Why Understanding Mobile Home Down Payments is Your First Step to Homeownership

When you’re searching for information about a down payment on a trailer, you’re likely wondering how much money you’ll need upfront to make your homeownership dream a reality. Here’s what you need to know right away:

Typical Down Payment Requirements:

- Standard Range: 10-20% of the home’s after-tax price

- Excellent Credit (720+): As low as 0-5% down

- Good Credit (660-719): Usually 10-15% down

- Fair/Poor Credit (<660): Often 20% or more down

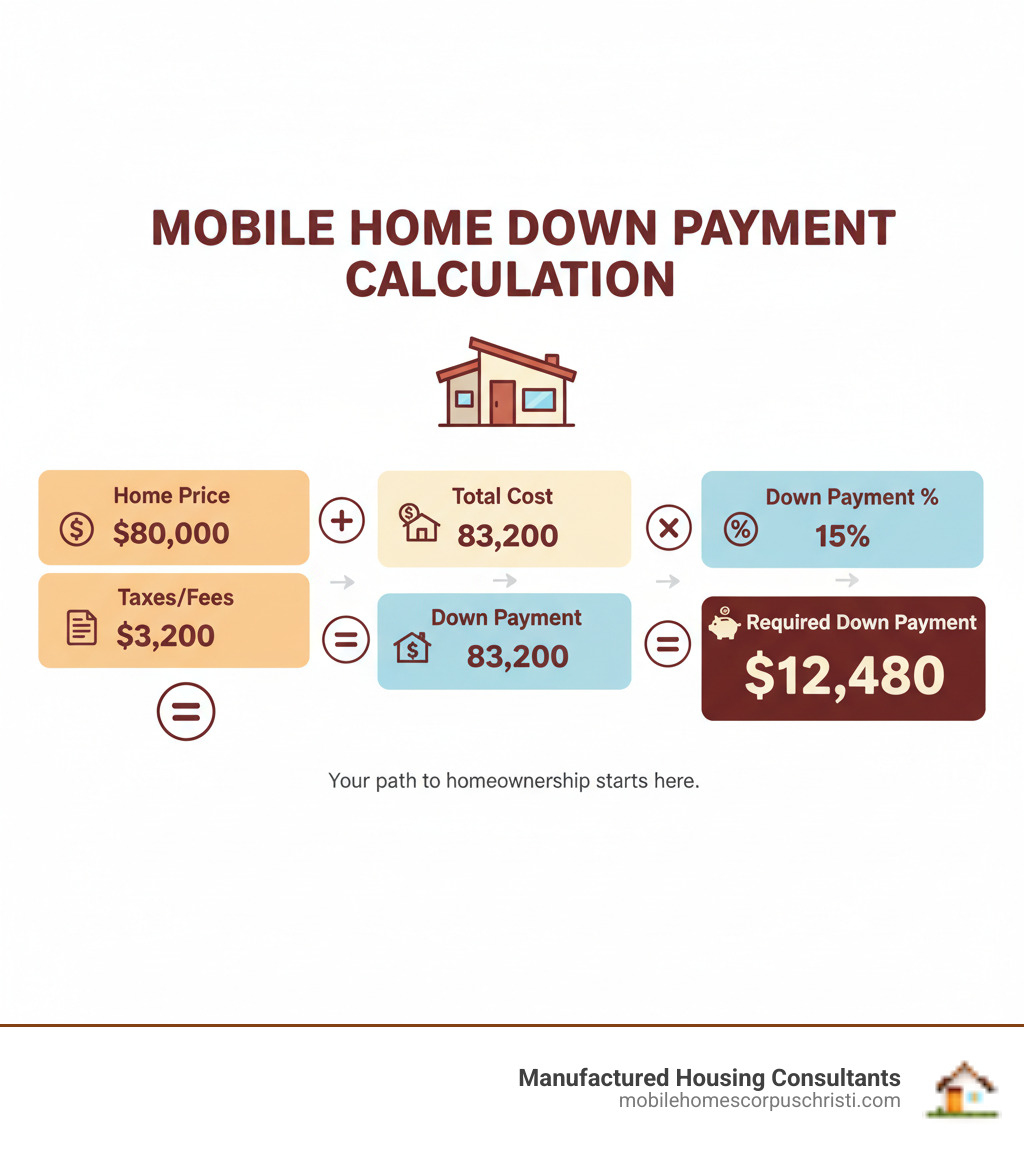

Quick Calculation Example:

- Home price: $80,000

- Down payment at 15%: $12,000

- Your loan amount: $68,000

For many families facing high traditional housing costs or credit challenges, manufactured homes offer an affordable path to homeownership. But understanding down payment requirements can feel overwhelming – especially when every lender seems to have different rules.

The good news? You have more options than you might think. From using trade-ins to reduce your cash needs to finding specialized financing programs, there are ways to make homeownership work even if you don’t have a large down payment saved up.

This guide will walk you through everything you need to know about mobile home down payments, including how to calculate yours, what factors affect the amount, and strategies to reduce your upfront costs.

What is the Typical Down Payment on a Trailer?

Picture this: you’ve walked through several beautiful manufactured homes, and you’ve finally found “the one.” Your family can already imagine making memories in those spacious rooms. But then reality kicks in, and you’re wondering: “Okay, how much cash do I actually need to bring to the table?”

Here’s the straightforward answer: most lenders expect a down payment on a trailer between 10-20% of the home’s total price. This range has become the industry standard, and it’s what you should plan for when budgeting for your new home.

Let’s make this real with an example. Say you’ve fallen in love with a manufactured home that costs $80,000 after taxes and fees. With a typical 15% down payment, you’d need $12,000 upfront. That leaves you financing $68,000 – much more manageable monthly payments than trying to cover the full purchase price.

Now, here’s where it gets interesting: that percentage isn’t carved in stone. We’ve seen situations where buyers with excellent credit put down as little as 5%, while others might need 25% or even 30% depending on their financial situation. Your credit score, the lender you choose, and even the specific home you’re buying all play a role in determining your exact requirement.

The key thing to remember is that this percentage gets calculated on the after-tax price, not just the sticker price you see advertised. This means all those extra costs we’ll talk about in a moment get added to the home’s base price before your down payment percentage kicks in.

Planning for your down payment is just one piece of the homeownership puzzle. For a complete picture of all the costs involved, take a look at our guide on How to Budget for Your New Manufactured Home.

How Home Type Affects Your Down Payment

When people say “trailer,” they might be talking about anything from a tiny travel trailer to a spacious manufactured home. But here’s what matters for your financing: manufactured homes and modular homes are treated very differently by lenders, and this directly affects your down payment requirements. For helpful background on the differences, see Manufactured housing and Modular building.

Manufactured homes are built to federal HUD standards and are designed to be moved (even though most never leave their first location). Modular homes, on the other hand, are built to the same codes as traditional stick-built houses. Lenders see modular homes as less risky investments, which often translates to lower down payment requirements.

There’s another crucial factor: whether you own the land or rent a lot. If you’re buying a manufactured home that will sit on land you own, you might qualify for a traditional mortgage with lower down payment options. But if you’re moving into a manufactured home community where you’ll rent the lot, you’ll likely need a chattel loan, which typically requires a higher down payment.

Factoring in Taxes and Fees

Here’s where many first-time buyers get surprised: the sticker price is just the beginning. When calculating your down payment, you need to factor in sales tax, delivery costs, and setup fees because these all get rolled into your total purchase price.

Sales tax alone can add thousands to your final cost, and rates vary depending on where in Texas you’re having your home delivered (see the Texas Comptroller’s overview of sales tax). Then there are delivery fees for getting your home from the factory to your site, plus setup costs for getting everything properly installed and connected.

The good news? At Manufactured Housing Consultants, we include setup, delivery, and AC in our home prices. This means no surprise costs popping up at the last minute. You’ll know exactly what your total investment will be from day one, making it much easier to calculate that down payment and plan your budget.

When all these costs get added together, they create your total purchase price. That’s the number your down payment percentage gets applied to, so it’s worth understanding every piece of the puzzle before you start shopping for financing.

The Financial Power of a Larger Down Payment

Think of your down payment on a trailer as an investment in your financial future. While it might be tempting to put down the bare minimum, increasing that upfront payment can create a ripple effect of benefits that’ll make you smile every time you write that monthly check.

The magic starts with simple math. When you put more money down, you’re borrowing less from the lender. That smaller loan amount becomes the foundation for everything else that follows. Your monthly payments drop because there’s less principal to pay off each month. It’s like choosing a lighter backpack for a long hike – you’ll feel the difference every step of the way.

Here’s where it gets really exciting: those lower monthly payments free up money in your budget for other things. Maybe it’s that family vacation you’ve been planning, or simply having breathing room for unexpected expenses. When homeownership feels comfortable instead of stressful, you know you’ve made a smart financial move.

The long-term savings are where the real power shows up. Even putting down an extra few thousand dollars can save you tens of thousands in interest over your loan term. Manufactured home loans often run 10 to 20 years, so every dollar you don’t have to borrow is a dollar that won’t accumulate interest year after year. It’s like getting a discount that keeps paying you back.

You’re also building instant equity – the portion of your home that you actually own outright. Instead of starting from zero, a larger down payment gives you a head start on building wealth through homeownership. That equity becomes a financial safety net and a foundation for your family’s future.

Lenders love to see substantial down payments because it shows them you’re serious and financially stable. This translates into what’s called a better loan-to-value (LTV) ratio – essentially, you’re borrowing a smaller percentage of the home’s value. When lenders see lower risk, they often reward you with better interest rates and more favorable loan terms.

We know saving for a larger down payment isn’t always easy, but the financial advantages compound over time. If you’re considering going all-in with cash, our guide on the Advantages of Buying a Mobile Home with Cash explores how eliminating monthly payments altogether can transform your financial picture.

Key Factors That Influence Your Down Payment Requirement

Think of your down payment on a trailer requirements like a recipe – several ingredients come together to determine the final amount you’ll need upfront. While we’ve covered the typical ranges, the reality is that your specific situation will influence where you land within those ranges, and sometimes even outside them.

The good news? Understanding these factors puts you in control. When you know what lenders are looking for, you can take steps to improve your position and potentially reduce your down payment requirements or secure better loan terms.

How Your Credit Score Impacts the Down Payment on a Trailer

Your credit score is like your financial report card – and lenders pay close attention to it when determining how much you’ll need to put down. The higher your score, the less risk you represent to lenders, which translates directly into better terms for you.

If you have excellent credit (720+ FICO score), you’re sitting in the driver’s seat. Many lenders will roll out the red carpet with down payment options as low as 0% to 5%. You’ll also qualify for the best interest rates available, which can save you thousands over the life of your loan. Some lenders even offer zero-down programs for buyers with credit scores above 700.

With good credit (660-719 FICO score), you’re still in great shape. The standard 10-15% down payment typically applies here, and you’ll have plenty of lender options to choose from. While you might not get the absolute lowest rates, they’ll still be very competitive and manageable for most budgets.

If your credit score is fair or poor (below 660), don’t let that discourage you from pursuing homeownership. Life happens, and we understand that. You’ll likely face a down payment requirement of 20% or more, and interest rates will be higher, but financing is absolutely still possible. Lenders view lower scores as higher risk, so a larger down payment helps balance that equation.

Here’s something many people don’t realize: improving your credit score before applying can dramatically change your financing landscape. Even moving from fair to good credit can save you thousands of dollars and reduce your down payment requirements significantly.

That’s why we’re passionate about helping our customers not just buy homes, but build stronger financial futures. Check out our insights on the Benefits of Improving Your Credit Score Before Buying Mobile Home and explore our Low FICO Home Loans options designed specifically for buyers working to improve their credit situation.

Financing Options Available Through Manufactured Housing Consultants

At Manufactured Housing Consultants, we believe that everyone deserves a path to homeownership, regardless of where they’re starting from financially. That’s why we’ve built relationships with a diverse network of lenders and developed financing solutions that work for real families in real situations.

We offer traditional financing for buyers with strong credit profiles. These programs often come with competitive rates and down payment requirements in the standard 10-20% range – or even lower if your credit score is exceptional.

Secured chattel loans are another popular option, especially when your manufactured home will be placed on leased land rather than property you own. With a chattel loan, your home itself serves as collateral, making it possible to secure financing even when a traditional mortgage isn’t the right fit. The down payment and interest rate will depend on your credit score, income, and the home’s value.

What sets us apart is our commitment to flexible payment programs. We work with lenders who truly understand the manufactured housing market and the unique needs of our customers. This means we can often find creative solutions that align with your budget and circumstances, even if your credit history isn’t perfect.

Here’s our promise: we look past just the numbers on a credit report. We see families who want stable, affordable housing, and we’re dedicated to making that happen. Whether through our specialized programs or partnerships with understanding lenders, we’ll work hard to find a financing solution that fits your situation.

Ready to explore your options? Our Manufactured Home Financing Options page has detailed information about all our programs, and our financing experts are always available to discuss your specific needs and goals.

Can’t Meet the Down Payment? You Still Have Options

Let’s be honest – staring at a down payment on a trailer requirement can feel overwhelming, especially when you’re already stretching to make homeownership happen. Maybe you’ve been saving for months, or perhaps life threw you a curveball that ate into your down payment fund. Take a deep breath. You’re not out of options, and you’re definitely not alone.

The beautiful thing about working with manufactured home specialists is that we’ve seen it all. Families who thought homeownership was out of reach have found creative ways to make it work. Sometimes the solution is right in your driveway, and other times it’s a program you didn’t even know existed.

Using a Trade-In as Your Down Payment on a Trailer

Here’s where things get interesting. That older mobile home sitting on your property? It might be your ticket to a brand-new manufactured home. Just like trading in your car at a dealership, you can often use the equity from your current home to cover part or all of your down payment requirement.

Assessing your trade-in value is the first step. Even if your current home has seen better days, it likely still holds value that can work in your favor. We’ll help you determine exactly what your home is worth and how that translates into down payment dollars. Sometimes families are pleasantly surprised by their home’s value, even when it needs some TLC.

But it’s not just mobile homes that can work as trade-ins. Applying equity from vehicles like RVs, boats, or even cars can sometimes help reduce your cash requirements. While every situation is different, we’ve helped families get creative with their assets to make homeownership possible.

Old mobile homes are particularly valuable in trade-in scenarios because they’re in the same category as what you’re purchasing. This makes the process smoother and often results in better trade-in values. Plus, you won’t have to worry about selling your old home separately – we handle everything as part of your new home purchase.

The trade-in approach simplifies your life in multiple ways. You’re not juggling two separate transactions, you don’t have to find buyers for your old home, and you can often move directly from your current home into your new one. To get a better understanding of what your current home might be worth, check out our guide on Mobile Home Trade-In Value and our comprehensive Ultimate Mobile Home Trade-In Guide.

Finding Down Payment Assistance

Beyond trade-ins, there’s a whole world of assistance programs designed specifically to help families like yours achieve homeownership. These aren’t charity programs – they’re smart business practices that help lenders find qualified buyers and help families build wealth through homeownership.

Lender-specific programs are often your best starting point. Many of our financing partners offer programs with reduced down payment requirements, sometimes as low as 0% for qualified buyers. These aren’t too-good-to-be-true offers – they’re legitimate financing options designed to expand homeownership opportunities.

Dealer incentives can also play a significant role in reducing your upfront costs. Here at Manufactured Housing Consultants, we regularly offer promotions and special deals that can help offset your down payment requirements. These might include cash-back offers, reduced pricing, or special financing terms that make homeownership more accessible for Texas families.

Gift funds from family members represent another path forward. Many financing programs allow you to use money gifted by relatives toward your down payment. There are specific rules about documentation and how these gifts must be structured, but it’s a legitimate way to get the help you need from family who want to see you succeed.

The key is knowing where to look and having someone in your corner who understands all the available options. We specialize in finding creative financing solutions for families with all types of credit situations. Our job is to explore every avenue until we find the one that works for your specific circumstances. For more information about the full range of financing options available, visit our page on Financing for Mobile Homes.

Frequently Asked Questions about Mobile Home Down Payments

When it comes to financing your manufactured home, we hear the same thoughtful questions from families all across Texas. These are the moments when you’re really thinking through the numbers and want to make sure you’re making the best decision for your family’s future. Let’s walk through the most common concerns together.

Can I get a trailer with no money down?

This is probably the question we get asked most often, and honestly, we completely understand why. The idea of moving into your new home without having to come up with thousands of dollars upfront sounds pretty amazing, right?

Here’s the real story: yes, it’s possible, but it’s definitely not common. Zero down options for a down payment on a trailer or manufactured home are typically reserved for buyers with excellent credit scores – we’re talking 700+ FICO scores. Even then, these programs are often limited-time lender promotions rather than standard offerings.

The catch? When you finance 100% of your home’s purchase price, you’ll almost always face higher interest rates. Think about it from the lender’s perspective – they’re taking on more risk by not requiring any money down, so they protect themselves with higher rates. This means your monthly payments will be larger, and you’ll pay significantly more over the life of your loan.

We’ve seen families get excited about no-money-down deals, only to realize later that a modest down payment would have saved them thousands in the long run. It’s worth crunching the numbers with our financing team to see what makes the most sense for your situation.

Is a bigger down payment always the best choice?

This is such a smart question because it shows you’re thinking beyond just getting approved for the loan. While we’ve talked a lot about the benefits of putting more money down, the truth is that it’s not always the right choice for every family.

Let’s be honest about both sides. A bigger down payment saves you money by reducing your loan amount and the total interest you’ll pay. It also lowers your monthly payments, which can make a huge difference in your family’s monthly budget. Plus, lenders often reward larger down payments with better interest rates.

But here’s what we always tell families: don’t drain your savings account just to make a bigger down payment. Life happens – cars break down, medical bills pop up, or job situations change. You need to keep your emergency fund intact even after buying your home.

We’ve worked with families who put every penny they had into their down payment, then struggled when unexpected expenses came up just a few months later. The importance of budgeting for ongoing home costs can’t be overstated – things like maintenance, insurance, and utilities don’t disappear once you get the keys.

Our advice? Find that sweet spot where you’re putting down enough to get good loan terms without leaving yourself financially vulnerable. Every family’s situation is different, and that’s exactly why we take the time to understand yours.

Can I include the cost of land in my trailer financing?

This question touches on one of the more complex aspects of manufactured home financing, and the answer really depends on your specific situation. Let’s break it down in simple terms.

If you’re planning to place your manufactured home on leased land – like in a mobile home community – you’ll typically need what’s called a chattel loan. These loans cover the home only, not the land, because you don’t own the land. The home is considered personal property, similar to how a car loan works.

Things get different when you own the land or are buying both the home and land together. In these cases, you might qualify for traditional mortgage financing that bundles everything into one loan. This happens when your manufactured home becomes permanently attached to your land, making it real property instead of personal property.

There’s also something called land-in-lieu financing, where the value of land you already own can help you qualify for better terms on your home loan, even if they’re not bundled together.

We know this can feel confusing – honestly, it’s one of the more complicated parts of manufactured home buying. That’s exactly why our team specializes in these types of loans. We’ll walk you through your specific situation and help you understand which financing options make the most sense.

Our Financing Services team has helped hundreds of Texas families steer these decisions. We’re here to make sure you understand all your options before making this important decision.

Your Path to Homeownership Starts Here

You’ve made it through the complete guide to understanding down payment on a trailer requirements, and now you’re equipped with the knowledge to take that exciting next step toward homeownership. It’s been quite a journey together, covering everything from basic calculations to creative financing solutions.

Let’s recap what we’ve finded along the way. The 10-20% standard remains your North Star when planning your budget. Whether you’re looking at a cozy single-wide or a spacious double-wide manufactured home, this range will serve you well in most financing scenarios.

Your credit score truly is crucial – it’s like your financial report card that lenders use to determine how much risk they’re taking on. If you have excellent credit, you might qualify for those fantastic 0-5% down payment options. Good credit typically lands you in that comfortable 10-15% range. Even if your credit needs some work, don’t worry – we specialize in helping families with all credit situations find their path to homeownership.

We also explored the financial power of a larger down payment. While it might seem daunting to save more upfront, every extra dollar you put down works for you over the entire life of your loan. You’ll enjoy lower monthly payments, pay less interest over time, and build instant equity in your new home.

Most importantly, if you can’t meet a large down payment requirement, you still have real options. From using trade-ins to applying for assistance programs, there are multiple pathways to make homeownership work for your situation.

Here at Manufactured Housing Consultants, we understand that every Texas family’s situation is unique. That’s why we’re passionate about offering specialized financing for all credit situations, including our FICO improvement programs. We work with 11 top manufacturers to bring you the largest selection at guaranteed lowest prices, and we deliver homes anywhere across Texas.

Your dream of owning a manufactured home doesn’t have to wait. We’re here in Corpus Christi, ready to walk alongside you through every step of the financing process. From calculating your down payment to finding the perfect home that fits your budget, we make it our mission to turn your homeownership dreams into reality.

Ready to get started? Start your financing pre-approval process with us today! Your new home is waiting, and we can’t wait to help you find it.