Why Buying Foreclosed Homes for Cheap Makes Financial Sense

If you buy foreclosed homes for cheap, you could save thousands on your path to homeownership. These properties often sell for 20-50% below market value because lenders want to recoup losses quickly. This makes them an attractive option for budget-conscious buyers willing to take on some risk and renovation work.

However, buying cheap doesn’t always mean buying smart. Foreclosed homes come with unique challenges, such as unknown repair costs, title issues, or lengthy approval processes that can turn a great deal into a financial headache.

The key is understanding what you’re getting into before you make an offer. Whether you’re a first-time buyer or an investor, foreclosed homes require a different approach than traditional sales. This guide will walk you through the main ways to buy foreclosed properties, the steps to purchase them safely, and help you decide if this path aligns with your goals.

Understanding Foreclosures: The Pros and Cons

When you’re looking to buy foreclosed homes for cheap, it’s important to understand both sides of the coin. Foreclosed properties, including manufactured homes, offer incredible opportunities but also come with unique challenges.

Why Are Foreclosed Homes Cheaper?

Simply put, banks are lenders, not real estate investors. When a property goes into foreclosure, the bank owns a house it doesn’t want. Lenders are motivated to sell quickly to avoid costs like maintenance, taxes, and insurance. This urgency often leads to below-market pricing to attract buyers and close deals fast.

Another reason is that they’re typically sold “as-is.” The previous homeowners were likely struggling financially, so home maintenance was not a priority. This deferred maintenance means the property often needs significant work. Unlike traditional sellers, banks can’t disclose problems because they never lived there, and this uncertainty is reflected in a lower asking price.

The Major Benefits of Buying a Foreclosure

Despite the challenges, there are compelling reasons to buy foreclosed homes for cheap.

- Lower Purchase Price: Foreclosed properties can sell for 20-50% below market value, making homeownership more accessible.

- Instant Equity Potential: A lower entry point creates an opportunity for immediate equity. For example, buying a home for $50,000, investing $15,000 in repairs, and having it valued at $80,000 gives you $15,000 in equity from day one.

- Less Competition: The uncertainty and potential repair work scare away many casual buyers, meaning you’ll face fewer competitors.

- Customization Control: The renovation process allows you to create the exact space you want, with every dollar invested benefiting you directly.

For a deeper dive, check out our Guide to the Pros and Cons Before Buying Repo Mobile Homes.

The Potential Risks and Hidden Costs

Buying foreclosed homes isn’t without risk. Be prepared for these potential issues:

- Unknown Repair Costs: The “as-is” condition can hide expensive surprises, like structural damage or failing systems.

- Title Issues and Liens: Unpaid contractor bills, tax liens, or HOA assessments can sometimes surface after closing, becoming your responsibility.

- Occupancy Problems: Previous owners or tenants may still be living in the property, requiring a lengthy and costly eviction process.

- Lengthy Bank Approval: The approval process for short sales and REO properties can be slow, with decisions taking weeks or even months.

Before buying, understand what to look for during inspections. Our guide on What to Look For When Buying a Used Mobile Home covers many inspection basics. The key is to have realistic expectations and adequate financial reserves.

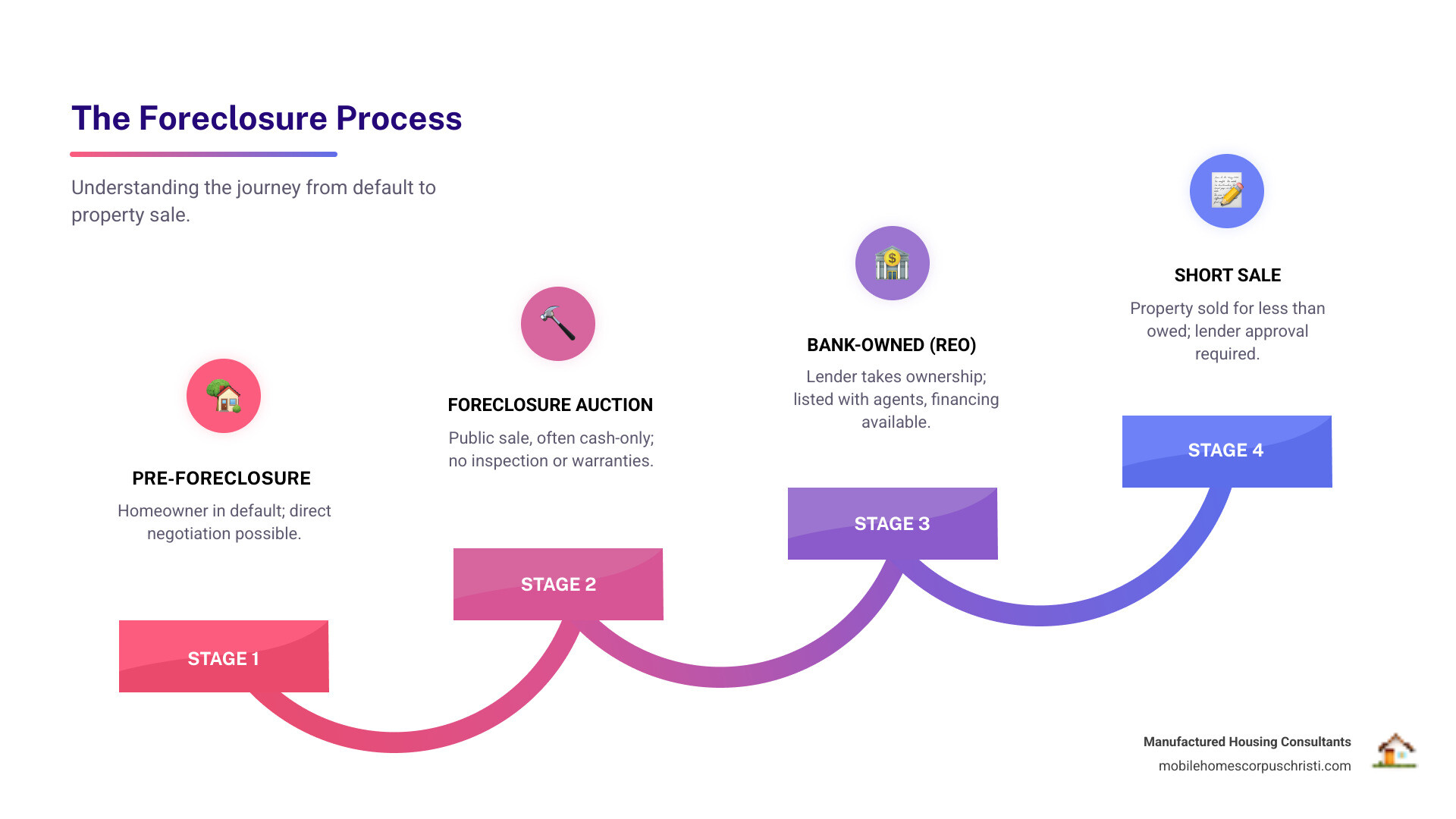

The Four Paths to Buying a Foreclosed Property

When you’re ready to buy foreclosed homes for cheap, you can take four different routes. Each path has its own process, risks, and rewards. Understanding these options helps you pick the one that matches your comfort level, timeline, and finances.

Pre-Foreclosure: Catching a Deal Before the Bank

This stage occurs after a homeowner has missed payments but before the bank officially takes over. You negotiate directly with the homeowner, who may be motivated to sell quickly to avoid foreclosure. This allows for a more personal transaction where you can often inspect the home and secure traditional financing. Finding these properties may require research through public records or working with a specialized real estate agent.

Foreclosure Auctions: High Risk, High Reward

Auctions happen on courthouse steps or online platforms. Bidding is , and you’re competing against other buyers, often investors. The main challenges are that most auctions require cash for the full purchase price within 24-48 hours, and you’re buying the property “as-is,” usually without any opportunity for an inspection. The potential for a deep discount is high, but so is the risk of buying a property with major hidden problems.

Bank-Owned (REO) Properties: The Most Common Route

REO (Real Estate Owned) homes are properties that didn’t sell at auction and are now owned by the bank. Lenders list these homes with real estate agents, making the process similar to a traditional sale. You can typically inspect the property and secure traditional financing. The bank has usually cleared the title and ensured the property is vacant, reducing some of the major risks. While still sold “as-is,” REO properties offer a good balance of savings and security, making them a popular choice. We offer our own Bank Repos in manufactured housing with similar benefits.

Short Sales: A Negotiation with the Lender

A short sale occurs when a homeowner owes more on their mortgage than the home is worth. The lender agrees to accept a lower payoff to avoid foreclosure. As a buyer, you can get a good price, but the process is notoriously slow. Every offer requires lender approval, which can take months or even over a year. You can usually inspect the home, but the seller is unlikely to make repairs.

Here’s how these four paths compare:

| Path | Price Potential | Risk Level | Can You Inspect? | Financing Options | Timeline |

|---|---|---|---|---|---|

| Pre-foreclosure | Good discounts through negotiation | Moderate | Yes, with permission | Traditional mortgages available | Variable, can be quick |

| Auction | Deepest potential discounts | Very High | Usually no | Cash only | Very fast (days) |

| Bank-owned (REO) | Moderate discounts | Low to Moderate | Yes | Traditional mortgages available | Moderate (weeks to months) |

| Short Sale | Good discounts with patience | Moderate to High | Yes, with permission | Traditional mortgages available | Very long (months to years) |

Each path offers different advantages. The key is matching the right approach to your specific needs and capabilities.

Your Step-by-Step Guide to Buy Foreclosed Homes for Cheap

Follow these essential steps to steer the foreclosure market successfully and find a great deal.

Step 1: Get Your Finances in Order

Before you start looking, get your finances in order. This is a necessity in the competitive world of foreclosures.

- Determine Your Budget: A common guideline is to keep your total housing costs (mortgage, taxes, insurance) under 36% of your pre-tax income. Don’t forget to budget for renovations.

- Get Pre-Qualified: A mortgage pre-qualification shows sellers you’re a serious buyer and tells you how much you can borrow. This is vital for REO and short sale offers.

- Explore Renovation Loans: Loans like the FHA 203(k) allow you to finance both the purchase price and repair costs into a single mortgage. This is a game-changer for fixer-uppers.

- Save for a Down Payment and Repairs: Having cash reserves for a down payment and unexpected “as-is” repair costs provides crucial flexibility and peace of mind.

For affordable housing options, explore our Mobile Home Financing Options to see how we help buyers with various credit situations.

Step 2: Find Foreclosure Listings

Once your finances are solid, it’s time to find available properties. There are numerous resources to help you buy foreclosed homes for cheap.

- Government Resources: The U.S. Department of Housing and Urban Development (HUD) lists available foreclosures. Fannie Mae’s HomePath and Freddie Mac’s HomeSteps are also excellent sources for their foreclosed properties.

- Bank Websites: Many large banks list their REO properties directly on their websites.

- Specialized Listing Services: Websites like Auction.com are large online marketplaces for foreclosure auctions. Other sites aggregate listings from various sources.

- Multiple Listing Service (MLS): Many REO properties and some pre-foreclosures are listed on the MLS. An agent specializing in foreclosures can provide access to these listings.

Step 3: Assemble Your Team and Do Your Due Diligence

You wouldn’t go into a complex surgery without a skilled medical team, right? The same principle applies to buying a foreclosed home. This isn’t a solo mission; it requires a specialized team and meticulous due diligence to ensure you truly buy foreclosed homes for cheap and smartly.

- Hire an Experienced Real Estate Agent: Find an agent who specializes in foreclosures. They understand the unique processes and can help you steer negotiations with banks.

- Conduct a Thorough Home Inspection: For REO and short sale properties, a home inspection is critical. Prioritize the foundation, plumbing, electrical, roofing, and HVAC systems, as these are the most expensive to fix. You’re buying “as-is.”

- Order a Title Search: A title search uncovers hidden liens from unpaid taxes, contractors, or second mortgages. While banks aim to clear titles on REO properties, it’s crucial to verify this before closing.

- Understand “As-Is”: This means the seller makes no warranties about the property’s condition and will not pay for any repairs. Your offer should reflect the cost of any anticipated work.

For more tips on avoiding common pitfalls, check out our guide on Mistakes to Avoid When Buying First Mobile Home.

Is a Foreclosed Home Right for You?

Before you jump in, it’s crucial to decide if this path aligns with your budget, skills, and timeline. Buying a foreclosed home isn’t for everyone, and a realistic self-assessment can save you from stress and financial strain.

Who Should Buy Foreclosed Homes for Cheap?

Here’s who typically thrives in the foreclosure market:

- DIY-Savvy Buyers: If you’re comfortable with repairs or managing contractors, you can turn sweat equity into savings.

- Real Estate Investors: The lower purchase price offers excellent potential returns for those looking to flip or rent out a property.

- Buyers with Cash Reserves: Cash is essential for auctions and provides a safety net for unexpected repairs in any foreclosure deal.

- Patient Homebuyers: The process can be lengthy and unpredictable, especially for short sales. Patience is a key virtue.

When to Reconsider Buying a Foreclosed Home for Cheap

On the flip side, there are situations where buying a foreclosed home might not be the best fit. Knowing when to reconsider can prevent significant frustration and financial strain.

- First-Time Buyers Needing Move-In Ready: The stress of immediate, major repairs can be overwhelming for a first home.

- Buyers on a Tight Schedule: If you have a strict deadline for moving, the unpredictable timelines of foreclosures can cause major problems.

- Limited Funds for Unexpected Repairs: While you might buy foreclosed homes for cheap, the savings can quickly evaporate if you encounter major structural or system failures that you didn’t budget for. If your budget is stretched thin and you don’t have a contingency fund for repairs, a foreclosed home could become a money pit.

- Those Who Prefer Simplicity: The foreclosure buying process involves more complexities than a traditional home purchase. If you prefer a straightforward transaction with minimal surprises, a regular market home might be a better fit.

Understanding these considerations is crucial. For a broader perspective on homeownership decisions, you might find our article on the Pros Cons of Buying a Mobile Home helpful, as it touches on similar themes of affordability versus unique considerations.

Frequently Asked Questions about Buying Foreclosed Homes

How much cheaper are foreclosed homes?

The discount varies. Auction properties can sometimes sell for up to 60% below market value, but they are high-risk. Bank-owned (REO) homes typically offer more modest but still significant savings, often in the 10-30% range below comparable homes. The final price depends on the property’s condition, location, and sale type. Some specialized sites even feature foreclosures under $10,000, though these are rare and usually require extensive work.

Can I get a regular mortgage for a foreclosed home?

Yes, for most types. Bank-owned (REO) properties and short sales are generally eligible for conventional, FHA, or VA loans, as long as the home meets the lender’s minimum property standards. Auction purchases, however, are the main exception, as they almost always require you to pay in cash within a very short timeframe (24-48 hours).

What is a renovation loan?

A renovation loan is a single mortgage that finances both the home’s purchase price and the cost of its repairs. This is ideal for foreclosure buyers, as it prevents you from having to pay for renovations out-of-pocket. The FHA 203(k) Renovation Loan is the most popular type, designed specifically for fixer-uppers. The lender approves you for the purchase price plus the estimated renovation costs, holding the repair funds in escrow to be paid out as work is completed.

Conclusion

To buy foreclosed homes for cheap can open up incredible value, but it requires patience, preparation, and a healthy respect for the risks. We’ve covered the four main paths to purchase, from pre-foreclosures to REO properties, each with a unique balance of savings and complexity.

Getting your finances in order and assembling the right team of experts are essential first steps. Performing thorough due diligence is critical, as “as-is” means any surprises are your responsibility to fix. The key is to match your approach to your budget, timeline, and comfort with uncertainty.

If the complexities of traditional foreclosures feel overwhelming, bank-repossessed manufactured homes offer many of the same affordability benefits with fewer headaches. At Manufactured Housing Consultants, we specialize in helping buyers find quality, affordable housing solutions. We offer the largest selection from 11 top manufacturers with guaranteed lowest prices and specialized financing for all credit situations, including FICO improvement. Our homes are delivered anywhere in Texas, giving you peace of mind and predictable costs from day one.

Ready to find an affordable home without the uncertainty of major repairs? Explore our available bank repo homes today