at auction, it reverts to the bank.

A house secures a loan. If payments stop, the bank forecloses to recoup its money. If the home doesn’t sell at auction, the bank takes ownership, and it becomes an REO property. The bank’s goal is to sell it quickly to recover the loan balance, which is why these homes can be an affordable option for savvy buyers.

To help you get a clearer picture, let’s compare REO properties with pre-foreclosure properties:

| Feature | Bank-Owned (REO) | Pre-Foreclosure |

|---|---|---|

| Owner | The bank or lender. | The homeowner (they still own it but are struggling with payments). |

| Status | The foreclosure process is complete, and the property officially belongs to the bank. | The homeowner has received a notice of default, but the foreclosure hasn’t been finalized yet. |

| Sale Type | The bank sells directly, usually through real estate agents. | The homeowner might try a “short sale” (selling for less than they owe) to avoid full foreclosure. |

| Condition | Typically sold “as-is.” The bank might tidy up, but major repairs are rare. | Varies a lot! The homeowner still lives there, so it could be well-maintained or neglected, depending on their situation. |

| Title Issues | The bank usually clears up old liens, aiming to give you a “clean” title. This is a big plus! | There can be multiple liens, so you’d need to do a lot of careful homework to uncover everything. |

| Pricing Goal | To get their money back quickly. Prices are often based on the outstanding loan balance or estimated market value. | Often priced below market value, but any short sale needs the lender’s approval, which can be tricky. |

| Investment Angle | You buy directly from the bank, often at a stable price, with less back-and-forth negotiation than other options. | A great opportunity for real estate investors, with potential for direct negotiation with the homeowner before it ever gets to the bank. |

How REO Homes Differ from Other Foreclosures

While “foreclosure” is a broad term, REO homes stand out from other distressed properties like those sold at public auctions or in short sales.

Auction properties are often bought sight-unseen and “as-is,” carrying risks like existing liens or occupants. The buyer is responsible for these issues. In contrast, with REO properties, the bank has completed the legal process and typically clears the title of prior liens. This results in a “cleaner” purchase with fewer legal headaches, offering a more direct path to owning one of these cheap bank foreclosed homes.

In a short sale, the homeowner sells for less than the mortgage balance with lender approval. The process can be long and uncertain, requiring multiple approvals with no guarantee of closing. REO properties have one decision-maker: the bank. Their process is more predictable. Banks list REO homes with real estate agents, making them easy to find on the MLS. These homes are often vacant, simplifying the buying journey, though they may need repairs. For more on similar options, like bank-repossessed mobile homes, see our guide on bank repossessions.

Legal Considerations and Disclosures

When buying cheap bank foreclosed homes, understand the legal landscape. Banks sell properties “as-is,” meaning they make no repairs. Since the bank never lived there, it knows little about the home’s condition. Therefore, your due diligence is critical. Rely on professional inspections to uncover potential issues. Some states have a “right of redemption” period, allowing the former owner to reclaim the property post-foreclosure, though this is more common with auction sales. Consult legal counsel to understand local laws. To be fully informed about your rights on real estate platforms, review their Privacy Policy and Terms of Service.

Where to Find Listings for Cheap Bank Foreclosed Homes

Finding cheap bank foreclosed homes is easier when you know where to look.

- Bank websites: Major banks like Bank of America have dedicated REO portals with listings, resources, and financing options.

- Government agencies: The U.S. Department of Housing and Urban Development (HUD) lists foreclosed properties that are often bargains, sometimes with buyer protections.

- Specialized online marketplaces: Sites like Auction.com, the nation’s largest platform, provide access to auctions in all 50 states. MLS listings also have foreclosure sections.

- Local real estate agents: REO specialists have inside knowledge of new listings and can guide you through the unique process of buying from a bank.

Searching by State or Region

The number of foreclosures varies by region, influenced by local economic factors. Texas offers many opportunities for buyers seeking cheap bank foreclosed homes due to its diverse economy. You can find hundreds of Texas foreclosures, from urban condos to rural homes, on major listing platforms.

In South Texas, Corpus Christi area foreclosures provide local options in a unique market. Find details on local listings in our Corpus Christi Bank Owned Homes & REO Properties For Sale section.

Tips for Finding the Best Deals on Cheap Bank Foreclosed Homes

Finding the best deals on cheap bank foreclosed homes requires preparation and strategy.

- Act quickly: Good deals go fast, often receiving multiple offers within days.

- Get pre-approved: A pre-approval letter shows banks you’re a serious buyer who can close the deal.

- Work with an REO agent: These specialists understand bank processes and can spot potential red flags.

- Look for older listings: Banks may be more motivated to negotiate on properties that have been on the market for a while.

- Set up automated alerts: Use listing websites to get notified about new properties that match your criteria.

Not all foreclosures are good deals. Do your homework to tell real opportunities from money pits. For help evaluating properties, see our Guide to the Pros and Cons Before Buying Repo Mobile Homes.

The Rewards vs. The Risks of Buying Bank-Owned

Buying cheap bank foreclosed homes can be a mystery box—it could be a treasure or a bigger project than expected. These properties can be amazing opportunities, but they aren’t automatic goldmines. Success requires homework and realistic expectations. Banks want to sell these properties, not manage them, which creates opportunities for buyers who approach the process with their eyes open.

Key Advantages of Buying a Bank-Owned Home

There are real benefits to buying cheap bank foreclosed homes.

- Lower prices: Banks price properties to sell quickly, often at or below the loan balance, which can mean significant savings.

- Less competition than auctions: The process is more manageable than a high-pressure auction, allowing time for research and inspections.

- Cleaner titles: Banks typically clear outstanding liens, reducing the risk of inheriting financial issues.

- No emotional sellers: The transaction is purely business, focused on facts rather than sentiment.

- Affordability: These homes provide a path to homeownership and equity building that might otherwise be out of reach.

For similar opportunities, consider investing in a repo mobile home, which can have lower entry costs.

Potential Downsides and How to Mitigate Them

However, buying cheap bank foreclosed homes has risks.

- “As-is” condition: This is the biggest challenge. Banks don’t make repairs, so that leaky roof or faulty wiring is your problem. Always get a thorough professional inspection and budget 10-20% extra for unexpected repairs.

- Significant repairs: Vacant properties often suffer from neglect, leading to issues from plumbing to structural damage. Get multiple contractor bids before making an offer to understand the true cost.

- Vandalism or neglect: Vacant homes can be targets for vandalism or suffer from lack of care. Drive by the property at different times and inspect the interior for damage.

- Lengthy bank approval: Bank bureaucracy can slow down the offer approval process, sometimes taking weeks. An experienced REO agent can help steer this.

- Competition from cash investors: Investors with cash can make attractive offers. Be prepared with pre-approved financing to compete.

The goal is finding the best value, not just the lowest price. A cheap home with expensive hidden repairs is no bargain.

Your Step-by-Step Guide to Buying a Bank-Owned Home

Buying a cheap bank foreclosed home is a process with specific steps. Once you know them, it becomes manageable. Your roadmap to success includes preparation, the right team, and realistic expectations. A skilled REO agent is your guide, and financial pre-approval is your ticket to being taken seriously by banks.

Step 1: Inspection and Due Diligence

Since banks sell properties “as-is,” this step is crucial for uncovering surprises.

- Get a professional home inspection: This is essential, not optional. An inspector will check the foundation, roof, plumbing, electrical, and HVAC systems for hidden issues.

- Check for major issues: Look for signs of structural damage (cracks, uneven floors) and problems with plumbing and electrical systems, which are common in vacant homes.

- Estimate repair costs: Get quotes from licensed contractors to understand the true cost of the home. Budget extra for unexpected issues.

For more insights on evaluating properties, our Repo Mobile Homes: A Complete Guide offers applicable principles.

Step 2: Making an Offer and Negotiation

After your due diligence, it’s time to make an offer.

- Submit a formal offer: Your agent will submit the offer. Expect the bank to have its own addendum with extra clauses.

- Provide proof of funds: A pre-approval letter or proof of funds is required. Banks only work with serious, financially prepared buyers.

- Negotiate the price: The negotiation process is straightforward. Banks want to sell and often price homes with room to negotiate, especially on properties needing repairs. Don’t hesitate to make a reasonable offer below asking.

For tips on making a competitive and sound offer, resources like Better Money Habits® can provide guidance.

Step 3: Securing Financing for Cheap Bank Foreclosed Homes

Financing cheap bank foreclosed homes can be tricky, especially for properties needing repairs.

- Financing challenges: A home in poor condition may not meet lender requirements for a conventional loan.

- Renovation loans: If a property fails to meet habitability standards, consider renovation loans like the FHA 203(k). These loans cover both the purchase price and repair costs in one mortgage, making fixer-uppers more accessible.

At Manufactured Housing Consultants, we specialize in flexible financing for new manufactured homes. Our expertise in Financing for Mobile Homes shows the creative solutions available when you have the right team.

Step 4: Understanding the Closing Process

Closing is the final step to becoming a homeowner.

- Closing costs: Expect to pay 2% to 5% of the loan amount for fees like title searches, insurance, and attorney costs.

- Title search and insurance: These are essential to ensure there are no hidden claims on the property and to protect you from future ownership issues.

- Other costs: You’ll pay prorated taxes from the closing date. Be aware that banks may include specific fees in their addendums.

Use a closing costs calculator to estimate your expenses and avoid surprises.

Frequently Asked Questions about Bank Foreclosed Homes

Are bank-owned homes always a good deal?

Not always. While a cheap bank foreclosed home often has a low asking price, that’s not the whole story. The true cost includes the purchase price plus all necessary repairs. A home that seems like a bargain could cost more than a move-in-ready property after renovations. The real “deal” is found by getting a thorough inspection and calculating your total investment to ensure the final value meets your budget.

What is the biggest mistake to avoid when buying an REO property?

The biggest mistake is skipping a thorough professional inspection and underestimating repair costs. Since REO properties are sold “as-is,” you are responsible for all issues, from leaky roofs to faulty wiring. What seems like a cosmetic fix could be a major structural or safety problem that turns your purchase into a money pit. Other mistakes to avoid are not securing financing before making an offer and not working with an experienced REO agent.

How can I stay updated on new bank-owned property listings?

To find new listings for cheap bank foreclosed homes quickly, use a combination of strategies:

- Set up alerts: Use online platforms like Zillow, Redfin, and Auction.com to create personalized email alerts for new foreclosure listings in your target areas.

- Work with an REO agent: These agents often have early access to listings through their connections with banks and can set up advanced searches on the MLS.

- Check bank websites: Major banks like Bank of America often list their REO inventory directly on their websites.

- Use specialized sites: Websites like BankOwnedProperties.org can provide filtered listings by location.

This multi-pronged approach will keep you informed and ready to act on new opportunities.

Conclusion

We’ve explored cheap bank foreclosed homes, a potential treasure hunt for affordable homeownership. We’ve covered what they are, where to find them, and how to weigh the rewards against the risks. Success depends on research, inspections, proper financing, and a professional team. These homes are a unique opportunity but require a specific approach and a readiness for repairs.

If the “as-is” nature of foreclosures isn’t for you, we at Manufactured Housing Consultants offer a wonderful alternative: a brand new home. We provide beautiful, new mobile and manufactured homes with the largest selection from 11 top manufacturers at guaranteed lowest prices. We also offer specialized financing for all credit situations and can deliver anywhere in Texas.

Whether you’re ready for an REO project or prefer a simpler path, being prepared is key. For another great route to affordable homeownership, explore our bank repo mobile homes or Find Affordable Mobile Homes in Corpus Christi today. Your perfect home could be a click away!