Why Texas Is the Perfect State to Buy Your Dream Home

When you’re ready to buy home Texas, you’re stepping into one of the most diverse and opportunity-rich housing markets in America. Texas offers everything from sprawling ranches to modern manufactured homes, with no state income tax and a thriving economy that continues to attract families nationwide.

Quick Guide to Buying a Home in Texas:

- Budget Planning – Median home prices range from $88,827 in smaller towns to $535,000 in Austin

- Get Pre-Approved – Secure financing with conventional, FHA, VA, or specialized manufactured home loans

- Choose Your Location – Consider property taxes, school districts, and commute times across 254 counties

- Find Your Home Type – Single-family homes, new construction, or quality manufactured homes

- Make an Offer – Include Texas-specific terms like the “option period” for inspections

- Complete Inspections – Check for common Texas issues like foundation problems and pest concerns

- Close and Move In – Review all documents carefully and get your keys

Texas stands out because it combines affordability with opportunity. While cities like Houston have a median listing price of $335,000, you can find quality homes for under $100,000 in towns like Coleman or Brady. The state’s unique benefits, including no state income tax and homestead exemptions, make homeownership more accessible. Whether you’re drawn to Austin’s tech boom or the quiet charm of smaller communities, the Lone Star State offers paths to homeownership for every budget, from traditional homes to modern manufactured housing.

Understanding the Texas Housing Landscape

When you’re ready to buy home Texas, you’re entering one of the most exciting and diverse real estate markets in the country. The beauty of the Texas housing market lies in its incredible variety, from downtown Austin condos to sprawling ranches and modern manufactured homes.

Current Market Trends and Prices

The median home price in Texas is around $345,000 as of 2024, but prices swing dramatically depending on location.

- Houston offers great value with a median listing price of about $335,000.

- Austin commands premium prices at approximately $535,000.

- Dallas follows close behind at around $384,990.

- San Antonio keeps things more affordable at about $274,383.

For budget-friendly options, small towns offer incredible opportunities. Coleman charms buyers at just $88,827, while Brady comes in at $101,169, and Brownwood offers quality living at $169,431. The current market has a heat index of 42, indicating a buyer’s market, which gives you negotiating power. Homes average about 52 days on the market, showing steady activity.

Key Factors to Consider in the Lone Star State

When you buy home Texas, some unique factors will impact your wallet and comfort.

- Property Taxes: Texas has some of the highest rates in the nation (around 1.74% of assessed value), but this is balanced by zero state income tax.

- The Texas Homestead Exemption: This program reduces your home’s taxable value, potentially saving you hundreds or thousands each year. Every eligible homeowner should apply. Check out The Texas Homestead Exemption for details.

- Utilities: Texas weather is intense. Summers are hot, so expect average utility costs of around $402 per month. Look for homes with energy-efficient features.

- Homeowners Insurance: Costs are significantly higher than the national average—about $4,142 per year—due to weather events like hurricanes and hailstorms.

- School Districts: Highly-rated school districts (check sources like GreatSchools) directly impact property values and are a key consideration for resale, even if you don’t have children.

- Commute Times: In sprawling Texas cities, traffic can be a major factor. Carefully consider your daily routes.

From Single-Family to Single-Wide: Types of Homes in Texas

Texas offers something for every lifestyle and budget.

- Single-family homes are the most common, offering private yards and space.

- Condos and townhomes provide urban convenience with less maintenance.

- New construction homes let you customize finishes and get the latest features.

- Existing homes offer character in established neighborhoods.

- Manufactured homes represent an incredible opportunity. Today’s models feature luxury amenities like stone fireplaces, granite countertops, and spacious porches. Built to strict quality standards, they often exceed site-built homes in energy efficiency. You can explore The pros and cons of manufactured homes to learn more.

Popular architectural styles include Ranch, Colonial, Craftsman, Modern Farmhouse, Mediterranean Revival, Victorian, Contemporary, and modern Manufactured homes, offering diverse designs that rival traditional construction.

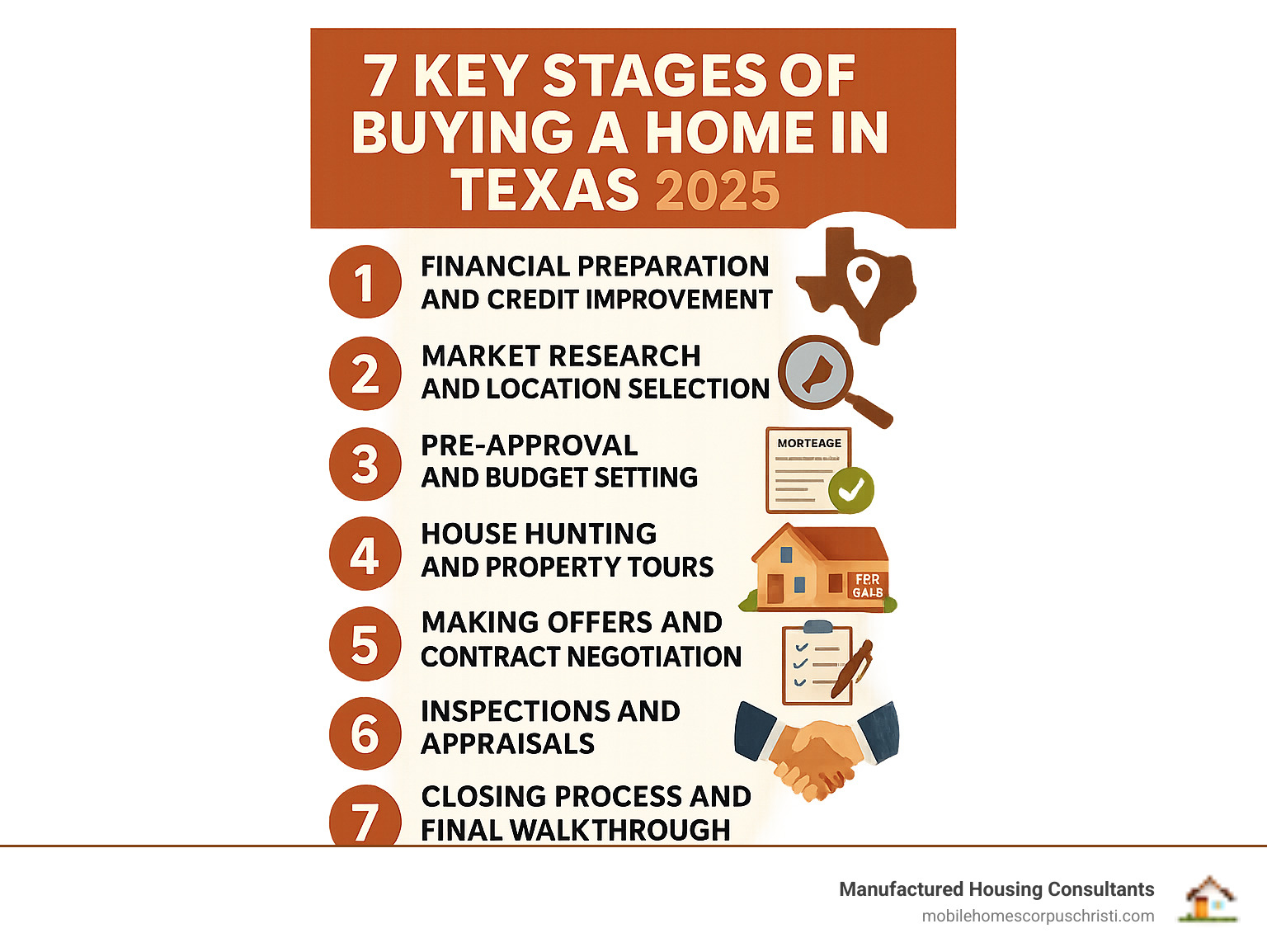

The Ultimate Step-by-Step Guide to Buy a Home in Texas

Ready to buy home Texas? This roadmap will guide you through the process, from financial prep to closing day.

Step 1: Financial Preparation Before You Buy a Home in Texas

Getting your finances in order is the first and most critical step.

Getting Your Budget Right

Determine what you can afford. Lenders often use the 28/36 rule: your housing costs shouldn’t exceed 28% of your gross monthly income, and total debt shouldn’t top 36%. For example, with a $5,000 monthly income, your ideal housing payment is around $1,400. Remember to factor in Texas’s average utility costs of $402 per month.

Your Credit Score Matters

Your credit score heavily influences your interest rate. A score of 740 or higher gets you the best rates, but scores in the 670-739 range are also strong. If your credit needs work, pay down debts and dispute errors. We offer FICO improvement programs to help strengthen your credit while you search for a home.

The Down Payment Reality Check

You don’t always need 20% down. FHA loans require as little as 3.5% down, and some conventional loans accept 3% from first-time buyers. For a $200,000 home, that’s $6,000-$7,000 instead of $40,000. Also, budget for closing costs, which are typically 2-5% of the purchase price. Many of our mobile home financing options can help reduce these upfront expenses.

Getting Pre-Approved Is Non-Negotiable

Get pre-approved by a lender before you start house hunting. A pre-approval letter shows sellers you’re a serious buyer and defines your borrowing limit. Shop around with different lenders, as rates and terms vary. Multiple credit inquiries for a mortgage within a 45-day period count as a single inquiry.

Step 2: Finding the Right Property and Agent

Now for the fun part—the house hunt.

Starting Your Search Online

Use real estate websites like Homes.com, Zillow, or HAR.com to filter by price, location, and features. You can take virtual tours and check out neighborhoods from your couch.

Separating Needs from Wants

Make two lists: absolute needs (e.g., three bedrooms, good school district) and nice-to-haves (e.g., two-car garage, updated kitchen). This keeps you focused and helps you stick to your budget.

Finding Your Real Estate Champion

A good local real estate agent is your advocate and negotiator. Look for agents with experience in your target area and check their reviews. In Texas, agents must represent either the buyer or seller exclusively, ensuring they fight for your interests.

Exploring Manufactured Housing Options

Don’t overlook manufactured homes. Today’s models feature luxury amenities like granite countertops and energy-efficient designs that rival traditional homes. At Manufactured Housing Consultants, we work with 11 top manufacturers to offer the largest selection in Texas. Whether you’re searching for mobile homes for sale in Texas or want new construction, we deliver anywhere in the state with financing for every credit situation.

New vs. Existing Manufactured Homes: What to Consider

- New manufactured homes offer full customization, modern energy efficiency, warranties, and the latest tech. The upfront cost is higher, but long-term maintenance is lower.

- Existing manufactured homes cost less initially but may need repairs. Financing can be more challenging for older models, but they are great for buyers who enjoy renovation projects.

Step 3: Making an Offer and Navigating the Contract

When you’ve found “the one,” it’s time to make an offer.

Crafting Your Winning Offer

Your offer includes the price, closing date, earnest money amount, and contingencies. Your agent will help you create a competitive yet protective offer.

Understanding Earnest Money

Earnest money is a “good faith” deposit, typically 1-3% of the purchase price, held in an escrow account. It shows the seller you’re serious and is usually applied to your down payment.

The Texas “Option Period” – Your Safety Net

The option period is a negotiated timeframe (usually 7-10 days) where you can terminate the contract for any reason without losing your earnest money. You pay a small, non-refundable option fee for this right. This period is crucial for conducting inspections and due diligence.

Seller Disclosures and Legal Requirements

Texas law requires sellers to provide a disclosure notice detailing any known property issues. Read this document carefully. Your agent will also provide the required Information About Brokerage Services form.

Step 4: Inspections, Appraisal, and Closing Day

These final steps ensure the property is sound before you get the keys.

The Home Inspection – Your Best Investment

A professional home inspection is crucial, even for new construction. Texas homes face unique issues like foundation problems, HVAC strain, roof damage from hail, and pests like termites. An inspection costs $300-$600 but can save you thousands.

Negotiating Repairs

After the inspection, you can ask the seller to fix major issues or provide repair credits. Focus on big-ticket items like the foundation, HVAC, or roof, not minor cosmetic flaws.

The Appraisal Process

Your lender will order an appraisal to confirm the home’s value supports the loan amount. If the appraisal is low, you may need to renegotiate, bring more cash to closing, or walk away.

Final Walkthrough and Closing Day

Before closing, do a final walkthrough to ensure the home is in the agreed-upon condition. On closing day, you’ll sign numerous documents and pay closing costs (3-5% of the purchase price in Texas). Once funds are transferred, you’re officially a Texas homeowner!

Financing Your Texas Home: Mortgages and Assistance Programs

Finding the right financing when you buy home Texas is easier than you think, thanks to the state’s numerous loan options and assistance programs. There’s a path to homeownership for nearly every situation, including for those rebuilding credit.

Common Loan Options for Texas Homebuyers

- Conventional Loans: The most popular choice, ideal for buyers with solid credit (620+) and a down payment of at least 3%. If you put down less than 20%, you’ll pay Private Mortgage Insurance (PMI).

- FHA Loans: Backed by the Federal Housing Administration, these loans require only 3.5% down and accept credit scores as low as 580, making them great for first-time buyers.

- VA Loans: An incredible benefit for veterans and active military, offering no down payment, no mortgage insurance, and competitive interest rates.

- USDA Loans: For homes in designated rural areas, these loans offer zero down payment financing for eligible buyers.

- Chattel Mortgages: These loans are specific to manufactured homes and are secured by the home itself rather than the land. At Manufactured Housing Consultants, we specialize in Mobile home financing options for all credit situations, including FICO improvement programs.

To learn more, you can research by Comparing mortgage loan types.

Tapping into Texas Homebuyer Assistance

Texas offers robust support for homebuyers.

- My First Texas Home: This program from the Texas State Affordable Housing Corporation offers competitive fixed-rate mortgages plus down payment assistance up to 5% of the loan amount for first-time buyers, veterans, or those who haven’t owned a home in three years.

- My Choice Texas Home: This program expands eligibility by removing the first-time buyer requirement, helping more families access affordable financing.

- Texas Mortgage Credit Certificate (MCC): This program provides a federal tax credit you can claim every year for a portion of your mortgage interest, potentially saving you thousands.

- Down Payment Assistance (DPA): Programs like Homes for Texas Heroes and Home Sweet Texas can provide up to 5% of your loan amount for down payment and closing costs, often as a forgivable loan.

We know credit challenges can be a hurdle. That’s why we offer specialized financing and FICO improvement programs. Our team provides resources like Avoiding common first-time buyer mistakes to ensure your journey is smooth.

Frequently Asked Questions about Buying a Home in Texas

How much do I need for a down payment in Texas?

You have flexible options. While a 20% down payment avoids Private Mortgage Insurance (PMI), it’s not required. FHA loans require as little as 3.5% down. For a home with a median price of $345,000, that’s about $12,075 instead of $69,000. Veterans or buyers in rural areas may qualify for VA or USDA loans with 0% down. Additionally, many Texas programs offer down payment assistance to help cover upfront costs.

Are property taxes really high in Texas?

Yes, Texas property taxes are among the highest in the nation, averaging around 1.74% of a home’s assessed value. However, this is balanced by the fact that Texas has no state income tax. This often offsets the higher property tax bills for most families. Furthermore, when you buy home Texas as your primary residence, you can apply for the Homestead Exemption, which reduces your property’s taxable value and lowers your annual tax bill.

What is the “option period” in a Texas real estate contract?

The option period is a powerful, buyer-friendly feature in Texas real estate. It’s a negotiated timeframe, typically 7 to 10 days, where you can terminate the contract for any reason without losing your earnest money deposit. To secure this right, you pay a small, non-refundable “option fee” to the seller. This period gives you a crucial window to conduct home inspections, get repair quotes, and perform other due diligence to ensure you’re making a sound investment when you buy home Texas.

Conclusion: Your Texas Dream Home Awaits

Congratulations! You now have the knowledge to steer the Texas home buying process with confidence. You understand the market’s diversity, from an $88,827 home in Coleman to a $535,000 home in Austin, and you know how factors like property taxes and the option period work.

The beauty of the Texas housing market is its variety. Whether you want a traditional ranch, a modern farmhouse, or a beautifully appointed manufactured home with granite countertops and energy-efficient features, Texas delivers options for every budget.

You don’t have to steer this journey alone. At Manufactured Housing Consultants, we’ve spent years helping families find their perfect home. We offer the largest selection of new manufactured homes from 11 top manufacturers at guaranteed lowest prices. More importantly, we provide specialized financing for all credit situations, including FICO improvement programs, because we believe everyone deserves a shot at homeownership.

Here’s what sets us apart: We deliver homes anywhere in Texas, work with buyers facing credit challenges, and prove that affordability and quality can go hand-in-hand. Our modern manufactured homes come with features that rival traditional stick-built homes, like stone fireplaces and energy-saving windows.

The Texas dream is real and achievable. With a wide range of home prices and robust assistance programs, homeownership is closer than you might think.

Your next step? Start exploring what’s available. Take a look at the beautiful, affordable options we have available, and let’s begin turning your Texas homeownership dream into reality.

Explore beautiful and affordable homes in Corpus Christi, Texas