What is the “Blue Book” for a Mobile Home?

When you need to know the value of a nada trailer house, you won’t find it in the Kelley Blue Book. The manufactured housing industry’s equivalent is the NADA Manufactured Housing Appraisal Guide, now owned by J.D. Power. This is the primary resource for valuing these homes.

Quick Answer for NADA Trailer House Valuations:

- NADA Guide: The industry standard “blue book” for manufactured homes built after 1976.

- Basic Report: $35 for consumer use (e.g., insurance, general value).

- Professional Report: $55 for detailed analysis (e.g., financing, legal needs).

- Limitations: Uses a depreciation model, not local market data.

- Best Use: A starting point for valuation, not the final market price.

The NADA guide differs from car valuations by using a depreciation model instead of actual sales data. It calculates what your home should be worth based on its age, manufacturer, and features, but it doesn’t factor in local market demand, specific condition, or land ownership.

Understanding this is key. A home with a NADA value of $40,000 could sell for $60,000 in a desirable community or just $30,000 if it needs significant repairs. The guide offers a baseline, but real-world factors set the actual price.

Decoding the NADA Trailer House Value Guide

The NADA Manufactured Housing Appraisal Guide, now under J.D. Power, is the mobile home equivalent of the Kelley Blue Book. It serves as a starting point for determining the value of a nada trailer house.

Unlike car valuations that use sales data, the NADA system uses a depreciation model. It calculates a baseline value by starting with the home’s original cost and subtracting value based on age and condition. This “depreciated replacement cost” is useful for insurance, quick estimates, or relocation planning. Banks, appraisers, and tax assessors use these standardized values.

However, the NADA guide has limitations. It doesn’t account for local market conditions, like high demand in your community, or specific upgrades you’ve made. It’s a great starting point, but not the final word on your home’s market price.

More info about mobile home loans or financing

How the NADA Trailer House Guide Works

To get a NADA valuation from the J.D. Power website, you’ll provide key details about your home:

- Age: Only homes built after the 1976 HUD Code implementation qualify.

- Size: Length and width determine the square footage, a direct value factor.

- Manufacturer: Reputable builders often mean better value retention.

- Condition: The home’s state (excellent, good, fair, or poor) significantly adjusts the value.

- Location: The system uses regional data, not hyper-local market conditions.

The system then processes this information using complex formulas to generate an accurate baseline value.

NADA Report Types and Costs

J.D. Power offers three report types for different needs:

- Basic Used Home Value Report ($35): Ideal for personal use, such as for insurance or getting a general value estimate. It’s not suitable for formal lending.

- Professional Used Home Value Report ($55): A comprehensive report for serious transactions like refinancing, estate settlements, or legal matters. It works with official appraisal forms (1004C/70B) required by lenders.

- New Home Price Report ($45): Designed for new manufactured homes, this report is useful for retailers, appraisers, and ensuring compliance with the HPML Appraisal Rule for high-priced mortgage loans.

Each report gives a “depreciated replacement cost in retail dollars,” which is the cost to replace your home today, minus depreciation. The system can also factor in market appreciation in some areas, challenging the myth that these homes only lose value.

HPML Appraisal Rule compliance

Key Factors That Determine Your Mobile Home’s Worth

The NADA guide provides a baseline, but the true market value of your nada trailer house depends on several factors it doesn’t fully capture:

- Home Condition: A well-maintained home with a solid structure, good roof, and updated finishes is always more valuable. Regular maintenance protects your investment.

- Age and HUD Code Compliance: Homes built after June 15, 1976, meet federal safety standards (the HUD Code), making them easier to finance and more valuable than pre-1976 “mobile homes.”

- Size and Features: Larger homes with more bedrooms and bathrooms command higher prices. Modern appliances, updated kitchens, and energy-efficient windows also add significant value.

- Location: As with any real estate, a home in a desirable area with good schools and amenities is worth more. Even within a community, a premium lot can increase value.

- Community Quality: For homes in a park, the quality of management and amenities like clubhouses or pools directly impacts home values. A well-run community helps homes retain their worth.

What to Look For When Buying a Used Mobile Home

Land Ownership: Real Property vs. Chattel

Whether you own or rent the land beneath your home is one of the most significant factors affecting its value and appreciation potential.

When you own the land, your home is typically classified as “real property,” like a traditional house. This allows the home to appreciate in value, sometimes even faster than site-built homes in certain markets. Owning the land also qualifies you for better financing, such as traditional mortgages with lower rates, turning your nada trailer house into a wealth-building investment.

In a rented lot situation, the home is considered “chattel” or personal property. These homes tend to depreciate, and financing is limited to personal property loans, which usually have higher interest rates and shorter terms. While community living offers benefits, the financial implications of renting the land are significant.

Why Do Mobile Homes Depreciate in Value?

Mobile vs. Manufactured vs. Modular Homes

The terms used for factory-built housing can be confusing, but they have a direct impact on value and financing.

- Mobile Homes (Pre-1976): Built before the national HUD Code, these homes don’t meet modern construction standards. This makes them very difficult to finance, limiting buyers to cash-only purchases. Their value is often tied primarily to the land they occupy.

- Manufactured Homes (Post-1976): These homes are built to the federal HUD Code, which covers design, safety, and construction. They are much easier to finance and hold their value better. The NADA guide focuses on these homes.

- Modular Homes: Built in sections in a factory to the same local and state building codes as traditional site-built homes. They appraise and finance like site-built homes and typically have higher values than manufactured homes.

- CrossMod® Homes: A newer category that blends factory efficiency with site-built features like permanent foundations and garages. They are designed to appraise and finance like traditional homes.

Beyond the Book: Appraisal and Market Comparisons

The NADA guide provides a solid baseline for your nada trailer house, but it’s just the start. Its depreciation model doesn’t account for key factors like a $15,000 kitchen remodel or high local market demand. To determine the fair market value—what a buyer will actually pay—you need to look beyond the book.

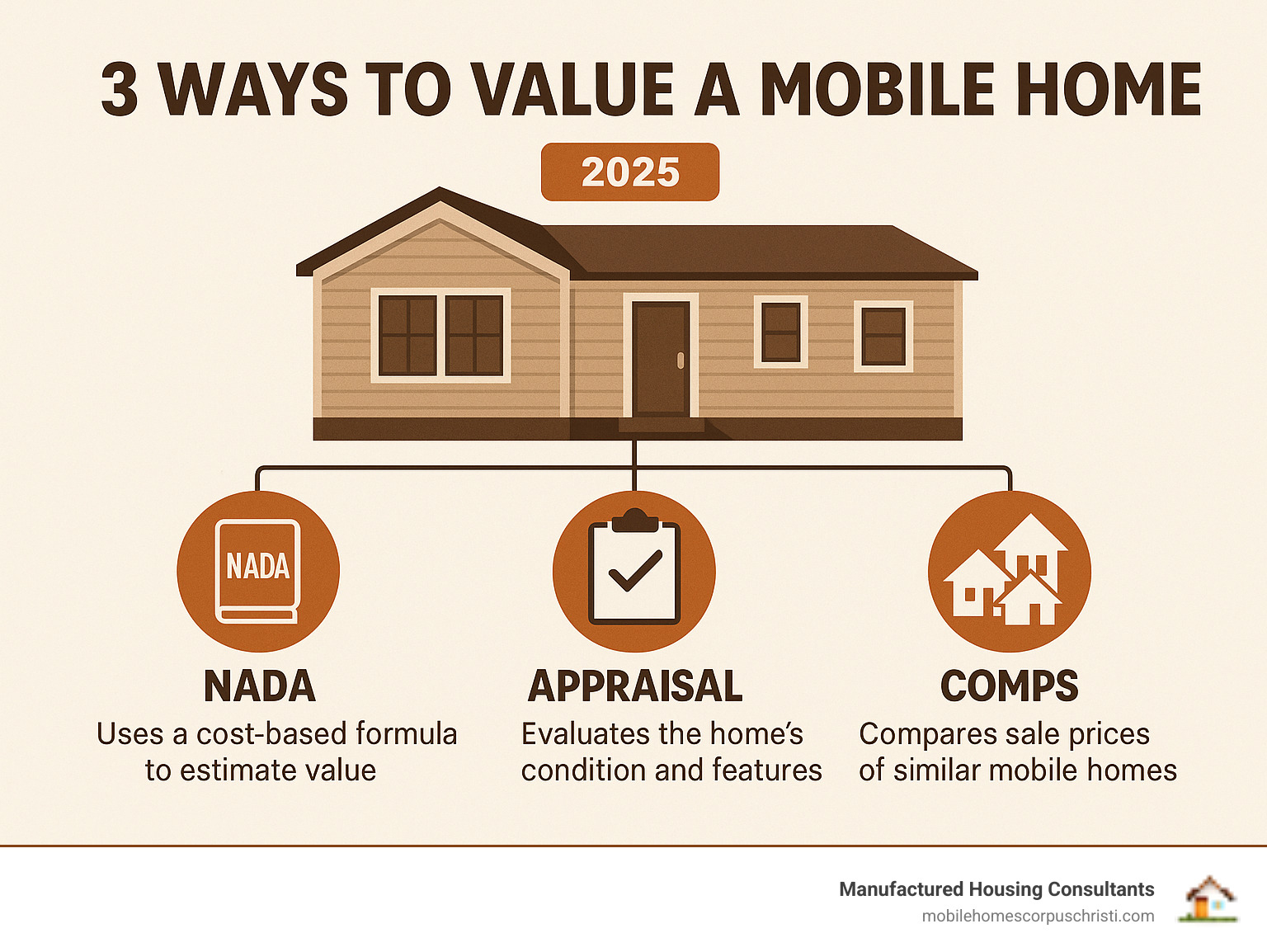

There are three main valuation approaches: the NADA guide for a baseline, a professional appraisal for a detailed analysis, and comparable sales (comps) for real-world market data. Each provides a different piece of the value puzzle.

| Valuation Method | Primary Basis | Cost (Approx.) | When to Use | Pros | Cons |

|---|---|---|---|---|---|

| NADA Guide | Depreciation Model (Cost-Based) | $35 – $55 | Baseline value, insurance estimates, quick checks, moving home to new location | Quick, standardized, recognized by many institutions, includes manufacturer quality | Doesn’t account for local market, specific condition, land value, or unique upgrades |

| Professional Appraisal | In-depth analysis (Cost, Income, Sales Comparison) | $250 – $500 | Financing, legal proceedings, estate settlement, complex properties | Most accurate for specific property, considers local market, condition, upgrades, and land value | More expensive, can take time, relies on appraiser’s expertise and available comps |

| Comparable Sales (Comps) | Recent sales of similar homes in the area | Free (DIY) | Setting sale price, buyer research, understanding local market trends | Reflects current market demand, provides real-world selling prices, easy to research | Can be difficult to find truly comparable homes, requires adjustments for differences, subjective |

The Role of a Professional Appraiser

For major financial decisions like selling, refinancing, or settling an estate, hiring a certified appraiser is a smart move. An appraiser provides an expert opinion on your property’s current market worth.

An appraiser conducts a thorough inspection, noting the home’s condition, quality, and any upgrades. They use multiple valuation methods, including the cost approach and, most importantly, an analysis of recent sales of similar homes in your local market. They also verify the property’s classification (real property vs. personal property), which is crucial for value and financing.

You should hire an appraiser when:

- Getting a mortgage (lenders require it).

- Selling your home to set an accurate price.

- Handling legal matters like divorce or estate settlements.

- Valuing significant upgrades not captured by the NADA guide.

More info about the appraisal process

Using Comparable Sales (Comps)

To understand what your nada trailer house is worth in the current market, analyzing comparable sales (comps) is essential. This method looks at the recent sale prices of similar homes, revealing what real buyers are willing to pay.

To perform a comps analysis, find homes sold in the last 6-12 months that are similar to yours in age, size, condition, and features. Crucially, you must compare homes with the same land ownership status (owned land vs. rented lot), as this dramatically affects price. You’ll then need to make financial adjustments for any differences, such as a newer roof or an extra bedroom on a comparable property.

Using comps provides the most realistic picture of your home’s value because it reflects current local market demand. While finding perfect comps can sometimes be challenging, especially in rural areas, they offer the most accurate snapshot of market value.

Finding Mobile Homes for Sale in Corpus Christi

How to Increase the Value of Your Mobile Home

Strategic improvements can significantly increase the value and appeal of your nada trailer house, debunking the myth that they only depreciate. With the right upgrades and care, you can build real equity that attracts buyers and boosts appraisals.

Focus on high-return improvements:

- Kitchen and Bathroom Remodels: Updated countertops, cabinets, fixtures, and modern appliances offer strong returns.

- Energy Efficiency: New windows, insulation, and modern HVAC systems add value and lower utility bills.

- Flooring: Replacing old carpet with modern laminate or vinyl plank instantly updates the home.

- Curb Appeal: Fresh paint, landscaping, and outdoor living spaces like decks create a great first impression.

- Structural Maintenance: Regular upkeep of the roof, foundation, and skirting is essential to protect your investment.

Interior and Exterior Upgrades

Focus on upgrades that buyers and appraisers value most. Curb appeal is critical; a fresh coat of paint, new skirting, and neat landscaping make a strong first impression. Inside, kitchens and bathrooms are key. Even small updates like new hardware, modern fixtures, or new countertops can have a big impact. Replacing worn carpet with modern flooring like vinyl plank can transform the entire home. Finally, energy-efficient windows and a modern HVAC system appeal to buyers’ desire for lower utility bills. Consistent maintenance alongside these upgrades signals a well-cared-for home, maximizing its value.

The Importance of Documentation

Proving the value of your improvements is as important as making them. When you sell or appraise your nada trailer house, good documentation can add thousands to its value.

- Keep Receipts: Save all receipts for materials and labor from renovations and major repairs. This provides proof of investment for appraisers and buyers.

- Log Maintenance: Keep a record of routine maintenance like HVAC servicing or roof inspections. This demonstrates the home has been well-cared for.

- Collect Warranties: Transferable warranties for new appliances, windows, or roofing are a strong selling point.

- Take Photos: Before-and-after photos offer powerful visual proof of your upgrades.

Proper documentation justifies your asking price, builds buyer confidence, and ensures appraisers can accurately assess your home’s worth.

Investing in a Repo Mobile Home

Frequently Asked Questions about NADA Trailer House Valuations

Valuing a nada trailer house can be confusing. Here are answers to some of the most common questions we hear from families about manufactured home valuations.

Does Kelley Blue Book (KBB) provide values for mobile homes?

No. While Kelley Blue Book is the standard for vehicle values, KBB does not provide values for mobile or manufactured homes. Their focus is on cars, trucks, and RVs.

The industry’s “blue book” for manufactured homes is the NADA Manufactured Housing Appraisal Guide, now owned by J.D. Power. It provides the standardized baseline value that lenders, insurers, and buyers use. When you hear “blue book value” for a manufactured home, it refers to the NADA guide.

manufactured and mobile home values

How is the NADA depreciation model different from using comparable sales?

Understanding this difference is key to accurate pricing.

- The NADA depreciation model is a cost-based approach. It calculates value by starting with the home’s original price and subtracting for age and condition based on national data. It’s a formula that does not account for local market factors like high demand, specific upgrades, or a premium lot.

- Comparable sales (comps) are a market-based approach. This method analyzes what buyers have recently paid for similar homes in your specific area. It reflects real-world supply and demand.

For example, a home with a NADA value of $45,000 could sell for $65,000 in a hot market or $35,000 if it needs repairs. The best strategy is to use both: start with the NADA value as a baseline, then use comps to adjust for your local market.

Can a home built before 1976 get a NADA value?

No. The NADA guide only includes homes built after June 15, 1976. This is the date the federal HUD Code for manufactured home construction and safety was established. Homes built before this date are technically “mobile homes.”

These pre-1976 homes face significant challenges:

- Valuation: Without a NADA value, determining their worth is difficult. Often, the value lies almost entirely in the land it sits on.

- Financing: Most lenders will not finance pre-1976 homes because they don’t meet modern safety standards, limiting the buyer pool to cash purchasers.

To value a pre-1976 home, you’ll need to research local comparable sales or consult a real estate professional with experience in these specific properties.

Mistakes to Avoid When Buying First Mobile Home

Get an Accurate Value for Your Texas Mobile Home

To understand the true worth of your nada trailer house, you need a complete picture. The NADA guide (J.D. Power Values) is the starting point, but a truly accurate assessment combines this baseline with a comparable sales analysis and, for critical transactions, a professional appraisal.

In the Texas market, local factors are everything. A home with a NADA value of $45,000 might sell for $55,000 in a great community or struggle to get $35,000 if it needs repairs. Local school districts, job markets, and community quality all play a role that a national guide can’t capture.

At Manufactured Housing Consultants in Corpus Christi, we specialize in the Texas market. We understand that your home is a major investment. Our team uses real-world knowledge to help you steer valuation complexities, whether you’re assessing your equity, planning an upgrade, or exploring a sale.

With experience across 11 top manufacturers and specialized financing options, we have unique insight into how homes hold their value in Texas. We know which improvements matter most to local buyers and can help you make informed decisions to maximize your investment.