Why Trading In Your Manufactured Home Makes Financial Sense

When you trade in trailer homes, you’re essentially using your current home’s value as credit toward purchasing a newer, better manufactured home – similar to how car dealerships handle vehicle trade-ins. This straightforward process allows you to seamlessly transition from your old home to a new one without the typical stress and uncertainty of the real estate market.

Quick Answer: How to Trade In Your Trailer Home

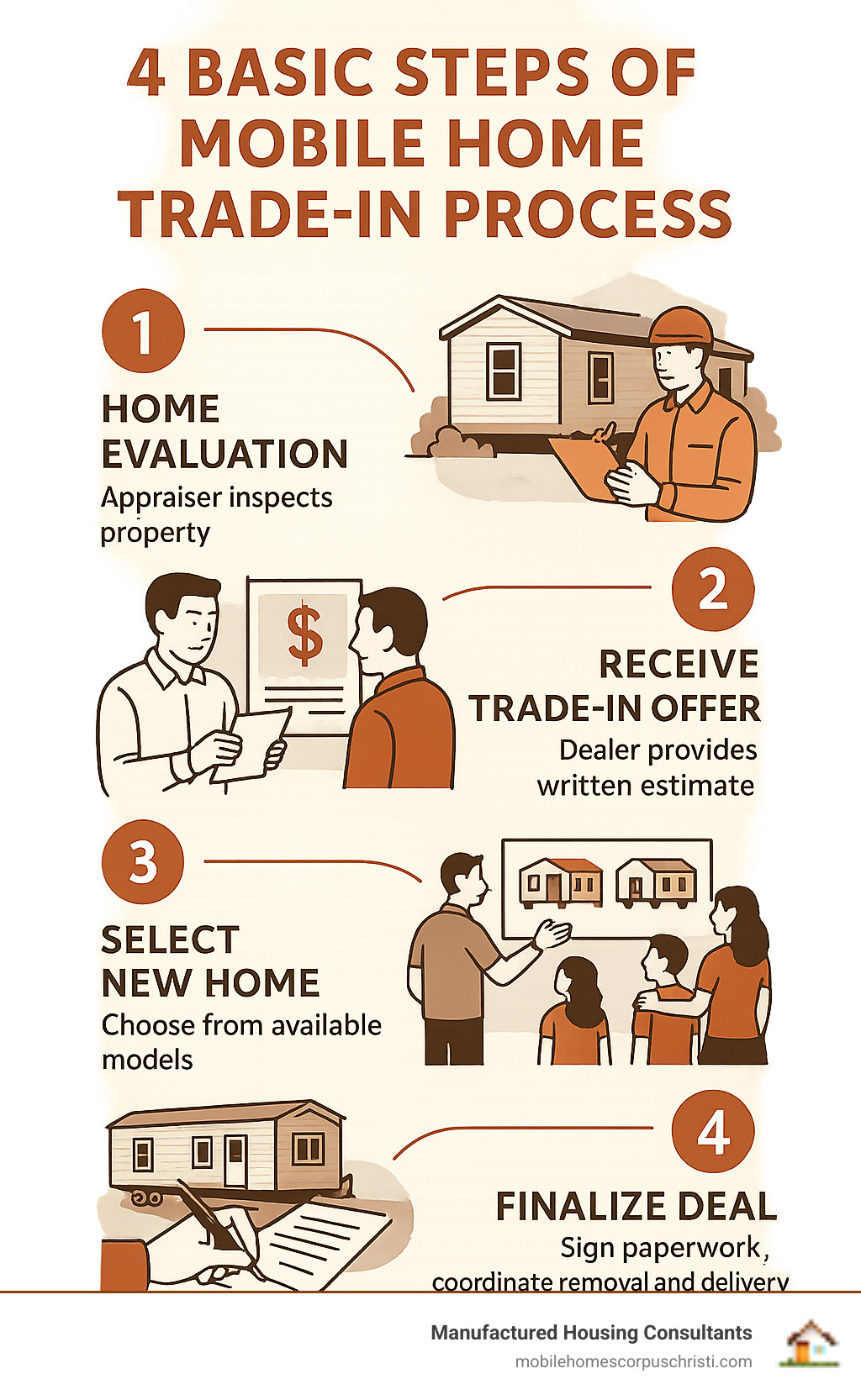

- Get your home evaluated – A professional appraisal determines your home’s current market value based on its age, condition, and features. This valuation often uses industry-standard resources like the NADA® Manufactured Home Value Guide to establish a fair price.

- Receive a trade-in offer – Based on the evaluation, the dealer provides a clear, written offer for your home’s trade-in credit.

- Apply credit to new purchase – Your trade-in value is directly subtracted from the price of your new home, reducing the down payment or the total loan amount.

- Complete the transaction – The dealer coordinates all the final steps, including the paperwork, removal of your old home, and the delivery and setup of your new one.

The mobile home trade-in process has become increasingly popular among homeowners looking to upgrade without the hassle of selling their current property separately. As one industry expert notes, “Mobile home trade-in is an increasingly popular route for homeowners who wish to upgrade their living space without the complications of selling their old home separately.”

For budget-conscious families, trading in offers several key advantages. You avoid the time-consuming and often frustrating process of finding a private buyer, which can involve endless showings, difficult negotiations, and deals that fall through. You also get to skip the costly and time-intensive repairs often needed to make an older home competitive on the open market. Dealers frequently offer additional incentives on the new home purchase, making the upgrade more affordable than you might expect. The entire process typically takes just a few weeks, not months, and you have a professional team managing everything from the title transfer to the final home placement.

Whether you’re dealing with an older mobile home that needs constant repairs or simply want to move into a modern, energy-efficient manufactured home, understanding the trade-in process can save you thousands of dollars and countless headaches.

Understanding the Mobile Home Trade-In

When you trade in trailer homes, you’re basically using your current manufactured home as a down payment toward a newer, better one. It’s similar to trading in your car at a dealership – except instead of driving off the lot, you’re getting a brand new home delivered right to your property. This process is designed for maximum efficiency and minimum stress for you and your family.

The beauty of this process lies in its simplicity. You take the equity you’ve built up in your current home and apply it directly to your new purchase. Your equity is the market value of your home minus any outstanding loan balance. By leveraging this value, you significantly reduce the amount of cash you need upfront and can often secure a more favorable loan on your new home. This makes upgrading to a modern home with more space and better features a realistic option for many families.

Here’s how we make it work for you: We’ll evaluate your current manufactured home, give you a fair trade-in value, and then subtract that amount from the price of your new home. Instead of juggling two separate transactions – selling your old home and buying a new one – everything happens in one smooth, coordinated process.

The biggest advantage? We handle all the heavy lifting. This isn’t just about avoiding showings. We manage the title transfer, coordinate with utility companies for the swap, and handle the complex logistics of removing your old home and installing the new one. No more dealing with potential buyers who want to negotiate every little detail, no more worrying about repairs that might scare off a sale, and no more stress about timing the move perfectly. We take care of it all.

But like any major decision, trading in has both pros and cons compared to selling your mobile home for cash. Let’s break it down:

| Feature | Trading In Your Mobile Home | Selling for Cash |

|---|---|---|

| Convenience | ✅ One-stop process with dealer handling everything | ❌ Multiple steps: listing, showing, negotiating, coordinating removal |

| Time Investment | ✅ Quick evaluation and immediate offer | ❌ Can take months to find the right buyer |

| Repair Requirements | ✅ Minimal – we accept homes in current condition | ❌ Often need costly updates to attract buyers |

| Final Value | ❌ May be less than private sale maximum | ✅ Potentially higher if you find the right buyer |

| Paperwork | ✅ We handle all documentation | ❌ You manage contracts, titles, and legal requirements |

| Guaranteed Sale | ✅ No risk of deals falling through | ❌ Buyers can back out or financing can fail |

For most families, the convenience, speed, and peace of mind make trading in trailer homes the smart choice. While a private sale might yield a slightly higher price on paper, the hidden costs of repairs, marketing, and your own time often close that gap. With a trade-in, you get to focus on the exciting part—picking out your dream home—instead of stressing about selling your current one.

Want to learn more about the pros and cons of buying a mobile home in general? We’ve got you covered with all the details you need to make the best decision for your family.

Understanding the Mobile Home Trade-In

Think of a mobile home trade-in just like trading in your car at a dealership. You bring us your current manufactured home, we evaluate its worth, and then apply that value toward the purchase of your brand new home. It’s really that simple! This approach removes the biggest problems homeowners face when they decide it’s time for an upgrade.

When you trade in trailer homes with us, you’re essentially using your home’s equity as a down payment or credit toward your upgrade. This means less cash out of your pocket and often lower monthly payments on your new home. For many families in Texas, this financial advantage is what makes the dream of a newer, more spacious, and energy-efficient home an affordable reality.

The biggest advantage? We handle everything for you. A private sale requires you to become a part-time real estate agent, marketer, and project manager. You have to worry about listing your home, dealing with potential buyers who might not qualify for financing, and coordinating showings while you’re trying to live your daily life. With a trade-in, you have one expert partner. We take care of the evaluation, paperwork, and even the complex process of removing your old home once your new one is delivered and set up.

This streamlined approach turns what could be a months-long, stressful process into a single, efficient transaction. Instead of selling first and then buying—and worrying about where you’ll live in the meantime—you’re doing both at the same time with one trusted partner.

To help you decide if trading in is right for your situation, let’s look at how it compares to selling your home for cash:

| Feature | Trading In Your Mobile Home | Selling for Cash |

|---|---|---|

| Convenience | We handle everything – appraisal, paperwork, removal | You manage listings, showings, negotiations |

| Time to Complete | Typically 2-4 weeks | Often 3-6 months or longer |

| Upfront Costs | Minimal – we coordinate the process | Marketing costs, repairs, staging expenses |

| Financing Hassles | None – we handle all financing aspects | Deal with buyer’s loan approvals and delays |

| Guaranteed Sale | Yes – once we agree on value, deal is done | No guarantee – market dependent |

| Maximum Value | Fair market value, plus convenience benefits | Potentially higher, but not guaranteed |

The trade-in process works especially well for families who want to upgrade without the stress and uncertainty of the traditional selling process. The financial certainty is a major relief; you know the exact value you’re getting for your old home and the final cost of your new one. You get the peace of mind of knowing exactly when you’ll be moving into your new home, without worrying about whether your old one will sell in time or if a buyer’s financing will suddenly fall through.

For more details about the advantages of upgrading, check out our guide on the Pros & Cons of Buying a Mobile Home.