Why Trading In Your Manufactured Home Makes Sense

When you trade in manufactured home for a newer model, you use your current home’s value as credit toward the new one, similar to trading in a car. This process simplifies your upgrade by eliminating the hassle of selling your old home separately. Instead of juggling two transactions, you handle everything through one dealer, making it a streamlined path to homeownership.

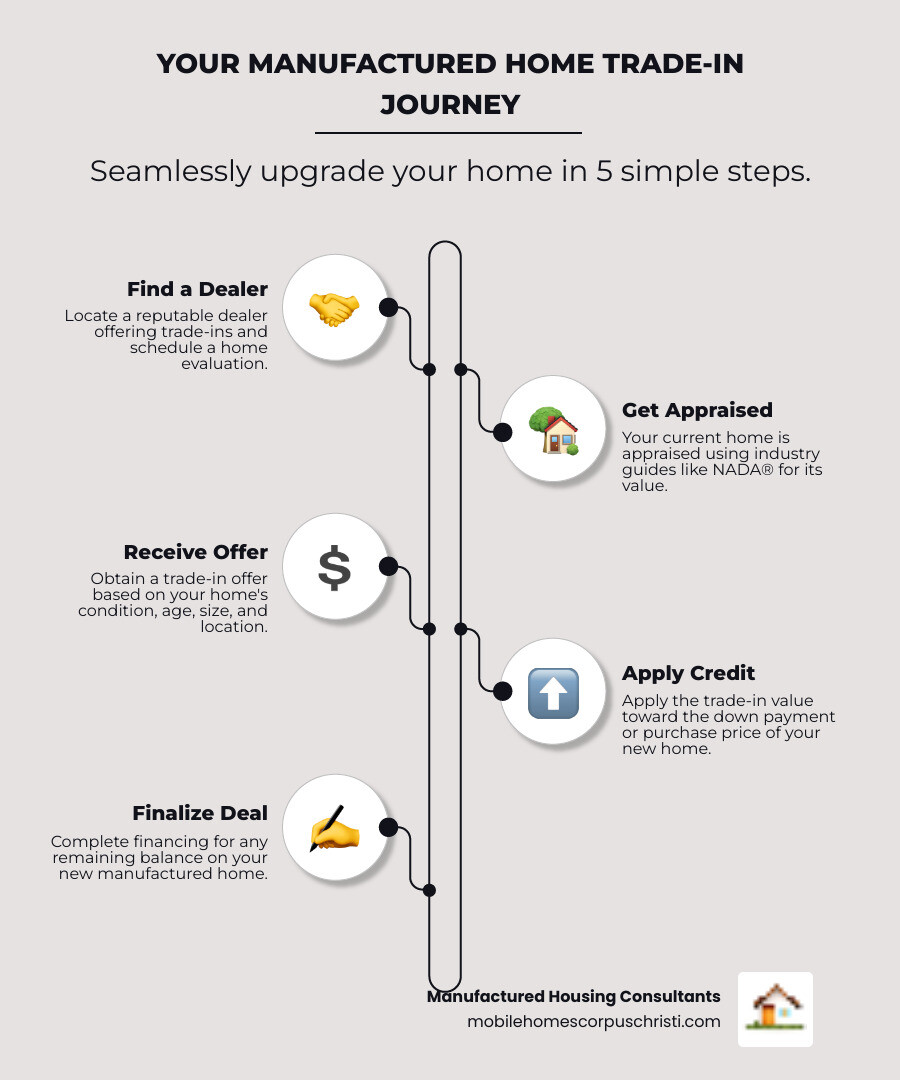

Quick Answer: Here’s how manufactured home trade-ins work:

- Find a dealer that accepts trade-ins and schedule a home evaluation.

- Get your home appraised using industry guides like NADA® value (for homes built after 1976).

- Receive a trade-in offer based on your home’s condition, age, size, and location.

- Apply the trade-in value toward the down payment or purchase price of your new home.

- Complete financing for any remaining balance on your new manufactured home.

Your trade-in value depends on several key factors: your home’s age and condition, whether it’s a single-wide or double-wide, its current location, and the costs involved in moving it. Homes built in 1976 or later have standardized NADA® values that dealers use as a starting point, though the final offer will reflect your specific situation.

While you might receive less than a private sale, the convenience is significant. You skip the stress of listing your home, showing it to buyers, and coordinating two closings. Plus, you often save on sales tax since you only pay tax on the difference between your trade-in value and your new home’s price.

Understanding the Manufactured Home Trade-In: Pros and Cons

If you’re dreaming of a new manufactured home with more space or modern, energy-efficient features, a trade in manufactured home can be an appealing option. However, it’s important to weigh the pros and cons to make the best choice for your family.

A manufactured home trade-in is a one-stop solution for upgrading. Instead of juggling two separate deals – selling your old home and buying a new one – you handle everything through a single dealer. It’s a simple, convenient, and smooth process.

The primary benefit is that your current home’s value becomes instant credit toward your new purchase. This means less money out of pocket upfront and potentially lower monthly payments. You also skip the process of listing your home, taking photos, and dealing with potential buyers.

If you’re curious about the bigger picture of manufactured home ownership, our guide on Pros and Cons of Buying a Mobile Home covers all the bases.

Trade-In vs. Selling Privately

Deciding whether to trade in manufactured home or sell it privately is a common question for homeowners.

| Feature | Trade-In | Private Sale |

|---|---|---|

| Speed of Transaction | Fast and streamlined – dealer handles everything | Can drag on for months waiting for the right buyer |

| Potential Value Received | Market value or slightly less (dealer needs profit margin) | Potentially higher since you keep the full sale price |

| Effort Required | Minimal – just show up and sign papers | Significant time investment in marketing and showings |

| Dealer Incentives | May include financing deals or free removal costs | You’re on your own |

| Market Value | Based on professional assessment and NADA® guides | Whatever buyers are willing to pay |

Choosing the trade-in route means you value your time and convenience. The dealer handles everything from determining fair value to finding the next owner, allowing you to focus on selecting your new home.

On the other hand, dealers need to cover their costs and make a profit, so they’ll offer market value or slightly less. If maximizing your return is the top priority, selling privately might yield more cash, but it will require significant effort on your part.

The Benefits of Trading In

Trading in your manufactured home offers several key advantages.

First, it’s hassle-free. You avoid weekend showings, keeping your home constantly “show-ready,” and negotiating with buyers. The dealer evaluates your home, makes an offer, and takes it off your hands.

Your trade-in value directly reduces your new home’s purchase price, acting as an instant discount. Less to finance means smaller monthly payments and a more manageable path to your upgraded home.

A bonus many people overlook is potential sales tax savings. In most states, you only pay sales tax on the difference between your new home’s price and your trade-in value. This can result in hundreds or even thousands of dollars in savings.

Ready to explore what’s possible with a new manufactured home? Our Upgrading to a New Mobile Home guide is packed with helpful insights.

Potential Drawbacks to Consider

It’s also important to be aware of the potential downsides.

The biggest concern is receiving a lower value than you might get from a private sale. Since dealers must cover costs for transport, cleanup, marketing, and profit, their offer will typically be less than what a private buyer might pay. You are essentially paying a premium for convenience.

You’ll also be limited to your dealer’s inventory when choosing your new home. While we at Manufactured Housing Consultants offer an extensive selection from 11 top manufacturers, smaller dealers may have fewer options. Ensure you can find a new home that fits your needs before committing.

Outstanding loan complications can also arise. If you still owe money on your current home, that debt must be handled. It can sometimes be rolled into your new loan, but this requires careful planning with your dealer and lender.

Don’t let these potential pitfalls catch you off guard. Our article on Most Common Mobile Home Buyer Mistakes can help you steer these issues.

How Your Manufactured Home’s Trade-In Value is Calculated

When you plan to trade in manufactured home, understanding its value is crucial. Dealers use a specific method to determine your home’s worth, combining industry-standard guides, professional appraisals, and current market demand. Knowing this process helps you enter negotiations feeling confident and prepared.

The valuation process starts with a baseline value, which is then adjusted based on your home’s specific condition and circumstances. Every upgrade, repair, and feature tells a story about your home’s worth.

The Role of Value Guides and Appraisals

If your manufactured home was built in 1976 or later, it has a NADA® value. Similar to the Blue Book for cars, NADA® provides a standardized value for manufactured homes and serves as a starting point for what your home might be worth.

These standardized price guides account for your home’s manufacturer, model, year, and general condition. While helpful for a ballpark figure, the valuation process doesn’t end there.

A professional appraisal is the next step. A dealer representative will conduct an in-person inspection to assess details an online guide cannot capture, such as recent renovations or needed repairs. These market-based appraisals are generally more reliable because they reflect your home’s actual condition and the local market.

To get a preliminary idea of where you stand, you can purchase a NADA® value report online.

Key Factors That Influence Your trade in manufactured home Value

Several key factors determine your home’s final trade-in value.

- Home condition is critical. An appraiser will inspect everything from flooring and paint to plumbing, electrical systems, appliances, windows, and the roof. A well-maintained, move-in-ready home will always command a higher value.

- Age and manufacturer also play a role. Newer homes typically hold their value better, and some manufacturers have stronger reputations for quality, which can increase the price.

- Size makes a difference. A double-wide home generally offers more value than a single-wide due to its larger space and additional features. More square footage usually translates to a higher trade-in value.

- Location can dramatically impact its value. A home on private land often commands a higher price than one in a leased community. The desirability of the neighborhood is also a factor.

- Foundation type can affect how the home is classified for financing, which influences its value. A permanent foundation often boosts worth.

- “In-place” versus “pull-out” value is a unique concept for manufactured homes. “In-place” value is what the home is worth in its current location, especially if it’s a desirable one. “Pull-out” value is its worth after being moved, which can be significantly lower as it becomes inventory that needs to be transported and re-sited.

- Transport costs are deducted from your offer. If moving your home is a complex or long-distance haul, that expense will reduce your trade-in value.

Understanding these factors helps you set realistic expectations. For more insights, check out our guide on What to Look For When Buying a Used Mobile Home.

Can I Trade In a Home That Needs Repairs?

Yes, you can trade in a home that needs repairs. You don’t need a perfect home to make a trade-in work.

When you trade in manufactured home that needs work, the dealer will assess the cost of those repairs and factor it into your trade-in value. It’s like selling “as-is”—the price reflects the work that needs to be done.

Honesty is the best policy. Be upfront about any known issues, such as a leaky faucet or a section of skirting that needs replacing. The dealer will conduct a thorough inspection, so transparency builds trust and smooths the process.

Dealers can work with homes needing both major repairs (like roofing or HVAC) and minor fixes. Even homes requiring significant work can have solid trade-in value if the structure is sound, the age is reasonable, and the location is desirable. Don’t let needed repairs stop you from exploring a trade-in.

The Step-by-Step Guide to a Successful Trade in Manufactured Home

Once you’ve decided to move forward, the trade-in process is straightforward. Following a clear set of steps will lead you from your current home to your new one efficiently.

The journey involves finding a trusted dealer, getting your home evaluated, understanding your equity, choosing your new home, and finalizing the financial details. This process typically takes just a few weeks, much faster than selling and buying separately.

Step 1: Find a Reputable Dealer and Get an Evaluation

Your first step is finding a dealer who specializes in manufactured home trade-ins. Not all dealers offer this service, so look for one with a solid reputation and a wide selection of new homes.

At Manufactured Housing Consultants, we’ve helped hundreds of Texas families steer this process. We make it straightforward and stress-free, offering the largest selection from 11 top manufacturers to give you plenty of options.

Next, schedule an in-person inspection of your current home. This is a thorough evaluation of its condition and marketability. Before the inspector arrives, gather your home’s details, including the year, manufacturer, model number, and dimensions. Having your title or lienholder information ready will also speed things up.

The inspector will assess your home’s interior and exterior, including appliances, flooring, walls, roof, and mechanical systems, as well as its location and potential moving costs. This evaluation forms the basis of your trade-in offer.

Step 2: Understand the Offer and Your Home’s Equity

After the evaluation, you’ll receive a trade-in offer. It’s important to understand how the dealer arrived at this number. A reputable dealer will explain the factors that influenced the valuation. The offer will account for the dealer’s costs to prepare and resell your home, so it may be less than a private sale price.

If you have an outstanding loan balance, this is the time to discuss how it will be handled. The dealer will work with you to determine your payoff amount and how it affects your equity. Your equity—the difference between your home’s value and what you owe—is what you can apply to your new purchase.

If you’ve been making payments for a year or more, you’ve likely built enough equity to significantly reduce your new home’s cost. This equity becomes your down payment or a direct credit, reducing the amount you need to finance.

While you can negotiate the offer, dealers must maintain reasonable profit margins. The goal is to find a fair deal for both parties.

Step 3: Choose Your New Home and Finalize the Financing

Now you can shop for your new home. With your trade-in value established, you’ll know your purchasing power. Explore different floor plans, features, and manufacturers to find the home that fits your needs and lifestyle.

Your trade-in value is applied directly to the new home’s purchase price, reducing the amount you finance. For example, if a new home costs $90,000 and your trade-in is worth $15,000, you only need to finance $75,000. This results in lower monthly payments and less interest paid over the life of the loan.

The final step is securing financing for the remaining balance. Working with a dealer who offers specialized financing is a major advantage. At Manufactured Housing Consultants, we work with borrowers in all credit situations and even offer FICO improvement solutions. Our team will guide you through the loan application, ensuring you understand all terms before you sign.

For a deeper dive into your financing options, check out our comprehensive guide on Mobile Home Loans or Financing.

Navigating the Financials and Paperwork

With your new home selected and the trade-in value set, the final stage involves handling the financials and paperwork. While this can seem complex, an experienced dealer can guide you through loan payoffs, title transfers, and tax considerations smoothly.

This stage is about ensuring all financial pieces fit together and the paperwork is squared away. Having professional guidance makes all the difference in ensuring a seamless transaction.

How Financing Works with a trade in manufactured home

Many people wonder if they can trade in a home that isn’t paid off. The answer is yes; in many situations, it’s possible to trade in a home with an outstanding loan.

Your equity acts as a down payment on your new home, which immediately reduces the amount you need to borrow. If your home is worth $25,000 and you owe $15,000, your $10,000 in equity becomes an instant credit toward your new purchase.

Any remaining loan balance can often be handled by rolling the debt into a new loan. The dealer works with your current lender to pay off the old loan, and the balance is incorporated into your new financing. This consolidates two loans into one for your upgraded home.

Lenders have different requirements for these transactions. Some may require the old loan to be settled before approving new financing, while others are comfortable with a rollover. We work with your current lender and our network of financing partners to find the best solution for you.

Our specialized financing options are designed to help Texas families regardless of their credit situation. For more information, see our guide on How to Budget for Your New Manufactured Home.

Essential Documentation for Your Trade-In

Having the right paperwork ready is essential for a smooth trade in manufactured home transaction. It makes the entire process much more efficient.

- Home Title or Lienholder Information: This is the most critical document. If your home is paid off, you’ll have the title. If not, your lender holds it, and you’ll need their contact and loan details to coordinate the payoff.

- Proof of Ownership: Copies of your original purchase agreement or loan documents help establish your ownership and can speed up verification.

- HUD Tag Information: This small metal plate on the exterior of your home contains crucial construction details. For homes built after 1976, this tag is often required for financing. If it’s missing, the U.S. Department of Housing can issue a Letter of Label Verification, but this process takes time.

- Loan Payoff Statement: If you have an existing loan, you’ll need an official statement from your lender showing the exact amount needed to clear your debt.

Our team will walk you through gathering these documents to ensure nothing falls through the cracks.

Understanding Tax Implications

There’s often good news when it comes to taxes and a trade in manufactured home.

In many states, you’ll only pay sales tax on the difference between your new home’s price and your trade-in value. For example, if your new home is $80,000 and your trade-in is worth $15,000, you might only pay sales tax on the $65,000 difference. This can save you a significant amount of money.

However, tax laws vary by state and can be complex. While we can offer general guidance based on our experience with Texas families, it’s always smart to consult a tax professional. They can review your specific situation and help you understand your tax liability and potential savings.

Conclusion: Take the Next Step Towards Your New Home

From understanding the process to navigating the financials, you now have the information needed to decide if a trade in manufactured home is the right choice for you.

Let’s recap the key benefits. The convenience and simplicity are significant; you handle the entire upgrade through a single transaction, avoiding the stress of selling your current home while shopping for a new one. The financial advantages are also compelling. Your trade-in value reduces the amount you need to finance and can lead to substantial sales tax savings.

Trading in offers a smart path to upgrading. Whether you need more space, modern features, or a fresh start, this process removes the biggest barrier most people face: what to do with their current home.

Here at Manufactured Housing Consultants, we aim to be the right partner for your trade-in journey. We understand every family’s situation is unique, which is why we offer the largest selection from 11 top manufacturers in Texas. Our guaranteed lowest prices ensure you get the best deal, and our specialized financing options work for all credit situations—we even help with FICO improvement.

We are committed to making homeownership accessible and deliver homes anywhere in Texas. Our team has guided countless families through the trade-in process, and we’re excited to help you with your next chapter.

The path to your new home is clearer than you might think. You don’t need perfect credit or a home in pristine condition. You need a partner who understands the process and puts your family’s needs first.

Ready to see what your current home is worth and explore your options? Visit our page to Trade-in or Sell Us Your Old Mobile Home and let’s start this exciting journey together. Your dream home is waiting.