Why Understanding Mobile Home Financing Options Matters

Financing for mobile homes opens the door to affordable homeownership, but it works differently than a traditional mortgage. With manufactured homes averaging around $145,200 compared to traditional homes exceeding $416,900, they offer a realistic path to ownership for many families.

Your main financing options include:

- FHA Loans: Government-backed with down payments as low as 3.5%.

- Conventional Loans: Fannie Mae/Freddie Mac programs with 3% down for qualifying homes.

- Chattel Loans: Personal property loans for homes on leased land, often with higher rates and shorter terms.

- VA/USDA Loans: Zero-down options for military and rural buyers.

- Personal Loans: An unsecured option for homes that don’t qualify for other financing.

The primary challenge is that lenders often treat mobile homes as personal property, not real estate, leading to higher interest rates and shorter loan terms. Your loan options depend heavily on whether you own the land, if the home meets current safety standards, and its legal classification. Homes built before 1976 face additional problems, while newer homes on permanent foundations may qualify for conventional mortgages.

Fortunately, financing for mobile homes has improved. In 2013, 86% of buyers used expensive chattel loans, but by 2021, that number dropped to 42% as more conventional financing became available, making homeownership more accessible.

First, What Kind of Home Are You Buying?

Before seeking financing for mobile homes, it’s crucial to understand the type of home you’re buying. This detail significantly impacts your financing options, as lenders evaluate homes based on safety standards and legal classification. Some homes qualify for traditional mortgages, while others are limited to more expensive personal property loans.

Mobile vs. Manufactured Homes

While often used interchangeably, “mobile home” and “manufactured home” have distinct meanings that affect financing.

Mobile homes were built before June 15, 1976, prior to federal construction standards. Due to varying quality, most lenders are hesitant to finance them. Finding financing for mobile homes from this era is challenging, often requiring the home to be updated to current safety standards. Otherwise, you may be limited to more expensive chattel or personal loans.

Manufactured homes are built on or after June 15, 1976, and must adhere to strict federal building codes from the U.S. Department of Housing and Urban Development (HUD). These regulations, known as HUD’s Manufactured Home Construction and Safety Standards, cover construction, safety, and energy efficiency. Because they meet these standards, lenders are more willing to finance them, giving you access to government-backed loans and conventional mortgages, especially if the home is on a permanent foundation on land you own.

Modular Homes

Modular homes are a premium type of factory-built housing. They are constructed in sections at a factory and assembled on a permanent foundation at the building site.

The key difference is that modular homes must follow the same state and local building codes as traditional stick-built houses. This means they are considered real estate from the start.

For financing, this is ideal. Modular homes typically qualify for traditional mortgages with the same interest rates and 30-year terms as a standard house. The permanent foundation and compliance with local codes give lenders the confidence to treat them as a regular real estate investment, resulting in better loan terms for you.

Exploring Your Options for Financing for Mobile Homes

Finding the right financing for mobile homes depends on whether you own the land, the home’s age, and your credit score. Understanding what’s available is the first step to making the best choice for your situation.

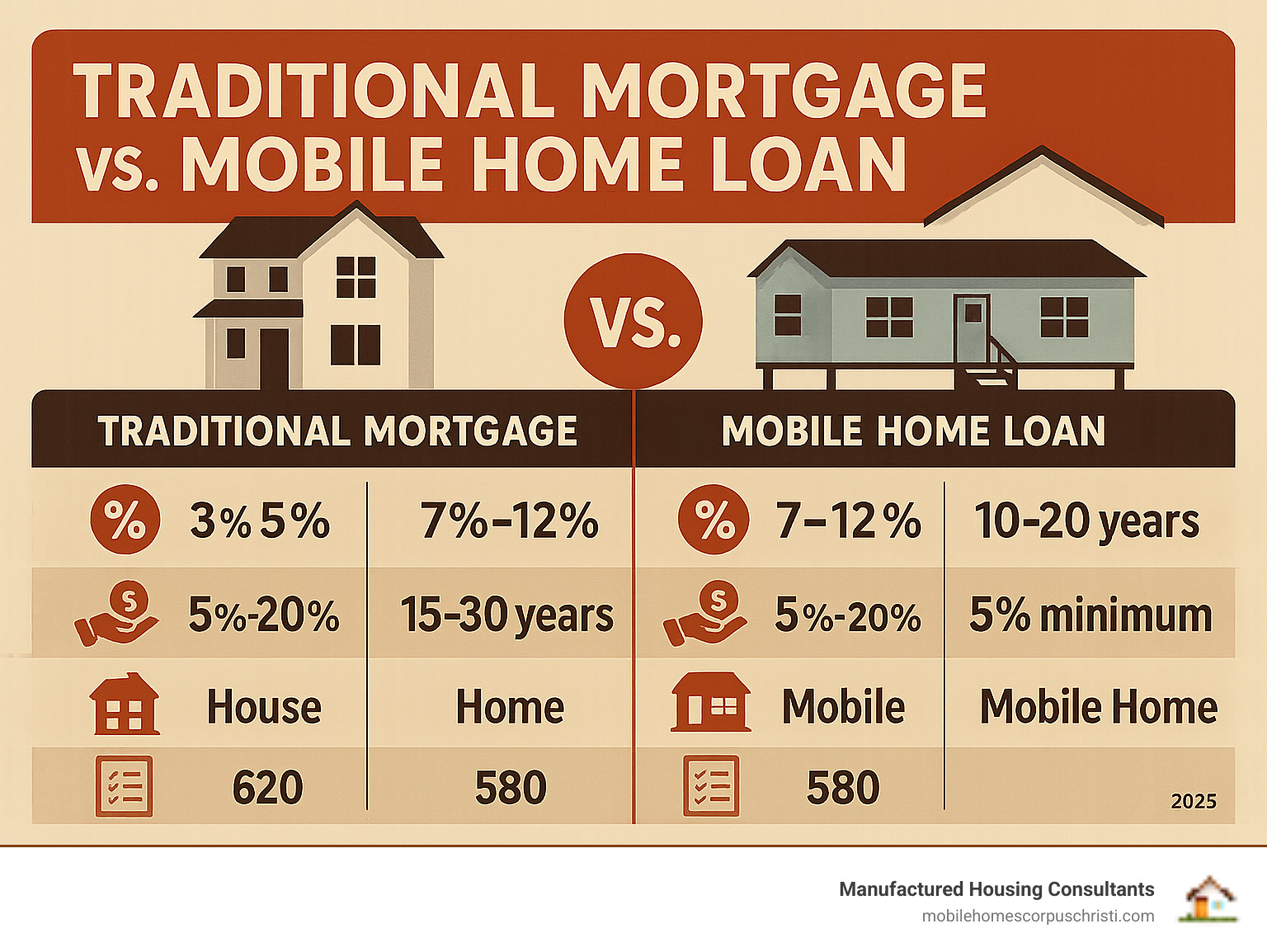

Here’s a helpful comparison of your main financing options:

| Loan Type | Typical Interest Rates | Loan Terms | Down Payment | Credit Score Requirements | Collateral Type |

|---|---|---|---|---|---|

| FHA Loans | Around 6.92% (variable) | Up to 30 years | 3.5% – 10% | 500-580+ | Home & Land (Real Estate) or Home (Personal Property) |

| Conventional | Competitive (similar to traditional mortgages) | Up to 30 years | 3% – 20% | 620+ | Home & Land (Real Estate) |

| Chattel Loans | 5.99% – 14% | Up to 20 years | Varies (often 5-10%) | 575-660+ | Home Only (Personal Property) |

| Personal Loans | 6.6% – 12.65%+ | Up to 7 years | None | 600+ | Unsecured (No Collateral) |

Government-Backed Loans: FHA, VA, and USDA

Government programs offer some of the most generous terms for manufactured housing, especially for buyers with less-than-perfect credit.

- FHA Loans: Backed by the Federal Housing Administration, these are a popular choice for affordable financing for mobile homes. Title I loans can finance a home on a leased lot, while Title II loans function like traditional mortgages for homes permanently attached to owned land, offering terms up to 30 years and down payments as low as 3.5%.

- VA Loans: An excellent benefit for qualifying veterans and service members, offering zero-down financing for manufactured homes permanently attached to owned land.

- USDA Loans: These zero-down loans are designed for low- and moderate-income buyers purchasing manufactured homes in eligible rural areas. The home must be permanently attached to land you own.

We offer more info about our Financing Services to help you steer these choices.

Conventional Loans: Fannie Mae & Freddie Mac

Conventional loans can offer some of the best terms if your manufactured home is titled as real property. Fannie Mae and Freddie Mac programs encourage lenders to offer these mortgages.

- Fannie Mae’s MH Advantage® program is for manufactured homes with features similar to traditional houses. It allows for down payments as low as 3% and 30-year terms for those with a credit score of at least 620.

- Freddie Mac’s CHOICEHome® and Home Possible® programs offer similar benefits, typically requiring a 3% down payment and a credit score of 680 or higher. Both programs require the home to be on a permanent foundation on land you own.

Understanding Chattel Loans for financing for mobile homes

Chattel loans treat your manufactured home as personal property, much like a car loan. This is a common option if you’re placing the home in a park or on leased land. The home itself is the collateral, not the land.

The trade-off is that chattel loans typically have higher interest rates (5.99% to 14%) and shorter terms (up to 20 years). This results in a higher monthly payment but allows you to pay off the loan faster. If you default, the repossession process is simpler for the lender than a real estate foreclosure, which contributes to the higher rates.

Personal Loans and Seller Financing

When other options don’t work, these alternatives can be valuable.

- Personal Loans: These are unsecured, so your home isn’t used as collateral. They offer fast funding and are useful for older homes that don’t qualify for other financing. However, they come with higher interest rates and much shorter terms (typically up to 7 years).

- Seller Financing: In a private sale, the seller may act as the lender. This can be a flexible solution for buyers who struggle to get traditional financing due to credit issues or the home’s age. Terms are negotiable but may involve higher interest rates.

If you’re considering paying cash instead, you might want to read about the Advantages of Buying a Mobile Home with Cash.

Preparing for Your Loan Application

Applying for financing for mobile homes is more successful with good preparation. It’s about presenting your best financial self and understanding what lenders require.

The Crucial Role of Your Credit Score

Your credit score is a key factor for lenders when approving your loan and setting your interest rate. Different loan types have different credit score expectations. FHA loans can be approved for scores as low as 500-580, while conventional loans often require 620-680+. Chattel loans typically look for scores in the 575-660 range.

A higher credit score not only improves your approval odds but can also save you thousands over the life of the loan through lower interest rates. Start by getting your report from all three bureaus at Check your credit for free.

If your score needs work, our credit recovery branch can help. You can also Read about the Benefits of Improving Your Credit Score Before Buying a Mobile Home for useful strategies.

Land Ownership: The Real Estate vs. Personal Property Question

Whether you own or lease the land is one of the most important factors in your financing journey.

- If you own the land and permanently attach the home to a foundation, it can be legally reclassified as real estate. This process, called “de-titling,” opens the door to conventional mortgages (Fannie Mae, Freddie Mac) and government-backed loans (FHA Title II, VA, USDA) with lower rates and longer terms.

- If you lease the land, such as in a mobile home park, your home remains personal property. This typically limits you to a chattel loan, which has higher interest rates and shorter terms. FHA Title I loans are a notable exception, as they can be used for homes on leased lots.

Key Steps in the Process for financing for mobile homes

Follow these steps to prepare your loan application:

- Check your credit: Know your score before you start.

- Determine your budget: Include the loan payment, insurance, taxes, and any lot rent.

- Research lenders: Work with lenders who specialize in manufactured housing, as they understand the unique requirements.

- Gather documents: Organize your pay stubs, tax returns, bank statements, and identification early.

- Get pre-approved: This shows you’re a serious buyer and clarifies what you can afford.

When you’re ready, you can Start your On-Line Application with us directly. Knowing your down payment requirements, which can range from 0% to 20%, will also help you plan.

Key Factors and Long-Term Costs to Consider

When exploring financing for mobile homes, it’s important to look beyond the interest rate to the total cost of ownership. Understanding how your home’s characteristics and ongoing expenses affect your finances is key to long-term success.

How Home Age, Size, and Location Impact Financing

A home’s age, size, and location are major factors for lenders.

- Age: Homes built before June 15, 1976 (pre-HUD) are difficult to finance with traditional loans due to outdated safety standards. Newer homes built after 1976 meet HUD standards and open up far more financing options, including FHA and conventional loans.

- Size: Single-wide homes are less expensive than double-wides, which affects loan amounts and program eligibility. For instance, FHA loan limits differ for single- and multi-width homes.

- Location: Local zoning regulations and community rules can dictate where a home can be placed and what types are allowed. Whether the home is on owned or leased land is the most critical location factor, determining if you can get a real estate mortgage or will need a chattel loan.

Budgeting for Ongoing Costs: Insurance, Taxes, and Lot Rent

Your monthly loan payment is only part of your total housing cost. Be sure to budget for these ongoing expenses:

- Taxes: If your home is classified as real estate (on owned land), you’ll pay standard property taxes. If it’s personal property, you may pay personal property taxes instead.

- Insurance: Lenders require mobile home insurance. Ensure your policy provides adequate coverage, especially for regional risks like hurricanes, and meets your lender’s requirements.

- Lot Rent: If your home is in a community on leased land, this can be a significant monthly expense. Understand what the fee covers before committing.

- Utilities and Maintenance: Account for electricity, water, sewer, and regular upkeep to maintain your home’s condition and value.

To prepare, Learn How to Budget for Your New Manufactured Home. A clear picture of all costs helps you choose financing for mobile homes that truly fits your budget.

Frequently Asked Questions about Mobile Home Loans

Here are answers to some of the most common questions about financing for mobile homes.

What is the oldest mobile home that can be financed?

Financing a mobile home built before June 15, 1976, is very challenging. These pre-HUD homes don’t meet modern safety standards, so most FHA, conventional, VA, and USDA loan programs will not approve them.

However, some options may still exist for these older homes:

- Chattel loans: Some specialized lenders will consider older homes, but expect higher interest rates and shorter terms.

- Personal loans: Since these are unsecured, the home’s age isn’t a direct factor, but the loan terms are generally less favorable.

- Seller financing: The current owner may be willing to act as the lender, bypassing traditional restrictions.

The newer the home, the more financing options will be available.

How long are the typical loan terms for a mobile home?

Loan terms for financing for mobile homes vary significantly by loan type:

- Real Estate Loans (FHA, Conventional, VA, USDA): If your home is permanently attached to land you own, you can qualify for terms up to 30 years, similar to a traditional mortgage.

- FHA Title I Loans: These typically offer terms of 20 to 25 years.

- Chattel Loans: As personal property loans, these usually have shorter terms, maxing out at 15 to 20 years.

- Personal Loans: These have the shortest terms, typically 2 to 7 years, resulting in higher monthly payments.

Is it harder to get a loan for a mobile home than a traditional house?

Yes, securing financing for mobile homes is often more challenging than getting a traditional mortgage. The main reasons include:

- Depreciation Risk: Lenders view manufactured homes, especially those not on owned land, as having a higher risk of losing value compared to traditional homes.

- Fewer Lenders: A smaller pool of lenders specializes in manufactured home financing, which can mean less competition and fewer options.

- Land Ownership: If you don’t own the land, you are generally limited to chattel loans, which have higher rates and shorter terms.

- Stricter Requirements: Lenders may impose higher credit score or down payment requirements for manufactured home loans.

Despite these challenges, the market has improved significantly. With good preparation and by working with a specialized lender, you can successfully secure financing.

Your Path to Homeownership Starts Here

Figuring out financing for mobile homes can seem complex, but homeownership through a manufactured home is absolutely achievable. Understanding your options—from government-backed FHA and VA loans to conventional and chattel loans—is the key to finding the right fit.

Your credit score, land ownership status, and the home’s age all influence your financing path. The good news is that the financing landscape has improved, with more options available than ever before.

At Manufactured Housing Consultants, we are your trusted guides in this process. As experts in manufactured housing and its financing, we offer the largest selection of new homes from 11 top manufacturers at guaranteed low prices. We provide specialized financing for all credit situations, including FICO improvement services to boost your score.

Our commitment is to make homeownership accessible. We’ve helped countless Texas families steer credit challenges and land ownership requirements to find the right home and financing. We simplify the complexities to match you with the perfect solution.

Your dream of homeownership is within reach. Let us help you turn that dream into a reality.

Explore our homes in Corpus Christi, Texas and let us help with your financing