A Simpler Path to Your New Home

Finding mobile home trade ins near me can be your fastest route to homeownership without the stress of selling your current home first. Here’s what you need to know:

Where to Find Mobile Home Trade-Ins:

- Local manufactured home retail centers

- Online dealer searches with service area filters

- Companies serving within 50-150 miles of major cities

- Specialized mobile home buying services

What You Can Trade:

- Single-wide and double-wide mobile homes

- Manufactured homes (built after 1976)

- Park models and modular homes

- Sometimes RVs, boats, or other titled assets

How It Works:

- Contact local dealers for evaluation

- Home inspection determines trade-in value

- Credit applied toward new home purchase

- Dealer handles removal and paperwork

Mobile home trade-in is becoming increasingly popular for homeowners who want to upgrade their living space without dealing with the complications of selling separately. As one industry expert notes: “Trading in your existing mobile home can help you offset the cost of a new, modern manufactured home.”

The process works just like trading in a car – you use your current home’s value to reduce what you pay for a new one. This means less money out of pocket and a much simpler path to better housing.

Most dealers offer free evaluations and can work with homes that aren’t fully paid off. The key is finding reputable dealers in your area who offer fair trade-in programs.

Explore more about mobile home trade ins near me:

- how to trade in a mobile home with a mortgage

- mobile home trade in value

- used mobile homes for sale in my area

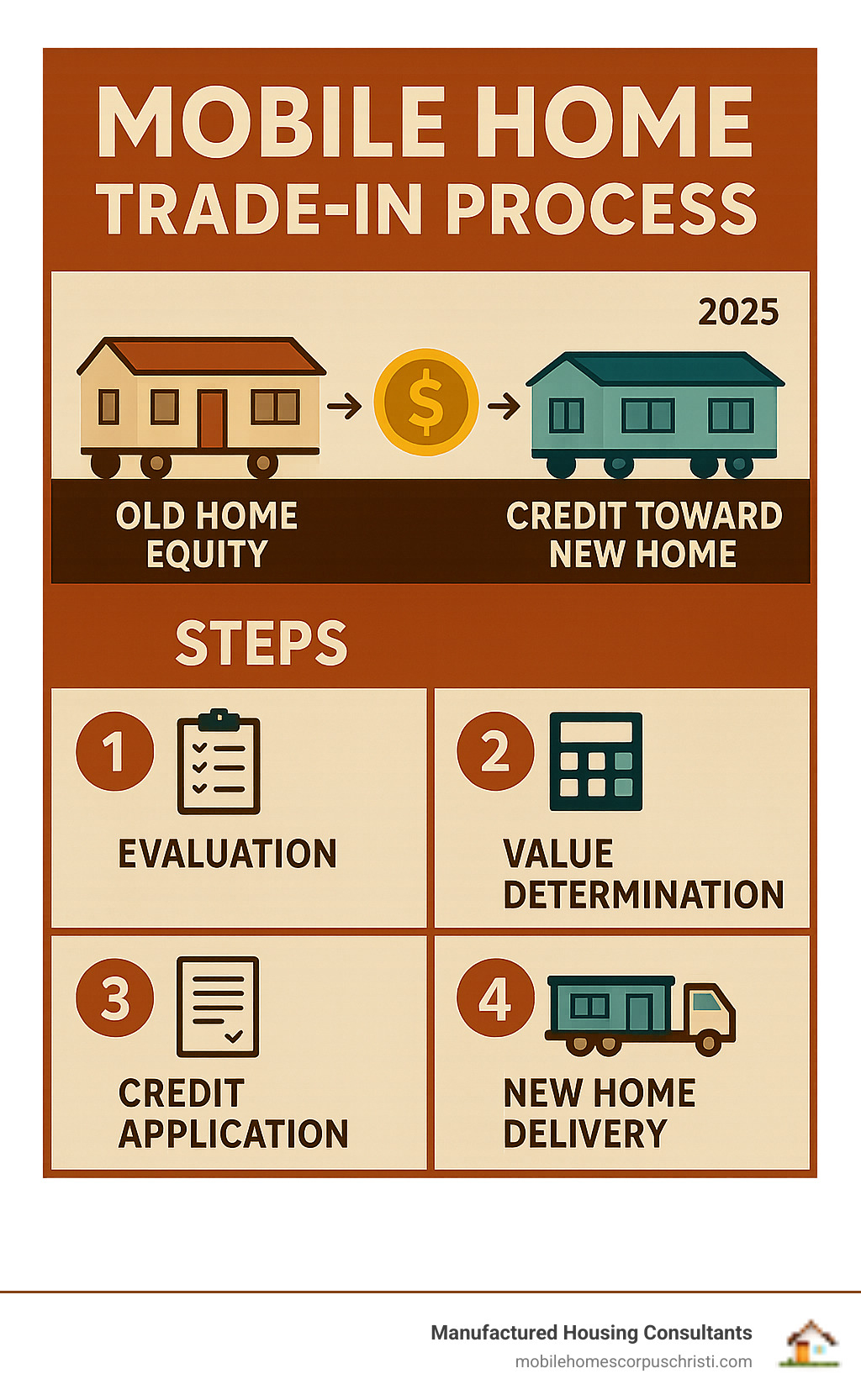

Understanding the Mobile Home Trade-In Process

When you’re searching for mobile home trade ins near me, you’re looking at one of the smartest ways to upgrade your living situation. Think of it just like trading in your car at the dealership – except this time, it’s your home that becomes the down payment for something better.

A mobile home trade-in lets you exchange your current home for credit toward a new manufactured home purchase. Instead of dealing with the headache of selling your old home yourself, the dealer handles everything. They evaluate your current home, give you a fair offer, and apply that value directly to your new home purchase. It’s truly a one-stop transaction that takes the stress out of upgrading.

The beauty of this process is that you don’t have to worry about finding buyers, showing your home, or coordinating two separate transactions. The dealer takes care of removing your old home and all the paperwork that comes with it.

How does the trade-in process work?

Getting started is easier than you might think. It all begins with an initial consultation where you tell us about your current home and what you’re hoping for in a new one. We’ll want to know the basics – your home’s year, make, model, and general condition.

Next comes the home inspection, where one of our representatives visits your property for a thorough evaluation. We look at everything from the foundation to the roof, checking both interior and exterior condition. This isn’t meant to be intimidating – we just want to make sure we give you the fairest possible value.

After the inspection, we’ll present you with a value offer based on what we found. If you’re happy with the offer, that credit gets applied directly to your new home purchase, reducing what you’ll pay out of pocket. Finally, we handle all the paperwork and title transfer for your old home, so you don’t have to stress about the details.

For a complete walkthrough of each step, check out our detailed guide on How to Trade In a Mobile Home.

What can be traded in?

You might be surprised by what counts as a trade-in! While most people think of single-wide homes and double-wide homes, we can work with much more than that. Manufactured homes built after 1976 are perfect candidates since they follow HUD codes and have established values.

Modular homes and park models are also great options for trade-ins. Park models are especially interesting – these smaller recreational homes often have owners who are ready to upgrade to full-time living spaces.

Here’s where it gets really interesting: some dealers will even accept other titled assets like RVs or boats. If you have a boat sitting in your driveway that you never use, it might just help you get into your dream home! The key is having a clear title – if it’s titled, it might have trade-in value.

How does financing work with a trade-in?

This is where trade-ins really shine financially. Your home’s trade-in value works like a substantial down payment, which means you need to finance less money for your new home. Lower loan amount equals lower monthly payments – it’s that simple.

The process is straightforward: after we evaluate your trade-in, the approved value gets subtracted from your new home’s price. Lender requirements are typically easier to meet when you have this built-in equity working for you.

There’s also a nice tax benefit – you only pay sales tax on the remaining balance after your trade-in credit is applied, not on the full price of your new home. That can add up to real savings.

If your current home isn’t paid off yet, don’t worry. We work directly with your lender to handle the payoff as part of the transaction. For all the details on this situation, read our guide on How to Trade In a Mobile Home With a Mortgage.

At Manufactured Housing Consultants, we offer specialized financing for all credit situations, making the whole process smoother for you.

How Your Mobile Home’s Trade-In Value is Calculated

Understanding how your home’s value is determined can help you prepare for a mobile home trade ins near me search with realistic expectations. The process isn’t as mysterious as it might seem, and knowing what goes into the calculation puts you in a better position to get the best possible value.

We use two main approaches when evaluating your home: market-based appraisals and the NADA® book value. Think of it like getting your car appraised – we look at both what similar homes are selling for and what the official guides say your home should be worth.

Our goal is always to ensure you’re getting a fair value that reflects your home’s true condition and market appeal. This usually means one of our representatives will visit your home in person to see exactly what we’re working with.

For more detailed insights into how your home’s worth is assessed, check out our page on Mobile Home Trade In Value.

The Role of the NADA® Value Guide

The NADA® guide is like the Kelley Blue Book for manufactured homes. If you’ve ever traded in a car, you’ll understand how this works – it’s the industry standard that gives us a starting point for valuation.

This guide is particularly reliable for manufactured homes built in 1976 or later. You input details about your home like the year, make, model, size, and condition, and it spits out an estimated value. Pretty straightforward, right?

But here’s the thing – while the NADA® value gives us a solid baseline, it’s just one piece of the puzzle. Your home has unique characteristics that a standardized guide can’t fully capture. Maybe you’ve made improvements, or perhaps your home is in an especially desirable location.

You can explore more about NADA® values on their official website: NADA® value information.

Key factors that affect your trade-in value

Beyond what the NADA® guide tells us, several real-world factors can significantly bump up or bring down your trade-in value. Understanding these helps you see the complete picture of what makes your home valuable.

Home condition is probably the biggest factor you can actually control. A well-maintained home with clean interiors, working appliances, and a solid exterior will always command a higher value. Even small things like fresh paint or deep cleaning can make a noticeable difference in your evaluation.

The age and size of your home matter quite a bit too. Newer homes naturally hold their value better, and larger homes – whether double-wide or triple-wide – typically have higher base values than single-wides. It’s simple math: more space usually means more value.

Your foundation type can be a game-changer. Homes on permanent foundations often appraise more like traditional site-built homes, which can significantly boost their value compared to homes that can be easily moved.

Location plays a crucial role in determining whether we’re looking at “in-place” value or “pull-out” value. If your home is nicely situated in a manufactured home community, its in-place value is generally much higher. However, if we need to remove it to make room for your new home, those transport and removal costs come directly out of the trade-in value.

Unfortunately, these moving costs can sometimes make older homes worth very little in a trade-in situation. In some cases, especially with pre-HUD homes, the value might only be what we can get for salvage materials.

On the bright side, upgrades you’ve made can really pay off. New appliances, updated HVAC systems, fresh flooring, or modern fixtures all demonstrate that you’ve cared for your home and can add real value to your trade-in.

Does my home need to be paid off?

Here’s some good news: your home does not need to be completely paid off before you can trade it in. We work with homeowners who still have mortgages all the time.

When you owe money on your current home, we use your trade-in value to pay off that remaining loan balance first. Any equity left over – that’s the amount remaining after your loan is satisfied – gets applied as credit toward your new home purchase.

Sometimes the trade-in value might be less than what you still owe. Don’t panic if this happens! We can often roll that remaining balance into the financing for your new home, or work out other solutions that make sense for your situation.

The key is being upfront about your loan situation from the beginning. We’ll work directly with your current lender to handle all the payoff details, making the transition as smooth as possible for you. Our team specializes in financing for all credit situations, so we’re pretty good at finding creative solutions that work.

Finding Mobile Home Trade Ins Near Me

Finding the right dealer for mobile home trade ins near me can feel overwhelming at first, but it doesn’t have to be. The key is finding a partner who truly understands your local market and offers transparent, fair evaluations. You want someone who’s been in the business long enough to know what they’re doing and who treats you like family, not just another transaction.

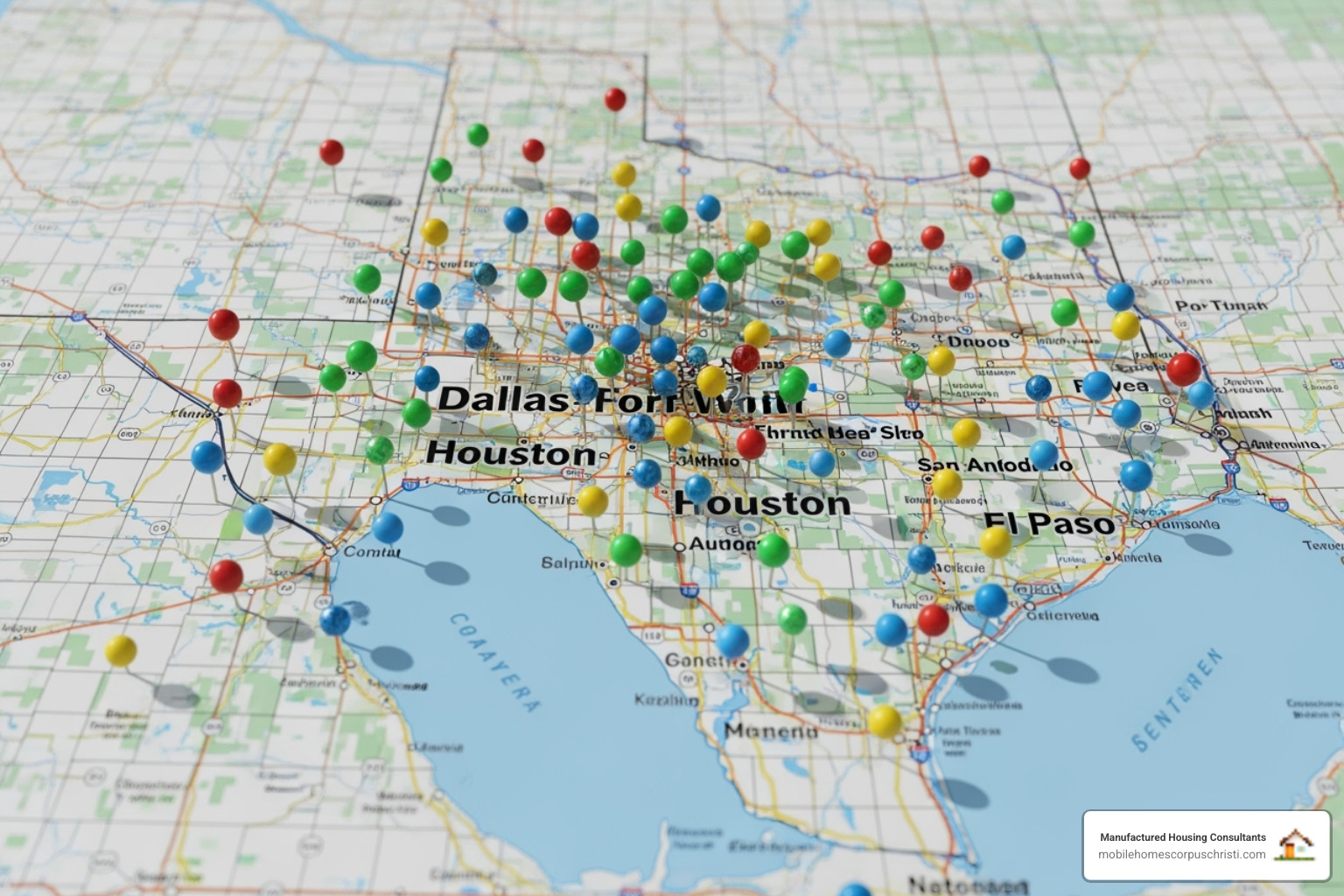

At Manufactured Housing Consultants, we’ve built our reputation on exactly that approach. Based in Corpus Christi, we offer Texas-wide delivery and trade-in services, which means whether you’re in Houston, Dallas, San Antonio, or a small town in East Texas, we can help you turn your current home into the down payment for your dream home.

What sets apart a great trade-in program? Local expertise makes all the difference. We understand Texas markets, from the coastal areas where humidity affects home condition to the dry regions where different challenges arise. This knowledge helps us give you the most accurate and fair evaluation possible.

To get a sense of what’s available in your area, check out our guide on Finding Mobile Homes for Sale in Corpus Christi.

Where to start your search for mobile home trade ins near me

Starting your search for mobile home trade ins near me is actually pretty straightforward once you know where to look. Your best bet is to begin with an online search, but here’s a pro tip: always check the service areas carefully. Some dealers might sound perfect until you realize they only work within a 50-mile radius of their location.

Local manufactured home retail centers should be your primary focus. These businesses live and breathe mobile homes, and most have established trade-in programs because it benefits everyone involved. You get a hassle-free way to upgrade, and they get a satisfied customer plus inventory for their used home lot.

Don’t be shy about calling dealers directly to ask about their trade-in programs. The conversation might go something like, “I’m looking to upgrade my mobile home and wondering if you offer trade-ins?” Most reputable dealers will be happy to explain their process, what types of homes they accept, and how they determine values.

The beauty of working with a company that offers statewide service is that you’re not limited by geography. We can evaluate your current home and deliver your new one anywhere in Texas, giving you access to our full inventory regardless of where you live.

Preparing for a trade-in evaluation

Once you’ve found a dealer who handles mobile home trade ins near me, it’s time to get your home ready for its close-up. Think of it like preparing for a job interview – you want to make the best possible first impression.

Gathering your paperwork is step one. You’ll need your title, year, make, and model information. If you can’t locate your title right away, don’t panic – knowing the basic details about your home is a good starting point, and we can help you figure out the rest.

Minor repairs and a good cleaning can make a surprising difference in your trade-in value. We’re not talking about major renovations here – just fixing obvious issues like leaky faucets, broken light fixtures, or torn screens. A thorough cleaning inside and out shows you’ve cared for your home and helps evaluators see its true potential.

Clear photos of both interior and exterior spaces can be helpful, especially if you’re starting with a phone consultation. Focus on well-lit shots that show off any upgrades or special features your home has. Good lighting makes everything look better – just ask any real estate agent!

A little effort upfront can translate into a better trade-in offer, which means more credit toward your new home.

Questions to ask dealers about mobile home trade ins near me

When you’re shopping around for mobile home trade ins near me, coming prepared with the right questions can save you time and help you avoid surprises later. Think of this as your chance to interview the dealer – after all, you’re trusting them with a significant financial transaction.

“What exactly is your evaluation process?” This is your starting question. You want to understand whether they use NADA® values, market appraisals, or a combination of both. A good dealer will explain their methodology clearly and tell you what aspects of your home they prioritize during inspection.

“Are there any removal or transport fees I should know about?” This question is crucial because these costs can significantly impact your final trade-in value. Some dealers include removal in their service, while others subtract these expenses from your trade-in credit. Getting this information upfront prevents unwelcome surprises.

“How do you determine the final value?” Ask for a breakdown of their decision-making process. How do they factor in condition, location, age, and any outstanding loans? Understanding their formula helps you know what to expect and whether their offer is fair.

“Can I apply my trade-in credit to any home in your inventory?” This matters more than you might think. Some dealers limit trade-in credits to specific models or manufacturers, which could restrict your choices. We’re proud to offer the largest selection from 11 top manufacturers, so your trade-in credit opens doors to incredible variety.

Ready to see what options await you? Take a look at our current inventory when you Shop our available homes – you might be surprised by what your trade-in can get you!

The Benefits and Drawbacks of Trading In

Making the decision to trade in your mobile home is a significant choice, and it’s important to weigh the convenience against the potential value you might receive. We want you to make an informed decision that’s right for your unique situation. While trading in is an incredibly popular and viable option for many homeowners looking to upgrade, it’s wise to understand both its major advantages and potential considerations.

When comparing mobile home trade ins near me to a private sale, the differences are quite clear. A trade-in offers convenience and speed – you can complete everything in conjunction with your new home purchase. The dealer handles all the logistics, and you avoid the hassles of marketing, showing, and negotiating with potential buyers. However, you might receive a lower value than what you could potentially get through a private sale.

On the flip side, a private sale could yield a higher selling price and gives you more control, but it’s time-consuming and uncertain. You’ll need to handle marketing, deal with potential buyers, and there’s no guarantee your home will sell quickly – or at all. The speed difference alone makes trading in attractive for many families.

For more details on whether trading in is the right path for you, explore our article: Can You Trade In a Mobile Home?.

Major Benefits of a Mobile Home Trade-In

The appeal of a mobile home trade-in lies largely in its simplicity and efficiency. It’s truly a game-changer for many homeowners looking to upgrade without the stress of managing two separate transactions.

Convenience is perhaps the biggest perk. Instead of juggling the sale of your old home while trying to purchase a new one, a trade-in combines everything into a single, streamlined process. You hand over your old home, and we help you into your new one. It’s genuinely a one-stop-shop that saves you immense time and stress.

You’ll also avoid all the hassles of a private sale. Selling a mobile home privately can be exhausting – marketing the home, fielding inquiries from curious neighbors and serious buyers alike, scheduling showings around your work schedule, negotiating with potential buyers, and navigating complex paperwork. With a trade-in, all that hassle simply disappears.

The financial advantages are substantial too. Your trade-in value directly offsets the cost of your new home, effectively reducing the amount you need to borrow or pay out of pocket. It acts like an instant discount on your upgrade. Plus, you won’t pay sales tax on the trade-in value itself – only on the remaining balance of your new home after the credit is applied.

For many families, the trade-in value serves as a significant down payment for their new manufactured home. This is incredibly helpful, especially if you don’t have a large amount of cash readily available. Your existing home becomes the key that open ups your new home.

Finally, we handle all the old home removal for you. This often-overlooked benefit saves you the time, effort, and considerable expense of hiring movers, obtaining permits, and coordinating the complex logistics of mobile home transport yourself.

Potential Drawbacks and Considerations

While the benefits are compelling, it’s equally important to understand the potential drawbacks when opting for mobile home trade ins near me. Being informed helps you set realistic expectations and ensures the best outcome for your situation.

The value you receive may be less than a private sale. When we take your home as a trade-in, we’re also taking on all the costs and risks associated with it. We need to transport it, potentially refurbish it, market it, and hold it in our inventory until it sells. These operational realities mean the trade-in value we offer might be lower than what you could potentially get handling everything yourself.

Dealer costs are naturally factored in to any trade-in offer. The costs for removal, transport, and inventory management all impact the allowance we can provide for your mobile home. It’s simply the reality of how the business works, but we’re always transparent about this process.

Older homes may have minimal value due to high removal costs. This is especially true for pre-1976 homes or homes in poor condition. Sometimes the costs of removal and transport can outweigh the home’s market value, resulting in a minimal trade-in offer or even salvage value. However, even in these cases, the convenience of having us handle removal might be worth it to avoid the expense and effort of disposal yourself.

You’ll also be limited to our inventory for your new home. While we’re proud to offer the largest selection from 11 top manufacturers, if you had your heart set on a very specific home that only another dealer carried, a trade-in might limit that flexibility.

The success of a trade-in depends on multiple variables, and our goal is to help you understand all of them so you can make the best decision for your family’s future.

Conclusion: Take the Next Step Towards Your New Home

Trading in your mobile home has emerged as one of the most convenient and popular options for homeowners ready to upgrade their living situation. Throughout this guide, we’ve explored how you can use your current home’s value to directly offset the cost of a new manufactured home, creating a streamlined path to better housing.

The trade-in process offers remarkable advantages: simplified financing where your home’s value acts as a down payment, elimination of private sale headaches, and professional handling of old home removal. You’ll save on sales tax since you only pay on the remaining balance after your trade-in credit is applied.

Of course, every option has its considerations. The trade-in value you receive may be less than what you could potentially get through a private sale, since dealer costs for removal, transport, and inventory are factored into the offer. For older homes, especially those built before 1976, removal costs might significantly impact the trade-in value.

The key is weighing these pros and cons against your specific situation. If convenience, speed, and simplicity matter more to you than potentially maximizing every dollar, a trade-in could be your perfect solution. Research is essential – understanding your home’s condition, gathering your documentation, and asking the right questions will help you make the best decision.

At Manufactured Housing Consultants, we bring decades of expertise to your trade-in journey. Based in Corpus Christi, we proudly serve homeowners throughout Texas with specialized financing for all credit situations and FICO improvement programs. Our selection from 11 top manufacturers means you’ll have incredible options for your new home, and our guaranteed lowest prices ensure you’re getting exceptional value.

We handle everything from the initial evaluation of your current home to the delivery and setup of your new manufactured home. Our team understands that this is more than just a transaction – it’s about finding you a better place to call home.

Ready to find what your current home is worth and explore the exciting possibilities for your new manufactured home? Let’s start this journey together.