Understanding Your Path to Affordable Homeownership

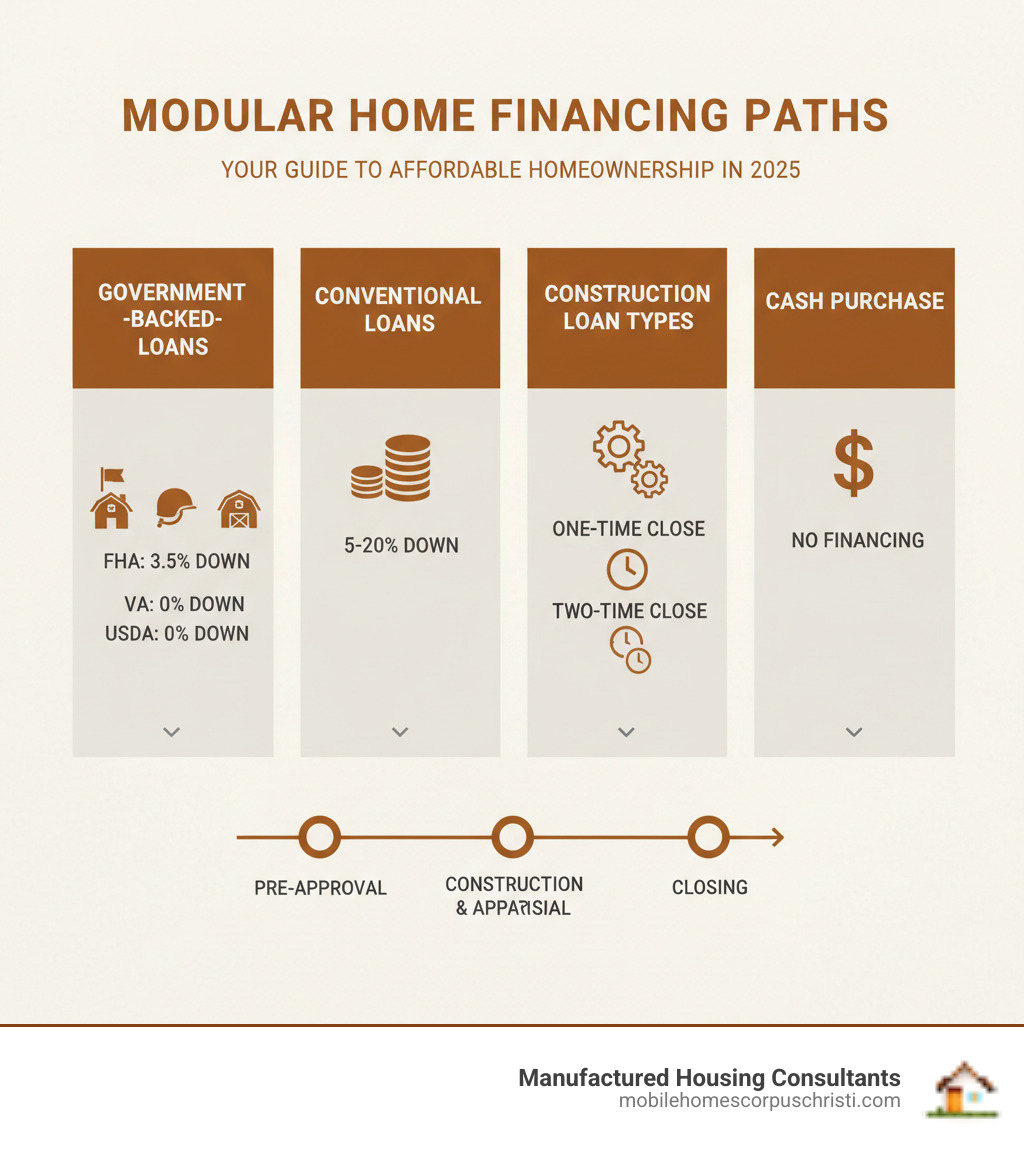

Modular home financing options include construction-to-permanent loans, government-backed programs like FHA and VA loans, conventional mortgages, and cash purchases – all designed to help you secure funding for a factory-built home that’s assembled on a permanent foundation.

Quick Answer: Top Modular Home Financing Options

- FHA Construction Loans: 3.5% down, credit scores from 580+

- VA Construction Loans: 0% down for eligible veterans

- USDA Construction Loans: 0% down for rural properties

- Conventional Construction Loans: 5-20% down, best rates for good credit

- One-Time Close Loans: Single closing, locked interest rates

- Cash Purchase: No financing needed, simplest process

The dream of homeownership doesn’t have to break your budget. With modular homes costing $50-100 per square foot compared to traditional homes at over $416,900 median price, you’re looking at significant savings. But here’s what many don’t realize: modular homes qualify for the same financing as traditional site-built homes.

Why modular financing is different from manufactured home financing:

Modular homes are built to local building codes and placed on permanent foundations, making them real property from day one. This means they appreciate in value and qualify for traditional mortgages – unlike manufactured homes that often require specialized chattel loans with higher rates.

Whether you’re dealing with credit challenges, limited savings, or just want the most affordable path to homeownership, understanding your financing options is the first step toward getting the keys to your new home.

Understanding Modular vs. Manufactured Home Financing

Here’s something that trips up a lot of homebuyers: not all factory-built homes are created equal when it comes to financing. Understanding the difference between modular and manufactured homes isn’t just about construction details – it’s about your wallet and your financing options.

Modular homes are the financing winners in this comparison. They’re built in sections at a factory, then transported to your land and permanently attached to a foundation. Here’s why lenders love them: they follow the same local and state building codes as traditional stick-built homes. Once that foundation is poured and your home is secured to it, you officially own real property.

This matters because modular home financing options work just like traditional home loans. Your home will likely appreciate in value alongside other homes in your neighborhood. Banks see modular homes as solid investments, which translates to better loan terms for you.

Manufactured homes play by different rules. They’re also factory-built, but they follow the federal HUD code established back in 1976. The big difference? They’re built on a permanent steel chassis – think of it like a really sturdy trailer frame that never gets removed.

When a manufactured home isn’t permanently attached to owned land, lenders often view it as personal property rather than real estate. This is especially true in mobile home parks where you lease the land. The result? Different financing options that can be more expensive and less favorable.

Want to dive deeper into manufactured home financing? Check out our comprehensive guide on Manufactured Home Financing Options.

The bottom line: Modular homes typically qualify for traditional mortgages with competitive rates, while manufactured homes might require specialized financing. Both can be great housing options, but knowing the difference helps you plan your budget and expectations.

What Are Chattel Loans?

If you’re looking at manufactured homes, especially in lease-land communities, you’ll probably hear about chattel loans. Don’t let the fancy name scare you – “chattel” just means movable personal property.

Think of chattel loans like car loans, but for homes. Instead of using both the land and house as collateral (like a traditional mortgage), a chattel loan only uses the manufactured home itself. This setup works when you’re placing your home on leased land or when the home isn’t permanently attached to real estate you own.

Here’s what to expect with chattel financing: Interest rates are typically higher than conventional mortgages because lenders see them as riskier investments. The loan terms are also shorter – usually 10 to 20 years instead of the 15 to 30 years you’d get with a traditional mortgage.

Chattel loans are common in leased land communities like mobile home parks. If you’re considering this option, make sure you understand the lease terms. Most lenders require at least a three-year initial lease with a 180-day termination notice requirement.

While chattel loans serve an important purpose for manufactured home buyers, they’re generally not needed for modular homes. Since modular homes become real property once installed, they qualify for more advantageous traditional financing options.

The Core Modular Home Financing Options

Here’s the exciting part: when you’re ready to move forward with your modular home, you’ll find that modular home financing options work almost exactly like traditional home loans. This is honestly one of the biggest perks of going modular!

Think of it this way – since your modular home will sit on a permanent foundation and meet the same building codes as any stick-built house, lenders treat it the same way. No special hoops to jump through or limited financing choices.

Your main paths forward include construction-to-permanent loans that handle both the building and long-term mortgage phases, government-backed programs like FHA, VA, and USDA that offer special benefits, conventional loans from private lenders, and of course, paying cash if you’re in that fortunate position.

We’ve helped hundreds of Texas families steer these choices, and honestly, there’s no one-size-fits-all answer. What works best depends on your credit situation, how much you can put down, and whether you qualify for any special programs.

For personalized guidance through this process, take a look at our Financing Services – we’re here to make this as smooth as possible.

One-Time Close vs. Two-Time Close Construction Loans

Building a modular home means you need money during construction, which is where construction loans come in. These loans work differently than regular mortgages – they release funds in stages as your home gets built, and you typically only pay interest on what’s been released.

The big decision here is whether to go with a one-time close or two-time close loan, and trust me, this choice can save you both headaches and money.

One-time close loans are the streamlined option that most of our clients prefer. You go through one closing process that covers everything – both construction and your permanent mortgage. The best part? Your interest rate gets locked in from day one, so you don’t have to worry about rates going up while your home is being built.

This works great if you have stable income and decent credit. The down payment requirements vary: FHA construction loans need 3.5% down, VA allows zero down for eligible veterans, conventional typically requires 5%, and jumbo loans need 10%.

Two-time close loans involve exactly what the name suggests – two separate closings. First, you close on the construction loan to fund the build. Then, once your home is complete, you apply for and close on a separate permanent mortgage.

While this sounds like more work (and yes, you’ll have two sets of closing costs), it offers flexibility that can be a lifesaver. Maybe your credit score will improve during construction, or you’re expecting a job change that will boost your income. Some folks even use equity from their current home to cover the down payment and closing costs.

Government-Backed Loan Programs

These programs exist to help more people achieve homeownership, and they’re some of the best modular home financing options available if you qualify.

FHA construction loans are incredibly popular because they only require a 3.5% down payment if your credit score is 580 or higher. Even if your score is between 500 and 579, you might still qualify with 10% down. You’ll pay mortgage insurance (MIP), but the low down payment often makes this worthwhile.

Your modular home needs to be built after June 15, 1976, and permanently attached to a foundation – which all modern modular homes are. We can even help structure loans to upgrade foundations if needed.

VA construction loans are an incredible benefit for our veterans and active-duty service members. We’re talking 0% down payment, competitive rates, and often no monthly mortgage insurance. The VA treats modular homes exactly like traditional homes, so there’s no difference in how they’re financed.

You might pay a VA funding fee (typically 1.25% to 3.3%), but this can usually be rolled into the loan. A credit score around 620 or higher is generally expected.

USDA construction loans are perfect for rural properties and offer 0% down payment for qualifying borrowers. These loans can even finance up to 102% of the home’s value, meaning closing costs might get rolled in too.

The catch is your property needs to be in a USDA-defined rural area, and you’ll need to meet income limits. With a minimum credit score of 640, this is an excellent option for lower-income families looking to build in rural Texas.

Conventional Construction Loans

Conventional loans come from private lenders like banks and credit unions, and they’re often the go-to choice for borrowers with solid credit and a decent down payment.

These loans really shine when you have good credit – we’re talking 620 or higher, with scores above 700 getting the best rates. Lenders see you as lower risk, which translates to better terms for you.

You’ll typically need to put down 5% to 20%, though some programs like Fannie Mae’s MH Advantage offer as little as 3% down for modular homes. If you can manage 20% down, you’ll avoid private mortgage insurance (PMI), which saves money every month.

Since these aren’t government-backed, private lenders have more flexibility in their terms, but they also tend to have stricter requirements. The upside? If you have excellent credit and a substantial down payment, conventional loans often offer the most competitive interest rates available.

The Pros and Cons of a Cash Purchase

If you’re lucky enough to consider paying cash for your modular home, let’s talk through whether it makes sense for your situation.

The advantages are pretty compelling. You’ll save a ton of money by avoiding mortgage interest – we’re talking potentially hundreds of thousands over what would have been a 30-year loan. You also skip loan fees, appraisal costs, and much of the closing costs.

The process becomes incredibly simple too. No extensive paperwork, no waiting for loan approval, no bank due diligence digging through your finances. You also become a much stronger buyer – sellers love the certainty of cash deals.

But there are disadvantages to consider. That cash becomes tied up in your home, which means it’s not available for emergencies or other investments. You might miss out on investment opportunities that could earn more than what you’d pay in mortgage interest.

There’s also something called opportunity cost – even with a low-interest mortgage, you could potentially make more money investing that cash elsewhere while making smaller monthly payments on your home.

Whether cash makes sense really depends on your complete financial picture, your comfort with risk, and what other opportunities you have for that money.

Preparing Your Application: Requirements and Key Factors

Getting your financing application ready doesn’t have to feel overwhelming. Think of it as gathering the pieces of your financial story – one that shows lenders you’re ready for homeownership. The best part? Starting with loan pre-approval gives you a clear picture of what you can afford and shows sellers you mean business.

Most lenders follow a similar process when evaluating modular home financing options. They want to see your income stability, understand your debts, and confirm you have the funds for your down payment and closing costs. Beyond the financial basics, you’ll also need to factor in site preparation costs since your modular home needs land and a foundation.

For a deeper dive into what lies ahead, check out our guide on What You Need to Know.

Essential Documentation for Your Modular Home Financing Options

Lenders need to see the full picture of your financial life, and having your documents organized upfront makes everything move faster. Here’s what you’ll want to gather before you apply:

Proof of income forms the backbone of your application. You’ll need recent pay stubs (usually the last month or two) and your W-2s from the past two years. If you’re self-employed, expect to provide tax returns for two to three years along with additional business financial records.

Your bank statements from the last couple months show lenders where your down payment money is coming from and that you have steady cash flow. They’re also looking for any large deposits that might need explanation.

The builder’s contract and plans are crucial for construction loans. This document spells out exactly what you’re building, how much it costs, and the timeline. Without it, lenders can’t move forward with your modular home financing.

You’ll also need a personal financial statement – basically a snapshot of everything you own and owe. This includes your assets, monthly income, and all your current debts like car payments or credit cards.

Don’t forget the basics: a photo ID and signed authorization for the lender to pull your credit report. If you have other income sources like Social Security or child support, bring documentation for those too.

Key Financial Metrics for Modular Home Financing Options

Three numbers can make or break your loan application. Understanding them helps you know where you stand and what you might need to improve.

Your credit score is probably the most important number lenders look at. It tells them how reliably you’ve handled credit in the past. FHA loans are the most forgiving, accepting scores as low as 580 for a 3.5% down payment (or even 500 with 10% down). Conventional loans typically want to see 620 or higher, while VA loans generally look for 580+. USDA loans usually require 640 or better.

Here’s the thing about credit scores – even a small improvement can save you thousands over the life of your loan. If your score needs work, our guide on Benefits of Improving Your Credit Score Before Buying Mobile Home has practical tips to help.

Your debt-to-income ratio (DTI) compares your monthly debt payments to your gross monthly income. Most lenders want this under 43%. So if you earn $5,000 monthly, your total debt payments (including the new mortgage) shouldn’t exceed about $2,150. If your DTI is too high, paying down credit cards or other debts before applying can help.

Your down payment affects everything – your loan amount, monthly payment, and interest rate. Put down 20% on a conventional loan and you’ll avoid private mortgage insurance. Government loans often require less: FHA needs just 3.5%, while VA and USDA can go as low as 0% for qualified buyers.

Additional Costs to Budget For

The sticker price of your modular home is just the beginning. Smart buyers plan for all the extras that turn an empty lot into your dream home.

Land purchase varies wildly by location. A rural lot might cost $20,000 while suburban land could run $100,000 or more. If you don’t own land yet, this becomes a major part of your budget.

Site preparation gets your land ready for construction. Land clearing averages around $2,750, while grading and excavation ensure proper drainage and foundation placement. Preparing undeveloped land typically costs $4,000 to $11,000 total.

Foundation costs depend on what you choose. A basic slab foundation runs about $8,500, while a full basement can cost up to $30,000. Modular homes need permanent foundations – it’s not optional.

Utility hookups connect you to civilization. Running a water main averages $1,600, while sewage connections cost around $3,200 (more if you need a septic system). Electrical hookups run about $1,350, and natural gas lines add roughly $550 per line.

Don’t forget permits and fees from your local building department, closing costs (typically 2-5% of your loan amount), and home insurance from day one. You’ll also want to budget for a driveway and basic landscaping to complete your new home.

For comprehensive budgeting advice, check out our guide on How to Budget for Your New Manufactured Home. Planning for these costs upfront prevents sticker shock later and keeps your project on track.

Frequently Asked Questions about Modular Home Financing

We get a lot of questions about modular home financing options, and that’s perfectly normal! Buying a home is one of the biggest decisions you’ll make, and we want you to feel confident every step of the way. These are the questions we hear most often from folks just like you.

For more general questions about mobile and manufactured homes, you might find our Mobile Home FAQS: What Homeowners Need to Know helpful too.

Do modular homes appreciate in value like traditional homes?

Absolutely! This is actually one of the biggest advantages of choosing a modular home, and it’s something that sets them apart from manufactured homes in a really important way.

Here’s why modular homes hold their value so well: they’re built to the exact same local and state building codes as any stick-built home you’d see in a traditional neighborhood. When your modular home arrives and gets permanently attached to its foundation on your land, it becomes real estate – not personal property like a car or RV.

What this means for you is pretty exciting. Your modular home will appreciate in value following local market trends, just like your neighbor’s traditionally-built house. When the housing market in your area goes up, your home’s value goes up too. This makes modular homes a smart long-term investment, not just a place to live.

The fact that appraisers and lenders view modular homes as real estate from day one is also why securing traditional modular home financing options is so much easier than you might expect.

What are the best modular home financing options for bad credit?

Don’t let less-than-perfect credit keep you from your dream of homeownership! We work with people in all kinds of credit situations, and there are definitely paths forward for you.

FHA loans are usually your best bet when credit is a concern. These government-backed loans are designed to help people who might not qualify for conventional financing. You might be surprised to learn you can potentially qualify with a credit score as low as 500 – though you’d need to put down 10%. If your score is 580 or higher, that down payment requirement drops to just 3.5%.

Yes, FHA loans do require mortgage insurance, which adds to your monthly payment. But think of it this way: it’s the key that opens the door to homeownership when other doors might be closed.

Here’s something else that might help: we specialize in credit improvement strategies. Sometimes small changes can make a big difference in your score and your loan options. Things like paying down existing debt or fixing errors on your credit report can boost your score faster than you’d think.

If you have a family member or friend with good credit who’s willing to help, adding a cosigner to your application can also improve your chances and help you get better terms.

We believe everyone deserves a shot at homeownership, regardless of where their credit stands today. Check out our guide on Low FICO Home Loans for more detailed information, and don’t hesitate to reach out. We’ve helped plenty of folks with credit challenges find their way to homeownership.

How long can you finance a modular home?

Great news here – financing terms for modular homes work just like traditional site-built homes! This is another area where the “real property” status of modular homes really works in your favor.

Most lenders offer the standard mortgage terms you’d expect: 15-year fixed-rate mortgages for those who want to pay off their home faster, and the popular 30-year fixed-rate mortgages that keep monthly payments more manageable.

The specific loan term you can get depends on your lender and the type of loan you choose. FHA loans for modular homes typically come with 30-year terms, which is the same as you’d get for any other house.

These longer financing terms are actually another sign that the lending industry sees modular homes as long-term, appreciating assets – just like traditionally-built homes. It’s pretty reassuring to know that when you choose modular, you’re not giving up any of the financing advantages that come with traditional homeownership.

Conclusion: Your Path to Owning a Modular Home

You’ve made it to the end of our journey through modular home financing options, and here’s the exciting truth: homeownership is absolutely within your reach!

What we’ve finded together is that modular homes aren’t some second-class housing option—they’re quality, permanent real estate that lenders treat just like traditional site-built homes. This means you get access to the same great financing programs, from FHA loans with just 3.5% down to VA loans with zero down payment for our veterans, and USDA loans for rural properties. Whether you choose a streamlined one-time close construction loan or need the flexibility of conventional financing, there’s a path that fits your situation.

The beauty of modular homes lies in their recognition as real property from day one. They appreciate in value, qualify for standard 30-year mortgages, and give you all the benefits of traditional homeownership—often at a fraction of the cost.

But here’s what matters most: preparation is your secret weapon. Having your financial documents organized, understanding your credit score, and budgeting for those extra costs like site preparation and utility hookups will make your financing journey smooth and stress-free.

At Manufactured Housing Consultants, we’re not just here to sell you a home—we’re here to make your dream of homeownership a reality. With our largest selection from 11 top manufacturers and guaranteed lowest prices, we’ve helped countless Texas families find their perfect home. What makes us different is our commitment to specialized financing for all credit situations, including FICO improvement assistance. Bad credit? We’ve seen it all, and we’ve helped people just like you secure financing.

Whether you’re in Corpus Christi or anywhere else in Texas, we deliver homes statewide and provide expert guidance every step of the way. Your credit challenges don’t define your future—your determination does.

Your modular home is waiting, and we’re ready to help you get there. Don’t let another day pass wondering “what if?”