Why Low FICO Scores Don’t Have to End Your Homeownership Dreams

Low FICO home loans are available through several government-backed programs and alternative lending options, even with credit scores as low as 500. Here are your main financing paths:

Government-Backed Options:

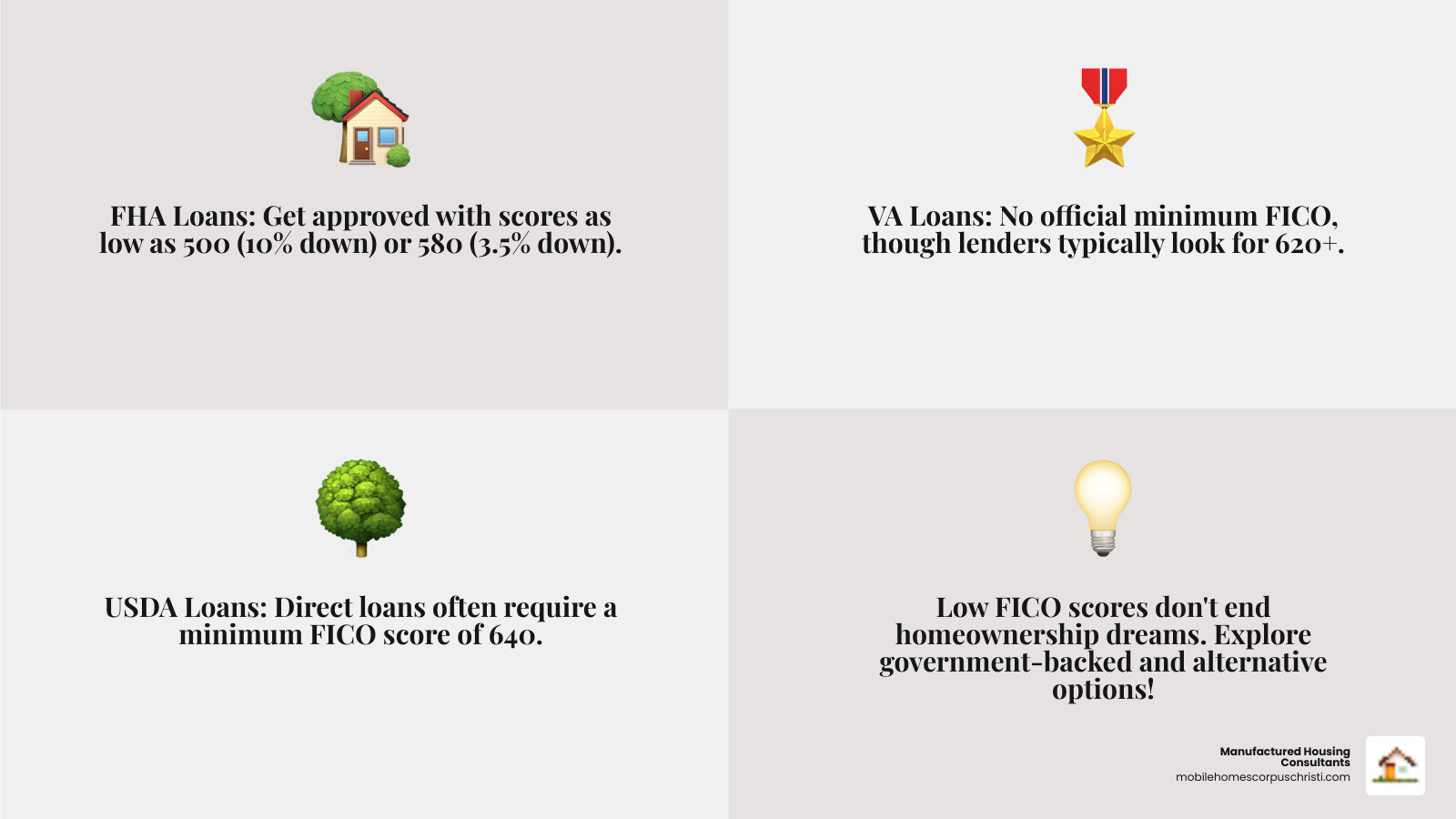

- FHA Loans – 500 minimum score (10% down) or 580 score (3.5% down)

- VA Loans – No official minimum, lenders typically want 620+

- USDA Loans – 640 minimum for direct loans

Alternative Options:

- Non-QM loans for unique situations

- Manual underwriting for no credit history

- Credit union and community bank programs

If you’ve been told your credit score is too low to buy a home, that’s simply not true anymore. Specialized lenders now work with borrowers who have scores of 500 or higher. The key is knowing which programs fit your situation, like government-backed FHA, VA, and USDA loans, which offer flexible credit requirements. These programs exist to help people with credit challenges achieve homeownership.

Your credit score doesn’t define your future; it’s just one factor lenders consider. Down payment size, income stability, and debt-to-income ratio all play important roles. The path to homeownership with less-than-perfect credit is achievable with the right guidance and loan program.

Your Guide to Low FICO Home Loans: Government-Backed Options

Government-backed loans are your best friend when you have a low credit score. Because the federal government insures them, lenders can take on more risk and offer flexible terms to borrowers who might not qualify elsewhere. Instead of focusing solely on your credit score, these low FICO home loans look at your whole financial picture.

FHA Loans: The Most Accessible Path

FHA loans are often the most accessible path to homeownership with less-than-perfect credit. You can get approved with a credit score as low as 500, but there’s a catch. If your score is between 500 and 579, you’ll need a 10% down payment. If you can get your score to 580 or higher, the down payment drops to just 3.5%.

Most conventional loans require a score of 620 or higher, so FHA loans provide a real opportunity. The trade-off is the Mortgage Insurance Premium (MIP), which protects the lender. If you put down less than 10%, you’ll pay MIP for the life of the loan. With 10% down or more, it can be removed after 11 years. While it adds to your monthly payment, it’s the price of getting approved with a lower score. FHA loans also have property standards to ensure the home is safe, which protects you as the buyer.

Ready to explore your options? Check out more info about our financing options to see how we can help.

VA Loans: A Benefit for Service Members

If you’ve served our country, VA loans are one of the best benefits you’ve earned. Guaranteed by the Department of Veterans Affairs, these loans offer incredible advantages. The biggest is no down payment required, eliminating a major hurdle for most homebuyers.

Even better, VA loans don’t require private mortgage insurance (PMI), which can save you hundreds monthly. While the VA doesn’t set a minimum credit score, most lenders look for scores around 620, but some will work with scores as low as 500. The key is finding the right lender. You will pay a one-time funding fee, but this can often be rolled into your loan amount.

If you’re eligible for VA benefits, Check your eligibility and see what you qualify for.

USDA Loans: Financing for Rural Areas

Don’t overlook USDA loans if you’re open to living in a rural area. The U.S. Department of Agriculture created this program to help low- and moderate-income families achieve homeownership outside of major cities. Surprisingly, 97% of the United States is considered “rural” by USDA standards, so many suburbs and smaller cities qualify.

Like VA loans, USDA loans offer no down payment financing. For credit scores, USDA direct loans typically require a minimum of 640, but some lenders work with scores as low as 550 through their guaranteed loan programs, often using manual underwriting. There are income limits and the property must be in an eligible location, but if you qualify, USDA loans are an excellent path to homeownership.

| Loan Type | Minimum Credit Score | Down Payment | Mortgage Insurance |

|---|---|---|---|

| FHA | 500 (10% down) or 580 (3.5% down) | 3.5% – 10% | Required (MIP) |

| VA | No official minimum (lenders vary) | 0% | None |

| USDA | 640 (some lenders accept 550) | 0% | Annual fee required |

Each of these government-backed programs offers unique advantages for low FICO home loans. The key is understanding which one fits your situation best.

Exploring Other Paths: Conventional and Non-Traditional Mortgages

Government-backed loans are great, but they aren’t your only option for securing low FICO home loans. Alternative lenders, private lenders, and credit unions are offering creative solutions. These lenders often use manual underwriting, where a person reviews your complete financial story instead of relying on an algorithm. This human touch can make all the difference.

Conventional Loans with Less-Than-Perfect Credit

Don’t write off conventional loans. While not government-insured, they can work for borrowers with less-than-perfect credit. Most conventional lenders want a minimum FICO score of 620, but a larger down payment can help offset a lower score.

Conventional loans can save you money long-term. You’ll pay Private Mortgage Insurance (PMI) with less than 20% down, but you can cancel it once you reach 20-22% equity. This is a key advantage over FHA loans, where the Mortgage Insurance Premium (MIP) often lasts for the entire loan term. A larger down payment can help you avoid PMI and may secure a better interest rate.

When to Consider Non-Qualifying (Non-QM) Mortgages

Non-Qualifying (Non-QM) mortgages don’t follow the strict federal rules, making them perfect for people with unique situations. This includes self-employed borrowers, people with a recent bankruptcy, or anyone with unique income sources.

Some Non-QM lenders allow you to qualify using bank statements instead of tax returns. The trade-off is higher interest rates, but when other doors are closed, Non-QM loans provide a genuine path to homeownership. Their flexible underwriting approach means lenders look at your actual ability to pay.

Buying a Home with No Credit History

Having no FICO score doesn’t mean you can’t get a home loan. This is where manual underwriting becomes essential. An underwriter examines your non-traditional credit history to see if you’re reliable with payments, even if they aren’t reported to credit bureaus.

Non-traditional credit includes rent payments, utility bills, insurance payments, and phone bills. The key is showing a consistent pattern of on-time payments.

Documents needed for non-traditional credit verification:

- 12 months of canceled rent checks or money order receipts

- Utility bills showing payment history

- Insurance payment records (auto, health, life)

- Bank statements showing consistent bill payments

- Letters from service providers confirming payment history

The process takes more work, but it’s absolutely doable. We help gather the right documentation to present your financial story to lenders who specialize in manual underwriting.

Boosting Your Approval Odds: Key Factors Beyond Your Score

When it comes to low FICO home loans, your credit score is just one piece of the puzzle. Lenders conduct a “holistic review” of your finances, searching for “compensating factors” that show you’re a responsible borrower, even if your score has taken some hits. This approach gives you the power to strengthen your application by improving other factors that lenders value.

The Power of a Larger Down Payment

A larger down payment dramatically improves your approval odds because it directly reduces the lender’s risk. When you put more of your own money into the home, you show serious commitment, and the lender is less likely to lose money if something goes wrong.

For someone with a 500 FICO score seeking an FHA loan, the 10% down payment is your ticket in. Even if you qualify for 3.5% down with a 580 score, putting down more can lead to better interest rates. A larger down payment can also help you avoid private mortgage insurance (PMI) on conventional loans, saving you money monthly. If you don’t have the cash, gift funds from family or down payment assistance programs can help.

Managing Your Debt-to-Income (DTI) Ratio

Your Debt-to-Income (DTI) ratio shows lenders if you can afford the mortgage payment along with your other debts. To calculate it, divide your total monthly debt payments by your gross monthly income. Lenders look at two ratios: the front-end ratio (housing payment only) and the back-end ratio (all debts).

Most lenders want the back-end ratio under 43%, though some programs are more flexible. A strong DTI ratio shows you’re not overextended, which is a huge plus with a lower credit score. If your DTI is too high, you can pay down existing debt or increase your income.

Steps to Improve Your Credit for Better Terms

While we specialize in securing low FICO home loans now, improving your credit score can save you thousands over the life of your loan. Your FICO score is built on five factors:

- Payment history (35%): This is the biggest factor. Pay every bill on time.

- Credit utilization (30%): This is where you can see quick wins. Keep credit card balances low, ideally under 30% of your limit.

- Other factors: Length of credit history, new credit, and credit mix are also important. Avoid opening new credit accounts or closing old ones right before applying for a mortgage.

Shockingly, 44% of people have errors on their credit reports. Check your report and dispute any mistakes for a potential score boost. You can get your free report from all three bureaus at Get your free credit report.

We’re so committed to your success that we offer a specialized FICO Score Improvement Program. This program guides you through the credit improvement process to help you qualify for even better terms.

Understanding the Risks and Realities

While low FICO home loans make homeownership possible, they come with trade-offs. Lenders view lower credit scores as higher risk, which translates to higher interest rates and fees. Understanding the full picture is key to making an informed decision and ensuring your long-term financial success.

The Real Costs: Interest Rates and Fees for Low FICO Home Loans

With low FICO home loans, interest rates will likely be higher than for someone with excellent credit. A small difference of 1% or 2% can add up to tens of thousands of dollars over a 30-year loan. For example, on a $200,000 loan, a 6% rate costs about $240 more per month than a 4% rate—an extra $86,400 over 30 years.

Beyond the higher Annual Percentage Rate (APR), you’ll encounter fees like origination fees (0.5%-1% of the loan) and closing costs (2-5% of the loan). Then there’s mortgage insurance. FHA loans require a Mortgage Insurance Premium (MIP), and conventional loans with less than 20% down require Private Mortgage Insurance (PMI).

The key is to look at the total loan cost, not just the monthly payment. The Consumer Financial Protection Bureau has a great tool to Use this tool to compare interest rates.

The Role of Lenders and Mortgage Brokers

Many people with lower credit scores get turned down by their local bank and think it’s the end of the road. It’s not. Traditional banks often have strict, conservative guidelines. However, alternative lenders and specialized mortgage companies are more flexible and experienced with credit challenges.

This is where knowledgeable mortgage brokers are invaluable. We work for you, not a single lender. Our job is to shop around with multiple lenders to find the best possible terms for your situation. We know which lenders specialize in FHA loans, are flexible with DTI ratios, or excel at manual underwriting.

Finding specialists who understand low FICO home loans can be the difference between approval and rejection. When you’re ready, we can help you Start the pre-approval process to see what’s possible. Shopping for the best deal is crucial, and having an advocate to steer the differences between lenders is a major advantage.

Frequently Asked Questions about Low FICO Mortgages

When people come to us worried about their credit, we hear the same concerns. The good news is that most of these worries have solutions. Let’s tackle some common questions.

What is the absolute lowest FICO score to get a home loan?

The absolute lowest FICO score is typically 500, but this works primarily with FHA loans and requires a 10% down payment. Just because the FHA allows a 500 score doesn’t mean every lender will approve it. Lenders often have their own stricter requirements, called “lender overlays.”

So, while 500 is technically possible, finding a willing lender depends on your overall financial picture. Your individual circumstances, like a stable job, low debt-to-income ratio, and savings, can make all the difference. It just takes finding the right lender who looks at the whole person.

Can I get a home loan after a bankruptcy?

Yes, you can. Bankruptcy isn’t a permanent roadblock, but there are waiting periods. For a Chapter 7 bankruptcy, you typically need to wait 2 years for FHA and VA loans after discharge. For Chapter 13, it’s often just 1 year after discharge, provided you’ve made on-time payments.

Conventional loans are stricter, usually requiring 4 years after Chapter 7 and 2 years after Chapter 13. During the waiting period, it’s crucial to re-establish good credit. We’ve helped many clients steer this journey, and some also explore Non-QM loans for more flexibility.

Are there special programs for first-time homebuyers with bad credit?

Yes, many programs are designed to help first-time homebuyers with credit challenges. State and local programs are goldmines for assistance, offering down payment assistance through grants (money you don’t have to repay) or low-interest loans.

You can also find closing cost grants to cover thousands in fees. Most of these programs have income limits and require you to complete homebuyer education courses, which are great preparation for homeownership. These programs often work with low FICO home loans, so you can get both credit flexibility and financial assistance. We stay up-to-date on what’s available in Texas and can help you steer the application process.

Your Path to Homeownership Starts Here

Your journey to homeownership doesn’t have to end because of a credit score. As we’ve explored, low FICO home loans are accessible through pathways like FHA, VA, and USDA loans. The key is having the right strategy and working with people who understand your situation.

Homeownership is an achievable goal. While you can get approved with a 500 credit score, every point you raise means better interest rates and more options, saving you money.

At Manufactured Housing Consultants in Corpus Christi, Texas, we make homeownership accessible to everyone. We offer the largest selection of new mobile and manufactured homes from 11 top manufacturers with guaranteed lowest prices. More importantly, we provide specialized financing for all credit situations.

Our dedicated FICO improvement programs are designed to strengthen your financial standing for long-term success. We’re here to guide you, whether you’re starting with a 500 score or improving a 620. We deliver homes anywhere in Texas, bringing your dream home to you. Your credit score today is just your starting point.

Your path to homeownership starts with a single conversation. Let us show you what’s possible. Find your new home in Corpus Christi, Texas.