Why Repossessed Houses Offer Both Opportunity and Risk

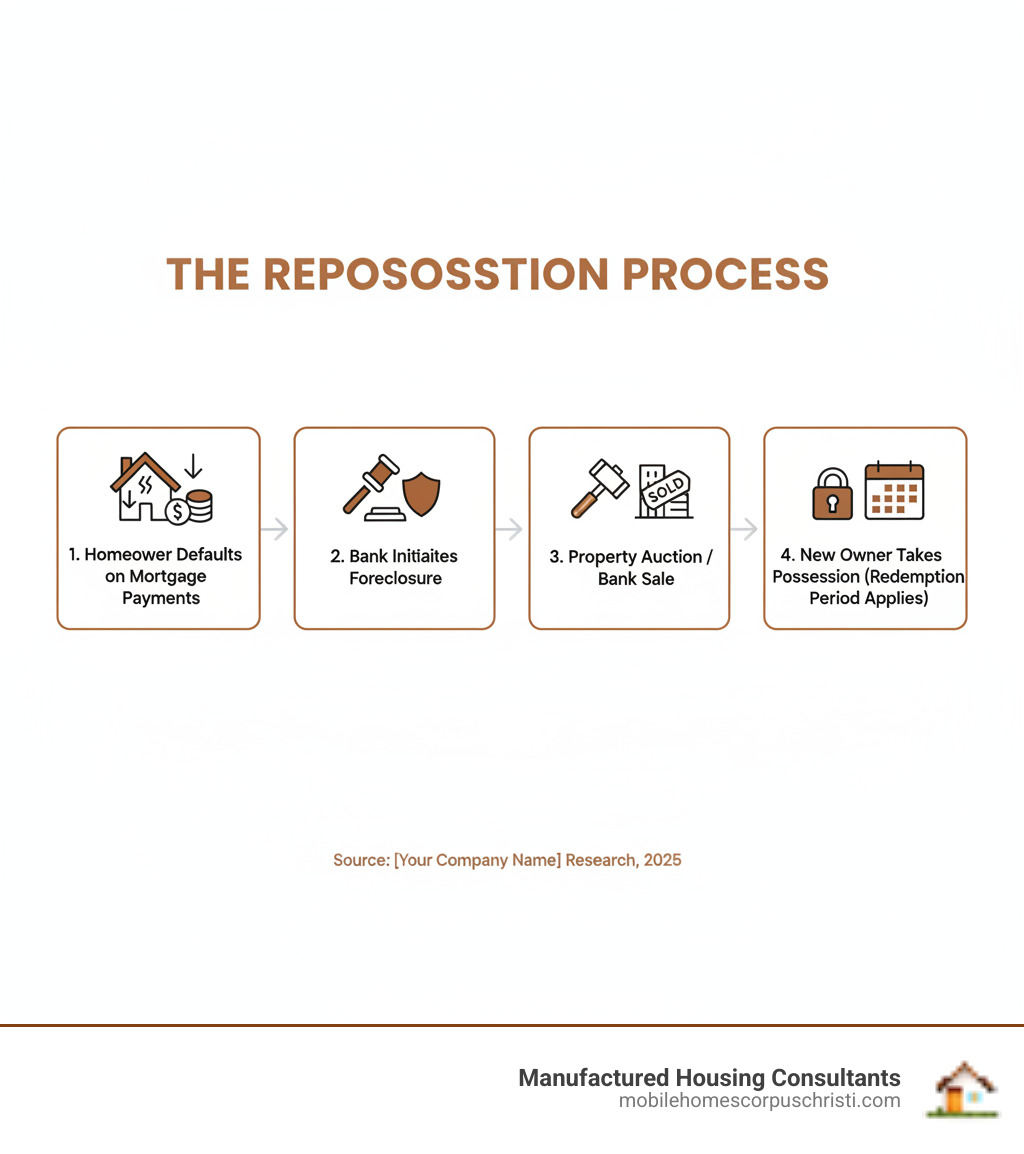

Repossessed houses to buy are properties that banks have seized from homeowners who couldn’t keep up with their mortgage payments. These bank-owned properties, also called REO (Real Estate Owned) homes, represent a complex market opportunity that attracts bargain hunters and investors alike.

Quick Guide to Finding Repossessed Houses:

- Public Auctions: Sheriff’s sales at courthouses, requires 10% deposit

- Bank REO Departments: Direct listings from major banks and credit unions

- Online Platforms: Auction.com, foreclosure listing websites, specialized databases

- Real Estate Agents: Agents with REO experience who access pocket listings

- Government Sales: HUD homes, VA foreclosures, tax sale properties

When a lender repossesses a property, they have dual responsibilities – acting fairly toward the former owner while seeking a quick sale to prevent losses from mounting. This urgency often creates opportunities for buyers to purchase homes at 10-30% below market value.

Banks don’t want to be property managers. Their primary goal is simple: recoup the outstanding loan amount as quickly as possible. This motivation drives the discounted pricing that makes repossessed properties attractive to budget-conscious buyers.

However, these potential savings come with significant risks. Repossessed homes are sold “as is” with no warranties, often sight unseen, and may carry hidden liens or need major repairs. The competition can be fierce, especially in markets with limited supply.

The Pros and Cons of Buying a Repossessed Home

Buying repossessed houses to buy is like treasure hunting – you might find incredible deals, but you’ll need to watch out for hidden pitfalls along the way. Let’s explore what makes these properties so tempting and what challenges you might face.

The Allure: Potential Advantages

The biggest draw of repossessed houses to buy is the price tag. These properties often sell for 10-30% below market value, which can translate to serious savings. Banks aren’t in the business of being landlords – they want these properties off their books quickly to stop bleeding money on maintenance and property taxes.

This urgency creates a win-win situation for savvy buyers. You get a discounted property, and the bank gets to cut its losses. The savings can be substantial enough to build instant equity from day one, giving you a head start whether you’re looking for a family home or an investment property.

The high investment potential is particularly attractive for those willing to roll up their sleeves. That 20% discount might cover your renovation costs and still leave you with a property worth more than you paid. If you’re interested in exploring similar opportunities in manufactured housing, our guide on Investing in a Repo Mobile Home offers valuable insights into maximizing returns.

The Reality: Risks and Challenges

Now for the not-so-fun part. Repossessed houses to buy come with their fair share of headaches that can turn your dream deal into a nightmare.

Most repossessed properties are sold “as-is,” which is banker speak for “whatever’s wrong with it is now your problem.” You might walk into a home with hidden damages that weren’t obvious during your quick viewing – think electrical issues, plumbing problems, or structural damage that could cost thousands to fix.

Legal issues and liens can also lurk beneath the surface. Previous owners might have left behind unpaid contractor bills, tax liens, or other debts tied to the property. Without proper research, you could inherit these problems along with your new house keys.

The competition for good repossessed properties can be intense. When a decent property hits the market at a below-market price, multiple buyers often swoop in quickly. This can lead to gazumping risk – where your accepted offer gets outbid at the last minute because the property stays on the market until contracts are signed.

Perhaps most stressful of all are the quick closing periods. Banks often demand closings within 28 days or less, giving you little time for thorough inspections or financing arrangements. Cash buyers have a huge advantage here, which brings us back to the competition problem.

For a deeper dive into navigating these challenges, check out our Guide to the Pros and Cons Before Buying Repo Mobile Homes, which covers many of the same principles that apply to traditional repossessed properties.

The bottom line? Repossessed properties can offer fantastic opportunities, but they’re not for buyers who want a simple, stress-free purchase. Success requires patience, preparation, and often a healthy cash reserve for surprises.

Where to Find Repossessed Houses to Buy

Finding repossessed houses to buy can feel like hunting for buried treasure – you need to know where to dig! The good news is that once you understand the landscape, these opportunities become much easier to spot.

Public and Online Auctions

The most traditional way to find repossessed houses to buy is through auctions, and they come in two main flavors: the dramatic courthouse steps experience and the modern convenience of online bidding.

Sheriff’s sales happen right at your local courthouse, where properties are sold to recover unpaid debts. These public auctions can be intense – imagine a room full of investors, cash buyers, and hopeful homeowners all vying for the same property. The atmosphere is electric, but it’s not for the faint of heart.

Here’s what you need to know before raising that bidding paddle: you’ll typically need a 10% non-refundable deposit ready to go, with the balance due within just twenty days. That means your financing better be rock-solid before you even walk through those courthouse doors.

Online auction platforms have revolutionized this process, making it possible to bid from your kitchen table. These websites specialize in foreclosure and bank-owned properties, offering detailed listings with photos and property information. The bidding process works similarly to any online auction – you register, place your bids, and hope for the best.

Bank REO Departments and Websites

Sometimes the best approach is going straight to the source. Banks have entire departments dedicated to managing their Real Estate Owned (REO) properties – basically, the homes they’d rather not own but ended up with anyway.

These REO departments are motivated sellers. Every month they hold onto a property costs them money in maintenance, taxes, and insurance. That urgency often translates into competitive pricing for buyers who know where to look.

Most major banks list their repossessed houses to buy directly on their websites or work with designated real estate agents. You won’t always see the word “repossessed” in big bold letters, but look for terms like “bank-owned,” “foreclosure,” or “REO” in the listings.

Credit unions can be goldmines too. They often have smaller inventories but may be even more motivated to sell quickly than larger banks. Our Bank Repos section dives deeper into this strategy and can help you steer these direct bank relationships.

Specialized Real Estate Agents and Listing Services

Here’s where having the right connections really pays off. Real estate agents who specialize in REO properties are like having an insider’s guide to the foreclosure market. They understand the unique challenges of buying repossessed houses and often have access to “pocket listings” – properties that haven’t hit the public market yet.

These agents speak the language of banks and can help you steer the sometimes tricky negotiation process. They know which lenders are most motivated and can often give you the heads-up on upcoming listings before the competition even knows they exist.

When you’re searching online, cast a wide net with your search terms. Use keywords like “bank-owned,” “foreclosure,” “REO,” and even “tax sale property” to uncover hidden opportunities. Many listing services offer email alerts that notify you the moment a new property matching your criteria hits the market – in this competitive space, being first can make all the difference.

The key to success in finding repossessed houses to buy is persistence and having multiple sources working for you. Don’t put all your eggs in one basket; instead, create a network of contacts and resources that keeps opportunities flowing your way.

A Buyer’s Guide: The Process and Due Diligence

Purchasing repossessed houses to buy is like learning to dance – it takes preparation, the right moves, and sometimes a little faith! Unlike buying a regular home where you can take your time, repo properties demand a more strategic approach. Let’s break down the essential steps to help you steer this unique market successfully.

Step 1: Securing Your Financing

Here’s the truth about repossessed houses to buy: cash offers are absolutely king. Banks love cash buyers because there’s no mortgage approval waiting period, no loan conditions to meet, and the deal can close lightning-fast. If you’re competing against other buyers, cash gives you a massive advantage.

But don’t worry if you’re not sitting on a pile of cash! Getting mortgage pre-approval is your next best move. This shows sellers you’re serious and ready to act quickly. Banks selling repo properties want certainty, and pre-approval gives them confidence you can actually close the deal.

Since many repossessed homes need significant work, consider renovation loans like the FHA 203(k). These clever loans let you finance both the purchase price and repair costs in one mortgage. It’s like getting a two-for-one deal that can make a fixer-upper financially feasible.

While we specialize in beautiful new manufactured homes at Manufactured Housing Consultants, we understand financing can be complex. Our guide on Financing for Mobile Homes offers valuable insights into loan processes that apply broadly to home purchases.

Step 2: Evaluating the Property’s Condition and Value

This step is where the “as-is” nature of repo properties gets real. Think of it as buying a mystery box – except this mystery box costs tens of thousands of dollars! Professional inspections are absolutely essential, even if they cost extra upfront.

Some auction properties won’t let you inside before bidding (yikes!), but if you’re buying through a bank or agent, demand a full home inspection. Don’t skip the structural survey either – it might reveal expensive problems hiding behind fresh paint or pretty staging.

You’ll also need a Comparative Market Analysis (CMA) to understand what the property is actually worth. This means looking at similar homes that recently sold nearby. The goal is knowing whether you’re getting a genuine bargain or just paying market price for a problem property.

Our guide What to Look For When Buying a Used Mobile Home offers excellent tips for assessing property condition that work perfectly for any type of repo home.

Step 3: Navigating the Legal Landscape

The legal side of buying repossessed houses to buy can feel like reading a foreign language, but it’s crucial to get it right. A thorough title search isn’t optional – it’s your protection against inheriting someone else’s financial problems.

This search reveals any outstanding liens, unpaid property taxes, or other legal issues attached to the property. Imagine buying your dream home only to find the previous owner owes thousands in contractor bills that are now your responsibility!

You also need to understand redemption rights in your area. Sometimes former homeowners have a window after the sale to reclaim their property by paying off their debt. While this is rare with bank-owned REO properties, it’s worth knowing about.

Working with a real estate attorney who specializes in foreclosures isn’t just smart – it’s essential. They’ll review all documents, explain the fine print, and protect you from legal surprises down the road. Think of them as your legal bodyguard in what can be a complicated transaction.

Key Considerations for Your Purchase

Before you get swept away by the excitement of finding repossessed houses to buy, let’s talk about what you’re really signing up for – both financially and emotionally.

Understanding the True Costs of Repossessed Houses to Buy

That tempting low price tag on repossessed houses to buy is just the beginning of your financial journey. Think of it like buying a used car – the sticker price rarely tells the whole story.

Your purchase price might be 10-30% below market value, but that’s where the savings can quickly disappear. If you’re buying at auction, auction fees will be tacked on, and these vary depending on the auction house. Then comes the big unknown: your renovation budget. Since these homes are sold “as-is,” you might find anything from missing fixtures to major foundation issues once you get the keys.

Don’t forget about holding costs while you’re fixing things up. You’ll still be paying property taxes, insurance, and utilities even if no one’s living there yet. Legal fees for a good real estate attorney aren’t optional – they’re essential for navigating the complex title issues we discussed earlier.

Here’s what the real numbers might look like compared to a traditional purchase:

| Cost Category | Repossessed Home Purchase | Traditional Home Purchase |

|---|---|---|

| Purchase Price | Often 10-30% below market value | Market value, subject to negotiation |

| Inspections | Limited or none before purchase, full post-purchase inspection critical | Typically full inspection before purchase, often a contingency |

| Renovation Budget | Potentially significant, often required | Varies, usually for cosmetic or desired upgrades |

| Closing Costs | Standard, plus potential auction fees, legal fees for complex title | Standard, legal fees, title insurance |

| Hidden Issues | High risk of major structural or system failures | Lower risk, often covered by inspection contingencies |

| Time to Close | Often very fast (e.g., 28 days) | Standard (30-60 days), more flexible |

| Legal Due Diligence | Extensive, critical for title and lien checks | Standard, usually handled by closing attorney/title company |

The reality is that your “bargain” might end up costing the same as a traditional home purchase once you factor in all the extras. That’s not necessarily a bad thing, but it’s important to go in with realistic expectations.

Key Advice for First-Time Buyers of Repossessed Houses to Buy

If this is your first rodeo with repossessed houses to buy, we admire your courage! But we also want to make sure you don’t get bucked off before you even get started.

Start small if you can. Consider a less complex property for your first repo purchase. It’s like learning to swim in the shallow end – you’ll gain confidence and experience without risking everything.

Build your dream team before you need them. Find a real estate agent who knows REO properties inside and out, a lawyer who specializes in foreclosures, and a contractor you trust for inspections and repairs. These relationships are worth their weight in gold when things get complicated.

Keep a large cash reserve – and we mean larger than you think you need. Take your renovation budget estimate, then add another 20-30% for surprises. Trust us, there are always surprises with repo homes. You’ll want cash available for immediate repairs after closing.

Patience isn’t just a virtue – it’s a survival skill in this market. You might face bidding wars, legal delays, or renovation setbacks that stretch on longer than expected. The buyers who succeed are the ones who stay calm and flexible.

Do your homework thoroughly on the neighborhood, recent sales, and potential rental income if you’re investing. Our guide on Mistakes to Avoid When Buying First Mobile Home offers wisdom that applies to any first-time purchase – the importance of preparation can’t be overstated.

The best deals aren’t always the ones with the lowest price tags. They’re the ones where you’ve done your research, planned for contingencies, and kept your eyes wide open throughout the process.

A Safer Path to Affordable Homeownership

After exploring repossessed houses to buy, let’s be honest about what we’ve finded. Yes, the potential for 10-30% discounts is real and exciting. But so are the very real risks that come with these properties.

The challenge of finding truly good deals on repossessed homes has become increasingly difficult. You’re competing with seasoned investors who have deep pockets and years of experience. Even when you win the bidding war, you’re taking on a property sold “as-is” – which often means hidden damages, potential legal issues, and renovation costs that can quickly spiral out of control.

We’ve seen too many buyers get caught up in the excitement of a “bargain” only to find they’ve inherited someone else’s problems. Between the hidden repairs, legal battles over liens, and the stress of racing against tight closing deadlines, what seemed like a great deal can quickly become a financial nightmare.

That’s exactly why we started Manufactured Housing Consultants here in Corpus Christi. We believe there’s a better way to achieve affordable homeownership – one that doesn’t require you to gamble with your financial future.

When you choose a new manufactured home from us, you’re getting something no repossessed property can offer: complete peace of mind. Every home comes with a full warranty, so you’re protected from day one. There are no hidden repairs waiting to surprise you, no legal battles over previous owners’ debts, and no wondering what’s lurking behind the walls.

We work with 11 top manufacturers to bring you the largest selection of quality homes in Texas. Our guaranteed lowest prices mean you’re getting genuine value without the uncertainty. And here’s something you’ll never find with repossessed properties – we offer specialized financing for all credit situations, including programs designed to help improve your FICO score.

The best part? We handle everything from start to finish, delivering homes anywhere in Texas. No auction stress, no bidding wars, no racing against impossible deadlines. Just straightforward, honest service that puts your needs first.

If you’re tired of the uncertainty and risk that comes with repossessed houses to buy, we invite you to find how much easier homeownership can be. Why settle for someone else’s problems when you can start fresh with a brand-new home that’s built just for you?

Explore our affordable bank repo alternatives and see how we’re helping families across Texas find their perfect home without the stress and uncertainty of the repossessed property market.