What Are Bank Repossessed Homes and Why They Matter

Bank repos homes are manufactured homes that lenders have taken back after the original owner couldn’t make their mortgage payments. Here’s what you need to know:

Quick Facts About Bank Repos Homes:

- Definition: Foreclosed properties sold by banks to recover loan losses

- Pricing: Often available at 20-60% below market value

- Condition: Sold “as-is” with no warranties or guarantees

- Competition: High demand can lead to bidding wars

- Financing: May require specialized lenders or cash purchases

For budget-conscious families facing credit challenges or high housing costs, bank repos homes offer a path to affordable homeownership. Banks don’t want to be landlords – they’re in the lending business, not the housing business. This creates opportunities for savvy buyers who understand the risks.

As one industry expert notes: “Banks are often not motivated to sell their foreclosure properties quickly or at a fair market value,” but when they do sell, the discounts can be substantial.

The process starts when homeowners fall behind on payments. After several missed payments and legal proceedings, the bank takes ownership and lists the property for sale. These homes can offer incredible value, but they come with unique challenges that traditional home purchases don’t have.

Whether you’re a first-time buyer or looking for investment opportunities, understanding how bank repos work is crucial before diving in.

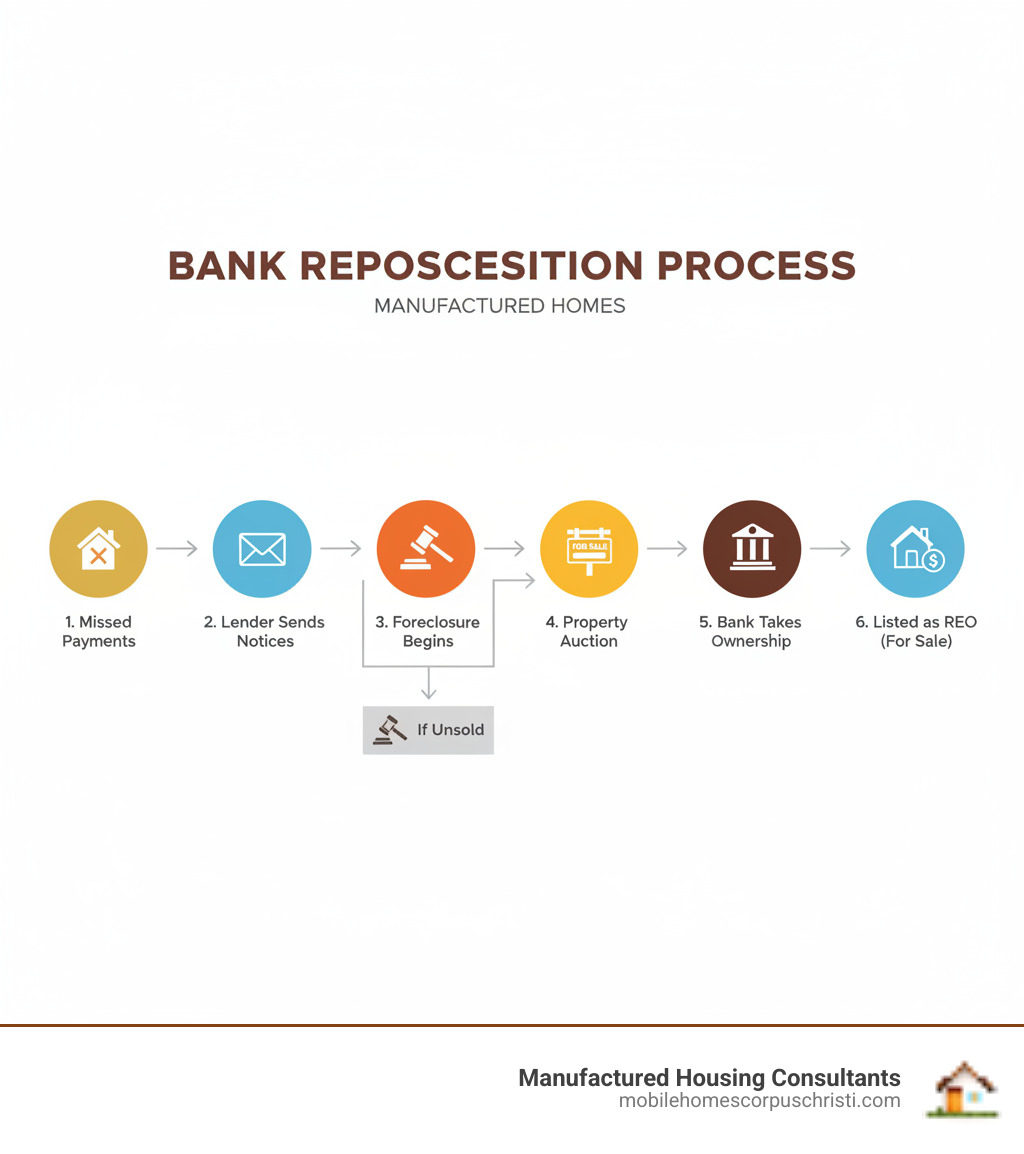

The Foreclosure Process: How a Manufactured Home Becomes Bank-Owned

Nobody wants to lose their home. And honestly, banks don’t want to take them either. When we talk about bank repos homes, we’re looking at manufactured homes that have traveled a difficult path from someone’s dream home to a bank’s unwanted asset.

The journey typically starts with missed payments. Life happens – job loss, medical bills, divorce – and suddenly those monthly mortgage payments become impossible to make. At first, the lender will try to work things out. They’d much rather have you paying something than nothing at all.

But when homeowners can’t pay and negotiations fail, the foreclosure legal process begins. The bank sends a Notice of Default, which is essentially a formal “wake up call” that says “pay up or we’ll have to take action.” This isn’t the end of the road though – even at this stage, many lenders are still open to finding solutions.

If the situation can’t be resolved, the bank moves forward with lender action to repossess the property. This is when your manufactured home officially becomes a bank-owned or REO property (Real Estate Owned). The bank didn’t want to become your landlord – they’re in the money business, not the housing business – so now their main goal is to sell it quickly and recover their losses.

For a complete picture of how this unfolds specifically for mobile homes, check out our Repo Mobile Homes: A Complete Guide.

Types of Foreclosure Sales

How a bank sells a foreclosed manufactured home depends on where you live and what was written in the original mortgage contract. The process varies by state and province, but there are two main approaches you’ll encounter:

Judicial Sale involves the court system every step of the way. The bank has to get a judge’s permission to sell the property, and often the court has to approve the final sale price too. It’s slower, but there’s lots of legal oversight. These properties usually end up at a public auction where anyone can bid.

Power of Sale is much faster and simpler, as long as there’s a clause in the mortgage contract that allows it. The bank can sell the property without getting the courts heavily involved, though they still have to try to get a fair market price. This is the most common way bank repos homes end up for sale.

Once the bank takes ownership through either method, they want that property off their books as quickly as possible. That’s when it gets listed as an REO property and becomes available to buyers like you – often at prices well below what similar homes are selling for.

The silver lining? All this legal complexity creates real opportunities for smart buyers who understand the process.

Weighing the Pros and Cons of Bank Repos Homes

Thinking about buying a bank repos home? You’re not alone! These manufactured homes can offer incredible opportunities, but they’re definitely not for everyone. It’s kind of like finding a designer jacket at a thrift store – it might be an amazing deal, or it might have a hidden stain that costs more to fix than buying new.

The key is doing your homework and understanding exactly what you’re getting into. Every bank repos home purchase requires due diligence and treating it as a calculated risk. For a broader look at manufactured home ownership, check out our guide on Pros and Cons of Buying a Mobile Home.

The Benefits: Why Buyers Are Attracted to Repos

Let’s start with the good news – there’s a reason people get excited about bank repos homes! The biggest draw is simple: below market value pricing. Banks aren’t in the real estate business; they’re in the lending business. When they end up owning a manufactured home, they want it off their books as quickly as possible.

This urgency creates significant discounts for buyers. We’ve seen properties sell for 20-60% below their actual market value. That’s not just a small savings – that’s life-changing money for many families.

The lender motivation to sell also puts you in a much better negotiation position. Unlike emotional sellers who might have fond memories attached to their home, banks look at these properties as numbers on a spreadsheet. They’re often willing to negotiate on price, closing costs, and terms because their main goal is recovering their investment.

This discount pricing can create increased equity from day one. Imagine buying a manufactured home worth $80,000 for just $50,000. You’ve instantly built $30,000 in equity! For investors, this represents serious investment potential. You can learn more about this opportunity in our guide to Buy Foreclosed Homes for Cheap.

The Potential Risks of Buying Bank Repos Homes

Now for the reality check. Bank repos homes come with some serious risks that can turn your dream deal into a nightmare if you’re not prepared.

The biggest challenge is the ‘as-is’ condition with no warranties. When banks sell these homes, they’re basically saying “what you see is what you get” – and sometimes what you don’t see is the real problem. There are no guarantees, no promises, and no take-backs if you find issues later.

Hidden damages are a real concern. Previous owners facing foreclosure might have skipped maintenance or, unfortunately, sometimes even caused intentional damage out of frustration. That beautiful manufactured home might have costly repairs lurking beneath the surface – anything from roof leaks to electrical problems to plumbing issues.

The lack of maintenance history makes things even trickier. Banks typically don’t know when the HVAC was last serviced, if there’s been water damage, or what repairs have been done. You’re buying blind unless you do a thorough inspection. Our guide on What to Look For When Buying a Used Mobile Home can help you know what to check.

Don’t forget about the high competition factor. Those attractive prices draw crowds, including professional investors who flip houses for a living. This can lead to bidding wars that drive prices back up, sometimes eliminating the savings you were hoping for. As one expert notes, finding foreclosures in a hot market can be especially challenging due to this competition.

Finally, watch out for title issues and outstanding liens. While banks usually clear these up, it’s not guaranteed. You might find unpaid taxes, contractor liens, or other legal issues that become your responsibility after purchase.

The bottom line? Bank repos homes can be fantastic opportunities, but they’re not for the faint of heart. They work best for buyers who have some cash reserves for unexpected repairs, aren’t afraid of a little work, and understand that the lowest price doesn’t always mean the best deal.

Your Step-by-Step Guide to Purchasing a Bank Repo Manufactured Home

Buying a bank repos home is like preparing for an adventure – you need the right gear, a solid plan, and a trusted guide. The process differs from traditional home buying, but with proper preparation, you’ll be well-equipped to find an amazing deal on your next manufactured home. For a complete overview of what to expect, our Manufactured Home Buying Process guide covers all the essentials.

Financial Preparations for Buying Bank Repos Homes

Getting your finances ready is like building a strong foundation – everything else depends on it. Bank repos homes often move quickly in the market, so having your financial ducks in a row gives you a serious advantage when the perfect property appears.

Creating a realistic budget is your first priority. These homes come “as-is,” which means you’re buying whatever condition they’re in. Smart buyers always budget extra for repairs and unexpected surprises. Think of it as buying insurance for your peace of mind. Our How to Budget for Your New Manufactured Home guide walks you through every expense you might encounter.

Mortgage pre-approval isn’t just helpful – it’s essential. Banks selling repos want to see serious buyers who can close quickly. A pre-approval letter shows you mean business and have the financial backing to follow through. We specialize in financing for all credit situations, so don’t worry if your credit isn’t perfect. We’ve helped countless families secure financing when other lenders said no.

Saving for your down payment and closing costs gives you more negotiating power. While some financing options require minimal down payments, having cash available can strengthen your offer significantly. Don’t forget about closing costs, which include legal fees, appraisal costs, and other expenses that can add up quickly.

Improving your credit score before you start shopping can save you thousands over the life of your loan. We offer FICO improvement strategies that can boost your score and qualify you for better interest rates. Check out our Financing for Mobile Homes resources to explore all your options.

Finding and Making an Offer on a Repo Manufactured Home

Once your finances are solid, the real fun begins – finding your perfect bank repos home and making it yours. This is where having the right team makes all the difference.

Finding the best listings starts with knowing where to look. As Manufactured Housing Consultants, we have exclusive access to Texas repo mobile homes that other buyers never see. Our relationships with 11 top manufacturers and specialized knowledge of the repo market means we can connect you with deals that aren’t available elsewhere. We also monitor bank websites and specialized REO sites to ensure you see every opportunity in your area.

Working with our experienced team gives you a huge advantage in this competitive market. We understand the unique challenges of bank repos homes and can guide you through the process smoothly. Our goal is to make buying a mobile home the easiest experience possible, and we’ve helped hundreds of families steer repo purchases successfully.

Property inspection becomes even more critical with repo properties. Since these homes are sold “as-is,” you need to know exactly what you’re buying. We recommend thorough professional inspections covering everything from the foundation to the roof. Yes, some utilities might be turned off, making inspections trickier, but a good inspector can still identify major issues. This step can save you thousands in unexpected repairs later.

Making your formal offer requires strategy and timing. Banks want to sell quickly, but they also have internal processes that can slow things down. We help you craft competitive offers that stand out while protecting your interests. Don’t be afraid to negotiate – banks aren’t emotionally attached to these properties like individual sellers might be.

The negotiation process with banks can feel different from traditional home sales. They might take longer to respond due to internal approvals, but they’re often more willing to negotiate on price, especially if your inspection revealed significant issues. We’ve seen buyers save tens of thousands by negotiating skillfully with motivated bank sellers.

Key Differences: Foreclosed vs. Traditional Manufactured Home Purchase

When you’re considering bank repos homes, it’s important to understand how different this experience is from buying a traditional manufactured home. Think of it like comparing a treasure hunt to a regular shopping trip – both can get you what you want, but the journey looks completely different.

The most obvious difference is price and negotiation power. With foreclosed manufactured homes, you’re often looking at discounts of 20-60% below market value. Banks aren’t trying to make a profit on these homes – they just want to recover their losses and move on. This puts you in a much stronger position than dealing with individual sellers who might have emotional attachments to their property or unrealistic price expectations.

However, that lower price comes with a trade-off in condition and what you know about the home. Bank repos homes are almost always sold “as-is,” meaning what you see is what you get – no warranties, no guarantees, and often very little information about the home’s history. Traditional sellers, on the other hand, are required to disclose known problems and often willing to make repairs or negotiate credits for issues that come up during inspection.

The timeline can be tricky with foreclosed properties. Sometimes banks want to sell so quickly that you can close in record time. Other times, their internal approval processes can slow things down, or you might find yourself in a bidding war with other buyers who spotted the same great deal you did. Traditional sales tend to follow a more predictable schedule.

Financing for foreclosed manufactured homes can get more complicated too. Because these homes are sold as-is, some lenders get nervous about their condition. You might need to work with specialized lenders or consider renovation loans to cover necessary repairs. At Manufactured Housing Consultants, we offer flexible financing options specifically designed for these situations, including programs for buyers with credit challenges.

The risk level is simply higher with foreclosed properties. You’re taking on more unknowns – potential hidden damage, deferred maintenance, or systems that might need immediate attention. Traditional purchases give you more protection through disclosures, inspection negotiations, and sometimes even warranties from the seller.

When you’re Investing in a Repo Mobile Home, these differences become even more important to consider. The potential for higher returns is definitely there, but so is the need for careful planning and realistic budgeting for unexpected repairs.

Frequently Asked Questions about Buying Repo Manufactured Homes

When our clients start exploring bank repos homes, they usually have similar questions swirling around in their minds. After years of helping families find their perfect manufactured home, we’ve heard just about every concern and curiosity. Let’s tackle the most common questions we get, so you can move forward with confidence.

Can I get a special mortgage for a bank repo manufactured home?

The short answer is absolutely yes! While some people worry that financing a repo manufactured home might be impossible, we’ve actually made it our specialty to help folks secure financing for exactly these situations.

Here’s the thing about bank repos homes – they might need a little extra creativity when it comes to financing, but that doesn’t mean you’re out of options. We offer Mobile Home Loans or Financing that’s custom specifically for your unique situation.

Specialized financing options we work with include lenders who understand manufactured homes inside and out. These aren’t your typical cookie-cutter mortgage companies – they get that manufactured homes have their own quirks and value differently than site-built homes.

Renovation loans can be a game-changer if your repo needs some TLC. Programs like FHA 203(k) loans let you roll the purchase price and repair costs into one mortgage. It’s like getting a two-for-one deal – you buy the home and fund the fixes all at once.

At Manufactured Housing Consultants, we’ve built our reputation on flexible financing for all credit situations. Whether your credit score makes you cringe or you’re dealing with past financial hiccups, we work with you to find solutions. Our FICO improvement programs can even help boost your credit while we’re working on your loan.

Cash certainly makes things smoother, but it’s not required. Having some extra funds for a down payment or immediate repairs can strengthen your offer, especially when you’re competing with other buyers.

What does buying a property ‘as-is’ truly mean?

When banks sell manufactured homes “as-is,” they’re basically saying “what you see is what you get” – and sometimes what you don’t see is what you get too. It’s like buying a used car from someone who hands you the keys and says “good luck!”

No seller repairs means exactly that. If the roof leaks, the furnace doesn’t work, or the kitchen sink is held together with duct tape and hope, the bank won’t fix a single thing. They’re not being mean – they’re just not in the home repair business.

Everything becomes your responsibility once you sign those papers. That mysterious stain on the ceiling? Yours to investigate and fix. The weird noise the water heater makes? Your new problem to solve. This is why we always tell our clients that a thorough inspection isn’t just recommended – it’s absolutely critical.

Hidden issues are always a possibility, even with the best inspection. Sometimes problems only show up after you’ve lived in the home for a while. That’s just the reality of “as-is” purchases. The key is going in with your eyes wide open and a realistic budget for surprises.

The importance of professional inspections cannot be overstated. A good inspector is like having a crystal ball – they can spot potential problems before they become your expensive headaches. It’s the best money you’ll spend during the buying process.

How do I avoid scams when looking for foreclosed manufactured homes?

Unfortunately, whenever there’s a good deal to be had, there are people looking to take advantage. The bank repos homes market attracts its share of scammers, but protecting yourself isn’t complicated if you know what to watch for.

Working with reputable companies like Manufactured Housing Consultants is your best defense. We’ve been in this business long enough to know all the tricks, and we’re invested in your success, not just making a quick buck. Our reputation depends on treating you right.

Verify everything before you hand over any money. If someone claims to have an exclusive list of foreclosures or pressures you to act immediately without proper documentation, that’s a red flag waving in the breeze. Legitimate properties and legitimate companies don’t need high-pressure tactics.

Avoid “too good to be true” deals that make your heart race. Yes, bank repos homes can be great bargains, but if something seems impossibly cheap without a clear reason why, dig deeper or walk away. Real bargains exist, but so do scams designed to look like bargains.

Never pay upfront fees for access to “secret” foreclosure lists. Legitimate foreclosure information is available through proper channels, including through our team. If someone wants money upfront just to show you what’s available, they’re probably not legitimate.

Get everything in writing and make sure you understand what you’re signing. Verbal promises don’t hold up when things go wrong, and in the repo market, having proper documentation protects both you and your investment.

Buying a manufactured home should be exciting, not stressful. When you work with experienced professionals who know the ins and outs of bank repos homes, you can focus on finding your perfect home instead of worrying about getting taken advantage of.

Conclusion: Is a Bank Repo Manufactured Home Right for You?

After exploring the ins and outs of bank repos homes, you might be wondering if this path to homeownership is right for your situation. The answer really depends on your personal circumstances, risk tolerance, and long-term goals.

The benefits are certainly compelling. Bank repos homes can offer significant discounts – sometimes 20-60% below market value – giving you instant equity and a chance at homeownership that might otherwise be out of reach. For Texas families facing tight budgets or credit challenges, these properties represent a real opportunity to build wealth and stability.

But let’s be honest about the challenges too. The “as-is” condition means you’re taking on more risk than with a traditional purchase. You might find yourself dealing with unexpected repairs, competing in bidding wars, or navigating complex financing requirements. It’s not a decision to make lightly.

The key is being prepared. If you’ve done your homework, secured proper financing, budgeted for potential repairs, and worked with experienced professionals, a repo manufactured home could be an excellent investment. Many of our clients have found incredible value in these properties, turning what started as a foreclosed home into their dream family residence.

At Manufactured Housing Consultants, we understand that every family’s situation is unique. Whether you’re looking at new manufactured homes from our 11 top manufacturers or exploring Texas repo mobile homes, we’re here to provide expert guidance throughout the entire process. Our specialized financing options work with all credit situations, and our FICO improvement programs can help you qualify for better rates.

The manufactured housing market offers flexibility, affordability, and quality that traditional housing often can’t match. When you combine that with the potential savings from a repo purchase, the opportunity can be truly remarkable.

Ready to explore your options? Our team has the experience and resources to help you steer this market successfully. We’ll work with you to find the right property, secure appropriate financing, and ensure you understand exactly what you’re getting into.

Find available bank repos homes today and let us help turn your homeownership dreams into reality. With the right preparation and professional support, that perfect home might be closer than you think.