Why Manufactured Home Financing Matters for Your Homeownership Journey

Manufactured home financing options offer a pathway to affordable homeownership when traditional housing costs seem out of reach. With manufactured homes priced at a median of $87,000 compared to $449,000 for site-built homes, these financing solutions can make your homeownership dream a reality.

Quick Answer: Main Manufactured Home Financing Options

- Chattel Loans – Personal property loans secured by the home itself

- Traditional Mortgages – Real estate loans requiring permanent foundation and owned land

- FHA Loans – Government-backed financing with lower down payments

- VA Loans – Zero-down financing for eligible veterans

- USDA Loans – Rural development loans with 100% financing

- Personal Loans – Unsecured financing for smaller loan amounts

- Manufacturer Financing – Direct financing through home dealers

The key difference between manufactured home financing and traditional home loans lies in how the property is classified. Your manufactured home can be treated as either personal property (like a car) or real property (like a traditional house), and this classification dramatically affects your financing options.

Most buyers don’t realize that financing a manufactured home involves navigating a unique landscape of lenders, loan types, and requirements. Whether your home sits on owned land with a permanent foundation or on leased land in a community park determines which financing paths are available to you.

Understanding these options upfront can save you thousands of dollars and months of frustration. The financing journey doesn’t have to be complicated when you know which path fits your situation.

Understanding the Foundation: How Property Type Affects Your Loan

Here’s something that might surprise you: not all manufactured homes are financed the same way. The secret lies in how your home is legally classified, and trust me, this isn’t just paperwork mumbo-jumbo. This classification is the foundation that determines your entire financing journey.

Think of it this way: your manufactured home can wear two different “hats.” It can be real property (like a traditional house) or personal property (more like a really nice RV). The hat it wears depends on two key factors: whether it sits on a permanent foundation and whether you own the land beneath it.

When your manufactured home is considered real property, it means the home is permanently attached to a foundation on land you own. The home’s title gets “retired” from a vehicle-style title and becomes part of the real estate deed. Essentially, the home and land become one unified piece of property.

If your home sits on leased land (like in a manufactured home community) or hasn’t been permanently affixed with a retired title, it’s treated as personal property. In this case, you’re financing the home separately from any land considerations.

The land situation is absolutely crucial here. Do you own the dirt under your home, are you buying it along with the house, or are you renting the space? Your answer will point you toward completely different financing paths. For more details about these classifications and how they impact your choices, check out what you need to know about manufactured home financing.

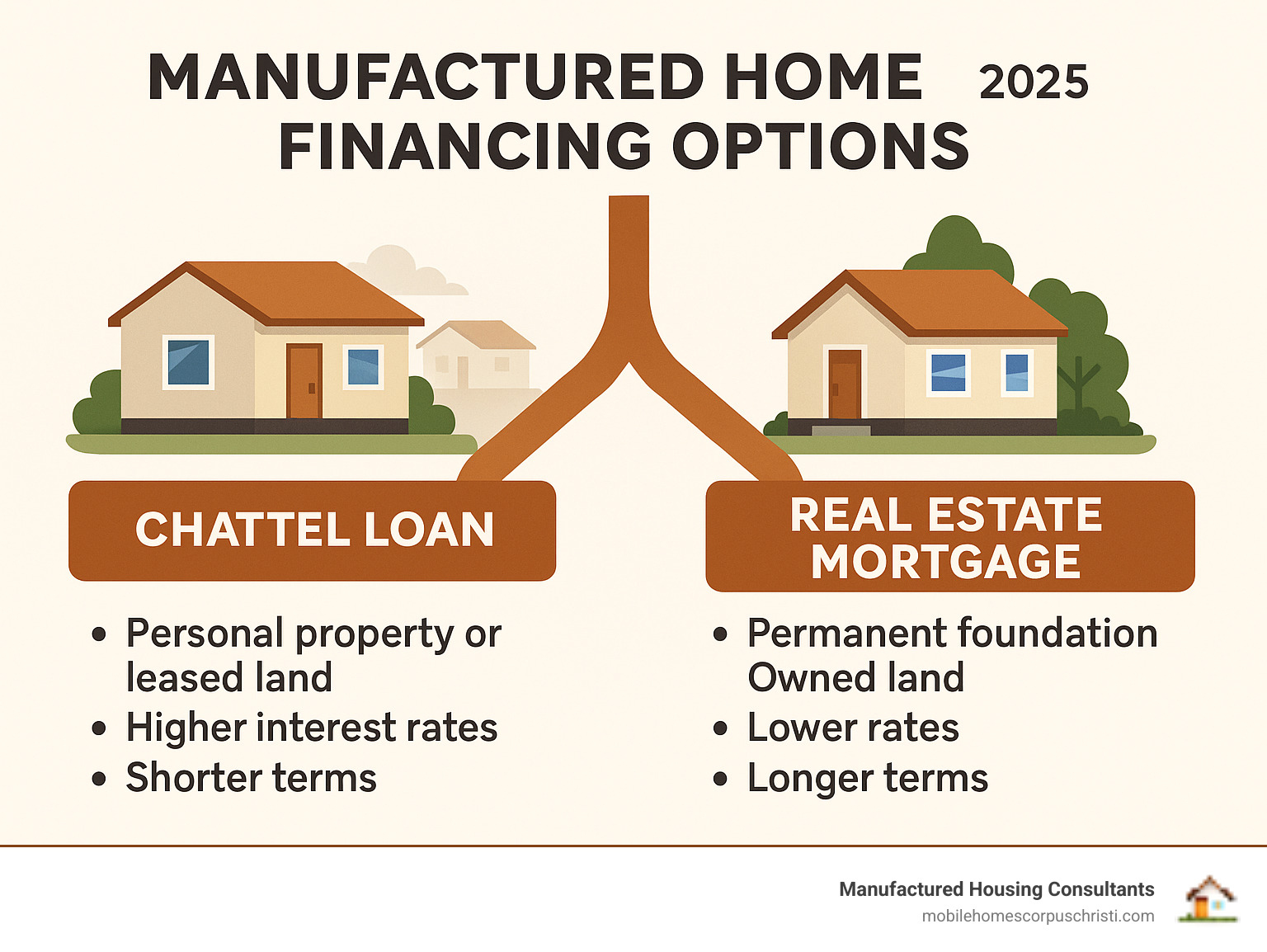

Chattel Loans vs. Traditional Mortgages

Now that we’ve covered the “why” behind property classification, let’s talk about the “what” – specifically, how this affects your manufactured home financing options. The two main paths are chattel loans and traditional mortgages, and they’re as different as night and day.

| Feature | Chattel Loans | Traditional Mortgages |

|---|---|---|

| Interest Rates | Typically higher (7-12%) | Generally lower (4-8%) |

| Loan Terms | Shorter (10-20 years) | Longer (15-30 years) |

| Property Type | Personal property (home only) | Real property (home + land) |

| Land Requirement | No land ownership needed | Must own the land |

| Appraisal Process | Home value only | Combined home and land value |

Chattel loans are secured by the manufactured home itself – think of it like a car loan, but for your house. These loans work perfectly when you’re placing your home on leased land or in a manufactured home community. The trade-off? You’ll typically face higher interest rates and shorter repayment terms because lenders view the home as more “mobile” and potentially riskier.

Traditional mortgages treat your manufactured home just like any site-built house, but only if it’s permanently affixed to a foundation on land you own. This setup often rewards you with lower interest rates and longer loan terms, making your monthly payments more manageable.

The closing process tends to be faster with chattel loans since you’re not dealing with land surveys, title searches, and other real estate complexities. However, that convenience comes at a cost in terms of interest rates.

Key Differences in Manufactured Home Financing Options

Financing a manufactured home isn’t quite the same as getting a loan for a traditional site-built home, and understanding these differences can save you time and frustration.

The appraisal process requires specialized knowledge. While appraising a site-built home follows well-established methods, manufactured homes need appraisers who understand HUD code construction, comparable sales in manufactured housing communities, and how to value the home separately from the land when necessary.

Lender availability is another key difference. While practically every bank offers traditional home mortgages, fewer specialize in manufactured housing finance. This is where working with experts who understand the manufactured housing world becomes invaluable. We’ve built relationships with lenders who “get” manufactured homes and can offer competitive terms.

Loan terms for manufactured homes, especially chattel financing, typically run shorter than the standard 30-year mortgage for site-built homes. This means higher monthly payments but faster equity building and complete ownership sooner.

The good news? These differences don’t make financing impossible – they just make it different. When you work with specialists who understand manufactured housing, navigating these unique aspects becomes much smoother. That’s exactly what we do at Mobile Home Loans or Financing, helping you find the right financing path for your specific situation.

Exploring Your Manufactured Home Financing Options

Ready to dive into the exciting world of manufactured home financing options? Think of this as your personal shopping guide – each loan type has its own personality and perks, but they all share the same goal: getting you the keys to your new home. The financing landscape for manufactured homes is more diverse than many people realize, and that’s actually great news for you.

Here in Texas, we’ve helped countless families steer these waters, and we know exactly which lenders understand manufactured housing inside and out. Finding the right financing isn’t just about getting approved – it’s about finding the option that fits your budget, your timeline, and your long-term goals. Whether you’re eyeing a cozy single-wide or a spacious double-wide, there’s a financing solution waiting for you.

The secret sauce? Working with specialists who speak “manufactured home” fluently. Not every lender does, but we’ve built relationships with those who do, making your journey smoother and often faster than you’d expect.

Conventional & Conforming Loans

When your manufactured home is permanently attached to land you own, conventional loans become your golden ticket to traditional mortgage benefits. These loans follow the same guidelines as Fannie Mae and Freddie Mac loans for site-built homes – which means competitive rates and familiar terms.

Here’s the catch (there’s always one, right?): your home absolutely must be on a permanent foundation and titled as real property. No exceptions. The good news? Once you meet this requirement, you’re playing in the same ballpark as traditional homebuyers.

Most lenders want to see a credit score of 620 or higher, though the sweet spot for the best rates usually starts around 680. Your debt-to-income ratio should typically stay under 43%, and you’ll need a down payment – though it doesn’t have to break the bank. Many conventional loans accept down payments as low as 5-10%, though you’ll pay Private Mortgage Insurance (PMI) until you reach 20% equity.

The beauty of conventional loans? You’re bundling your home and land into one neat package with one monthly payment. It’s clean, it’s simple, and it often comes with the most competitive rates available. Our financing services can help you determine if this path makes sense for your situation.

Government-Backed Manufactured Home Financing Options

Uncle Sam wants to help you become a homeowner, and government-backed loans are proof of that commitment. These programs often come with lower down payments, flexible credit requirements, and competitive rates because they’re backed by federal agencies.

FHA loans, backed by the Federal Housing Administration, are the workhorses of manufactured home financing. The most common type, FHA Title II, works just like a regular FHA mortgage – you can put down as little as 3.5% and qualify with credit scores that might make conventional lenders nervous. Your home needs to meet HUD code standards and be permanently affixed to land you own, but once you clear those problems, you’re golden.

VA loans are absolutely incredible if you qualify. We’re talking zero down payment, no PMI, and some of the best interest rates available. If you’re a veteran, active military, or qualifying surviving spouse, this could be your ticket to homeownership without the upfront cash crunch.

USDA loans are perfect for rural dreamers. Like VA loans, they offer 100% financing in eligible rural areas. There are income limits, but if you qualify, you’re looking at no down payment and no PMI – pretty sweet deal for country living.

These government programs level the playing field, making homeownership accessible to folks who might otherwise struggle with traditional financing requirements.

Chattel Mortgages and Personal Loans

Not planning to own your land? No problem! Chattel mortgages are specifically designed for homes that will sit on leased land, like in manufactured home communities. Think of it as a car loan for your house – the loan is secured by the home itself, not the dirt underneath it.

The biggest advantage of chattel loans is speed. We’re talking weeks, not months, to close. There’s less paperwork, no land surveys, no title searches – just you, your home, and your financing. This makes them perfect for homes on leased land or situations where you need to move quickly.

The trade-off? Higher interest rates and shorter loan terms than traditional mortgages. Most chattel loans run 10-20 years instead of the typical 30-year mortgage. This means higher monthly payments, but you’ll own your home free and clear much sooner.

Personal loans can work for smaller amounts or specific situations, though they’re rarely the best choice for financing an entire manufactured home. They offer flexibility but usually come with the highest interest rates and shortest terms.

For many Texas families, chattel financing opens doors that traditional mortgages can’t. If you’re considering a home in a community setting or need faster closing times, this might be your perfect match. Our mobile home loans in Texas are designed to work with your specific situation, not against it.

Getting Approved: A Buyer’s Checklist

You’ve explored the different manufactured home financing options, and now you’re ready to take the next big step. Getting approved for a loan might feel intimidating, but here’s the truth: with the right preparation, it’s absolutely manageable. Think of it as putting together a financial story that shows lenders you’re ready for homeownership.

The smartest move you can make right now? Get pre-approved. This isn’t just a nice-to-have – it’s your roadmap to success. Pre-approval shows you exactly how much home you can afford, makes your offer stronger when you find the perfect home, and speeds up the final loan process. Plus, it helps us guide you toward homes that truly fit your budget, so you’re not wasting time looking at places outside your price range.

Eligibility Requirements and Documentation

Lenders want to get to know your financial story before they hand over the keys to your new home. While each lender might have slightly different requirements, the basics remain pretty consistent across all manufactured home financing options.

Your proof of income is the foundation of your application. If you’re employed, you’ll need recent pay stubs and your W-2 forms from the past two years. Self-employed? You’ll provide tax returns (typically two years’ worth) and profit & loss statements. Lenders want to see that steady income flowing in to cover your monthly payments.

Next up are your bank statements from the last 2-3 months. These show lenders three important things: you have money for a down payment, you manage your finances responsibly, and you have some savings as a safety net. It’s like showing them a snapshot of your financial habits.

Your credit report tells the story of how you’ve handled money in the past. Lenders will pull this themselves, but it’s smart to check your own credit beforehand. You might find errors you can dispute, which could boost your score before you apply.

Don’t forget the basics: a valid government-issued photo ID and, once you’ve found your dream home, the signed home purchase agreement. You’ll also need details about the manufactured home itself – the make, model, year, and serial number. For new homes, CSA certification or HUD code compliance documentation proves your home meets all safety and construction standards.

Ready to get the ball rolling? We’ve streamlined everything with our on-line application to make this process as painless as possible.

How to Improve Your Chances of Approval

Worried about your credit score or financial situation? Take a deep breath – you have more control than you think. There are concrete steps you can take right now to dramatically improve your chances of approval and potentially save thousands in interest over the life of your loan.

Improving your credit score is often the single most powerful thing you can do. Pay every bill on time, every month – even small improvements matter. Focus on paying down credit card balances to lower your credit utilization ratio. And resist the temptation to open new credit accounts while you’re loan shopping. Even a 20-point credit score increase can mean significantly better interest rates. We actually offer services to help with benefits of improving your credit score before buying a mobile home, so don’t hesitate to ask.

Increasing your down payment works like magic with lenders. The more you put down, the less risk they’re taking on, which often translates to better rates and easier approval. Even an extra $2,000 or $3,000 can make a noticeable difference in how lenders view your application.

Your debt-to-income ratio is another key factor lenders scrutinize. They typically want to see this below 43%. Pay down those credit cards, car loans, or personal loans if you can. Every dollar of debt you eliminate gives you more breathing room in this calculation.

Stable employment history tells lenders you’re reliable. They love seeing at least two years with the same employer, but don’t panic if you’ve switched jobs recently – just be ready to explain the change and show it was a positive move.

Finally, build up your savings account. This shows financial responsibility and gives you a cushion for unexpected expenses, which makes lenders sleep better at night.

The best part? We work with all credit situations, so even if your financial picture isn’t perfect right now, we can help you find a path forward. Take some time to explore the pre-approval process with us – it’s the first step toward holding the keys to your new home.

Special Considerations: New vs. Used Homes

Choosing between a new or used manufactured home isn’t just about price – it’s a decision that can significantly impact your manufactured home financing options. Think of it like buying a car: both will get you where you need to go, but the financing journey looks quite different.

New manufactured homes are the smooth sailing option when it comes to financing. They’re built to current HUD standards, come with fresh warranties, and make lenders feel comfortable. Banks and credit unions love new homes because there’s less guesswork involved – no surprises hiding behind walls or outdated electrical systems.

With a new home, you’ll typically have access to the full menu of financing choices. Conventional loans, FHA financing, VA benefits, and USDA rural loans are all on the table, assuming your home meets the foundation and land requirements we discussed earlier. Appraisers find it easier to value new homes too, since they can compare similar models and current market prices.

Used manufactured homes tell a different story, though it’s not necessarily a sad one! These homes offer incredible value – you’re getting more house for your dollar. But financing can get trickier as homes age, especially if we’re talking about homes from the 1990s or earlier.

Here’s where things get interesting: the older your potential home, the fewer financing doors remain open. Many traditional lenders have age limits – some won’t finance homes older than 20 years, while others draw the line at 15 years. This often steers you toward chattel loans or personal financing, which typically means higher interest rates and shorter repayment terms.

The appraisal process becomes more like detective work with used homes. Finding comparable sales for a 1985 model in good condition? That takes a skilled appraiser who really knows manufactured housing. This is one reason why working with specialists who understand this market makes such a difference.

Let’s talk about something important: depreciation versus appreciation. While site-built homes generally appreciate over time, manufactured homes behave more like a mix between real estate and vehicles. A new manufactured home on owned land with a permanent foundation can absolutely appreciate in value. However, a used home on leased land might depreciate, especially in its early years.

Don’t let this discourage you! A well-maintained used manufactured home can still be an excellent investment in your quality of life and financial stability. The key is understanding these financing realities upfront so you can plan accordingly.

Whether you’re dreaming of that new-home smell or the charm of a established home, we’re here to help you steer the financing landscape. Want to get a realistic picture of costs? Check out what to expect to spend on a new mobile home for sale, and we’ll guide you through the best financing options for your situation.

Your Path to Homeownership Starts Here

Take a deep breath – you’ve just steerd the complete landscape of manufactured home financing options! While it might feel like a lot to digest, here’s the beautiful truth: financing a manufactured home is absolutely achievable, and there’s likely a perfect solution waiting for you.

The world of manufactured home financing isn’t as intimidating as it first appears. Whether you’re drawn to the flexibility of a chattel loan for a home on leased land, the stability of a traditional mortgage with your own property, or the attractive benefits of government-backed programs like FHA, VA, or USDA loans, you now have the knowledge to make an informed decision.

Remember those key takeaways we covered? Property classification matters – knowing whether your home will be personal or real property shapes everything else. Your credit and finances can be improved with some focused effort before you apply. New and used homes each have their advantages, and the right choice depends on your budget and goals.

Here’s what makes this journey even better: you don’t have to walk it alone. At Manufactured Housing Consultants, we’ve built our reputation on being the expert guides who truly understand manufactured home financing. We know which lenders work best for different situations, which programs offer the most benefits, and how to steer the unique aspects of manufactured home loans.

We genuinely simplify this process for you. No matter what your credit situation looks like today – whether it’s excellent, needs some work, or falls somewhere in between – we work with all credit situations. We even offer FICO improvement programs to help you qualify for better terms and lower rates.

Think about it: you’re not just buying a home, you’re investing in your future. With our largest selection of new mobile and manufactured homes from 11 top manufacturers and our guaranteed lowest prices, you’re getting both quality and value. Plus, we deliver anywhere in Texas, so your dream home can become reality no matter where you want to plant your roots.

Your homeownership dream is closer than you think. The financing options exist, the homes are available, and the expertise is right here to guide you through every step. Why not take that exciting next step today?

Ready to get started? Find your perfect home in Corpus Christi, Texas, or reach out to us wherever you are in our great state. Your new home is waiting for you!