Why Mobile Home Financing Opens Doors to Affordable Homeownership

Mobile home financing offers a path to homeownership that’s often $200,000-$300,000 cheaper than traditional single-family homes. With prices from $50,000 to $500,000, manufactured homes are an affordable alternative in today’s housing market.

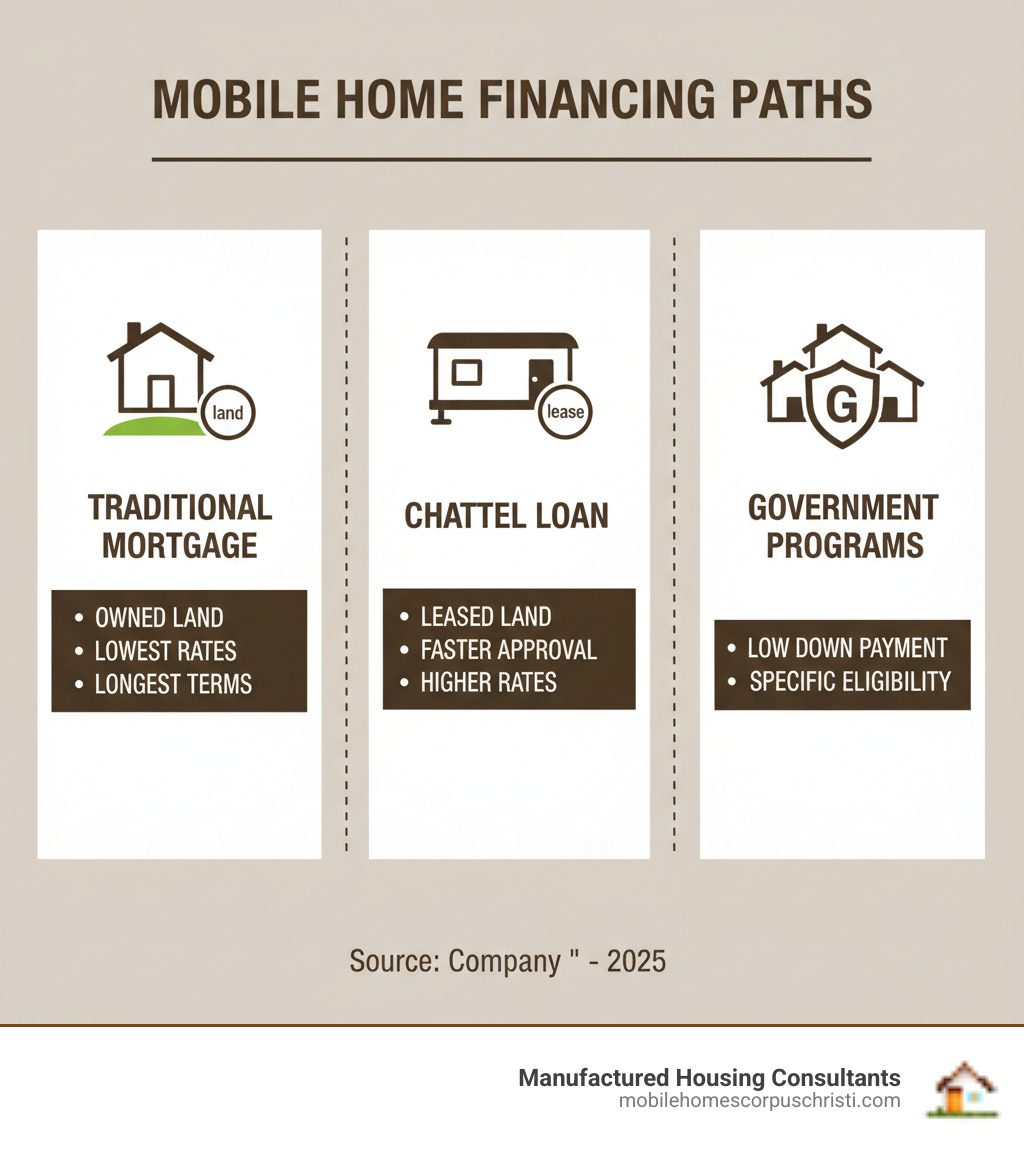

Quick Answer: Mobile Home Financing Options

- Traditional Mortgage: For homes on owned land; offers the lowest rates and longest terms.

- Chattel Loan: For homes on leased land; features faster approval but higher rates.

- Government Programs: FHA Title I, VA loans, and Fannie Mae MH Advantage provide low down payment options.

- Down Payment: Typically 5-35%, but can be as low as 5% with insurance.

- Credit Score: A minimum of 600 is often required, with 620+ for the best terms.

The financing landscape for manufactured homes has evolved. Once difficult to finance, today’s options often rival traditional mortgages. While about 42% of these are chattel loans, programs like Fannie Mae’s MH Advantage are closing the gap with conventional terms.

The primary factor determining your financing is whether you own or lease the land. This decision impacts your loan type, interest rate, and equity-building potential.

Modern manufactured homes are built to federal HUD standards, can appreciate in value, and offer the same amenities and energy efficiency as site-built homes.

Understanding Your Mobile Home Financing Options

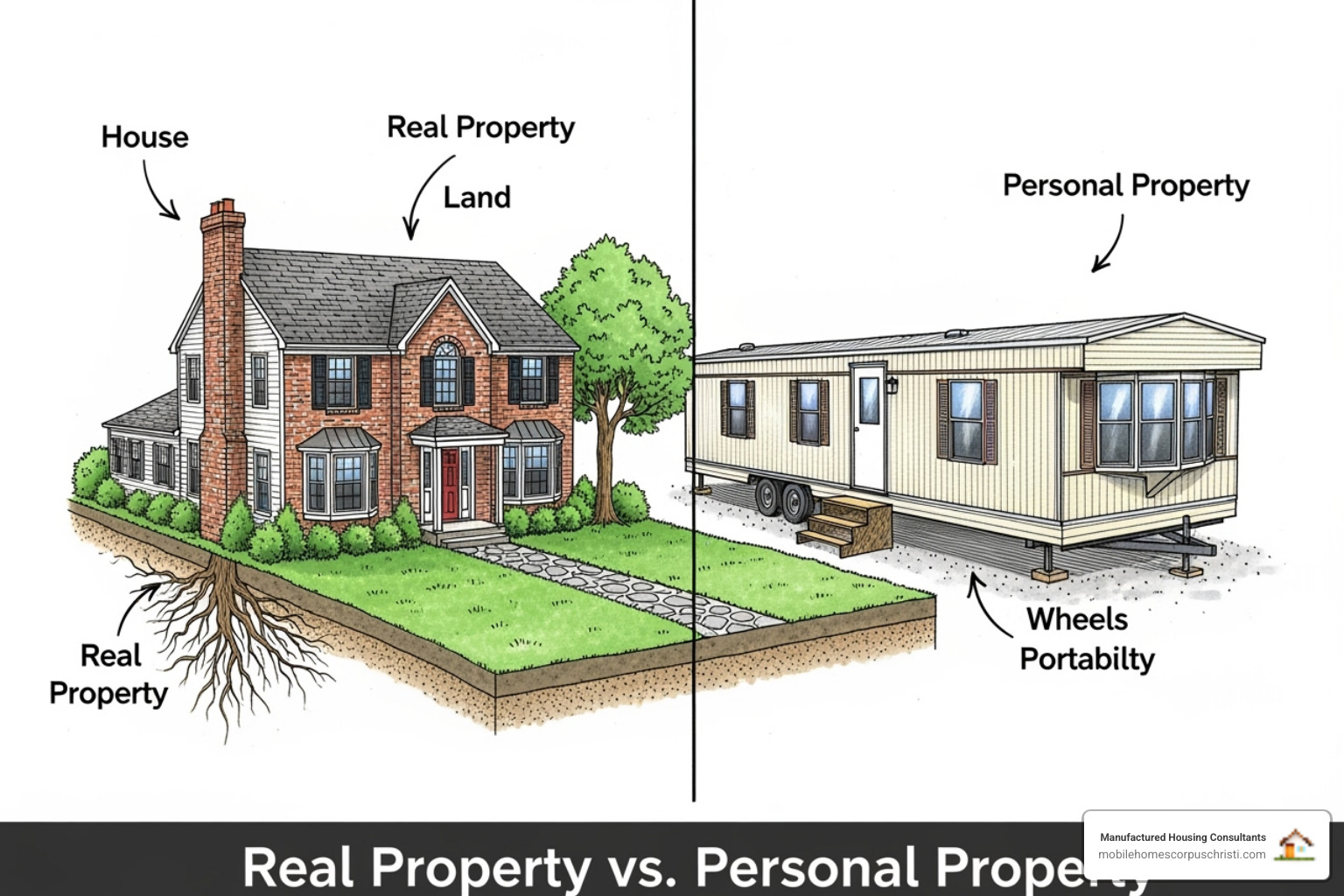

Understanding your mobile home financing options is easier when you know the key difference: whether your home is considered real property or personal property. If you own the land and the home is permanently attached, it’s real property, like a traditional house. If you lease a lot, the home is personal property, financed more like a vehicle.

At Manufactured Housing Consultants, we guide Texas families through these financing options for manufactured homes to find the best path forward.

Traditional Mortgage vs. Chattel Mortgage

Land ownership is the deciding factor between these two loan types.

Traditional mortgages are available when your manufactured home is on a permanent foundation on land you own. This setup is treated as real estate, securing the lowest interest rates and longest loan terms (up to 30 years). Down payments can be as low as 3-5%, though the closing process takes 30-45 days.

Chattel mortgages secure the loan with the home itself, treating it as personal property. Common for homes on leased land, these loans make up about 42% of manufactured home financing. They offer faster closing times (2-3 weeks) and flexible credit requirements but come with higher interest rates and shorter terms (10-20 years). For more details, see this explanation of what is a chattel loan.

Government-Backed Loan Programs

Government programs offer excellent opportunities, especially for buyers with less-than-perfect credit or smaller down payments.

- FHA Title I loans: These government-insured loans work for both personal and real property. Key requirements include using the home as a primary residence and, for park locations, having a lease with at least three years remaining.

- VA loans: Veterans and active military can access incredible benefits, including zero down payment options and competitive rates. The home must be on a permanent foundation and meet VA standards.

- Fannie Mae’s MH Advantage: This program offers a 30-year fixed-rate mortgage with as little as 3% down, with terms that rival conventional home loans.

These programs, including the HUD Title I program, provide lower down payments and more flexible terms, making them valuable for first-time buyers.

How Land Ownership Impacts Your Loan

Whether you own the land or lease a lot is the single most important factor in your mobile home financing journey, determining your interest rate, loan type, and equity potential.

Owning land classifies your home as real estate, while leasing land keeps it as personal property. Both paths lead to homeownership, but the financing differs significantly.

Financing a Mobile Home on Owned Land

Owning your land provides significant advantages in mobile home financing. When the home is on a permanent foundation, lenders treat it as real estate, which open ups:

- Lower interest rates: You’ll qualify for traditional mortgage rates, saving thousands over the loan’s life.

- Longer loan terms: Amortization can extend to 25-30 years, resulting in lower monthly payments.

- Greater equity potential: You build wealth as both the home and land appreciate in value.

This process may require a construction loan if you’re buying land and a new home simultaneously, which can later be converted to a permanent mortgage.

Financing a Mobile Home in a Park (Leased Land)

Leasing a lot in a park offers benefits like lower upfront costs and community amenities. The primary financing tool is a chattel loan, where the home itself secures the loan.

Expect higher interest rates (roughly 7% to 14%) and shorter terms (10-15 years), leading to higher monthly payments but faster ownership. Lenders will also scrutinize your lease agreement, preferring long-term stability. For example, FHA Title I loans require at least three years remaining on your lease.

In addition to loan approval, you’ll need to pass the park approval process, where management verifies your financial stability. While you don’t build land equity, your home can still appreciate, and you gain access to park amenities. We work with lenders who understand both scenarios and can help you find the right Financing for Mobile Homes. Our goal is to find the financing that fits your specific situation.

Qualifying for Mobile Home Financing

Lenders assess several key factors to determine your eligibility and loan terms. Understanding these requirements is the first step toward a successful application through our Pre-Approval Process.

The Role of Your Credit Score and Income

Your credit score and income stability are primary considerations for lenders.

- Credit Score: For mobile home financing, most lenders look for a minimum score of 600-620. A score of 670 or higher typically secures the best rates. However, options exist for scores below 575, often requiring a larger down payment. Don’t be discouraged by a low score; we specialize in finding solutions and outlining the Benefits of Improving Your Credit Score Before Buying Mobile Home.

- Income: Lenders prefer at least two years of steady employment to verify income stability.

- Debt-to-Income (DTI) Ratio: This ratio compares your monthly debt payments to your gross income. Most lenders prefer a DTI below 43%, though some programs allow up to 50%.

Down Payment Requirements

Your down payment is your initial investment. The required amount depends on your loan type, credit, and the home.

- Government-backed programs: Fannie Mae MH Advantage and FHA loans allow down payments as low as 3-5%.

- Standard range: Most buyers should expect to put down between 5% and 35%. Stronger credit and newer homes on owned land typically require less down.

- Down payment sources: You can often use trade-in value from an existing home or land equity. Investment properties usually require at least 20% down.

A larger down payment reduces your monthly payments and can secure a better interest rate. It’s important to know What You Need to Know about your budget.

How a Home’s Age, Condition, and Certifications Affect Financing

The home itself plays a major role in financing.

- Age: Lenders consider a home’s “Remaining Economic Life” (REL). Newer homes are much easier to finance and receive better terms. Homes over 20-25 years old can be difficult to finance.

- Certifications: Homes must meet specific standards. In the U.S., this is the federal HUD Code (since 1976). In Canada, it’s the CSA Z-240 or A-277 certification. These ensure the home meets safety and construction standards.

- Condition and Installation: A well-maintained home on a permanent foundation will appraise better. Lenders also look for proper installation and a minimum size of 400-600 square feet.

By working with us, you get a new manufactured home that meets all current standards, ensuring the best financing options.

Long-Term Considerations: Value, Regulations, and Pros & Cons

Beyond securing mobile home financing, it’s important to understand the long-term aspects of your investment, including value retention and regulations.

The Truth About Mobile Home Depreciation

The myth that manufactured homes always lose value is outdated. While mobile home depreciation can occur with older models or in poor locations (e.g., a $160,200 double-wide might lose $55,000 in five years), modern homes often appreciate.

Key factors that drive appreciation include:

- Installation on a permanent foundation on owned land.

- Placement in a desirable location with good amenities.

- Regular maintenance and smart, energy-efficient upgrades.

When treated like real estate, a manufactured home’s value can grow with the broader housing market. Proper upkeep is crucial for building equity. Understanding this is key, especially if you plan to Trade In a Mobile Home With a Mortgage in the future.

Navigating Legal and Zoning Regulations

Understanding the regulatory landscape protects your investment. These rules maintain standards and property values.

- Local zoning laws: These dictate where manufactured homes can be placed, whether on private land or in designated communities. Check these rules before you buy.

- Permitting: You will need permits for transportation, installation, and utility connections. These ensure your home is set up safely and legally.

- Installation requirements: Proper anchoring and utility hookups are not just bureaucratic problems; they are safety measures that also support your home’s value.

- Certifications: In the U.S., homes must comply with the federal HUD Code. In Canada, CSA certifications (A-277 or Z-240) are required.

As Texas-based experts, we guide you through local regulations. Following these Top 7 Mobile Home Financing Tips can save you time and money.

Frequently Asked Questions about Mobile Home Financing

Here are answers to common questions about mobile home financing.

What are typical interest rates for mobile home loans?

Mobile home financing rates generally range from 7% to 14%, depending on your credit score, loan type, and the home itself. Chattel loans for homes on leased land are often between 5.5% and 8.5%, while traditional mortgages on owned land secure lower, more conventional rates.

New mobile homes typically receive better rates (5.99% to 8%) than used ones (8% to 14%). This is a key reason we focus on new homes, as it leads to lower monthly payments. A higher credit score also secures a better rate, but we specialize in finding financing for all credit situations.

Can I get financing for a used or older mobile home?

Yes, but it is more difficult than financing a new home. Lenders are cautious due to the home’s “Remaining Economic Life.” Home condition is critical; a well-maintained older home is more likely to be approved than a neglected one.

Financing a used home often requires a higher down payment (up to 35%) and involves shorter loan terms, resulting in higher monthly payments. Many lenders will not finance homes older than 20 years. This is why we recommend new manufactured homes, which offer better financing, warranties, and energy efficiency.

Are there special programs for first-time buyers?

Yes, several excellent programs are available to help first-time buyers.

- FHA Title I loans: These government-backed loans are designed for manufactured homes and offer flexible terms, making them ideal for homes in parks.

- Fannie Mae MH Advantage program: This allows for a down payment as low as 3% on a 30-year mortgage, with terms similar to a conventional home loan.

- State and Local Programs: Texas offers various housing assistance initiatives that can be combined with manufactured home financing to make your purchase more affordable.

These programs often accommodate lower credit scores and smaller down payments, making homeownership more accessible. We can help you identify which programs you qualify for.

Your Path to Homeownership

Mobile home financing provides an affordable path to homeownership, with manufactured homes costing significantly less than traditional houses. As this guide shows, financing options exist for nearly every situation, regardless of land ownership status or credit history.

The key is understanding your choices: traditional mortgages for owned land, chattel loans for leased lots, and government programs like FHA Title I and Fannie Mae MH Advantage for lower down payments. Modern manufactured homes are high-quality, energy-efficient, and can appreciate in value, making them a smart investment.

At Manufactured Housing Consultants, our mission is to simplify this process for Texas families. We work with all credit situations, from excellent scores to those needing FICO improvement. We believe everyone deserves a place to call home.

We offer the largest selection from 11 top manufacturers at guaranteed lowest prices and deliver anywhere in Texas. The financing landscape has never been better, with more programs and lender support than ever before.

Your journey starts with understanding what’s possible. We’re here to guide you through every step, from credit improvement to securing the best financing terms.