Is Trading In Your Mobile Home the Right Move?

Mobile home trade in value is the amount a dealer offers for your current home when purchasing a new one from them. Here’s what determines your trade-in worth:

Key Value Factors:

- Age and condition – Well-maintained homes worth up to 50% more

- Size – Double-wides command 20-50% higher values than single-wides

- Location – In-place value significantly higher than pull-out value

- Land ownership – Homes on owned land appreciate, rented land depreciates 3-3.5% annually

- Market demand – Regional variations affect final offers

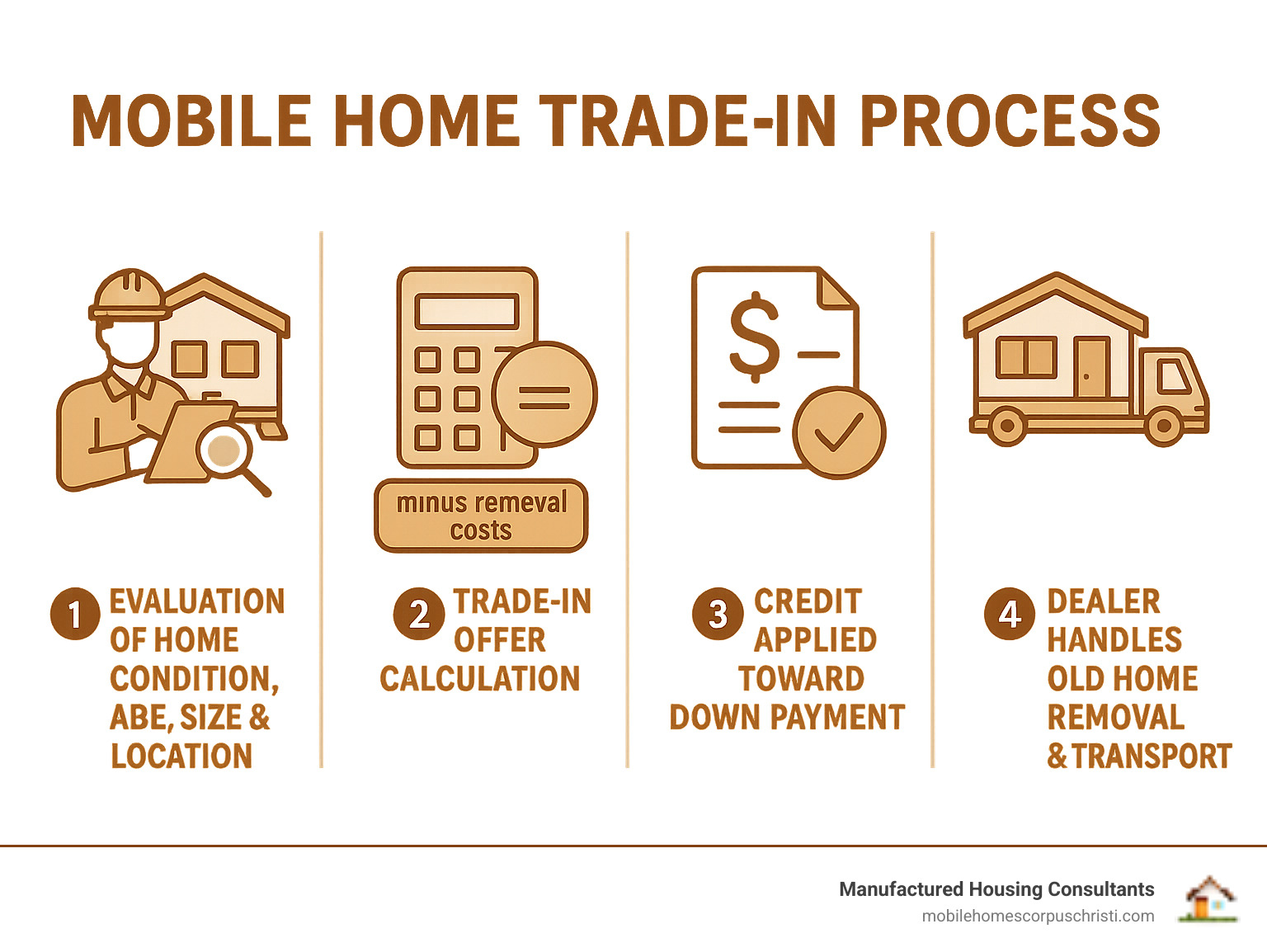

Typical Trade-In Process:

- Dealer evaluates your home’s condition and features

- Offers trade-in credit toward new home purchase

- Handles removal and transport logistics

- Applies credit to down payment or purchase price

Trading in your mobile home offers convenience and simplicity, but it may not maximize your financial return. The trade-in value may not always be as high as you would expect because dealers need profit margins when reselling your old home.

Many families choose trade-ins when upgrading to larger homes or downsizing for retirement. Others prefer this route to avoid the hassle of private sales, showings, and negotiations.

The decision between trading in versus selling privately depends on your priorities: convenience and speed versus maximum dollar value. Understanding how dealers calculate trade-in offers helps you make the best choice for your situation.

How Is Mobile Home Trade-In Value Determined?

Determining your mobile home trade in value is more complex than looking up a car’s worth. At Manufactured Housing Consultants, we act as detectives, assessing everything from your home’s structure to market trends across Texas.

Valuation methods combine industry guides with real-world market knowledge. Our professional evaluations consider your specific situation, not just generic numbers. It’s a mix of science, experience, and understanding current buyer demand.

Market conditions play a huge role. High demand and low inventory increase your home’s worth, while a flooded market can lower it. We constantly monitor the Texas manufactured housing market to provide realistic valuations.

Mobile homes don’t always lose value. A home on rented land typically depreciates about 3-3.5% annually. However, the manufactured housing market grew by 58.34% nationwide between 2018 and 2023, outpacing site-built homes.

As our article on Why Do Mobile Homes Depreciate in Value? explains, factors that can lead to appreciation include being on owned land with a permanent foundation, meeting modern HUD standards, consistent maintenance, and a desirable location.

Key Factors That Influence Your Mobile Home Trade-In Value

When we evaluate your home for a mobile home trade in value, we’re looking at several important factors that directly impact what we can offer you.

Age and condition are critical. While a mobile home can depreciate over time, a well-maintained home can be worth up to 50% more than a neglected one of the same age. We examine everything from the roof and siding to plumbing, electrical systems, and appliances.

Size makes a difference too. Double-wide homes generally command 20-50% higher resale values than single-wides. More space means more appeal to families, and that translates to better value for you.

Location significantly impacts your home’s worth. A home in a well-maintained community with good amenities or in an area with high demand will fetch a higher offer. We know the Texas market well, so we understand which locations are most desirable.

The biggest factor might be land ownership. Homes on rented land are considered “chattel” and typically depreciate like vehicles. But homes permanently attached to owned land with proper foundations are classified as “real property” and can appreciate just like traditional houses. This distinction can mean thousands of dollars in difference.

Pre-1976 HUD Code homes present special challenges. Mobile homes built before June 15, 1976, often have little to no trade-in value because they don’t meet modern safety standards. They’re difficult to finance, insure, or even move legally in many cases.

Upgrades and maintenance can significantly boost your home’s appeal. Recent kitchen or bathroom renovations, new flooring, or energy-efficient improvements add real value. Keep those receipts and photos – they help us give you a better offer.

Market demand in your specific area also plays a role. When there’s high demand for manufactured homes and limited supply of similar used homes, your mobile home trade in value could be higher than you’d expect.

Understanding ‘In-Place’ vs. ‘Pull-Out’ Value

This distinction often catches homeowners off guard, but it’s crucial to understanding your home’s true worth.

In-place value is what your mobile home is worth sitting exactly where it is right now – connected to utilities, settled in its community, ready to live in. A significant portion of any mobile home’s value comes from its location and installation. When someone can just move in without major hassle, that’s valuable.

Pull-out value is quite different. This is what your home is worth if it needs to be disconnected from utilities, potentially taken apart (for multi-section homes), and transported somewhere else. The logistics alone can be a nightmare, and the costs eat into the value quickly.

Removal and transport costs can be substantial. You’re looking at permits, specialized hauling equipment, possible road closures, and sometimes pilot cars for wide loads. These costs easily run into thousands of dollars. Transport alone averages around $20 per mile, and that doesn’t include disconnection or breakdown costs.

The impact on your final offer is straightforward: if we have to spend thousands moving your old home, that reduces what we can offer you. It’s simple math, but it’s also reality. That’s why understanding the Market for Used Mobile Homes helps you see the bigger picture.

Using Value Guides and Professional Appraisals

Industry tools help us determine a fair mobile home trade in value, but they’re just one part of the equation.

Value guides like the NADA® Manufactured Housing Appraisal Guide serve as a starting point. They provide baseline values based on your home’s manufacturer, age, size, and features. Think of them as helpful references, not the final word.

Book values help us understand wholesale values—what a dealer might pay when planning to resell the home. However, these guides don’t always capture real-world market conditions or local factors that affect a home’s actual value.

Professional evaluations are key to getting the most accurate assessment. Our team provides detailed evaluations customized to your trade-in situation, giving you comprehensive insights.

During a value assessment, we examine your home’s overall condition, foundation, upgrades, and potential transport costs. We inspect everything from carpeting and walls to plumbing, electrical systems, appliances, and roofing.

Documentation makes the process smoother. Having your home’s title, year, make, and model ready is ideal. Maintenance records or upgrade receipts are also incredibly helpful and can boost your offer. The more we know about your home, the better we can evaluate its true worth.

Trading In vs. Selling Privately: What to Consider

When it’s time for a new home, you have two main paths: trade in your current mobile home with us or sell it privately. The right choice depends on what matters most to you.

Trading in is the full-service option. We handle everything from the mobile home trade in value assessment to paperwork and removal, all as part of one smooth transaction when you buy a new home from us.

Selling privately is the DIY approach. You control the process and may earn more money, but it requires a significant investment of your time and energy.

If you’re considering the cash route, you might find our insights on Advantages of Buying a Mobile Home with Cash helpful in understanding what buyers are looking for.

The Pros and Cons of a Mobile Home Trade-In

Let’s break down what each option really means for you:

| Feature | Trading In (with Dealer) | Selling Privately (for Cash) |

|---|---|---|

| Speed | Generally faster; part of a single transaction for your new home. | Can be slow; depends on market demand and your marketing efforts. |

| Convenience | High; dealer handles valuation, paperwork, and removal. Less hassle. | Low; you manage marketing, showings, negotiations, and closing. |

| Price | Often lower than private sale; dealer needs profit margin for resale. | Potential for higher profit; you set the price and negotiate directly. |

| Effort | Minimal effort from your side; streamlined process. | Significant effort; requires time, marketing skills, and patience. |

The convenience factor can’t be overstated when you’re trading in. We handle the entire process while you focus on picking out your new home. There’s no need to worry about strangers walking through your current home, fielding phone calls at all hours, or dealing with buyers who change their minds at the last minute.

On the flip side, the speed of a private sale can be unpredictable. In a hot market, you might get multiple offers quickly. In a slower market, your home could sit for months while you’re making payments on both your old and new homes.

Negotiation is another key difference. When you trade in, we give you a fair offer based on current market conditions and our assessment. With a private sale, you might negotiate with several potential buyers, which can be exciting if you enjoy that process – or stressful if you don’t.

When Does Selling for Cash Make More Sense?

Sometimes going the private sale route makes perfect sense, especially if maximizing your profit is your top priority. You’re essentially cutting out the middleman and keeping the full sale price for yourself.

A strong seller’s market can work in your favor when selling privately. If there are more buyers than available homes in your area, you might find yourself in the enviable position of having multiple offers or selling above your asking price.

Unique or highly upgraded homes often do better with private sales. Maybe you’ve installed beautiful hardwood floors, upgraded to granite countertops, or added energy-efficient windows. A private buyer who falls in love with these features might pay top dollar, while a dealer calculates trade-in value more conservatively.

The key question is your willingness to manage the sale process. This means taking photos, writing listings, scheduling showings, answering questions, negotiating offers, and handling all the paperwork. Some folks find this exciting and empowering. Others would rather focus their energy on enjoying their new home.

We’re here to help either way. If you’re curious about what we can offer, check out our page about how to Trade-in or Sell Us Your Old Mobile Home. We’ll give you a straightforward assessment and let you decide what works best for your situation.

How to Maximize Your Mobile Home Trade-In Value

Getting the best mobile home trade in value requires smart preparation. The effort you put in can significantly boost your offer, as a well-maintained home can be worth up to 50% more than a neglected one.

Repairs and maintenance should be your first priority. Walk through your home with a critical eye and fix the obvious issues. That dripping faucet in the bathroom? Fix it. The broken window latch in the bedroom? Replace it. Make sure all your appliances are working properly – nothing says “problem home” like a stove that won’t light or an air conditioner that blows warm air.

Curb appeal matters more than you might think. Your home’s exterior creates the first impression, so take some time to spruce things up. Trim back overgrown landscaping, clean the siding, and make sure your doors and windows sparkle. If you’re in a mobile home park, tidy up the area around your home too – it all contributes to that positive first impression.

Inside your home, deep cleaning can work wonders. We’ve seen homes transform from “maybe” to “definitely” after a thorough cleaning. Get those carpets professionally cleaned, wipe down walls, and make sure your kitchen and bathrooms are spotless. Pay special attention to any lingering odors – they can be deal-breakers.

Don’t forget about documentation of upgrades. Did you install new energy-efficient windows last year? Replace the flooring? Update the kitchen cabinets? Gather those receipts, take before-and-after photos, and organize service records. This paperwork proves the value you’ve added to your home and gives us solid reasons to offer a higher mobile home trade in value.

For more insights on keeping your home in top shape, our Mobile Home FAQs: What Homeowners Need to Know guide has plenty of helpful tips.

A Practical Checklist for Pre-Trade-In Preparations

Before our team comes out to evaluate your home, here are the essential tasks that can help maximize your mobile home trade in value:

- Fix leaks: Check all faucets, pipes, and the roof for any signs of water damage

- Test appliances: Ensure the stove, refrigerator, washer, dryer (if included), and HVAC system are all fully functional

- Clean carpets: A professional cleaning can make a huge difference in the perceived condition of your home

- Tidy landscaping: Mow the lawn, trim bushes, and clear any debris around the home

- Gather paperwork: Collect your home’s title, any manuals for appliances, and records of repairs or upgrades

The Mobile Home Trade-In Process: Step-by-Step

Trading in your mobile home can be a smooth and simple process. At Manufactured Housing Consultants, we handle most of the heavy lifting for you.

The first step is our dealer evaluation. Once you reach out to us about a potential trade-in, we’ll schedule a convenient time to visit your home. During this visit, our experienced team will thoroughly inspect your current manufactured home, taking note of its age, overall condition, size, special features, and location factors. We don’t just eyeball it – we also reference industry-standard guides like NADA® to establish a solid baseline for your mobile home trade in value.

Next comes receiving your offer. After our comprehensive evaluation and considering current market conditions in your area, we’ll present you with a clear trade-in value offer. This amount will be applied directly as credit toward either the purchase price or down payment of your beautiful new manufactured home. We believe in transparency, so we’ll walk you through exactly how we arrived at this number.

The negotiation phase is where we really get to work together. While trade-in values are typically based on wholesale pricing, we understand that every situation is unique. We’re always open to discussion and will thoroughly explain our reasoning behind the offer. Our goal isn’t just to make a deal – it’s to ensure you feel completely confident and comfortable with the value you’re receiving for your current home.

Finally, we handle finalizing the deal. Once we’ve agreed on your mobile home trade in value and settled on the perfect new home for you, our team takes care of all the paperwork headaches. This includes transferring ownership of your old home and completing the purchase documentation for your new one. Since we specialize in working with all credit situations and even offer FICO improvement services, we can also help you explore various Mobile Home Loans or Financing options that work best for your budget.

Essential Documentation for a Smooth Transaction

Having the right paperwork ready makes everything go much faster and smoother. Here’s what you’ll want to gather before we start the process:

Your home title is the most important document – we can’t transfer ownership without it. If your current home still has an outstanding loan balance, don’t worry! We’ll need your loan payoff information, but you typically don’t have to pay off the loan before trading in. We can work directly with your lender to handle these details.

We’ll also prepare a bill of sale that formally records the entire transaction, along with a sales agreement that clearly outlines all the terms and conditions for both your trade-in and your exciting new home purchase.

Since we’re here in Texas, there are some state-specific forms required for mobile home transfers, but don’t stress about figuring those out on your own. Our team knows exactly which forms are needed and will guide you through each one, making sure everything is completed correctly and filed properly.

The beauty of working with us is that we handle the complicated stuff, so you can focus on the fun part – choosing your amazing new home from our selection of 11 top manufacturers!

Frequently Asked Questions about Mobile Home Trade-Ins

Trading in a mobile home isn’t something most people do every day, so it’s natural to have questions. Let’s clear up the most common ones.

Can I trade in a mobile home that isn’t paid off?

Yes, this is very common. You don’t need to pay off your current loan before exploring a trade-in.

When we calculate your mobile home trade in value, we first apply that amount to your outstanding loan balance. If our offer is higher than what you owe, the extra money becomes equity you can use for your new home.

If you owe more than the trade-in value (known as being “upside down”), we can often help. Our financing team can work to roll the remaining balance into your new home loan, simplifying the process.

We coordinate directly with your lender to handle the payoff and paperwork, so you don’t have to worry about the logistics.

What if my old mobile home has no trade-in value?

It’s not uncommon for older or damaged homes, especially pre-1976 models, to have no monetary trade-in value. Even in this situation, we can often help.

We frequently offer removal-only deals, where we take your old home off your hands for free as an incentive for purchasing a new one from us. This saves you thousands in disposal and transport costs.

Scrapping the home for valuable metals like aluminum and copper is another possibility, though you must factor in transportation costs and local regulations.

We may also offer other incentives on your new home purchase to make the deal work. Our goal is to help you move into one of our beautiful new homes from 11 top manufacturers.

Do I need a real estate agent to trade in my mobile home?

No, a real estate agent is not needed when you trade in your mobile home directly with a dealer like us.

Trading in means you sell your old home to us as part of the transaction for your new one. We handle the entire process: valuation, paperwork, removal, and financing coordination. This eliminates the need for marketing your home to the public.

The biggest bonus is that you avoid paying real estate commission fees, which can be substantial. That money stays in your pocket or goes toward your new home, simplifying the process and saving you money.

Conclusion: Take the Next Step Towards Your New Home

Now that you understand how mobile home trade in value is calculated, you’re ready to make an informed decision about your next move. Throughout this guide, we’ve walked through the key factors that shape your home’s worth – from age and condition to the crucial difference between in-place and pull-out values.

The choice between trading in and selling privately ultimately comes down to what matters most to you. Trading in offers best convenience – we handle everything from valuation to paperwork to removal, letting you focus on what’s exciting: choosing your new home. While a private sale might net you more money, trading in eliminates the stress of showings, negotiations, and uncertain timelines.

Here in Texas, the manufactured housing market is thriving. Values have been climbing steadily, and there’s strong demand for quality homes across the state. Whether you’re in Corpus Christi or anywhere else in Texas, this growth creates opportunities for homeowners looking to upgrade.

At Manufactured Housing Consultants, we’ve built our reputation on making the trade-in process as smooth as possible. We’ll fairly assess your mobile home trade in value and apply that credit toward one of our beautiful new homes from 11 top manufacturers. Our team understands the local market inside and out, so you can trust that you’re getting a fair evaluation.

What sets us apart is our commitment to finding solutions that work for your situation. We offer guaranteed lowest prices, and our financing specialists work with all credit situations – even helping with FICO improvement when needed. From your first call to the day we deliver your new home, we’re with you every step of the way.

Ready to see what your current home is worth and explore your options for upgrading? We’d love to help you open up the value in your current home and find the perfect new one for your family’s next chapter.