Why Mobile Home Trade-Ins Are Your Fastest Path to Homeownership

Learning how to trade in a mobile home can be your ticket to upgrading your living situation without the stress of selling your current home first. Much like trading in a car, you use your current home’s value toward the purchase of a new one from a dealer. This one-stop solution eliminates the hassle of finding private buyers and coordinating two separate transactions.

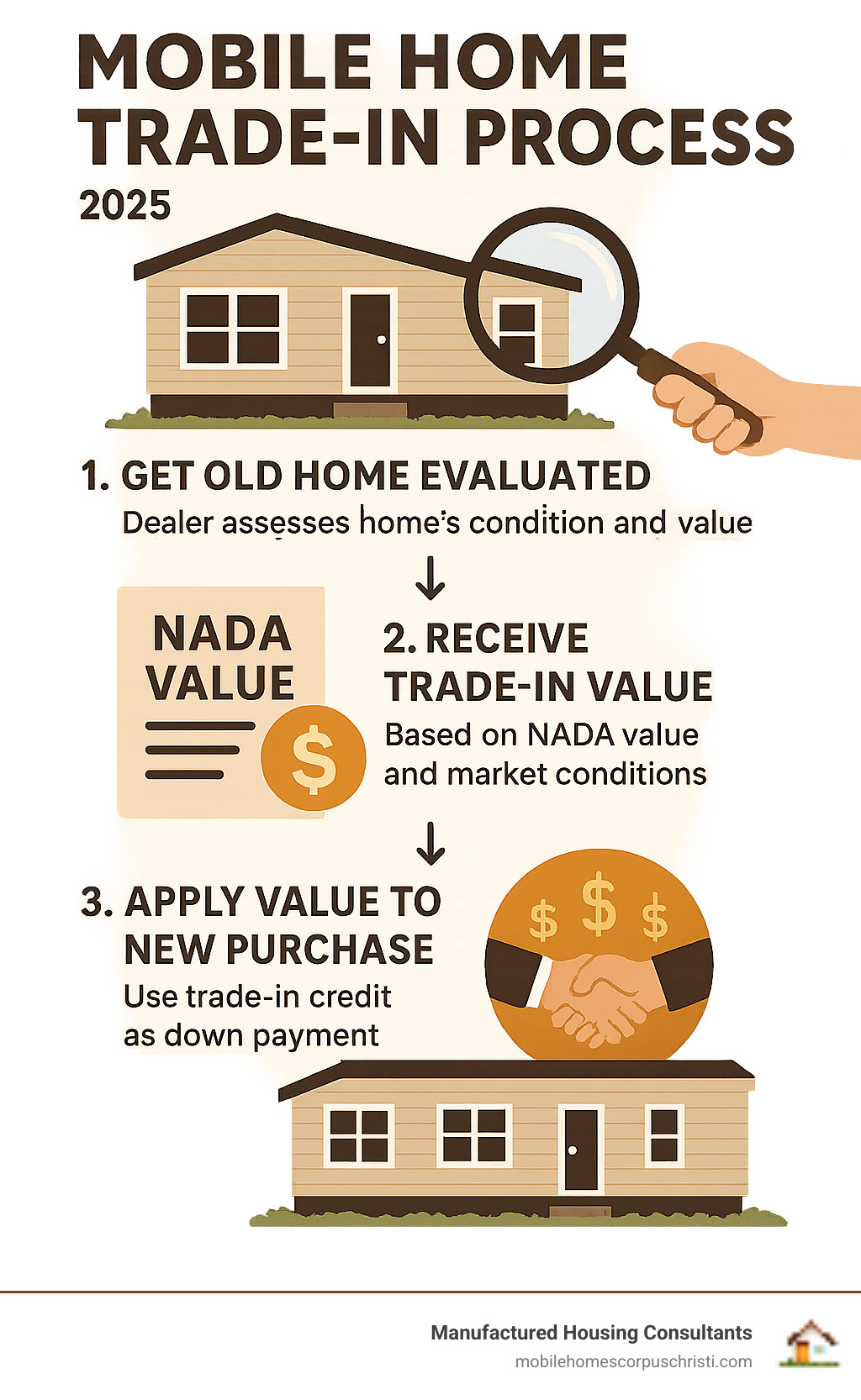

Here’s the quick overview:

Mobile Home Trade-In Process:

- Get your home evaluated – A dealer assesses your home’s condition and value.

- Receive a trade-in offer – The offer is based on NADA® value and market conditions.

- Apply value to new purchase – Your trade-in credit acts as a down payment.

- Complete the swap – The dealer coordinates your old home’s removal and new home’s delivery.

- Save on taxes – You only pay sales tax on the price difference, not the full amount.

As one industry expert noted, “Trade-in options for purchasing a new manufactured home are an innovative and often overlooked way of making homeownership more attainable.”

The primary advantages are avoiding the stress of a private sale, getting immediate credit toward your new home, and significant tax savings. However, it’s important to know that dealers must account for their own costs, so the trade-in value may be less than what you could get from a private sale. It’s a trade-off between maximum value and maximum convenience.

Understanding the Mobile Home Trade-In

What is a Mobile Home Trade-In?

A mobile home trade-in is a straightforward process: you exchange your current home for a new one through a dealer. Instead of selling your home privately, you use its equity as a down payment on your next home. This streamlined approach offers incredible convenience, whether you’re upgrading to a larger home or downsizing. We handle the complex details, making your current home a simple stepping stone to your new one.

Trade-In vs. Selling Directly to a Dealer: Which is Right for You?

You have two main paths for your current home: trading it in or selling it privately. The best choice depends on your priorities.

| Feature | Trade-In | Selling for Cash (Private Sale) |

|---|---|---|

| Convenience | High – one-stop-shop, dealer handles everything | Low – requires marketing, showings, negotiations, paperwork |

| Speed | Fast – often part of a single transaction | Variable – can be quick or take months |

| Value | May be lower than private sale | Potential for higher market value |

| Effort | Minimal | High |

| Sales Tax Savings | Yes, on the trade-in value | No, full sales tax on new purchase |

| Dealer Incentives | May offer promotions to make trade-in appealing | None |

| Outstanding Loan | Can often be rolled into new financing | Must be paid off before title transfer |

The biggest difference is convenience versus maximum value. A trade-in is a one-stop shop, saving you from marketing, showings, and uncertain timelines. A private sale can be slow and requires significant effort, from repairs and staging to advertising and negotiations.

While a dealer’s trade-in offer may be lower than a top-dollar private sale (as we must account for resale costs), the value is often balanced by speed, simplicity, and special dealer incentives like financing deals or upgrade packages. For many, avoiding the stress of a private sale is worth it.

If a smooth, hassle-free transition is your goal, learning how to trade in a mobile home is your best bet. You can find more about the Advantages of Trading In Your Mobile Home on our website.

The Pros and Cons of Trading In

Let’s summarize the key benefits and drawbacks of a mobile home trade-in.

Pros:

- One-Stop-Shop Experience: We handle everything from evaluation and financing to the final home swap. No juggling multiple companies or timelines.

- Streamlined Process: We manage all the complex logistics like title transfers, home removal, and new home delivery, so you can focus on the exciting parts.

- Sales Tax Savings: You only pay sales tax on the difference between the new home’s price and your trade-in value, which can save you thousands.

- Dealer Promotions: Gain access to special financing, upgrade packages, or discounts exclusive to trade-in customers.

Cons:

- Lower Value Than Private Sale: The trade-in offer reflects our costs for reconditioning, transport, and resale, so it may be less than what a private buyer would pay.

- Limited to Dealer’s Inventory: Your choice of a new home is limited to what the dealer offers, though our selection from 11 top manufacturers is extensive.

- Debt Can Carry Over: If you have an outstanding loan, it can be rolled into your new financing, which will increase the new loan amount.

The bottom line is a choice between convenience and maximizing profit. If speed and peace of mind are your priorities, a trade-in is an excellent solution.

How Your Mobile Home’s Trade-In Value is Determined

Multiple factors determine your home’s trade-in value. Here’s what we look for during an evaluation:

- Age and Manufacturer: Newer homes, especially those from reputable manufacturers, hold more value. Homes built after the June 1976 HUD code implementation are particularly desirable.

- Condition: The overall condition of the interior and exterior is crucial. This includes the roof, siding, flooring, fixtures, and appliances. A well-maintained home will always command a higher value.

- Size: Larger homes like double-wides or triple-wides typically have a higher value than single-wides due to more living space.

- Location and Foundation: While the home will be moved, its current location affects the ease and cost of removal. The type of foundation (e.g., permanent, piers) also influences its value.

- Upgrades: Modern updates like a renovated kitchen, energy-efficient windows, or new flooring can significantly boost your home’s trade-in value.

- Pre-HUD vs. Post-HUD: Homes built before June 15, 1976 (pre-HUD) are harder to value and finance than post-HUD homes that meet federal safety standards.

Understanding NADA® Value and Professional Appraisals

To determine a fair value, we use industry-standard tools and market expertise.

NADA Book Value is the primary starting point, similar to the Kelley Blue Book for cars. This guide from the National Automobile Dealers Association provides a baseline value based on your home’s manufacturer, model, year, and size. It’s a reliable benchmark for homes built after 1976.

However, NADA is a guide, not a final price. It doesn’t account for specific upgrades, unique features, or local market conditions. That’s why our hands-on inspection is so important. For highly unique homes, a professional market-based appraisal might be used, which involves a more detailed analysis of comparable sales.

We combine NADA guidelines with our physical evaluation and knowledge of the current market to present a fair trade-in offer. You can learn about NADA® value to better understand this industry standard.

‘In-Place’ vs. ‘Pull-Out’ Value: What’s the Difference?

Understanding this distinction is key when considering how to trade in a mobile home, as the difference in value can be substantial.

- In-Place Value: This is what your home is worth in its current location, including land improvements and utility connections. It’s the price a buyer would pay to live in the home without moving it.

- Pull-Out Value: This is the home’s value after subtracting the significant costs of moving it. These expenses include disconnecting utilities, disassembly, transport, and permits, which can run into thousands of dollars.

The gap between these two values is created by the cost of removal and transportation. For a trade-in, we must base our offer on the pull-out value, as we will be moving the home. This is why a trade-in offer might seem lower than the home’s in-place market value. Understanding this helps set realistic expectations about your trade-in offer.

The Step-by-Step Guide on How to Trade In a Mobile Home

A little preparation can make the trade-in process much smoother. Here are the essential first steps to take:

How to trade in a mobile home: The essential first steps

- Gather Your Documents: Locate your home’s title, as this is required to transfer ownership. Also, find the data plate (usually inside a cabinet or closet) to confirm the year, make, and model.

- Assess Your Home’s Condition: Do an honest walk-through and note any obvious issues, like leaks, damage, or broken fixtures. This helps set realistic expectations for the evaluation.

- Make Minor Repairs: You don’t need a major renovation, but small, cost-effective fixes can make a good impression. Replacing light bulbs, tightening handles, or patching small holes shows the home has been cared for.

- Take Clear Photos: Good photos of the interior and exterior can help us get a preliminary sense of your home’s condition and speed up the process.

These steps set the stage for a successful trade-in. You can also explore our services to see how we can help.

The Evaluation Process for Your Mobile Home Trade-In

The next step is the official evaluation. At Manufactured Housing Consultants, we pride ourselves on a transparent process.

First, schedule an in-person evaluation. While photos are helpful, a look by a specialist is essential. We’ll arrange a convenient time to visit your home for a professional assessment.

During the visit, our team conducts a thorough inspection, checking:

- Structural Integrity: Foundation, chassis, roof, walls, and subflooring.

- Exterior: Siding, windows, doors, and any attachments like decks.

- Interior: Flooring, walls, ceilings, and the general condition of each room.

- Home Systems: Plumbing, electrical, HVAC, and all included appliances.

After the inspection, we combine our findings with the NADA® value, market conditions, and estimated removal costs. We then present you with a formal, transparent trade-in offer, explaining exactly how we arrived at the figure. This value can be applied directly to the purchase of your new home.

Navigating the financials of how to trade in a mobile home

Understanding the financial side is crucial when learning how to trade in a mobile home.

Trading with an Existing Loan: You can absolutely trade in a home with a loan. The first step is to get a “payoff quote” from your lender, which is the exact amount needed to clear your debt. We factor this into the trade-in calculations.

- Positive Equity: If your trade-in value is higher than your loan payoff, the difference becomes a credit toward your new home’s down payment.

- Negative Equity: If you owe more than the home is worth, the remaining debt can often be rolled into your new home loan. This allows you to move forward without paying cash out-of-pocket to cover the difference.

Sales Tax Savings: A major financial benefit in Texas is that you only pay sales tax on the difference between the new home’s price and your trade-in value. For example, on a $100,000 new home with a $20,000 trade-in, you’re only taxed on $80,000, saving you a significant amount.

Your final purchase agreement will clearly detail the trade-in value, loan payoffs, and tax calculations. We offer specialized financing for all credit situations. You can learn more about Mobile Home Loans or Financing on our website.

Finalizing the Deal and Choosing Your New Home

This is the most exciting part: choosing your new home.

With your trade-in value confirmed, you can confidently browse our large selection of new homes from 11 top manufacturers. Your trade-in value is applied directly to the purchase price, serving as your down payment and reducing the amount you need to finance.

Once you’ve selected your new home, we’ll guide you through the final paperwork, including the purchase agreement and the title transfer for your old home. Our team handles all the legal details efficiently.

Finally, we coordinate the entire swap. We manage the removal of your old home and the delivery and setup of your new one, anywhere in Texas. This seamless coordination eliminates the stress of juggling contractors and timelines.

This comprehensive process ensures your journey ends with you holding the keys to your perfect new home. Ready to see what’s available? You can shop for your new home today!

Frequently Asked Questions about Mobile Home Trade-Ins

We understand that learning how to trade in a mobile home brings up plenty of questions. Here are the answers to the most common concerns our customers share with us.

Can I trade in a mobile home that still has a loan on it?

Yes, this is very common. We handle these transactions regularly. The first step is to get an official payoff quote from your lender.

If your home’s trade-in value is more than you owe (positive equity), we pay off the loan and the remaining amount is credited toward your new home. If you owe more than the trade-in value (negative equity), the difference can often be rolled into your new home’s financing. This allows you to upgrade without needing to pay off the old loan in cash first. We guide you through the entire process.

How does a trade-in affect my sales tax?

This is a major financial benefit. In Texas, you only pay sales tax on the difference between the new home’s price and your trade-in value. You do not pay sales tax on the trade-in value itself.

For example, if you buy a new $100,000 home and have a $30,000 trade-in, you only pay sales tax on $70,000. This can save you thousands of dollars compared to selling privately and then buying a new home, where you would pay tax on the full $100,000. Our team handles all the paperwork to ensure you receive this benefit.

What if my older mobile home has a very low trade-in value?

This is a common concern, especially for older (pre-1976) or poorly maintained homes. Sometimes, the cost to remove, transport, and recondition a home can exceed its resale value, resulting in a very low or even zero trade-in offer.

However, even if the direct trade-in value is minimal, we can often help. We look at the bigger picture of your new home purchase and may be able to absorb the removal cost as part of an overall incentive package. We’re always honest about the valuation and will work with you to find the best solution, whether that involves a trade-in or another approach.

Our goal is to help you into a new home. You can learn more about Important Things to Consider Before Buying a Mobile Home to help make your decision.

Conclusion: Is a Trade-In Your Path to a New Home?

Learning how to trade in a mobile home reveals a straightforward path to upgrading your living situation. The choice comes down to your priorities.

If you value convenience, speed, and simplicity, a trade-in is an ideal solution. It’s a one-stop process that eliminates the stress of a private sale, and the significant sales tax savings can make it a smart financial move. While a private sale might yield a higher price, it requires far more time and effort.

You should weigh your options based on your timeline and personal preference. At Manufactured Housing Consultants, we’ve helped countless Texas families make this transition smoothly. With the largest selection from 11 top manufacturers, guaranteed lowest prices, and specialized financing, we are committed to making your path to a new home as easy as possible.

Ready to see if a trade-in is right for you? Get a free evaluation and trade-in or sell us your old mobile home and let’s start the conversation today!