Why Easy Home Financing Matters for Your Homeownership Dreams

Easy home financing makes homeownership a reality, even with credit challenges or a tight budget. The key is knowing your options and working with partners who understand your situation.

Quick Answer: The 4 Main Paths to Easy Home Financing:

- Government-Backed Loans – FHA (3.5% down), VA (0% down), USDA programs

- Specialized Manufactured Home Financing – Chattel loans, land-home packages

- Alternative Lenders – 97% approval rates, flexible credit requirements

- Credit Building Programs – On-time payment reporting, co-applicant options

The traditional mortgage process isn’t your only choice. Specialized lenders approve 97% of customers and offer solutions when banks say no. Some programs provide approval in as little as 10 minutes for loans from $500 to $100,000.

Manufactured homes have unique financing options that big banks often don’t offer, including chattel mortgages for the home itself and specialized land-home financing programs.

Many of these programs also help you build credit. 60% of customers improve their credit score with on-time payments, and 1 in 3 graduate to prime rates over time.

Whether you’re a first-time buyer, have imperfect credit, or are considering a manufactured home, a financing path exists for you.

Understanding Your Financing Options: Find the Right Fit for Your New Home

Navigating home financing doesn’t have to be complicated. We’ll explain the various loan types to help you find the perfect fit for your new manufactured home, ensuring your path to homeownership is a smooth, easy home financing experience.

While traditional mortgages from large banks are one option, they are often designed for site-built homes. For manufactured homes or unique financial situations, specialized financing provides a much better fit. These options offer flexibility that traditional lenders often lack, and we specialize in these alternative routes to help everyone achieve homeownership. Learn more with our financing for mobile homes resources and complete guide to new home financing.

What Are Government-Backed Loan Programs?

Government-backed loans are a great resource for homebuyers who need a lower down payment or may not qualify for a conventional mortgage. These programs are insured by federal agencies, which allows lenders to offer more favorable terms.

- FHA Loans: Insured by the Federal Housing Administration, these are popular with first-time buyers. They require a down payment as low as 3.5% and have flexible credit and income requirements.

- VA Loans: Offered by the U.S. Department of Veterans Affairs, these loans are an incredible benefit for qualifying veterans, active-duty service members, and eligible spouses. They often require 0% down payment and have flexible credit guidelines.

- USDA Guaranteed Loan Program: The Single Family Housing Guaranteed Loan Program from the USDA also offers 0% down payment options for eligible borrowers in qualifying rural areas.

These programs are excellent examples of how accessible easy home financing can be.

Specialized Financing for Manufactured Homes

Manufactured homes have diverse financing options custom to their unique characteristics.

- Chattel Mortgages: These loans finance only the manufactured home, not the land. This is a common option if you own the land separately or lease a lot in a community. We can help you steer mobile home loans or financing to find the best chattel option.

- Land-Home Packages: This option combines the manufactured home and the land into a single loan, streamlining the process and often resulting in better rates and terms.

- Lender Partnerships: We have strong relationships with specialized lenders who understand the manufactured home market. They provide flexible terms and innovative solutions for all credit situations, allowing us to offer financing when traditional banks might say no. Our partners help provide a simple & easy application process to make your experience simple and easy. For general information, you can explore resources like easyfinancial.com, goeasy.com, Home Loans and Mortgages, or HUD.gov Loans.

The Path to Approval: What Lenders Look For

Before applying, it’s crucial to know where you stand. Understanding what lenders evaluate can transform the process into a straightforward path to easy home financing.

- Credit Score: This is a snapshot of your credit history. While higher scores get better rates, we’ve helped families with scores as low as 500. Your score is just one piece of the puzzle.

- Debt-to-Income Ratio (DTI): Lenders divide your total monthly debt by your gross monthly income. While traditional lenders prefer a DTI below 36%, we look at your complete financial picture.

- Down Payment: The 20% down rule is outdated. FHA loans require as little as 3.5%, while VA and USDA loans can offer 0% down. Specialized financing for manufactured homes often provides even more flexibility.

- Income and Employment: Lenders typically want to see two years of steady work history and will ask for pay stubs, tax returns, and bank statements to verify you can make monthly payments. We work with lenders who understand diverse employment situations, including self-employment.

For a complete picture, see what you need to know about financing.

Don’t Let Bad Credit Stop You: Your Guide to Easy Home Financing

A low credit score isn’t a dead end. We’ve seen customers with scores in the 500s get approved and improve their scores by 100+ points. Our FICO Score Improvement Programs can boost your score in as little as 3-5 business days by helping remove errors from your credit report. Learn more about our FICO score improvement program and the benefits of improving your credit score before buying a mobile home.

We specialize in finding lenders for low FICO scores who look beyond past mistakes to your current income and stability. Adding a co-applicant with stronger credit can also be a game-changer, potentially lowering your interest rate by up to 2%. Furthermore, building credit with on-time payments is a key benefit of our programs. We report your payments to all major credit bureaus, helping you rebuild your financial future. We also offer resources for low FICO home loans.

The Power of Pre-Approval

Getting pre-approved is your first major step. It shows sellers you’re a serious buyer and gives you a clear budget.

- Shop with Confidence: Pre-approval lets you know exactly what you can afford, so you can focus on homes within your budget.

- Set a Clear Budget: You’ll understand your monthly payment and other costs, preventing you from becoming “house poor.”

- Streamline the Application: The pre-approval application is straightforward. You’ll provide basic financial documents to get a conditional approval amount.

- Close Faster: Since much of the financial verification is already done, you can move from offer to closing much more quickly.

Ready to take the first step? Start your pre-approval process with us today and see how easy home financing can be.

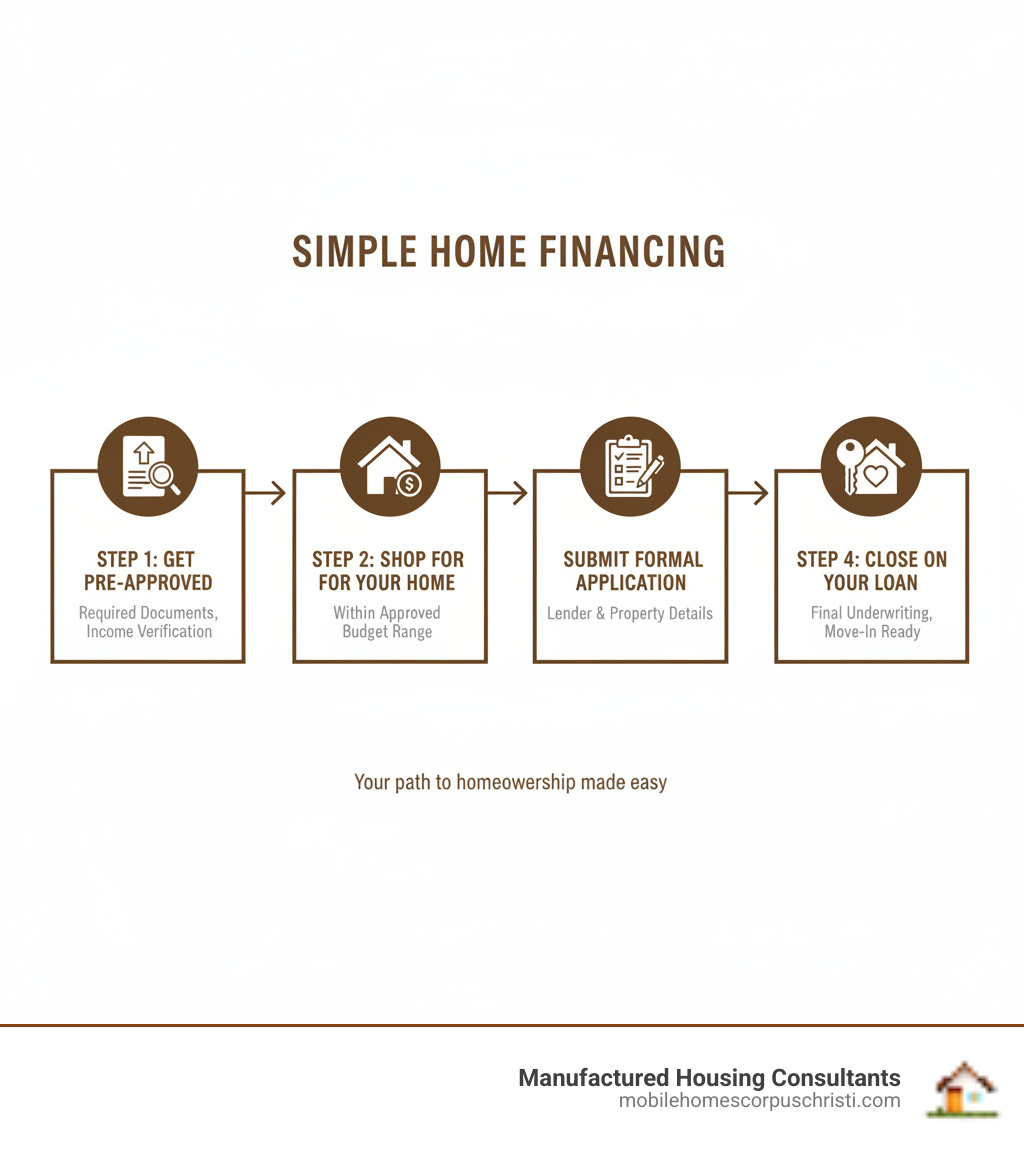

Your Step-by-Step Guide to Easy Home Financing

Buying a manufactured home should be an exciting adventure, not a maze of paperwork. We’ve broken down the loan application into clear, easy-to-follow steps to guide you toward easy home financing.

- Gather Your Documents: Save time by having your recent pay stubs, W-2s or tax returns (last two years), and bank statements ready.

- Get Pre-Approved: This is a game-changer. Pre-approval tells you how much you can afford, making home shopping less stressful and showing sellers you’re a serious buyer.

- Compare Loan Offers: We work with a network of specialized lenders. We’ll help you compare rates and terms to find the best deal for your financial situation.

- Complete the Formal Application: Once you find the right loan, you’ll fill out detailed forms. Many lenders, including us, offer a convenient on-line application.

- Underwriting and Closing: The lender will conduct a final review of your application (underwriting). Once approved, you’ll sign the final paperwork at closing and get the keys to your new home!

Decoding the Fine Print: What to Watch For

Understanding your loan agreement is crucial for a smooth easy home financing journey. Here are key terms to know:

- Interest Rates (APR): The Annual Percentage Rate (APR) is the total yearly cost of your loan, including fees. Always compare APRs to understand the true cost.

- Loan Term: This is how long you have to repay the loan. Shorter terms mean higher payments but less interest paid overall, while longer terms offer lower payments.

- Closing Costs: These are fees for the loan process, like appraisals and title insurance, typically 2-5% of the loan amount.

- Prepayment Penalties: Some loans charge a fee if you pay it off early. Many of our lenders offer terms without these penalties.

- Escrow Account: A portion of your monthly payment goes into this account, and the lender uses it to pay your property taxes and homeowner’s insurance for you.

Understanding these terms is vital for how to budget for your new manufactured home.

Leveraging Modern Tools for a Simpler Process

Technology has made easy home financing more accessible than ever. Modern tools make the application process faster and more convenient.

- Online Applications: Fill out your application from anywhere, anytime.

- Document Portals: Securely upload financial papers, speeding up verification.

- Mobile Apps: Manage your loan details and check payments from your phone.

- E-signatures: Sign contracts digitally to accelerate the loan process.

These tools are designed to be user-friendly, with features like screen-reader guides to ensure accessibility for all customers.

Beyond the Loan: Added Benefits and Protections

Loan approval is just the beginning of your easy home financing journey. The best partners provide long-term support and protection. With Manufactured Housing Consultants, you get a comprehensive support system that understands manufactured homes, ensuring peace of mind for years to come.

Home warranties act as a safety net for your investment. If a major system like your air conditioning breaks down, a warranty covers the repair, saving you from unexpected, costly bills.

We are proud to offer a FREE Lifetime Home Warranty on all new manufactured homes. This protects your home’s major systems—including HVAC, plumbing, and electrical—against normal wear and tear for as long as you own it. This commitment to quality ensures your investment is protected.

Beyond warranties, comprehensive protection plans can shield you from unexpected life events, with some plans even offering coverage for involuntary unemployment. We also provide rate reduction opportunities; for example, adding a co-applicant can sometimes reduce your interest rate by 2%. You can also benefit from our referral programs, earning $100 for helping a friend or family member find great financing.

Our financing services extend far beyond approval. We’re here to make your homeownership journey smooth, protected, and worry-free from day one.

Frequently Asked Questions about Easy Home Financing

It’s normal to have questions about the financing process. Here are straight answers to some of the most common ones.

How quickly can I get approved for a home loan?

Easy home financing can be surprisingly fast. With specialized lenders, pre-approval can take as little as 10 minutes once your paperwork is ready. This initial step gives you the green light to start shopping for a home immediately. The formal underwriting process takes longer (a few days to a couple of weeks), but the quick pre-approval allows you to move forward without delay. The key is working with lenders who specialize in manufactured homes, as they are much more efficient than traditional banks.

Can I get financing for a mobile or manufactured home?

Absolutely. While many people think it’s difficult, financing a manufactured home is straightforward with the right partner. You have several options, including chattel mortgages (which finance the home only) and traditional mortgages (if you’re buying the home and land together). Unlike big banks, our specialized lenders understand the value of manufactured homes and offer flexible requirements to help you get approved.

How much of a down payment do I really need?

The myth that you need 20% down is outdated. The reality is much more accessible. FHA loans require as little as 3.5% down, while VA loans (for veterans) and USDA loans (for rural areas) can require 0% down. For manufactured homes specifically, many of our specialized financing programs work with down payments of 3% or less. Easy home financing is designed to make homeownership attainable for people with real-world budgets.

Your Homeownership Dream is Within Reach

Easy home financing is about more than a loan; it’s about understanding your options, preparing your finances, and partnering with a team that cares about your success. By following this guide, you can move forward with confidence and turn your homeownership dream into a reality.

Here at Manufactured Housing Consultants, we specialize in making that journey smooth for our customers across Texas. We believe everyone deserves an affordable home, which is why we offer the largest selection from 11 top manufacturers at guaranteed lowest prices.

Our commitment to specialized financing sets us apart. We are experts in finding solutions for all credit situations and even offer FICO improvement programs. We deliver homes anywhere in Texas, making homeownership accessible and affordable.

Ready to take the next step? Learn about expert site preparation and land location. Our team is here to guide you, proving that home financing can be easier than you ever imagined.